Mumbai: An economy seen expanding to become the world’s third largest within the next seven years and with greater political stability than many emerging market rivals may be an appealing stock market investment theme. But not right now for Tim Love, who manages about $1 billion of EM equities.

“India is a growth play generally and it’s a brilliant one, but it’s expensive as heck,” said London-based Love, who works at the U.K. unit of GAM Holding AG, which oversees more than $130 billion in assets globally. “Other nations such as Mexico, Brazil, Turkey or Russia look incredibly cheap at the moment.”

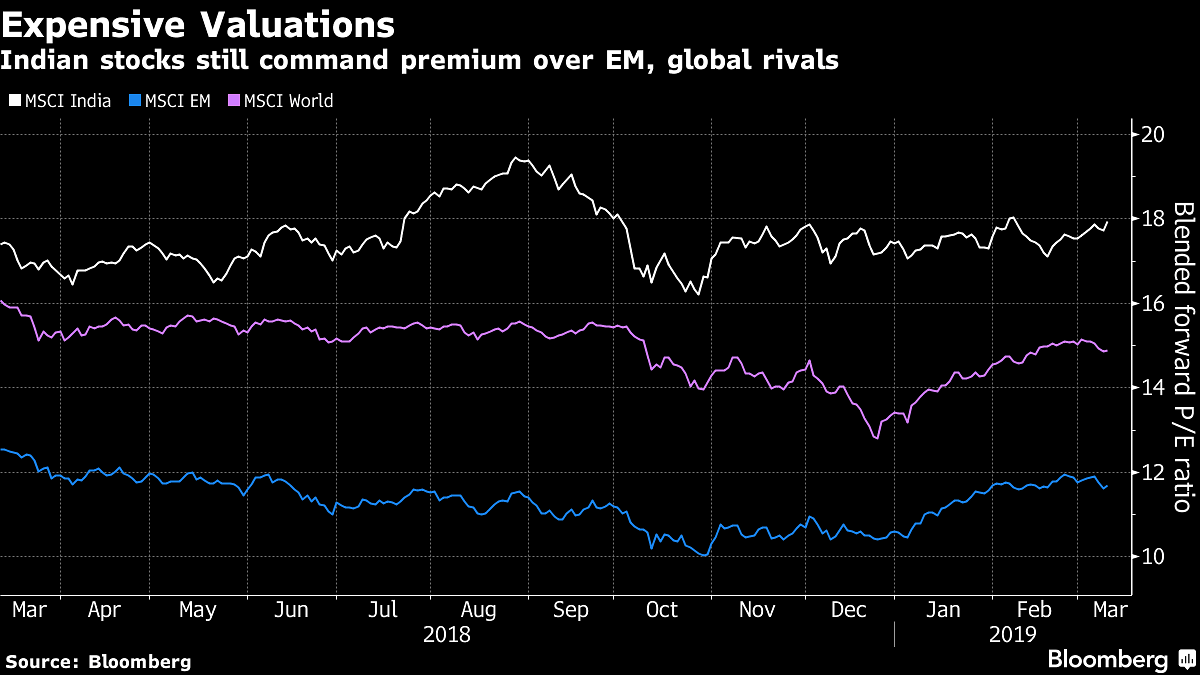

An MSCI index of Indian equities trades at a 53 percent premium compared with its emerging market rivals and is about 19 percent higher than global equities. The Indian gauge didn’t join a rally in EM and global counterparts this year, after outperforming them in 2018, mainly due to uncertainty about the composition of the next government to be formed after national elections in April and May.

Still, the relative underperformance of Indian stocks so far this year isn’t enough for Love to start buying. He plans to wait for 12 to 18 months to assess whether companies are reporting consistent earnings growth, which will narrow the price-earnings ratio and make the equities cheaper.

As of Jan. 31, about 7.4 percent of the $953 million of assets managed by GAM Multistock Emerging Markets Equity fund was in Indian equities, according to data compiled by Bloomberg. Love plans to increase the balance to as much as 20 percent, possibly over the next 18 months, if valuations decline to about 15 times estimated 12-month earnings.

Most of Love’s Indian holdings are scattered across banks and financial-services firms — State Bank of India, ICICI Bank Ltd., HDFC Bank Ltd., Axis Bank Ltd. and L&T Finance Holdings Ltd. — and software companies such as Tata Consultancy Services Ltd., Infosys Ltd. and HCL Technologies Ltd. When the valuations are to his liking, Love is looking to increase stakes in larger businesses, such as Maruti Suzuki India Ltd., Mahindra & Mahindra Ltd. and Reliance Industries Ltd., and several mid-sized firms such as KEC International Ltd.

Beside India’s potential for economic growth, its relative non-correlation with global trends — such as a slowdown due to rising interest rates — acts in the nation’s favor, the fund manager said. Love also expects that a widening tax base and stable oil price will minimize risks to India’s fiscal deficit, which has been a concern for investors.

Other factors behind Love’s call on Indian equities:

Parameter (estimated) MSCI India Index MSCI EM Index ROE 12.5 percent 12.4 percent Price-to-book ratio 2.6 times 1.4 times Dividend yield 1.7 percent 3.1 percent

“India has a consistent democracy, relatively stable politics and yes there should be a premium; but the valuations are pushing 18 times P/E, too high and more expensive than the S&P,” Love said.

Here are more comments from Love on elections and geopolitics:

The biggest risk after elections is the probability of a new government indulging in massive social spending and what impact it will have on the country’s fiscal account. If anyone replaces the incumbent, it will be a material negative as it may slow down reforms. I think it’s unlikely as once you start having a standoff with a neighboring state, people tend to rally to the flag, regardless of whether the government’s policies are good or bad. A dip in stock prices due to geopolitical tensions will be an opportunity to enter and add some Indian stocks.

Also read: No relief for investors after RBI is seen curtailing its support for the bond market