Mumbai: The Reserve Bank of India favors keeping the current inflation targeting regime unchanged, saying it has been effective in containing price-growth.

The current framework is appropriate for the next five years, according to a report from the RBI on Friday, after it reviewed the flexible inflation targeting regime, or FIT, put in place five years ago. It, however, acknowledged that some aspects like the time horizon to measure failure, process of admitting members to the rate panel, giving forward guidance and release of minutes need a review.

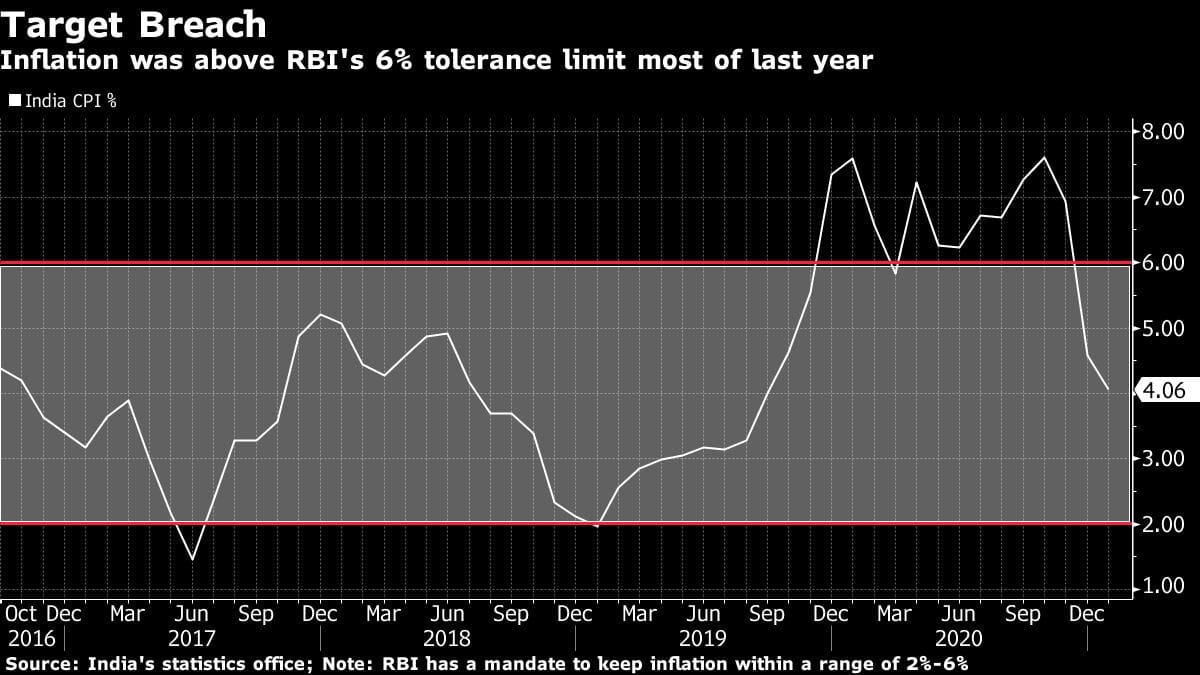

The existing mandate requires the RBI to keep headline inflation at the 4% midpoint of its target range of 2%-6%. While the central bank has managed to keep consumer-price growth mostly within bounds, a spike in food costs last year pushed inflation beyond its tolerance limit, forcing policy makers to pause interest rate cuts after 115 basis points of easing.

“During the period under review, headline CPI inflation averaged 3.9% in India with a decline in inflation volatility, attesting to the success of FIT in terms of its primary mandate,” the RBI said.

The central bank’s view represents a push back against any efforts by the government to relax the inflation goal in order to get policy makers to focus more on stimulating economic growth. Asia’s third-largest economy is headed for its biggest annual contraction on record in the fiscal year through March.

Governor Shaktikanta Das has made it clear that anchoring inflation expectations was the RBI’s primary task so that policy credibility is not undermined. He has said loosening the inflation target would dilute its effectiveness toward setting monetary policy.

The current band — a broad range of 400 basis points within which the central bank has sanction to operate by law — is already the widest in Asia, and only matched by Turkey and surpassed by Argentina.

“The international experience suggests that inflation targeting emerging market economies have either lowered their inflation targets or kept their targets unchanged over time,” the RBI said. “In India, however, the repetitive incidence of supply shocks, still elevated inflation expectations and projection errors necessitate persevering with the current numerical framework for the target and tolerance band for inflation for the next five years.” – Bloomberg

Also read: What are credit default swaps, the 2008 ‘taboo’ financial product that RBI wants to revive