New Delhi: India was once considered a very difficult jurisdiction for a company to commence operations. But over the last two decades, it has seen a deluge of billion-dollar companies, with many in upcoming sectors like financial and education technology.

These companies, with hardly any linkages to traditional well-established corporate groups, are causing a massive churn in the Indian corporate landscape and leading to intense competition with well established firms.

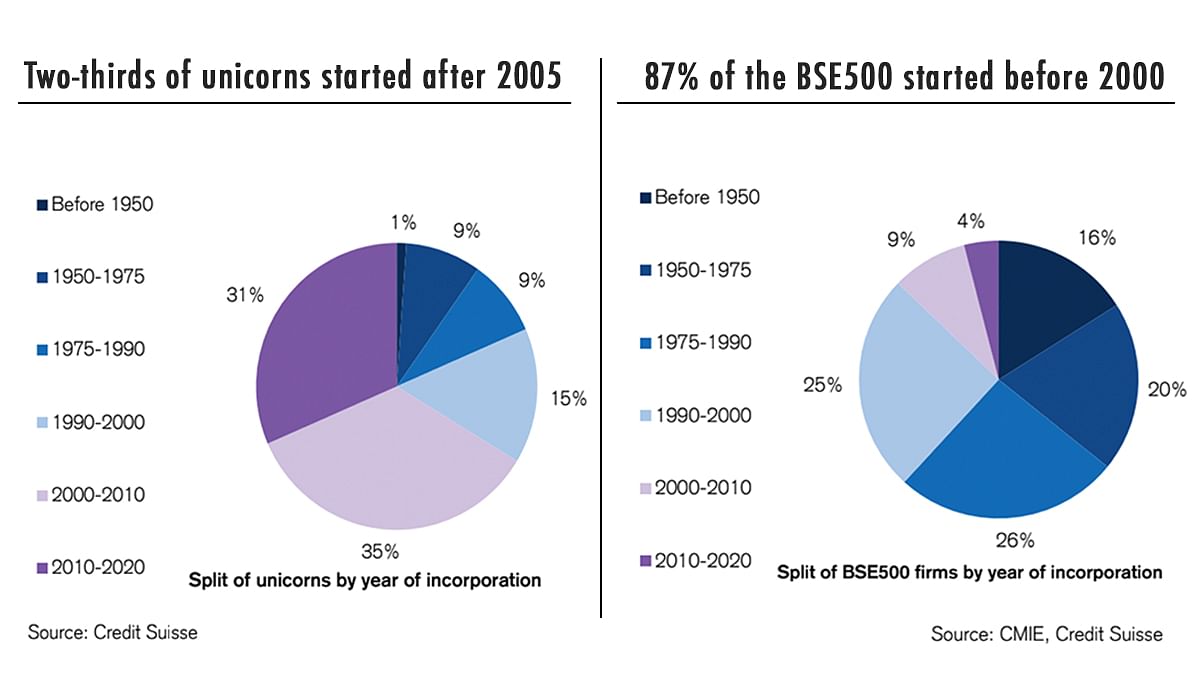

Nearly 67 of the 100 unicorns — unlisted firms with valuations exceeding $ 1 billion — came into existence in India after 2005, a Credit Suisse report said earlier this month, crediting the change in the regulatory, business and funding environment for the rapid rise in company formation over the last two decades.

In a sharp contrast, only 13 per cent of the 336 firms (with valuations exceeding $1 billion) of the BSE500 firms were started after 2000. Interestingly, 36 per cent of these firms started before 1975.

“Against 336 listed companies with billion dollar-plus market capitalisation, there are now 100 unicorns in India with a combined market capitalisation of US$240 bn. Two-thirds of these firms started after 2005, whereas only 46 of the listed firms were founded this century, and as many as 112 started before 1975,” the report said, explaining how a country “notorious for stifling entrepreneurship” saw a surge in new businesses.

While economic reforms freed up capital access, sizeable investments were still limited to a handful of family-owned dynastic businesses. This changed over the years, the report pointed out.

The shortage of risk capital was addressed by a surge in foreign private equity. The increase in teledensity and smartphone and internet penetration further helped many firms. “Till 2005 less than 15% of Indians had a phone, versus 85% now; 700 mn-plus people have internet access now due to cheap data and falling smartphone prices,” it said.

