New Delhi: The Narendra Modi government has made a massive push for self-reliance or ‘atmanirbharta’ in this year’s Budget, but the domestic steel industry has suffered a massive setback. It has lost its edge against foreign steel manufacturers, with the government either reducing import duties on finished steel products, or temporarily revoking anti-dumping and other duties.

It was a rare move that went against the government’s efforts to promote domestic production, but it doesn’t come as a complete surprise to the steel industry. Over the last few months, steel prices were surging, making it expensive to build houses, roads and other infrastructure. This led to a lot of backlash against the steel industry, with many alleging that it was making massive profits.

Last month, Union Road Transport & Highways Minister Nitin Gadkari had accused the big players in the steel industry of cartelisation and increasing steel prices. He had sought the setting up of a regulator to monitor the industry.

Gadkari’s concerns were also echoed by some other industry bodies, such as the Builders Association of India, which has been opposing the steady increase in steel and cement prices and has sought an export ban on finished steel to reduce domestic steel prices.

In a letter to P.K. Mishra, Principal Secretary to the Prime Minister, the Federation of Indian Mineral Industries (FIMI) also hit back at steel manufacturers after the latter sought a ban on iron ore exports to bring down steel prices. The letter alleged that steel manufacturers were enjoying a high degree of protection from international competition, but were still indulging in profiteering. FIMI had sought withdrawal of the import duty to make the domestic steel industry more competitive.

Also read: India’s iron & steel exports to China surge despite LAC tensions — $1.86bn trade in Apr-Aug

A protected industry

The Indian steel industry has been one of the most protected in the last few years, with customs duty and anti-dumping duties levied on a host of finished and semi-finished products like ‘long’ products of non-alloy, stainless and alloy steel, and ‘flat’ products of non-alloy and alloy steel.

On most products, a basic customs duty, anti-dumping duty and countervailing duty was imposed, making imported steel much more expensive than domestically produced steel.

While the basic customs duty varied from 10-12.5 per cent, anti-dumping duty, first imposed in 2015, was a fixed amount. The latter was mainly imposed to protect domestic manufacturers from low-cost imported items from China.

However, with domestic steel prices surging by nearly 50 per cent in the last few months, the government had little choice but to bring them down by facilitating steel imports. This was especially important as the government is banking on a massive infrastructure push to revive demand after the economy suffered a massive contraction in the aftermath of the pandemic.

Consequently, in the Budget, the government reduced import duties marginally and did away with anti-dumping duty and countervailing duties for a specific time period.

“With a view to providing relief to the MSME and other consumers of the steel products on account of recent sharp rise in prices, the Basic Customs Duty on several steel products such as ‘flat’ products and ‘long’ products of non-alloy and alloy steel has been reduced to 7.5 per cent from 10-12.5 per cent,” said Harsh Shah, partner at Economic Laws Practice (ELP).

Shah added that an exemption has been provided up to 31st March 2022 from duty on import of iron and steel scrap — it was earlier 2.5 per cent and has been reduced to nil. “Additionally, anti-dumping duty and countervailing duty on specified products of steel have been temporarily revoked up to 30 September 2021,” he said.

The government’s decision to reduce import duties was due to a sharp rise in steel prices, Shah added. “The aim behind the government’s decision to reduce import is to allow for import of steel at lower prices. If there is an excess supply of steel in the domestic market, prices will come down,” he said.

Also read: India’s steel demand bounces back at faster-than-expected rate

Why steel prices have surged

While users blame ‘cartelisation’ for the increase in steel prices, manufacturers point out that the prices have increased on account of both global and domestic factors.

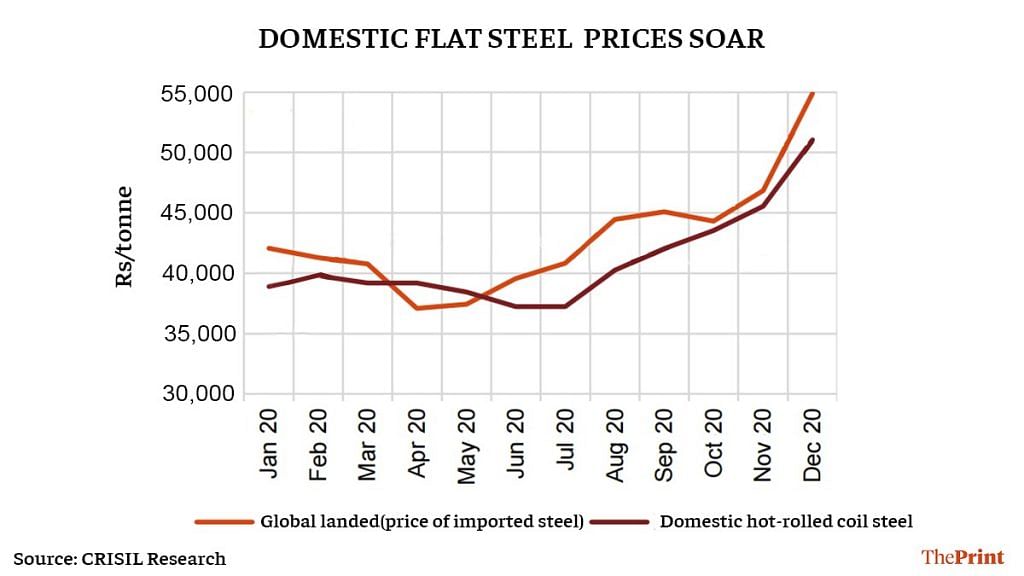

The prices have risen by nearly 50 per cent, touching two-year highs.

