Govt officials in India & South Korea say Washington isn’t willing to give waivers for mere import reductions. It wants a complete purchase halt.

New Delhi: Oil buyers who viewed Obama-era policies as precedent for US sanctions on Iran are getting a rude shock.

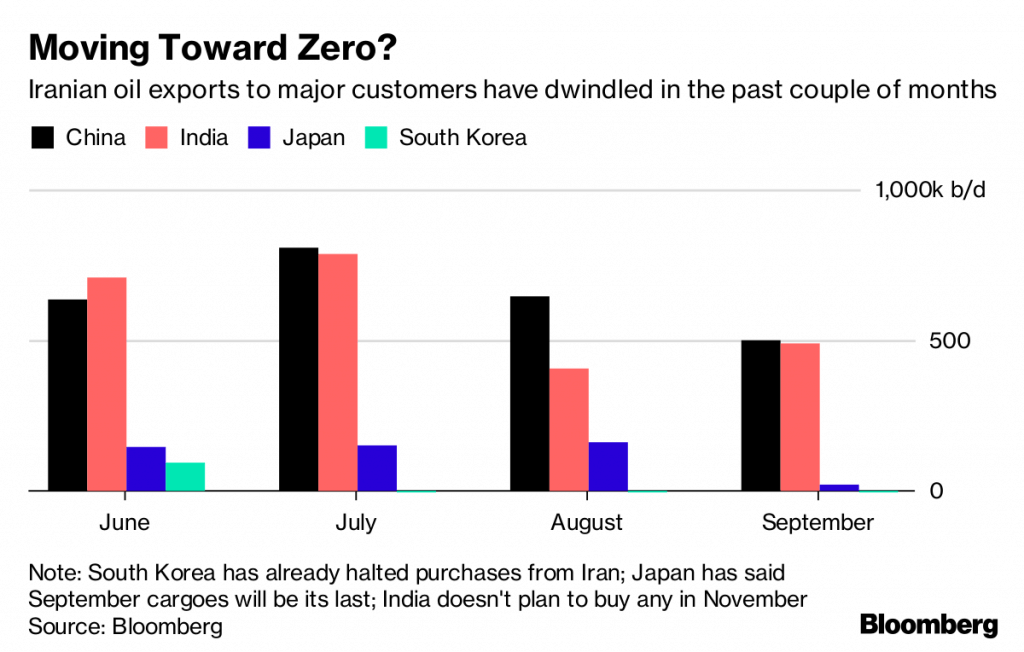

A Trump administration demand that oil purchases should stop has blindsided Asian importers who assumed they would only have to reduce shipments from the Persian Gulf state. Now, one after another, buyers are complying to avoid being cut off from the American financial system when restrictions on Iranian supplies take effect in November.

The miscalculation that President Donald Trump’s rules will be similar to Barack Obama’s is at the root of crude’s recent surge over $85 a barrel and forecasts for $100 oil. As refiners are forced to shun Iran, the market’s being squeezed more than traders expected. While the US granted waivers earlier this decade to nations that cut imports, such exemptions are proving harder to come by this time around.

“The Trump Administration has signaled it is far less willing to use the provisions in the Iran sanction statute that allow for countries to receive exceptions if they demonstrate significant reductions in purchases of Iranian oil,” said Jason Bordoff, director of the Center on Global Energy Policy at Columbia University in New York and a former Obama administration official.

That’s forcing buyers “to zero out their purchases of Iranian oil much more quickly at a time when oil markets are already tightening,” he said.

India is the latest major customer of Iranian oil to avoid purchases as its refiners declined to seek any cargoes loading in November. That follows Japan, where the government continues talks with the US The demand for zero imports was first met by South Korea, which relies on America to pressure its northern neighbor’s leader, Kim Jong Un, to abandon nuclear weapons.

Difficult negotiations

Government officials in India and South Korea — previously Iran’s second and third-largest customers — say negotiations with the US administration are significantly more difficult than when the Obama administration imposed restrictions on Iran over its nuclear program. Washington isn’t willing to give waivers for mere import reductions, and instead wants a complete halt, they said.

Top buyer China is a wildcard. Its government has said it opposes unilateral sanctions by the US, with which it’s fighting a trade war. Earlier this decade, it remained the Persian Gulf state’s biggest customer, although purchases fell as Iranian production was squeezed by American restrictions. Over the past couple of months, the Islamic republic’s shipments to the Asian nation have declined.

US expectations

“We will consider waivers where appropriate,” US Secretary of State Michael Pompeo said last month during a visit to New Delhi. But “it is our expectation that the purchases of Iranian crude oil will go to zero from every country or sanctions will be imposed,” he said.

The harder US stance means the amount of oil being taken out of the market is higher than what was expected in May, when Trump announced plans to reimpose sanctions on Iran. With America “incredibly serious” about its measures, the consensus on export losses has risen to as much as 1.5 million barrels a day, from 300,000 to 700,000 barrels earlier, according to Ben Luckock, co-head of oil trading at Trafigura Group.

Iran’s Oil Minister Bijan Namdar Zanganeh has said his country will come up with “other ways” to mitigate the sanctions impact. Still, tactics such as using an alternative payment mechanism may not be enough to fully cushion the blow to its exports, which have already plunged to the lowest level since February 2016.

Cautious buyers

That’s because Asian oil buyers and shippers will probably keep away even if Iran tries to keep its crude in the market. While they may not be technically falling foul of sanctions, any exposure to the Islamic republic’s cargoes could result in secondary restrictions or companies being cut off from American financial institutions.

“Potential deals with Iran just pale in comparison with deals in the United States,” Brian Hook, the US State Department’s special representative for Iran, said at a press briefing on Sept. 25, adding that the administration will “vigorously and aggressively” enforce sanctions.

As the chances of getting a waiver dwindle, oil processors in Asia are not only scrambling for alternative supplies, but may also have to bear higher costs. Plants that were originally configured to process Iranian crude may need to undergo rework.

Crucial waiver

Some South Korean facilities, for example, are optimised to run Iranian condensate, a type of ultra-light oil. “So obtaining the waiver from the US is extremely crucial,” said Kim Jae-kyung, a research fellow at the Korea Energy Economics Institute.

Energy firms also have to contend with the possibility of losing access to shale supplies, potentially denying them the chance to secure relatively cheap cargoes. When the Obama administration had imposed restrictions in 2012, US output was almost 50 per cent lower than current levels and American crude exports were banned.

“Companies have a choice either to do business in Iran or in the United States,” the US State Department’s Hook said. “Very few companies are going to choose Iran over the United States, and so that’s just the economic reality.” –Bloomberg