Further improvement in physical infrastructure like road connectivity, increasing financial innovation and development of ecosystems in several sectors are also contributing to the surge in firms.

Also read: ‘Smart businessman, politically savvy’ – How Adani is emerging as India’s next Ambani

High level of diversification

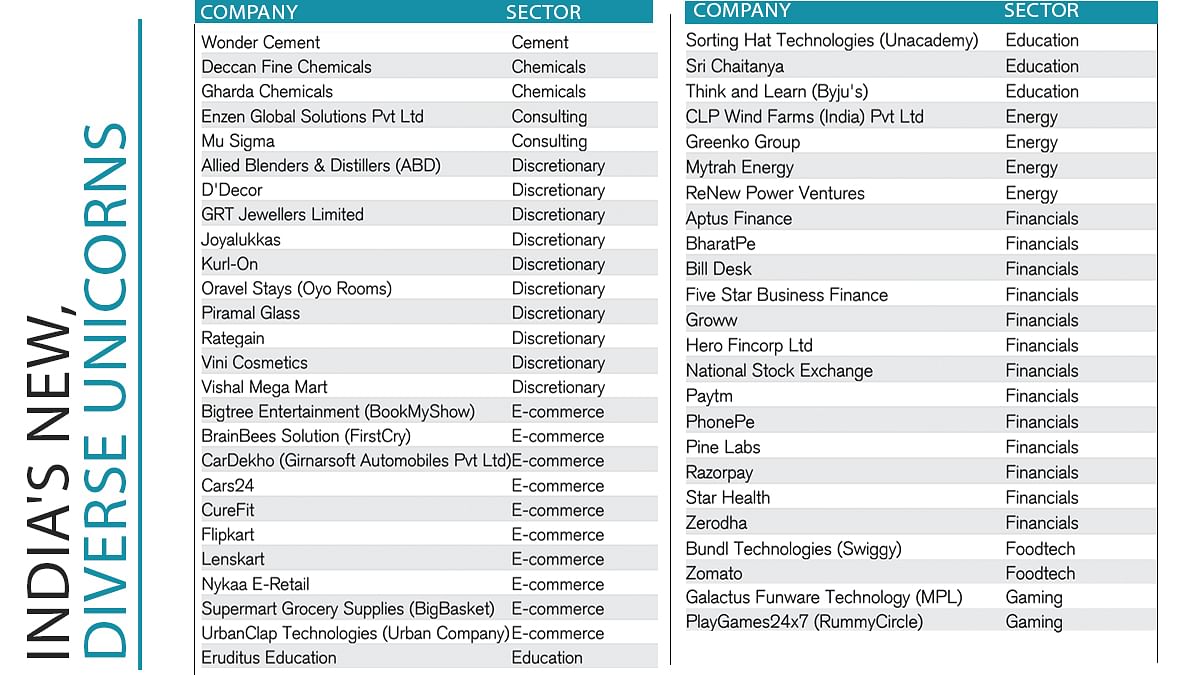

The list of 100 unicorns shows that while there are a few old firms that undertake conventional businesses like the National Stock Exchange, Transunion CIBIL and Parle Biscuits, most are upcoming firms in sectors like financial technology (fin-tech) and education technology (edu-tech).

Most of the unicorns in the list are well-known names that have carved their presence in many Indian households like Paytm, Zomato, Flipkart, Bharat Biotech, Manipal Hospitals, Ola Cabs, Byju’s, Book My Show, BigBasket and FirstCry.

