New Delhi [India], August 22 (ANI): India’s private sector demonstrated strong output across India for the 37th consecutive month in August, highlighting the latest HSBC Flash India PMI (Purchasing Managers’ Index) report.

The report showed that the Composite PMI Output Index recorded an impressive 60.5, marking the 37th consecutive month of expansion. This sustained growth reflects strong demand across various sectors, despite a slight dip in manufacturing activity.

“Output Index -stood at 60.5 in August, little changed from 60.7 in July and pointing to a sharp rate of expansion that was above its long-run trend level (54.6)” said the report.

The Manufacturing PMI fell to 57.9, down from previous highs, signalling a moderation in growth. However, the services sector continued to thrive, with the Services PMI rising to 60.4. This divergence highlights the ongoing recovery in the services industry, which has been a significant driver of economic activity post-pandemic.

“The HSBC Flash India Manufacturing PMI – slipped from 58.1 in July to a three-month low of 57.9 in August. The latest reading was nevertheless above the historical average (54.0) and signalled a strong improvement in the health of the sector” mentioned the report.

The index also highlighted that the new business inflows remained robust, contributing to the overall positive sentiment in the private sector. Although the growth rate for new orders slowed, it still indicated strong demand, suggesting that businesses are optimistic about future prospects.

“India’s flash composite PMI slipped slightly in August, though it remained significantly higher than the historical average. The manufacturing sector experienced a softer rise in output, while services firms saw a slightly quicker rise in business activity. Although new order growth for the manufacturing sector slowed to the weakest since February, the pace of expansion remained sharp, indicating continued strong demand and favourable market conditions” said Pranjul Bhandari, Chief India Economist at HSBC

The report added that the Job creation also remained solid, with both manufacturers and service providers actively hiring to meet increasing demand.

“One factor that supported the clearing of backlogs at manufacturers was another round of job creation. Moreover, the pace of employment growth was marked and broadly similar to July” the report stated.

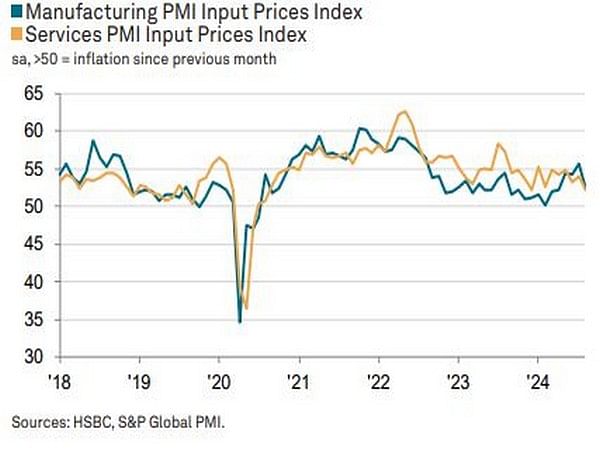

According to the report the Inflationary pressures were a mixed bag in August. While input cost inflation eased, output price inflation surged to an 11-year high in the manufacturing sector. This rise in output prices may pose challenges for businesses as they navigate the balance between maintaining profitability and managing consumer demand.

Overall, the August PMI data highlighted the resilience of India’s private sector, driven by strong demand and job creation. As the economy continues to recover, stakeholders will be keenly watching how inflation trends evolve and their potential impact on future growth.

“Private sector companies in India forecast higher output levels in the year ahead, amid expectations that demand conditions will remain favourable” report added.

The positive outlook for the services sector, coupled with steady manufacturing activity, bodes well for India’s economic trajectory in the coming months. (ANI)

This report is auto-generated from ANI news service. ThePrint holds no responsibility for its content.