New Delhi: Ever since the Ashok Gehlot-led Congress government in Rajasthan began announcing ‘freebies’ on LPG and electricity, it has attracted strong criticism from BJP leaders who have alleged that these schemes would hurt the finances of the poll-bound state.

Prime Minister Narendra Modi has also in the past spoken strongly about what he called ‘revdi culture’, or the practice of some states to attract votes by offering subsidies.

However, an analysis of Rajasthan’s finances, comparing it to other states and also its own history, shows that it is in a relatively strong position, and that its fiscal health has improved under Gehlot.

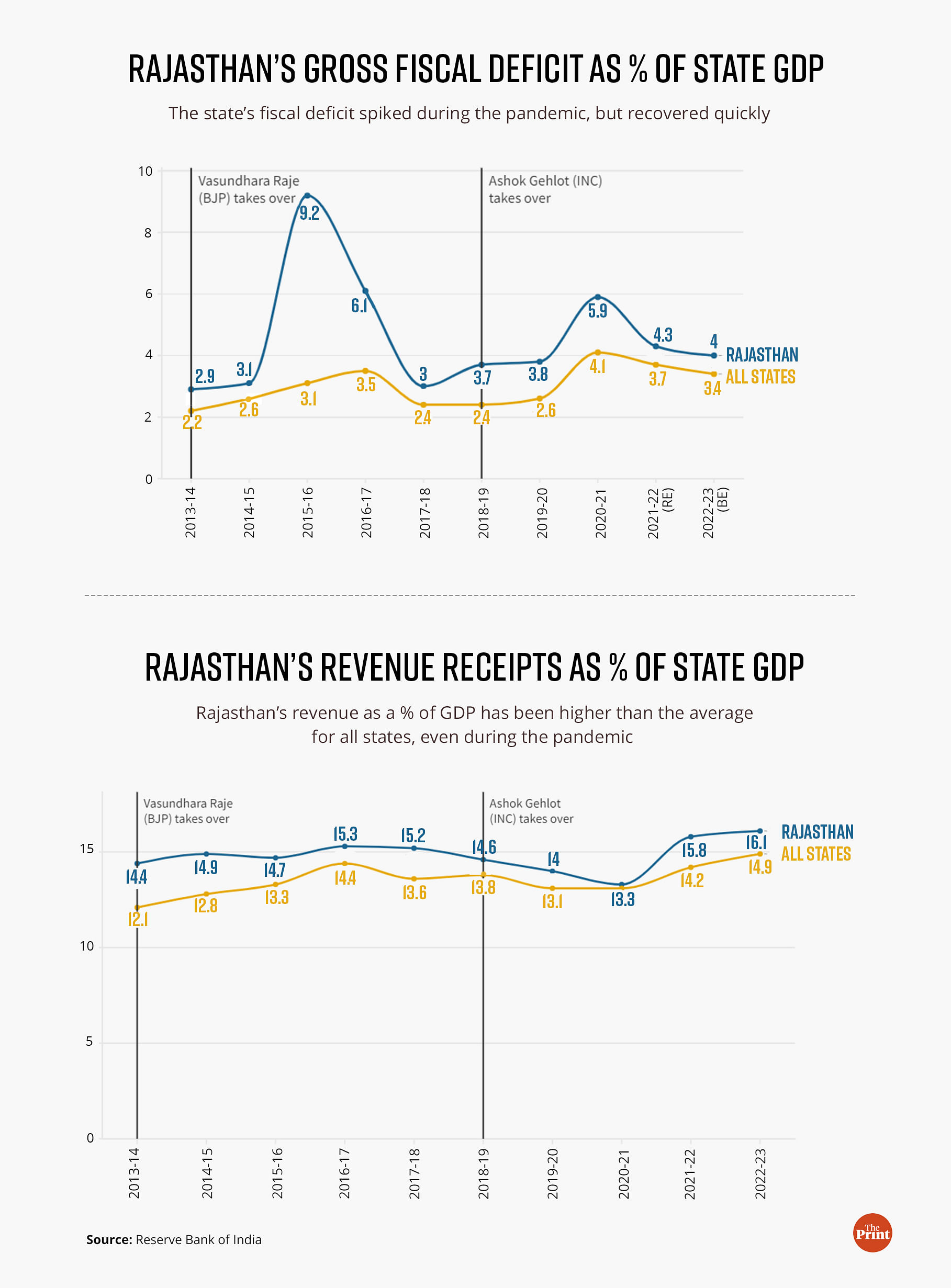

Not only has Rajasthan’s fiscal deficit — a measure of how much its expenditure exceeds its revenue — been falling, it has recently been falling faster than the average for all states.

