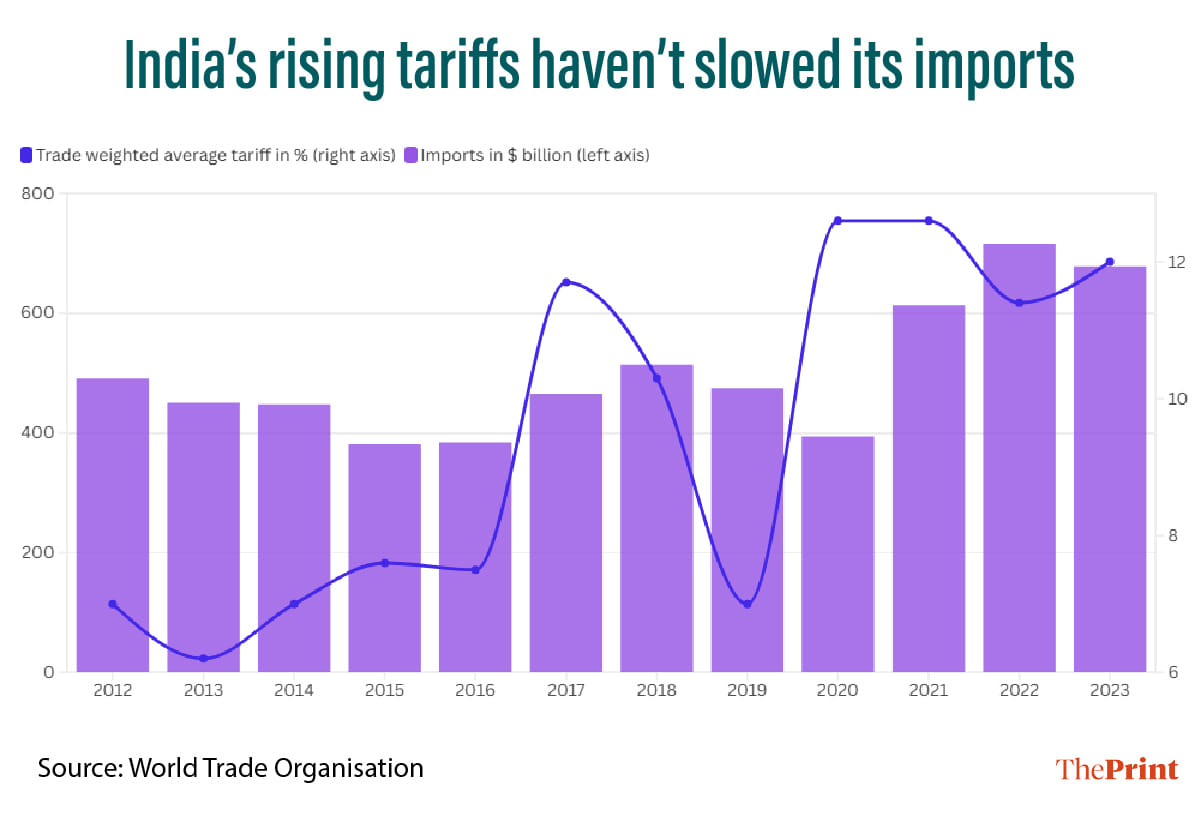

New Delhi: India’s average import tariffs have almost doubled since the Narendra Modi government first came to power in 2014, and yet, imports have surged in recent years, an analysis by ThePrint has found. A granular look at particular items that have seen import duties hiked reveals the same trend: duties have not deterred imports.

In 2023-24, the trade-average weighted tariffs on imported goods in India stood at 12 percent, according to data published in the World Tariff Profiles by the World Trade Organization (WTO), United Nations Trade and Development (UNCTAD) and the International Trade Center (ITC). This figure stood at seven percent in 2014.

Yet, India’s total merchandise imports stood at $678 billion in 2023-24, about 1.5 times what it was in 2014.

In fact, the lowest trade-average weighted tariffs India has had—at 6.2 percent — was in 2013, the last full year of the Congress-led United Progressive Alliance (UPA) government under former Prime Minister Manmohan Singh.

