New Delhi: Stock market volatility and a 10 percent fall in the markets in just two months have spooked India’s relatively new investors. Most of these investors started trading after the COVID-19 pandemic hit, and had never experienced a significant and sustained market correction until a few months ago. Now that they have, they’ve turned more cautious with their Systematic Investment Plans (SIPs).

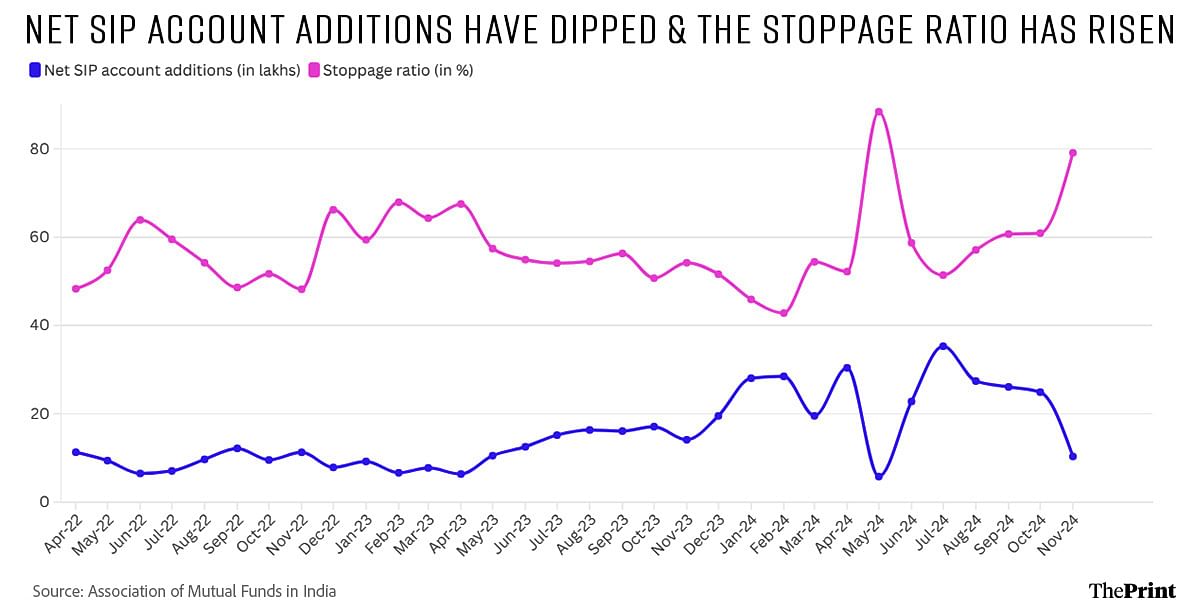

Analysis of data from the Association of Mutual Funds in India (AMFI) shows that net SIP account additions have been falling for four consecutive months now—the longest streak in more than two years—with a corresponding increase in the stoppage ratio, the ratio of account closures to account openings.

The data shows that net SIP account additions—the difference between openings and closures—fell to 10.3 lakh in November 2024, the lowest it has been since April 2023, except for an outlier month of May 2024. While the net additions increased immediately from the May 2024 dip, the November number comes after three consecutive months of falling net additions.

The stoppage ratio jumped to 79.1 percent in November 2024, the highest it has been since at least April 2022, again not counting the May 2024 blip.

Significantly, this trend in SIPs comes at a time when foreign investors have been pulling their money out of India. Foreign institutional investors (FIIs) pulled out a massive Rs 1.6 lakh crore from Indian markets over October and November. While FIIs have been net buyers so far in December, the number stands at just Rs 9,300 crore as of 12 December.

Also Read: Indian investors don’t need a coddling nanny. Let them make mistakes and learn