On the revenue side, Rajasthan’s receipts as a percentage of the state’s gross domestic product (GSDP) have been higher than the average for all states over the last decade. Recently, that gap has widened.

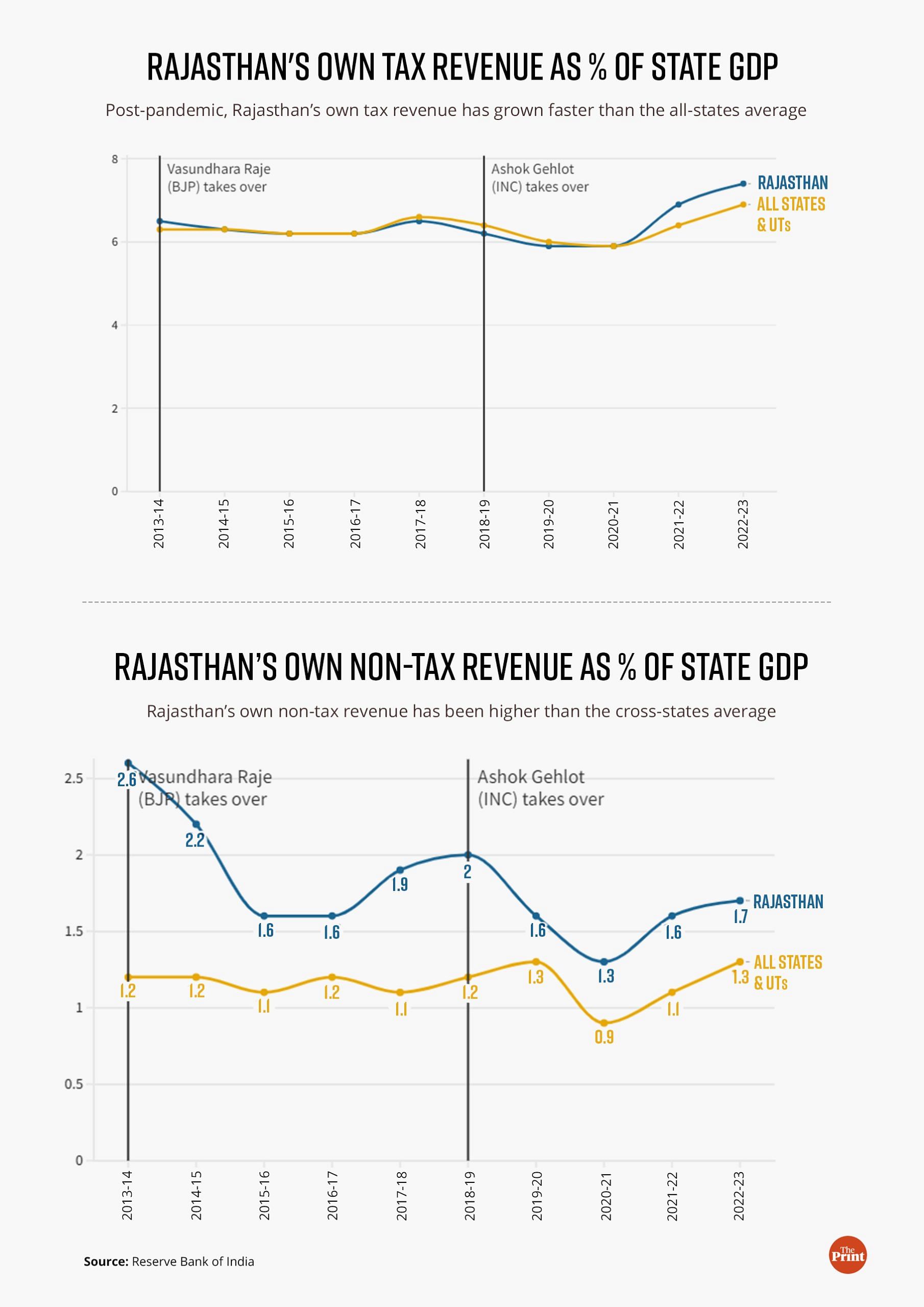

Notably, the state has also become more financially independent. That is, its own tax revenue and own non-tax revenue — the money it earns with no help from the Central government — have both been higher than the average for all states, and have both been rising recently.

