India’s unexpectedly strong economic growth last quarter has reduced chances of an interest rate cut at this week’s central bank’s policy meeting despite record-low inflation.

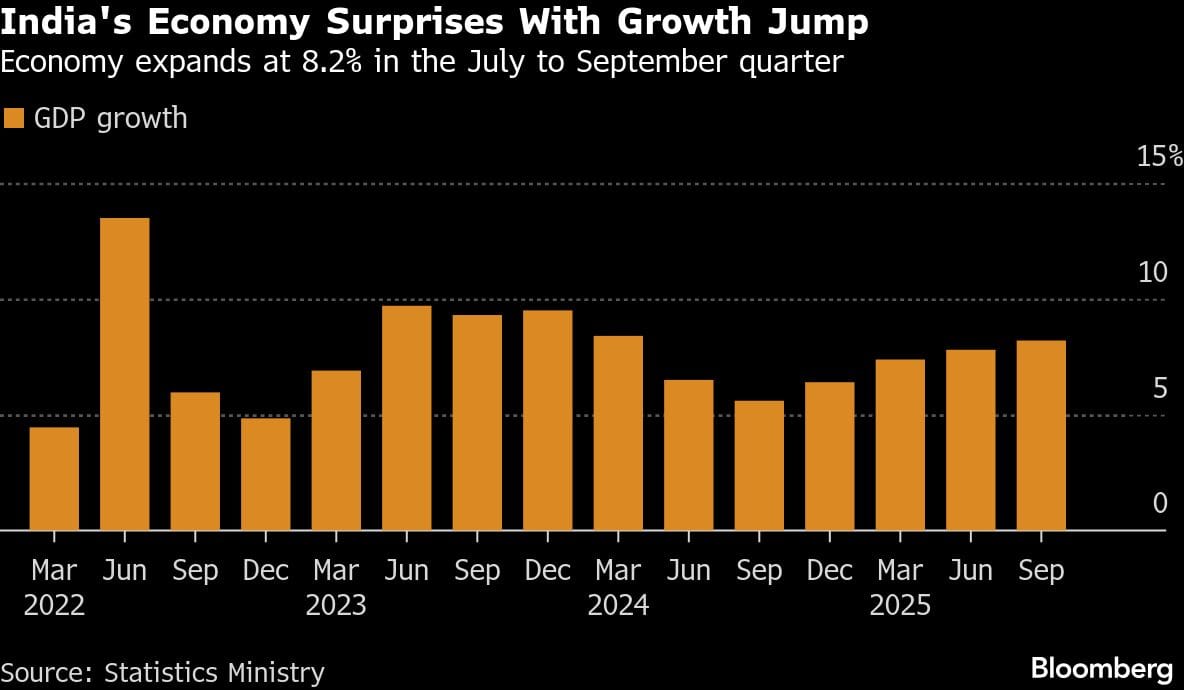

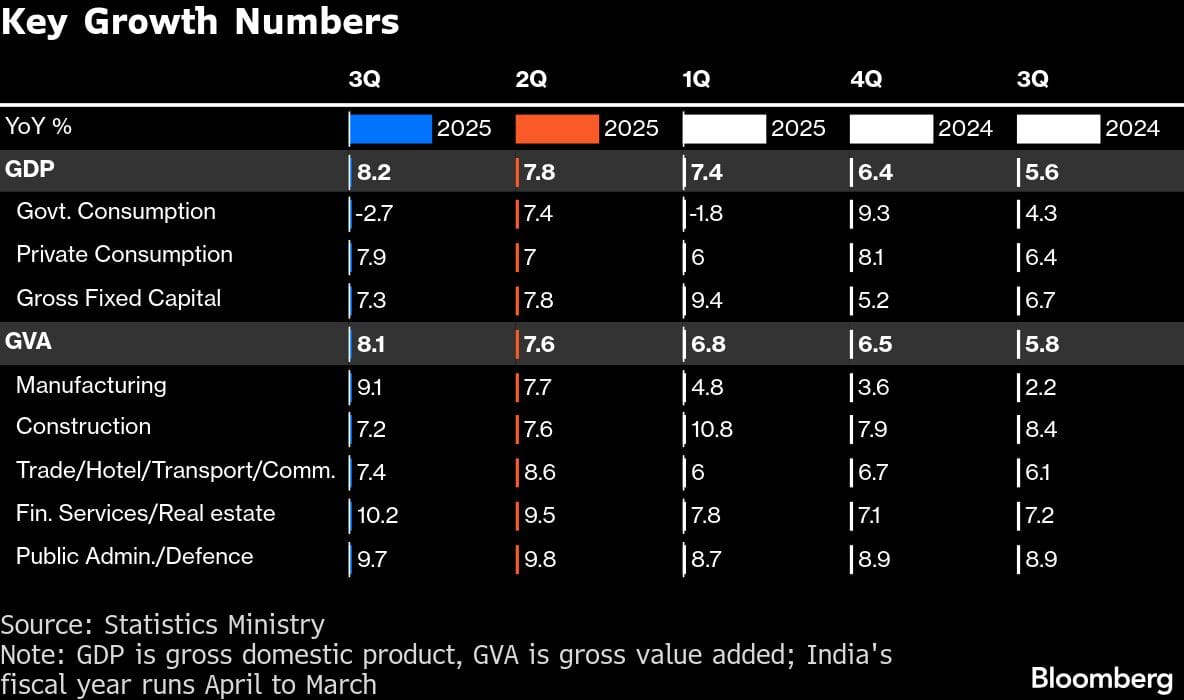

Economists at Barclays Plc, Standard Chartered Bank and State Bank of India expect the Reserve Bank of India to keep rates unchanged at 5.5% after its meeting on Friday. Gross domestic product for the July-September quarter rose an unexpectedly strong 8.2% from a year earlier, beating even the most bullish forecasts.

“Expectations built till a few days back of a shallow rate cut of 25 basis points appear to have faded,” said Soumya Kanti Ghosh, Chief Economic Adviser to State Bank of India and a member of the Prime Minister’s economic advisory council. The choice is now “tilted in favor of pause in December,” Ghosh said.

Before the GDP data, RBI Governor Sanjay Malhotra had flagged the possibility of cutting rates when the monetary panel meets later this week, citing record-low inflation. The retail price gage fell to a record 0.25% in October from a year earlier, data released last month showed.

Barclays economist Aastha Gudwani raised her growth forecast to 7.2% from 6.8% earlier. She cited another upside surprise on second quarter GDP and strong momentum so far in the October to December period, supported by festival demand and recent goods-and-services tax.

“We no longer expect the RBI monetary policy committee to cut the policy rate in the upcoming December 5 meeting,” she wrote, even as she acknowledged growth has peaked and will slow next year.

The strong data prompted economists across the board, including Santanu Sengupta of Goldman Sachs Group Inc., to sharply raise their growth forecasts for the year through March. They now expect expansion to be as much as half a percentage point more at around 7% to 7.5%. Goldman Sachs lifted its estimate to 7.4% from 7% earlier.

