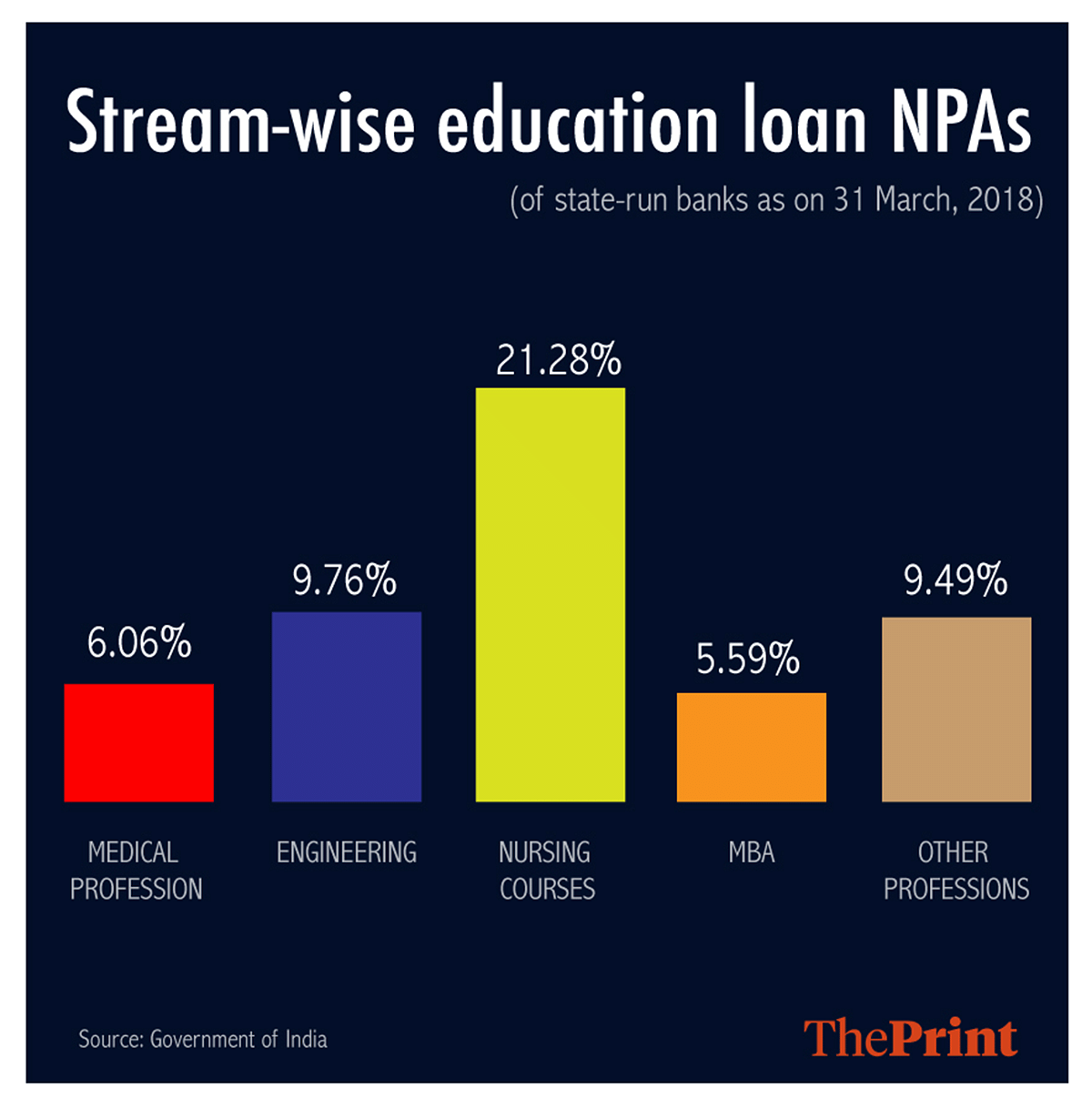

Total education loan NPAs of state-run banks grew to 8.97 per cent as of 31 March 2018, from 7.29 per cent two years ago.

New Delhi: Over one-fifth of the education loans given to nursing profession students in India have turned non-performing.

The NPA levels in the nursing sector are much higher than those in other education streams like engineering, medicine or MBA, data available with the government shows.

As of 31 March 2018, the total NPAs as a percentage of education loans for state-run banks was 21.28 per cent for nursing courses, 9.76 per cent for engineering courses, 6.06 per cent for medicine and 5.59 per cent for MBA courses, the government said Friday in an answer to a question in the Lok Sabha.

The total education loan NPAs of state-run banks grew to 8.97 per cent as of 31 March 2018, from 7.29 per cent two years ago.

Nursing sector

The alarming levels of NPAs in the nursing sector could make it difficult for aspiring professionals to get education loans as banks may become risk-averse and look to instead lend to other education streams.

“Those who enroll into nursing courses typically target to go abroad. But there are cases where they may not be able to get jobs overseas and settle for low paying jobs in India,” said a general manager handling the retail portfolio at a state-run bank.

“The remuneration they get in India may not be suffice to make repayments,” said the bank official on condition of anonymity.

He added that nursing aspirants are typically from the southern part of India and a couple of northern states.