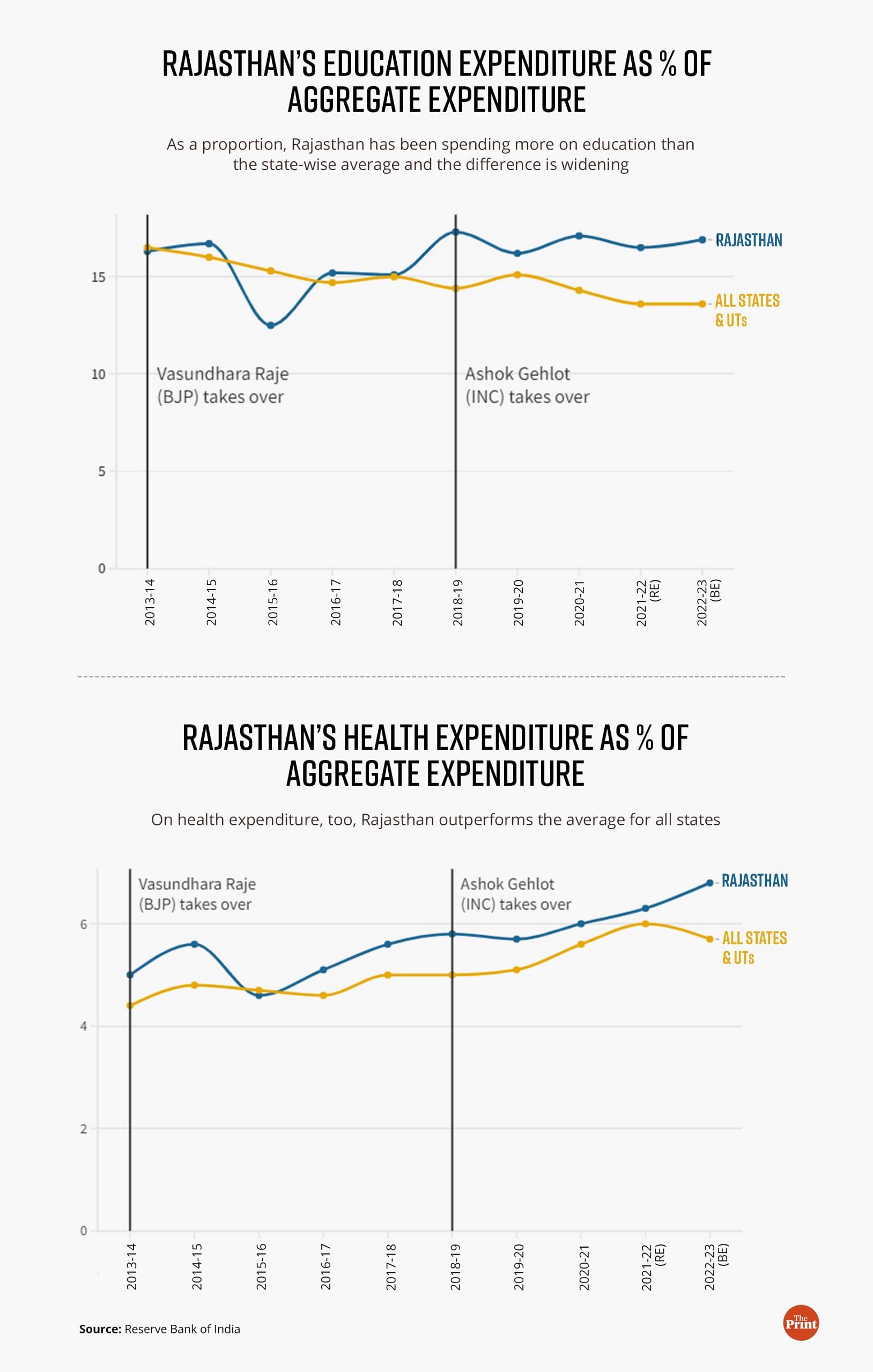

On the expenditure side, Rajasthan has been spending a higher proportion of its overall expenditure on social sectors like health and education as compared to the average for all states.

