New Delhi: The International Monetary Fund (IMF)’s new data doesn’t show Indian banking in the best light, or company.

Based on new data collated by the IMF, India has been ranked 33 among 137 nations in a global list of countries with bad ratio in a descending order.

Among large economies, India, with a gross non-performing assets (NPA) ratio of 10.3 per cent in the September-ended quarter, is doing only slightly better than Russia which has a gross NPA ratio of 10.7 per cent.

Gross NPA ratio is the ratio of non-performing loans to total loans advanced by banks.

Of the 32 countries whose gross NPA ratio is higher than India, 16 are in Africa and the rest are spread across Asia, Europe and the Caribbean, IMF data shows.

Countries at top of IMF list

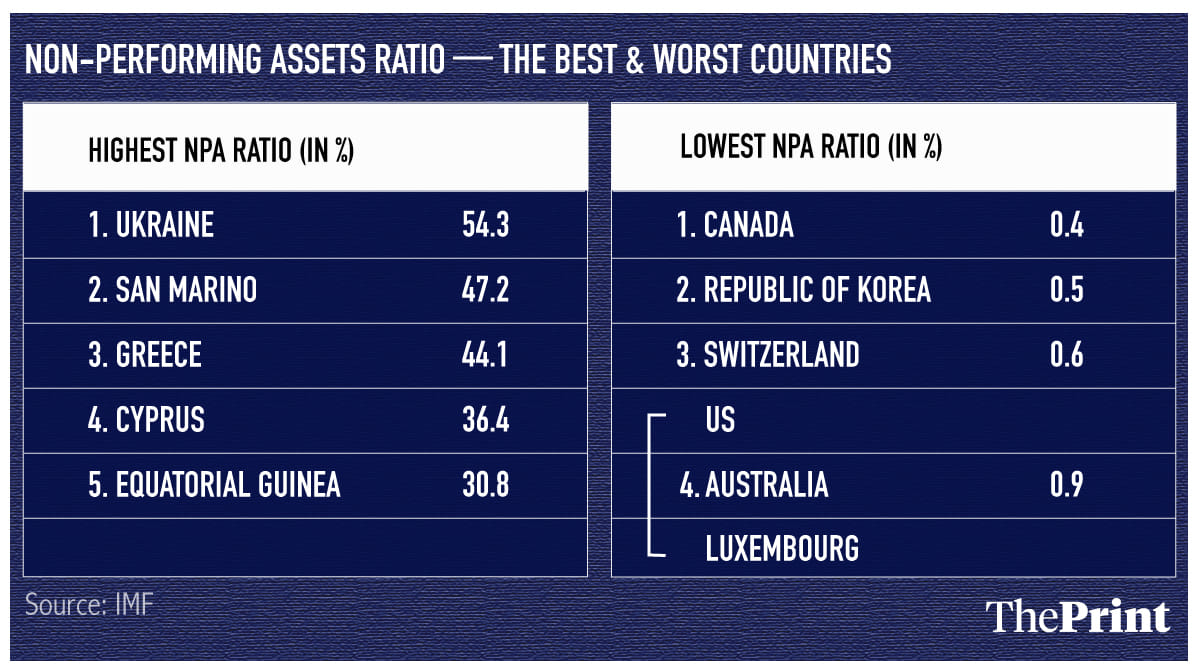

A country-wise break-up shows conflict-torn Ukraine has the highest NPA ratio at 54.3 per cent, followed by San Marino at 47.2 per cent and Greece at 44.1 per cent.

The lowest NPA ratio has been reported by Canada at 0.4 per cent, followed by South Korea at 0.5 per cent and Switzerland at 0.6 per cent.

The data has been collected by the IMF as part of the financial soundness indicators. Data for most of the countries, including India, is for the quarter ended September 2018.

Also read: Arvind Subramanian defends Urjit Patel’s ‘terrific job’, says need to address NPA issue

Indian crisis

Indian banks have been struggling as rising bad debts and the subsequent provisioning required by tighter regulatory norms has pushed these banks into massive losses. This has also wiped out capital that has pushed many state-owned banks’ capital adequacy ratio below the regulatory thresholds.

This has forced the government to step up capitalisation of these banks to ensure that they are well above the regulatory capital requirements.

To be sure, IMF’s estimates of NPAs varies marginally from that put out by the Reserve Bank of India (RBI).

In its financial stability report released in December 2018, RBI had said that the gross NPA ratio of Indian banks was at 10.8 per cent as of September-end, an improvement from the 11.5 per cent reported as of March 2018.

The gross NPA ratios of Indian banks has been improving and its likely to further improve if one goes by the December ended quarter result declared by a few banks.

Banks are hopeful that resolution of cases under the Insolvency and Bankruptcy Code stuck in the National Company Law Tribunal will further add to their profitability as they recover money from these written off assets. RBI estimates that the gross NPA ratio may come down to 10.3 per cent as of March 2019.

Also read: RBI on its own cannot solve the NPA crisis in Indian banking sector

not sure if this report includes power and other NPA s of the bhai group of india and others

All we have got in the last few years is spin.