Also Read: Can income tax relief help BJP clinch Delhi? Anatomy of the middle-class voter demographic

Trump’s tariff troubles with India

The trade-weighted average tariff is the total customs revenue of a particular product as a percentage of the overall import value. India’s trade-weighted average includes both agricultural and non-agricultural products. However, the values between the two starkly differ.

For example, in 2023, while the overall trade-weighted average of tariffs on imported goods stood at 12 percent, on agricultural products it stood at 65 percent, while on non-agricultural products it was at nine percent.

US President Donald Trump has taken exception to India’s tariff regime, calling New Delhi the “tariff king” and pushing Prime Minister Modi to ensure fairer trade during their meeting last week. India and the US have agreed to hit $500 billion in bilateral trade by 2030 while working together for the “first tranche” of a bilateral trade agreement by autumn this year.

Trump has claimed India has tariffs as high as 70 percent on American goods, including motor vehicles. In 2023-2024, India exported $77 billion worth of goods to the US, while importing $42.1 billion worth of goods from Washington D.C.—a deficit which has irked the American President.

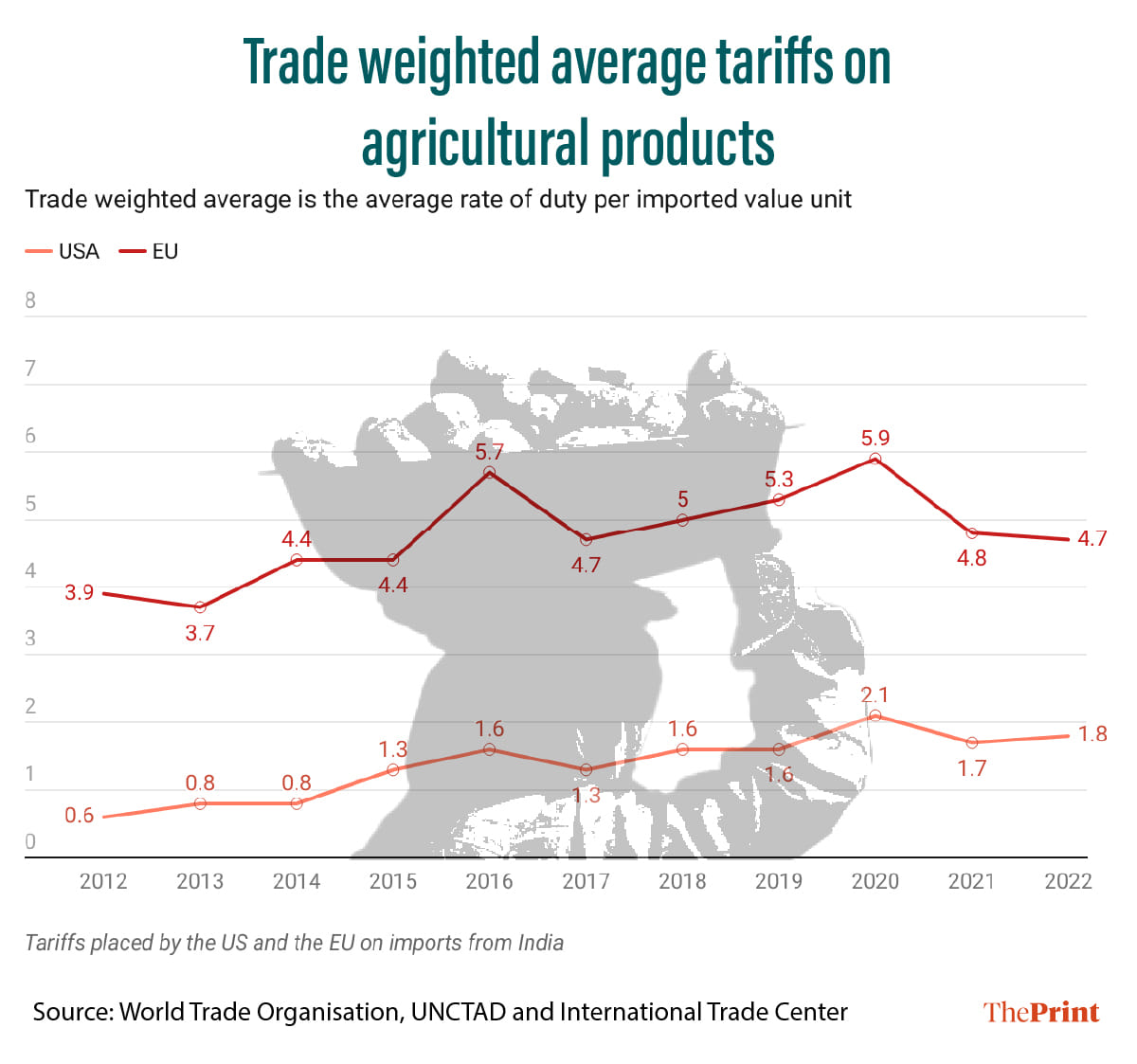

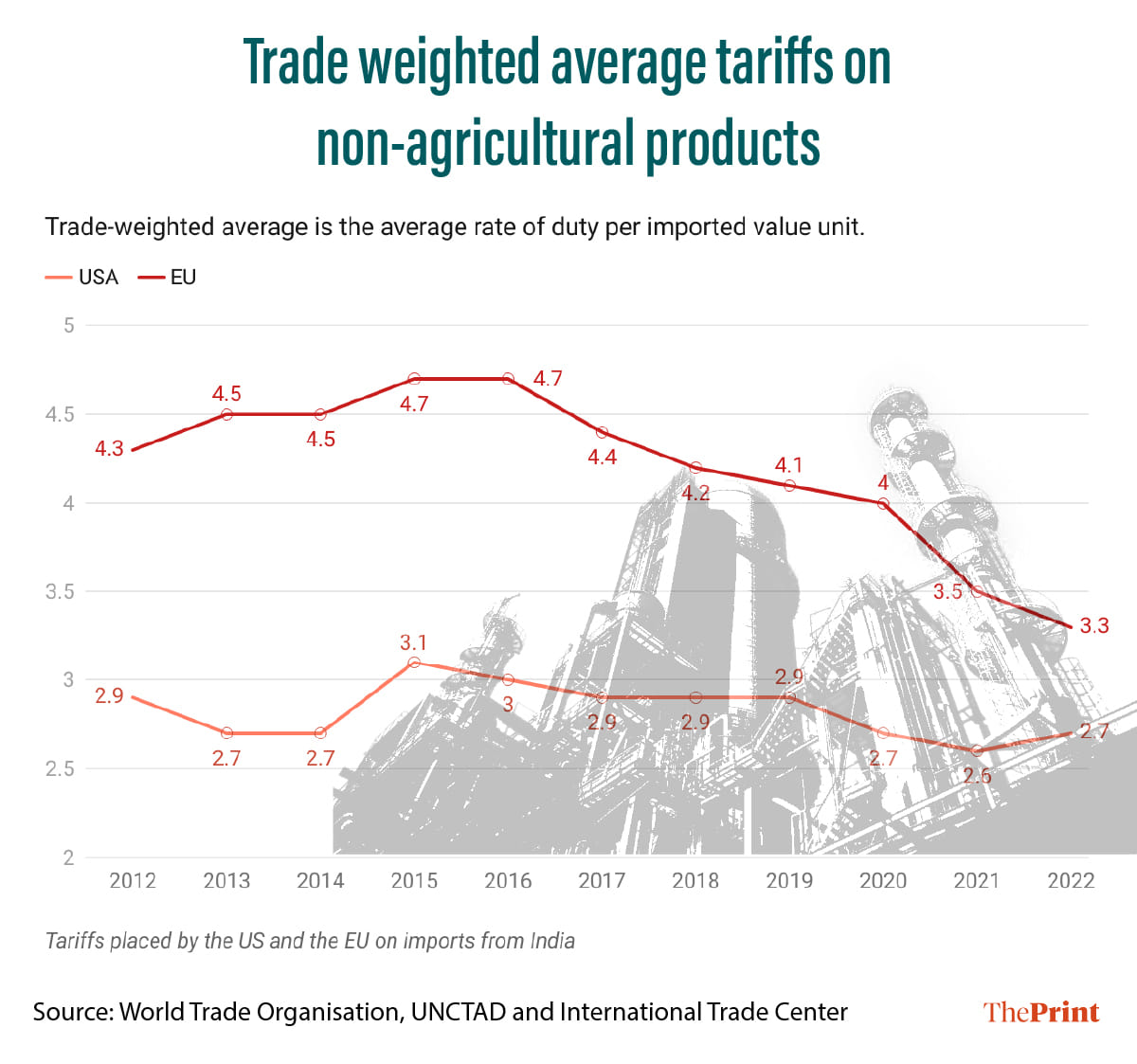

The data shows there is indeed a mismatch between the tariffs India levies on imports from its trading partners, including the US, and those the US levies on India.

According to the World Tariff Profiles, Indian non-agricultural goods had a trade-weighted average tariff of 2.7 percent in 2022 imposed by the US government, while in 2015 it stood at 3.1 percent under President Barack Obama.