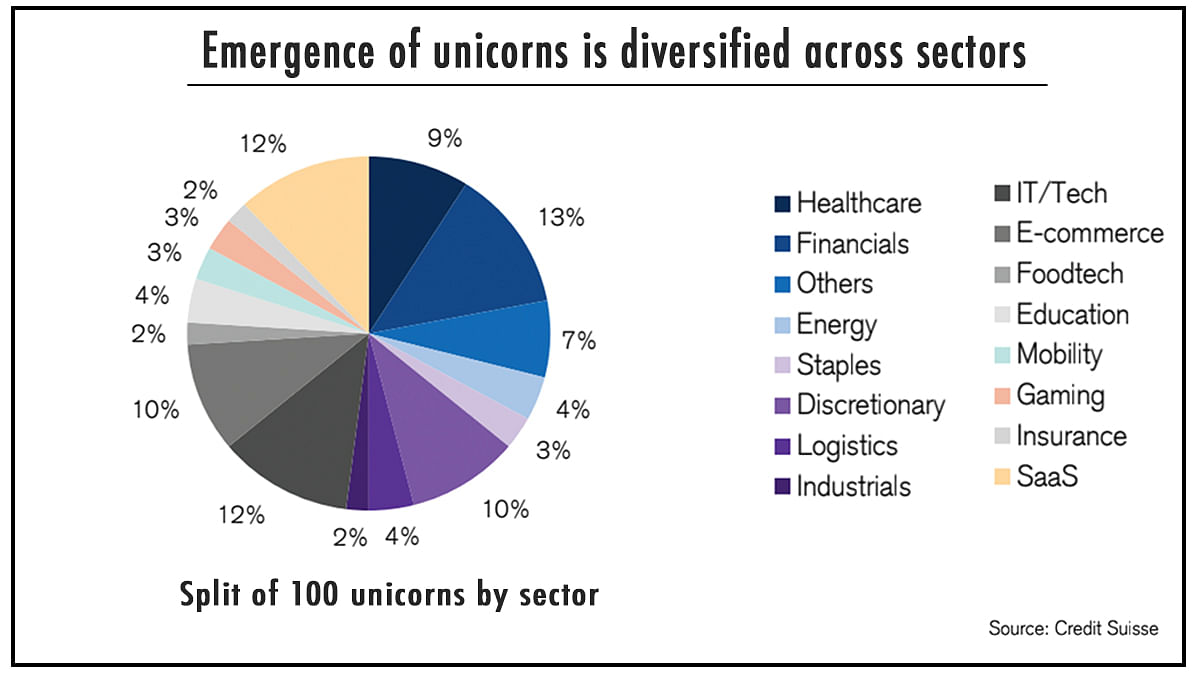

The sectoral split shows high levels of diversification, said the Credit Suisse report.

“The largely expected e-commerce, education technology, food-tech and mobility companies account for less than a fourth of the total. The largest number of firms are in finance (all non-banks), which includes a few conventional NBFCs (non-banking finance companies) in addition to the highly disruptive financial technology (FinTech) companies: given the unique position India is in (low financialisation and at the same time world-leading financial infrastructure),” the report said.

Software as a Service (SaaS), niche IT Service providers, gaming companies, insurance technology, and even new-age distribution and logistics firms enabled by technology have also achieved sufficient scale to be included in this list, the report said.

Also read: What happens when a vigilante & a gambler walk into a bond market? Check out India’s scene