New investors unused to market falls & volatility

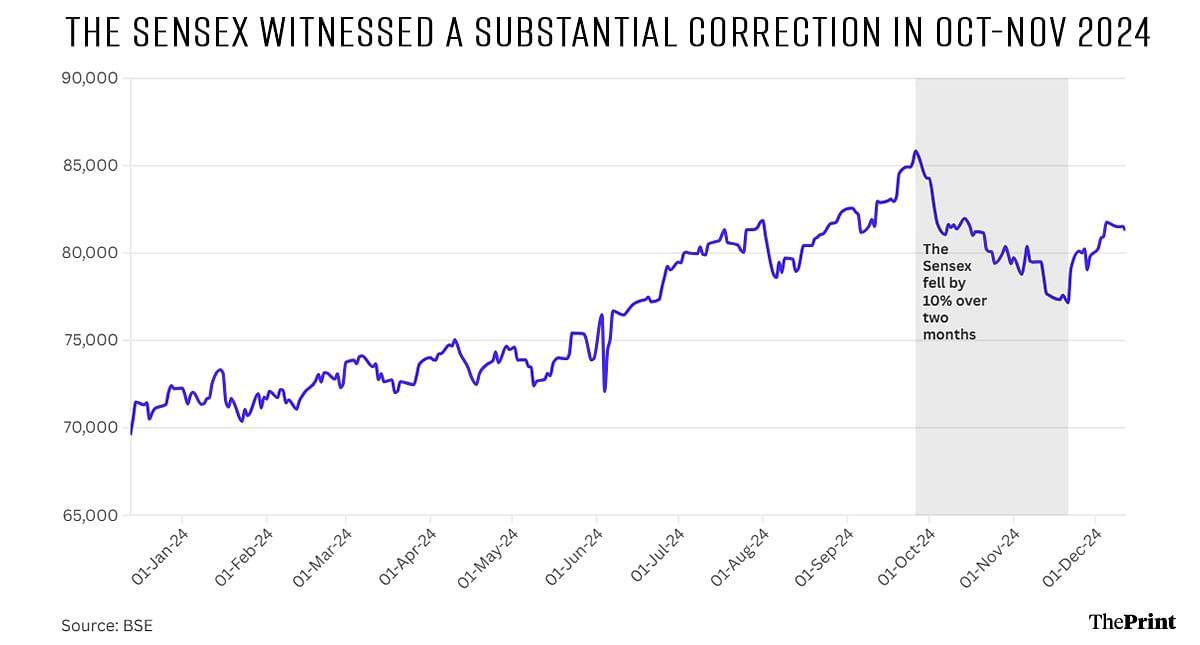

The main reason for this caution over SIPs is the recent volatility the market has seen since around June, including two months of a near-consistent fall over October-November 2024.

“Over the last few years, there has been a surge in new investors,” A. Balasubramanian, managing director and CEO of Aditya Birla Sun Life Mutual Fund, told ThePrint. “What happens is that first-time investors come to test the waters. If the returns they see are muted, then they hold back on their SIPs. And when the market turns volatile, this is what happens. Then, when the market again goes up, they return and then stay for a long period of time.”

According to official data, the number of demat accounts—necessary to trade in the stock market—surged from 4.09 crore in April 2020 to 17.9 crore in October 2024, which means more than three-fourths of the investors in the market currently are relatively new.

Coinciding with this surge in demat accounts was the surge in the stock market, with the Sensex seeing a 150 percent increase between April 2020 and September 2024. However, what followed was a relatively significant correction, when the stock market fell 10 percent over October and November.

This fall also followed a period of volatility starting in June, first associated with the results of the Indian general elections, and then due to foreign portfolio investors briefly shifting their investments to China in response to the Chinese government’s economic recovery measures, and currently due to FPIs shifting their money to the US in anticipation of US President-elect Donald Trump’s pro-business moves once he takes over in January.

“The one-way climb in the market is over,” V.K. Vijayakumar, Chief Investment Strategist, Geojit Financial Services, told ThePrint.

“The 10 percent correction from the September peak—the first 10 percent correction for most newbies—has unnerved many.”

Vivek Iyer, partner at Grant Thornton Bharat, however, said the market corrections were not the primary cause. Rather, he highlighted the volatility in the market and the overall “depression in market sentiment” as driving the new cautious approach adopted by SIP investors.

“Mutual funds are a reflection of the overall sentiment of the economy and any negative economic sentiment impacts the SIPs and increases stoppages,” Iyer explained. “The market correction is not the reason for stoppages. It’s the overall depression of market sentiment that has caused people to re-evaluate and wait for the tide to turn.”

‘Knee-jerk reactions of investors who will be back’

Analysts and industry players, however, believe that these trends are not worrying.

Balasubramanian explained that SIP investments have become part of mainstream investment options for people, with an increasing number choosing them over fixed deposits. As the markets start rising again, he said he expects the investors to return, and this time for good.

“So, the high stoppage ratio is not worrying,” Balasubramanian said. “As long as the number of SIP investors keeps rising, there is nothing to worry about. The ones who stop will see the market is rising over time and will eventually come back and then will stay for a long time.”

Vijayakumar voiced similar sentiments, saying this fall in the growth of SIP participation was a short-lived reaction. “The fall in the net SIP additions and the rise in the stoppage ratio are knee-jerk reactions to the market correction,” he noted.

(Edited by Nida Fatima Siddiqui)

Government thinks investors are minting money. Whereas situation is otherwise. Government is getting fat STT. Capital gains tax on shares and MF’s should be scrapped. If required STT can be enhanced.