Mumbai: Indian investment bankers are set for their best year ever, collecting almost 26 billion rupees ($347 million) in fees from local initial public offerings that have reached an all-time high in 2021.

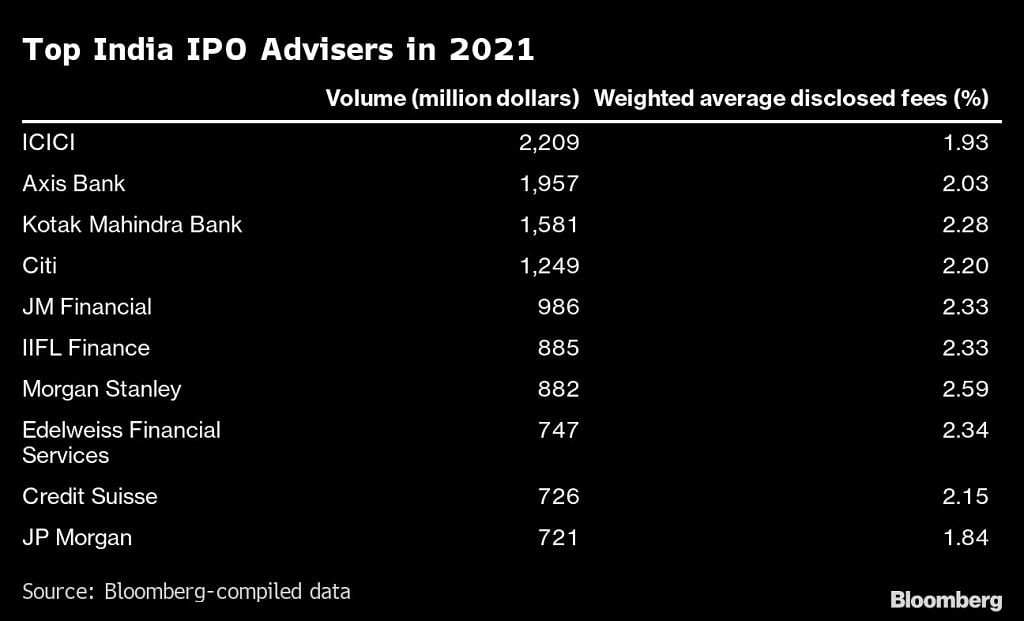

A little over 110 companies ranging from online grocers to food delivery and beauty startups listed their shares in Mumbai this year, raising almost $18 billion, according to data compiled by Bloomberg. The fees raked in by banks steering those first-time share sales are more than four times the previous record in 2017, figures provided by New Delhi-based Prime Database show.

“It was an extraordinarily busy year, something I haven’t seen in my 30-year career,” said Jayasankar Venkataraman, head of equity capital markets at Kotak Mahindra Capital Co. in Mumbai. “Investment bankers carried work home and they weren’t fully switched off.”

The IPO surge, coming amid a rally in the benchmark local stock index that hit a record in October, was led by companies including One 97 Communications Ltd., Zomato Ltd. and PB Fintech Ltd. The wave of listings in India has tracked the wider trend in Asia, where companies have raised about $181 billion this year, an unprecedented level.

One 97 offers digital payments services under the brand Paytm; Zomato is a food delivery startup; and, PB Fintech runs an online insurance market place called Policybazaar.

There are many more share sales lined up for next year in India besides the proposed mega listing by state-owned Life Insurance Corp. of India, which could raise at least 400 billion rupees ($5.3 billion).

The country’s biggest bank, State Bank of India, could mop up about $1 billion by selling a stake in its mutual fund venture through an IPO. More Retail Pvt., a grocery chain backed by Amazon.com Inc., is looking at an offering of as much as $500 million. E-commerce firm and Walmart Inc. unit, Flipkart Online Services Pvt., and digital-education startup Byju’s Pte. are also preparing for first-time share sales.

Kotak Mahindra’s Venkataraman expects 2022 will see similar amount of fundraising or a little more. But risks such as the spread of the omicron variant of the coronavirus, rising inflation and interest-rate increases could damp the sentiment in the market, he added. The S&P BSE Sensex is already off its record Oct. 18 closing level. –Bloomberg

Also read: Couple that travelled Indian cities by foot to create MapmyIndia worth Rs 4,400 cr after IPO