New Delhi: Policy uncertainty has been rising in India and is having a detrimental impact on the private sector’s willingness to invest in the country, the International Monetary Fund (IMF) has found in its latest country-specific report on India.

The IMF, in its annual Article IV consultation staff report on India, released last week, said its calculations showed heightened policy uncertainty negatively impacted not only new project announcements by the private sector, but also hindered projects that had already been announced, or were in the process of implementation.

The IMF noted that investment in India—taking public sector and private sector together—more than doubled from 15.5 percent of GDP in 1970-71 to a peak of 35.8 percent of GDP in 2007-08, but then declined to 27.3 percent of GDP during the COVID-19 pandemic in 2020-21. It recovered to 30.8 percent in 2023-24.

However, the IMF pointed out that post-pandemic recovery in investment has been driven by households and the public sector, while private corporate investment “has been sluggish especially compared with historical averages”.

“More importantly, private corporate investment in machinery and equipment, which is especially important to expand the production capabilities of the economy, has been weak, reaching 4.3 percent of GDP in 2022-23 compared to an average of 5.9 percent of GDP between 2011-12 and 2015-16, and 3.9 percent in 2020-21,” the IMF report said.

It added that nominal investment growth by private corporates has decelerated further from 21 percent in 2022-23 to 13 percent in 2023-24.

The negative impact of policy uncertainty

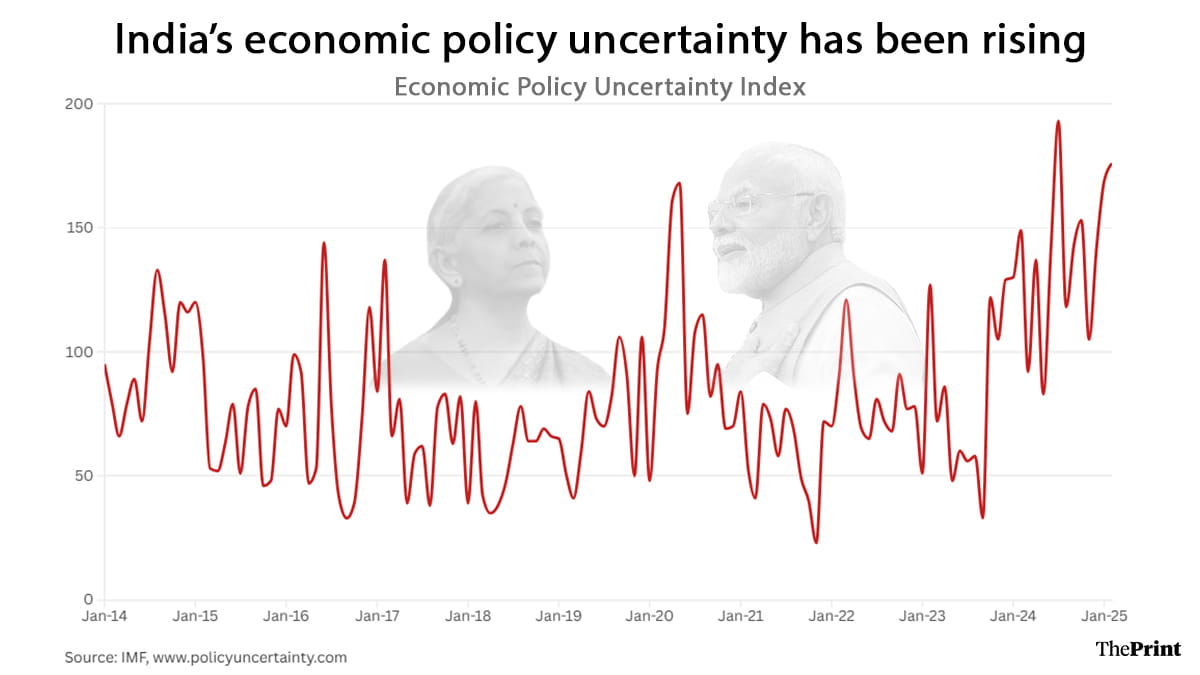

The IMF used an Economic Policy Uncertainty Index developed by economists Scott Baker of the Kellogg School of Management at Northwestern University, Nick Bloom of Stanford University, and Steven Davis of the Booth School of Business at the University of Chicago.

Using this data, the IMF noted that economic policy uncertainty in India was high in the early 2010s and at the onset of the COVID-19 pandemic in 2020.

“It increased again in late 2023 and has remained elevated and above trend since then, in part due to heightened global uncertainty, particularly regarding trade policy,” the IMF said.

The data from the index shows India’s economic policy uncertainty spiked to an index reading of 168 in May 2020, just as the COVID-19 pandemic was making an impact. It fell to 33 by September 2023, but again jumped to 176 by February this year. That is, uncertainty increased by 143 points in about a year and a half.

This is particularly important because the IMF’s analysis also shows that heightened uncertainty hurts investor sentiment.

“A one-standard deviation increase in uncertainty (that is, 40 points) is associated with a decline in the number of new projects announced by 11 percent, which is around 66 fewer projects per quarter,” the IMF said.

It added that a 40-point increase in uncertainty is correlated with eight more projects abandoned even after implementation had begun, five projects temporarily stalled, eight projects permanently shelved before implementation began, and four projects with implementation stalled.

(Edited by Nida Fatima Siddiqui)

Also Read: India’s growth can’t run on autopilot. Investors aren’t buying Modi’s global bright spot hype