Also read: Banks are saddled with bad loans of farmers as well, not just corporates

Rise and fall

Education loans have remained stagnant or contracted over the years in India.

As of 23 November 2018, outstanding education loans were at Rs 69,200 crore, a fall of 3.4 per cent from Rs 71,700 crore as of 24 November 2017, Reserve Bank of India (RBI) data shows.

Education loan has always been a risky segment for Indian banks, prompting the government to set up a credit guarantee fund to encourage banks to lend freely to students. This fund guarantees loans up to Rs 7.5 lakh without any collateral or third party guarantee.

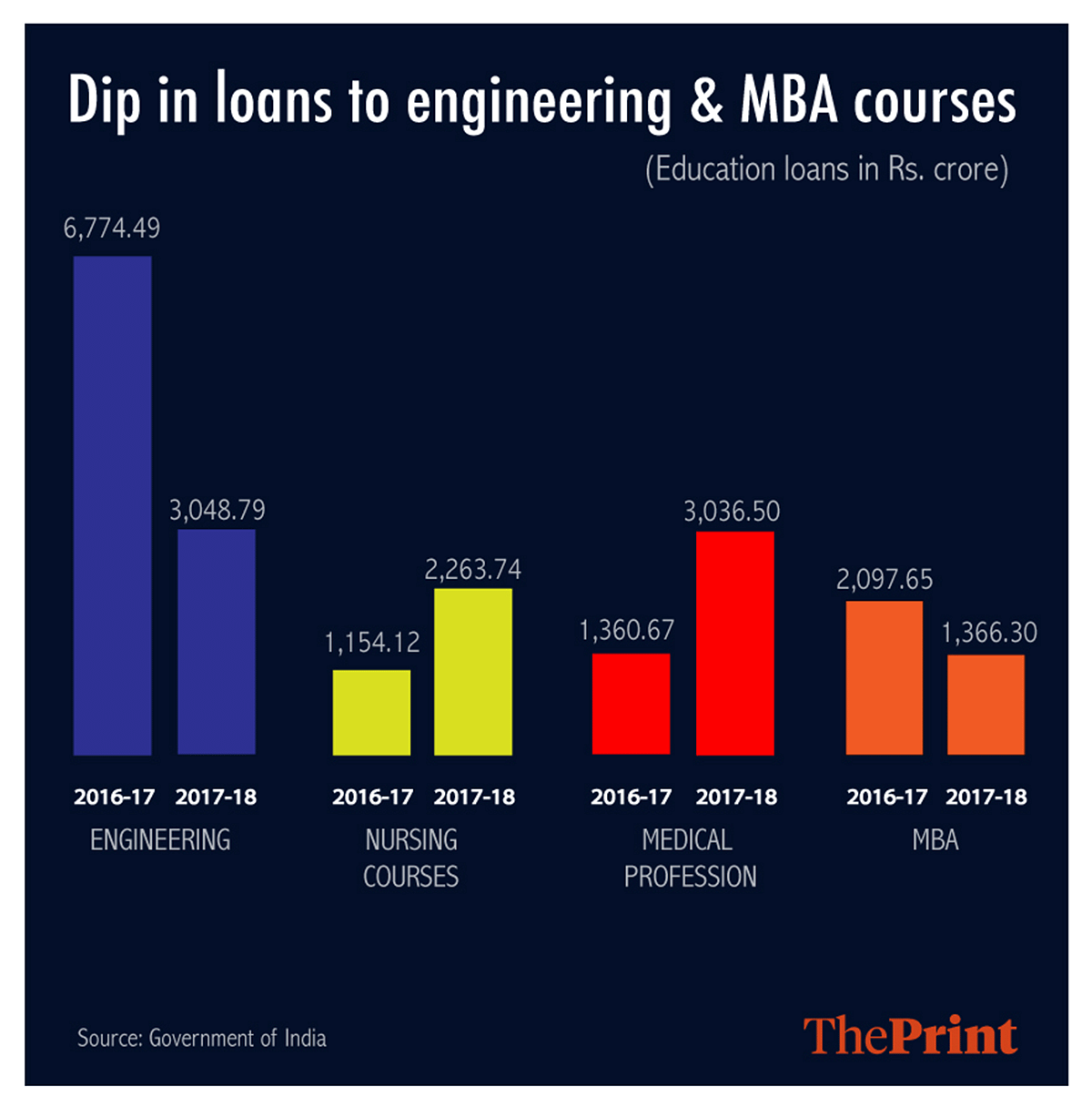

The data collated by the Indian Banks’ Association for the government further shows that while loan disbursements to professions of medicine and nursing have increased, there has been a sharp fall in loans to students pursing engineering and MBA.

Loans for engineering courses more than halved to Rs 3,049 crore in 2017-18, as against Rs 6,774 crore in 2016-17. Similarly, loans to students pursuing MBA courses also came down to Rs 1,366 crore in 2017-18 from Rs 2,098 crore in 2016-17, the government said in the answer.

However, loans to students pursuing medicine more than doubled to Rs 3,037 crore in 2017-18 from Rs 1,361 crore in 2016-17. Loans for pursuing nursing courses also rose to Rs 2,264 crore from Rs 1,154 crore.

What else do you expect when the nurses are paid 10-15k per month?