Competition leading to churn, Sensex has also seen a shift

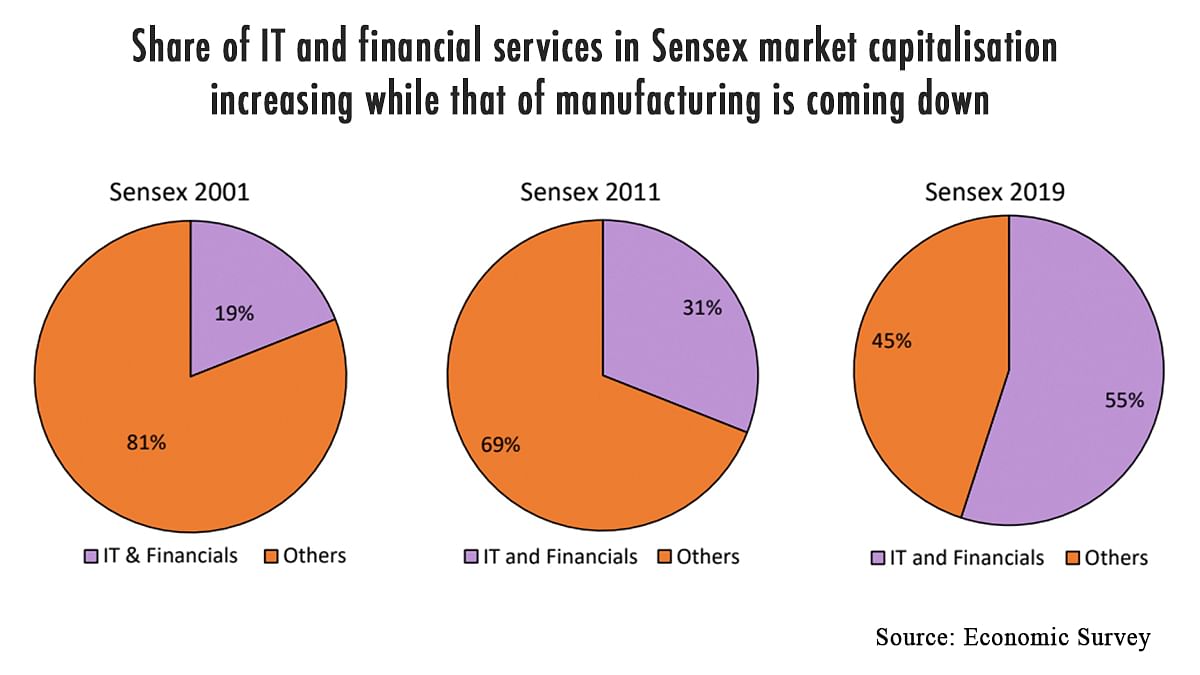

The fact that the decades after liberalisation have made it easier for new firms to commence operations and challenge the old established firms was also highlighted in the Economic Survey 2019-20.

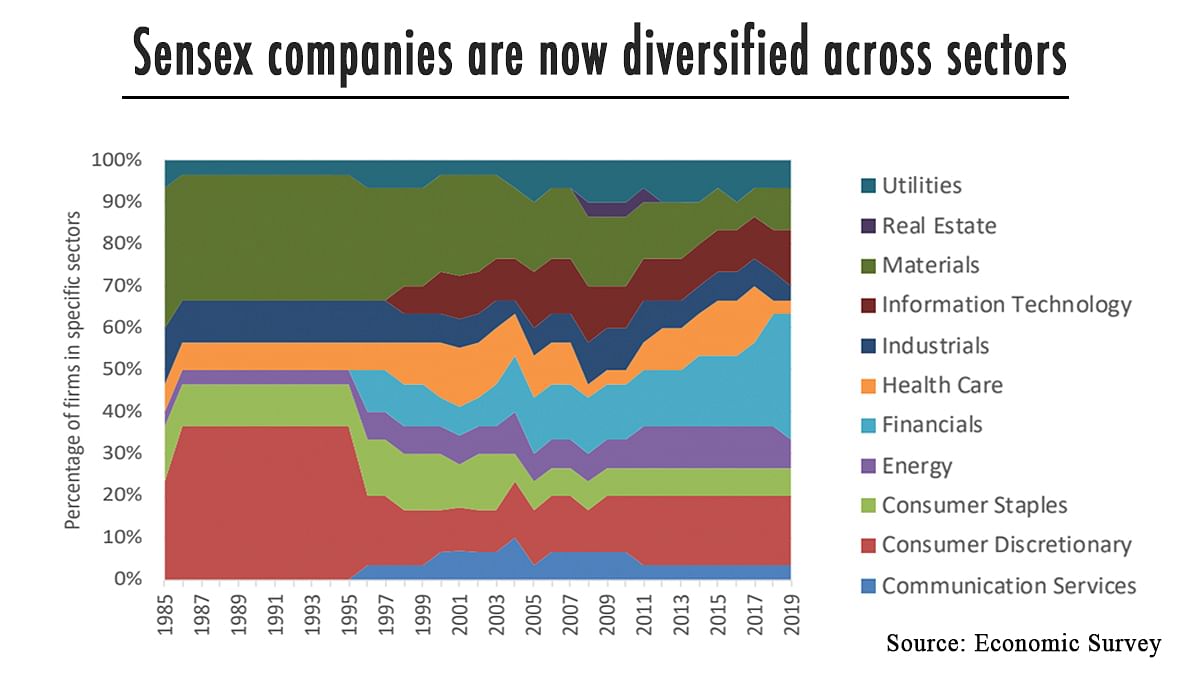

On this churn, the survey had pointed out how the share of IT firms and financial services in the total market capitalisation of the Sensex had risen over the last two decades.