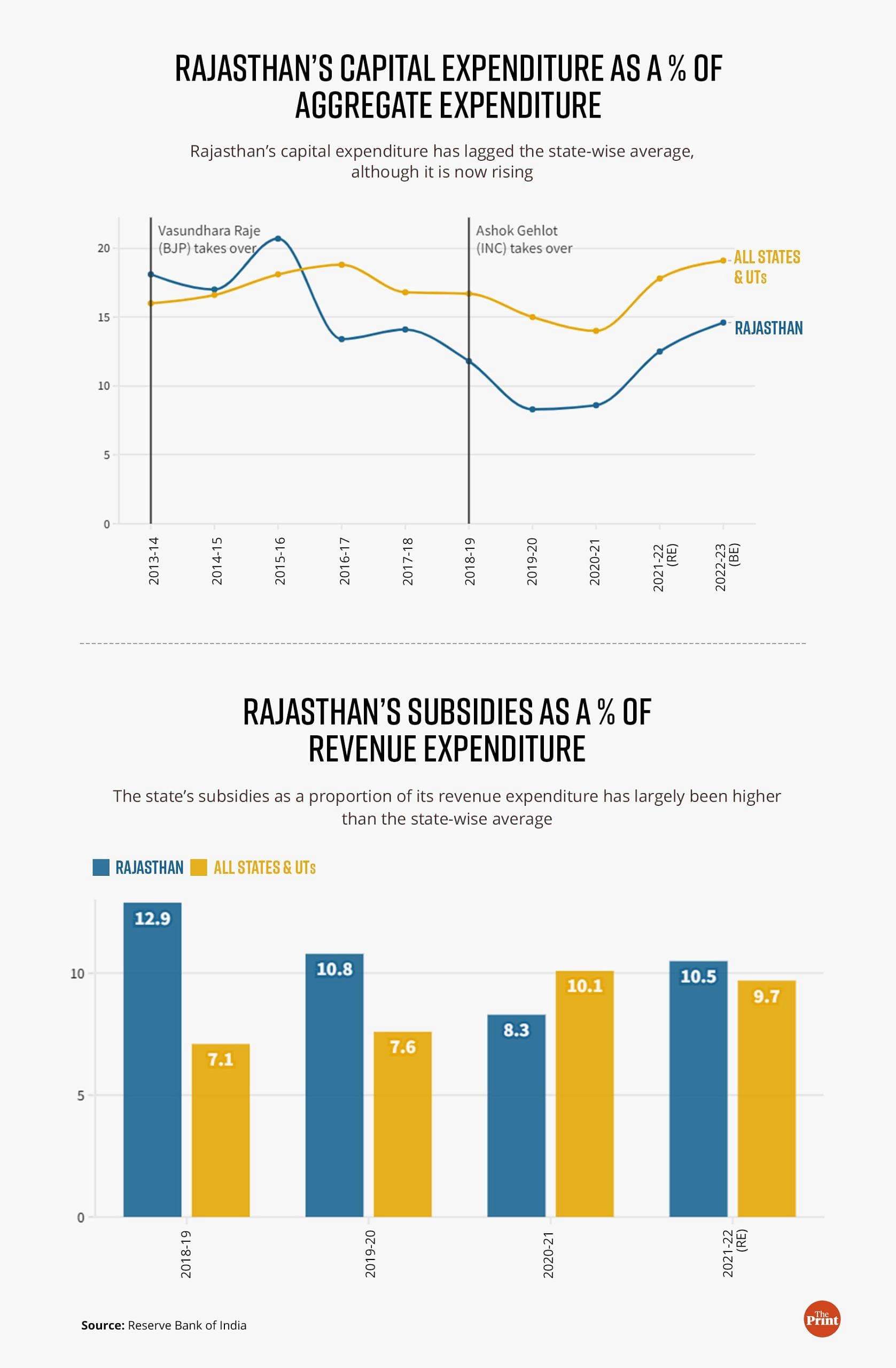

Where it performs worse, however, is in capital expenditure, where its spending has been lower than average for a while now, but even this has been growing in recent years.