During Trump’s first presidency between 2017 and 2021, the trade-weighted average of tariffs on Indian goods exported to the US remained at around 2.9 percent, before falling to 2.7 percent in 2020. The American President, who was inaugurated for a second term last month, has promised reciprocal tariffs on countries as a means to ensure fairer trade for the US.

Some tariff cuts have spurred imports

Even as Indian imports have increased in the last decade, its trade-weighted average tariffs have also risen. In 2012, India’s total imports stood at $490.7 billion, which has since grown to $678.2 billion in the financial year 2023-2024.

In 2012, the trade-weighted average tariffs stood at seven percent, which has since grown to 12 percent in 2023. However, in 2013, the average tariffs fell to 6.2 percent, while Indian imports stood at $450.2 billion. In 2015 and 2016, Indian imports fell below $400 billion, to $381 billion and $384.3 billion respectively, while the average tariffs stood at 7.6 percent and 7.5 percent respectively.

In 2019, the trade-weighted average import tariffs fell to their lowest under Modi’s government at seven percent. In that year’s budget, Finance Minister Nirmala Sitharaman announced that tariffs for specific inputs in the manufacturing process of cold-rolled grain-oriented (CRGO) steel would be halved from five percent to 2.5 percent.

Commerce Ministry data on the import of the associated product shows the customs duty cut worked in increasing imports of these items. The year Sitharaman made the announcement, India imported $1.336 billion of these particular steel inputs, which grew to $2.1 billion in 2022-23 and stood at $1.85 billion in 2023-2024.