China, which was a major exporter of steel, announced a huge stimulus package focused on infrastructure. This led to an increase in local demand and a shortage in countries where China was supplying steel. This forced the other countries to look at Indian steel as an alternative, leading to an increase in exports from India.

Iron ore prices have also surged globally, said V.R. Sharma, managing director of Jindal Steel and Power Ltd.

At the same time, domestically, smaller units were facing iron ore shortage that led to a reduction in domestic production. This resulted in a demand-supply mismatch, Sharma explained.

“While fully integrated steel mills did not see much of an impact, medium and small-scale mills faced a shortage of iron ore. This saw their production falling and they couldn’t cater to the local demand in their areas. The total production of steel is lower by around 10 per cent and this has caused a shortage,” he said, pointing out that steel production in India in 2020 was 97 million tonnes, as against the ideal level of 110-120 million tonnes.

Sharma added that traditionally, imported steel is 5-7 per cent costlier than domestic steel across products, and a reduction in import duties will not have much of an impact on the domestic steel industry.

“Even after the changes in the duties announced in the Budget, imported steel will be more expensive than domestic steel by around Rs 4,000 per metric tonne,” he added.

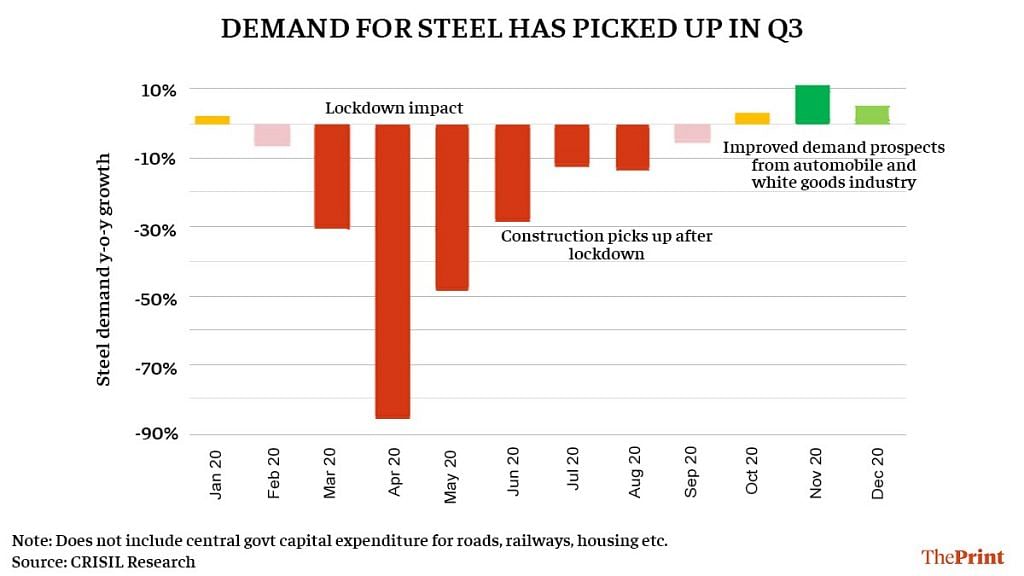

CARE Ratings, in a 20 January note, had pointed out that while consumption of finished steel grew by 7 per cent year-on-year in the October-December quarter of 2020, production grew at a much slower rate of 0.8 per cent. Domestic steelmakers have raised prices by around 47 per cent since June 2020, in line with higher international prices and high iron ore prices, the note added, pointing out that both have risen by 50-60 per cent.

Steel consumption plunged in the April-June quarter due to the lockdown, but then gradually started increasing as the economy started reviving and demand from different sectors started picking up. This raised demand even as supply struggled to keep pace.

Steel makers have raised the prices of hot-rolled coils multiple times since August, another ratings firm CRISIL said in an 11 January note, pointing out that prices have increased by Rs 13,800 per tonne to Rs 51,050 per tonne in December.

R.K. Sharma, secretary general of FIMI, alleged that steel manufacturers have formed a cartel.

“Japan and South Korea import their raw material and still produce their steel cheaper than India. Indian steel plants are making windfall profits while the final consumer is faced with high steel prices,” he said.

A profitable year for steel firms

Large steel producers have seen their profits surge in the current fiscal, with all the major firms like Jindal Steel and Power, Tata Steel, JSW Steel and Steel Authority of India Ltd reporting a substantial jump in revenues and margins.

“After a sharp drop in Q1FY21, the domestic steel industry has reported a sharp rebound in margins in the September 2020 quarter benefiting from improving demand and realisations on the one hand and softer coking coal costs on the other hand. Margins of steel companies are expected to show further expansion in the December and March FY21 quarter,” CARE Ratings said.

CRISIL forecast that large private steelmakers will “clock an impressive 800-1000 basis points improvement in their EBITDA (earnings before interest, taxes, depreciation and amortisation) margins in the second half of this fiscal, riding on the tailwinds of a 35 per cent increase in domestic steel prices, a 30-35 per cent decline in coking coal prices, and surging demand”.

Also read: Steel producers write to Modi defending price hike, demand 6-month ban on iron ore export

Modinomics is U turn economics