On the subsidies front, too, Rajasthan’s expenditure has been higher than the average. Its subsidy expenditure as a percentage of GSDP was falling pre-pandemic, at a time when it was rising on an aggregate basis for all states.

However, since the pandemic, Rajasthan’s subsidy expenditure has risen while it has fallen for all states taken together.

Officials in the Rajasthan government ThePrint spoke to say that all of this is part of a concerted strategy by the state government to provide a demand-side push by leaving people with more money to spend. This is expected to then boost collections from the sale of goods and services and, thus, strengthen the state’s finances.

Economists say that the decision to allocate more expenditure to ‘freebies’— which form a part of revenue expenditure — rather than capital expenditure is down to the priorities of the respective state government, and that one is not necessarily better than the other.

While capital expenditure can create jobs and create new assets, subsidies in the form of cheaper gas, free cycles, or free sewing machines can serve as a similar fillip to the natural gas, cycle, and sewing industries, they say.

“States spend on capital expenditure according to the size of their budgets,” Madan Sabnavis, Chief Economist at the Bank of Baroda, explained. “But to say that this portion of revenue expenditure is unproductive is also not necessarily correct.”

Other economists, however, feel that capital expenditure has a much higher efficacy in terms of spurring economic growth and job creation, since it creates actual assets.

“Capital expenditure has a much larger multiplier effect on the economy than revenue expenditure does,” Manish Gupta, Associate Professor at the National Institute of Public Finance and Policy, said. “Capital expenditure in the form of building roads, bridges, hospitals, and schools results in many more benefits in terms of job creation, demand creation for other related industries, and also spurs overall economic growth.”

Also Read: Rs 500 gas to free electricity, welfare schemes are doubling as poll ads for Gehlot govt

Maintaining fiscal balance

During the pandemic year of 2020-21, Rajasthan’s fiscal deficit — when expenditure is more than revenue in a fiscal year — as a percentage of its gross state domestic product (GSDP) spiked to 5.9 percent from 3.8 percent in the previous year, a 2.1 percentage point increase in one year. To be sure, it rose for all states too, but not by as much.

On average, for all states, the fiscal deficit rose from 2.6 percent in 2019-20 to 4.1 percent in 2020-21, an increase of 1.5 percentage points.

Since then, however, Rajasthan has done well to bring its fiscal deficit back under control. As per the latest data available, the state has estimated its fiscal deficit to be 4 percent of GSDP in 2022-23 as compared to the 3.4 percent average for all states.

That means Rajasthan has reduced its fiscal deficit by 1.9 percentage points in two years as compared to a 0.6 percentage point reduction for all states on average.

It is also worth noting that the fiscal deficit grew by 0.8 percentage points during the rule of BJP’s Vasundhara Raje from from 2013-14 to 2018-19 as compared to a somewhat lower growth so far of 0.5 percentage points under Gehlot.

Robust & independent revenues

Rajasthan’s revenue receipts — the money it earns through instruments like taxation — were mostly flat as a percentage of its GSDP under Vasundhara Raje.

Under Gehlot, the revenue receipts saw a more stark change, first dropping during the pandemic, and then mounting a robust recovery for the subsequent two years.

What is more notable, however, is that Rajasthan’s own tax and own non-tax revenue has recently been forming a higher share of its overall revenue receipts than what has been the case for the other states on average.

That is, while Rajasthan’s own tax revenue followed the same path as those of other states until 2020-21, it has grown faster than the average since then. The state’s own non-tax revenue, on the other hand, has consistently been above average over the last decade. This is in large part to the fact that Rajasthan – being relatively oil-rich – receives royalties for the oil produced in its territory. This is an advantage it has over most other states.

An increasing share of own revenues, both tax and non-tax, means that Rajasthan is increasingly becoming independent of the Centre, a major issue with many states who say that they have, in fact, become more dependent on the Union government since the implementation of the Goods and Services Tax (GST).

Also Read: EWS is upon us because politicians now offer reservation in elections just like freebies

What’s driving revenue growth?