“The forces of creative destruction following liberalization in the Indian economy have led to the rise of new sectors such as financials and information technology. Virtually non-existent in the Sensex of the early 1990s, the share of these sectors in the total market capitalization has increased over the years, so much so that these sectors dominate the Sensex today,” the survey had said.

The report had pointed out that this churn has also led to a more diversified mix of companies with far lesser concentration of market power enabling greater competition.

“Sectors once considered mainstays of the Indian economy are being displaced by new sectors bringing with them new technologies and products. The competitive advantage of entrenched firms is being rapidly challenged by new, smaller and more agile firms; every five years, roughly one in three firms in the Indian economy can expect to be challenged in a massive way by the forces of creative destruction,” the report said.

It had also said that the difference between the sizes of the largest and smallest firms is rapidly shrinking, and consequently monopoly power in the economy is declining and making way for more competitive markets.

“Consumers benefit from an increased variety of goods and services, lower prices and incessant improvement in the quality of existing products,” it had added.

Also read: From grocers to tailors, Amazon is fighting door to door to beat Mukesh Ambani’s Reliance

There was a time when Companies were valued on basis of Assets, Revenue, Profits, Value Added. Simply put… you Invest 1Crore, have a Revenue of Rs20 Crore mostly adding Value (no trading, speculation, etc..) have a Before Tax Profit of Rs2 Crore… what is the valuation….???

In the 1980’s all this changed…. intangibles entered the picture…. Trade Marks, Patents, Name, Market Share, Growth Potential, (Arbitrary) Share Prices, etc….etc…. are piled on top of the earlier parameters.. and now what is the Valuation….??? You get the idea

Because these so called Unicorns are being funded by the unscrupulous US financial sector and FPI’s.

It’s ‘notorious’ a newspaper should spelling right.

We are competing ,becoming fearless and taking risks in a vollatile and diversified mkt. with intelligence and accuracy and indomitable will.

Well compiled and very informative for the casual reader. It is very encouraging to note that our youngsters are capable. A jarring note in this symphony is that entrepreneurship in Industrials is only 2%. 98% of the start ups are in the services sectors. Probably, now, India needs to boost entrepreneurship in the manufacturing sectors. That is not very easy. We must recognize that services sector can’t forever subsist without a robust manufacturing sector. Can we have a supply chain going without supplies?

There are a plethora of niche products (like small HV transformers in the range of 40-100 Kv) which can be handled by our MSMEs. Probably the boost being given to this sector will see more entrepreneur efforts in this sector. MSMEs have to shift to rural areas which will supply the manpower –this will reduce exodus of labour to urban areas. The urban youth, including those who have migrated, fancy being a delivery boy, for Amazon, Flipkart, Swiggy etc. riding a mobike than greese their fingers on the shop floor.

Tail piece: These are some stray thoughts. Hopefully The Pritwill carry an analysis of our manufacturing sector soon.

Well said Col. Manu sectors should be given a push.

It’s not that easy. Its called barriers of doing buissnes. The service industries like swiggy and zato were able to take off since they had acess to an untapped market. Manufacturing is another buissnes entirely , most sectors are already donated by china and they have cracked the global market. The huge economies of scale lets them sell at extremely low prices. This is unlikely to change even if you put high Import duties.

See what is happening in solar panel sector. Every solar developer is scrambling to get their hands on chinese solar panels even with the hike in tarrifs

Dear VKP,

True. Not easy.

So, the biggies create the infrastructure for a product and foster an ecosystem of MSMEs around to support it with making components which go as inputs to the main product. A la the automobile sector. The scales can vary as per requirement and the product. This is but one model.

Besides, have you noticed that a purely Chinese product, unlike the Made in China products for established multi nationals like Apple, Titleist etc. are of low quality.

Tail piece: We can yet do it. More difficult, longer it will sustain.

Regards

If you are REALLY interested in seeing manufacturing and rural India grow and add $1+Trillion/yr to the Economy….. see my videos on YouTube Channel…. zeropollution2050 (one word)…

Thanks Ajay. Very informative video. Opportunities exist. If we have the will we will have a way.

Regards

Dont worry when Congress and the assorted leftists come to power they will be all Nationalised by Rahul G

No dogn yey of people yristinh fiscredited vongis

Commies are extinct world ober.only rss will tule yhe roost

Didn’t the article say most of these companies started after Congress and the assorted leftists came to power in 2004?