Part of the upside surprise in both quarters may be due to statistical factors such as an unusually favorable GDP deflator, which strips out inflation to derive real growth. Even so, the strength in output makes it harder for the RBI to justify a rate cut this week, economists say, as they revise up their full-year growth projections.

The central bank has been on pause since June after cutting the policy repurchase rate by a cumulative 100 basis points since February.

In its policy meetings scheduled this week, the RBI may raise its growth forecast from 6.8% earlier while lowering its inflation projection from 2.6%, economists said.

The “staggering GDP growth makes for a nail-biter RBI meet,” wrote Nomura Holdings economists Sonal Varma and Aurodeep Nandi. They cautioned, however, that growth was heavily flattered by statistical factors, and that “urban income growth remained weak, corporate sales was lackluster, industrial production growth low and external sector under pressure from steep US tariffs.”

A rapidly depreciating rupee could also prevent the central bank from lowering interest rates further. The local currency fell to a new all-time low against the dollar Monday as lingering uncertainty over a US trade deal overshadowed a robust growth. The rupee closed at 89.6350 to a dollar after declining to as low as 89.78 intraday. A rate cut may add more pressure on the exchange rate.

“The rupee could be a deciding factor, as a rate cut would add more pressure,” said Abhishek Goenka, CEO of IFA Global, a currency consultant. “Since growth is already strong, the RBI may prefer to pause and support the rupee rather than worsen the pressure with a cut,” he said.

(Updates with currency markets details in last two paragraphs)

(Reporting by Anup Roy)

Disclaimer: This report is auto generated from the Bloomberg news service. ThePrint holds no responsibility for its content.

Also read: India current account gap widens as Trump tariff hits exports