ThePrint delved even deeper into the financials of the state to figure out how Rajasthan was bolstering its own revenues. The bulk (about 70 percent) of Rajasthan’s revenue receipts come from tax. The rest comes from central transfers.

Tax receipts are divided into own tax and Rajasthan’s share in central taxes.

What is notable is that own taxes as a proportion of Rajasthan’s total tax revenue decreased under Vasundhara Raje from 66 percent to 62 percent over her term as Chief Minister, only to rise again under Gehlot to 67 percent in 2022-23.

In other words, Rajasthan became more dependent on tax devolution from the Centre under Vasundhara Raje, and became more independent under Gehlot.

Diving even deeper, analysis found that Rajasthan’s own tax revenue has benefited from the implementation of the GST. That is, since GST, taxes on the sale of goods and services have formed a higher share in the state’s own tax revenue.

This is a better position to be in than to be dependent on other internal sources of tax revenue such as tax on electricity, or on motor vehicles, since taxes like GST are more broad-based and apply across almost all goods and services.

The reason for this increased dependence on state GST, according to Arvind Mayaram, economic advisor to the Rajasthan chief minister and former Union finance secretary, is that the state has put in place “light-touch” tax regulations that improve compliance without “the need to keep doing raids”.

“It is very much part of a concerted effort by the state government,” he told ThePrint. “Which basically means that the systems that have been put in place are resulting in better compliance, and better compliance without harassment.”

Spending priorities

With revenues doing better than average, it should stand to reason that the state’s expenditure is commensurate with this performance. The data for Rajasthan shows its overall expenditure on health, education and other social sectors has been higher than the average.

That said, the data also shows that Rajasthan’s expenditure on capital creation has consistently lagged the average for all states. Budgeted at 14.6 percent of aggregate expenditure in 2022-23, Rajasthan’s capital expenditure is still significantly below the average of 19.1 percent for all states, although it is still the highest in the last seven years.

Looking over time, however, the data shows that the Gehlot government has managed to reverse a largely declining trend in the state’s capital expenditure. The capital expenditure was 18.1 percent of aggregate expenditure in 2013-14, which fell to 11.8 per cent in 2018-19, when Gehlot took over. Since then, it has risen — except for during the pandemic — to 14.6 percent in 2022-23.

The other area where the Gehlot government falls below average is regarding the amount the state spends on subsidies as a proportion of its revenue expenditure.

Revenue expenditure is largely to do with salaries, pensions, and other expenditure that needs to be made on a recurring basis. A larger share of subsidies in this is typically seen as being an increase in unproductive expenditure.

Available data on subsidies goes back only to 2018-19. What it shows is that Rajasthan was able to reduce its subsidy expenditure from nearly 13 percent of revenue expenditure in 2018-19 to 8.3 percent in 2020-21. During the same period, the subsidy spending by states on average rose from 7.1 percent to 10.1 percent.

After the pandemic, however, the available data shows Rajasthan’s subsidy expenditure increased its share to 10.5 percent in 2021-22 while on average states were able to reduce theirs to 9.7 percent.

“Several so-called freebies like gas, cycles, sewing machines, or even subsidised fertiliser to farmers, do serve to provide an impetus to particular industries that produce these items,” Sabnavis said. “Some states may choose to provide a fillip to their economies through this route rather than opting for capital expenditure.”

This ties into what Mayaram has to say about Rajasthan’s strategy. According to him, the state has tried to create a demand-side push rather than focussing on the supply-side as the central government has.

“When demand is languishing, then a supply-side push doesn’t really help the economy,” he explained. “In Rajasthan, we have looked at more of a demand side response. One tends to look at welfare expenditure as ‘freebies’ or as expenditure which is non-productive.”

“If you are doing freebies with a very clear idea in your mind that you are creating a demand side push, then it results in higher tax collections,” Mayaram added. “Look at, for instance, (Rajasthan’s incentives on) gas now. They are going to give gas at Rs 500 to the BPL families, which means that they will have that much more money to spend on other items.”

(Edited by Tony Rai)

Also Read: ‘Freebies form of bribery, bring in law to curb it,’ says RSS-affiliate SJM’s Ashwani Mahajan