Sitharaman’s reasoning for the customs tariffs cuts on the inputs for CRGO steel was that this was part of the government’s “Make in India” initiative. That is, the government’s strategy has been to cut tariffs on inputs that bolster India’s manufacturing push.

However, the cut in tariffs on such individual items has not been enough to lower India’s overall average tariffs.

While hikes have failed to deter imports

On the contrary, there are tariffs that were increased by the government that have failed to curb imports of those specific goods. In 2019-20, Finance Minister Nirmala Sitharaman increased the tariffs on polyvinyl chloride from 7.5 percent to 10 percent. As per the budget documents, the intention was to provide a level playing field for domestic manufacturers.

In that financial year, India imported roughly $2.2 billion worth of goods classified as polyvinyl chloride. By 2023-24, imports of these goods stood at $3.1 billion, a 41 percent increase, indicating that the increased tariffs had a lesser impact on the import of these goods than envisioned.

Between April and November 2024, the imports of polyvinyl chloride stood at $2.24 billion, which is almost the entire import value for 2019-20, the year the higher tariffs were imposed.

Similarly, that same year (2019-20), the Finance Minister increased the tariffs on plastic floor covers and ceiling covers from 10 percent to 15 percent. In 2019-20, the total import of these goods stood at roughly $63 million. In 2023-24, the total imports of the same goods stood at $65.3 million and at $68 million the year before.

(Edited by Radifah Kabir)

Also Read: Modi 3.0 gives giant relief to middle class—no tax on income up to Rs 12 lakh