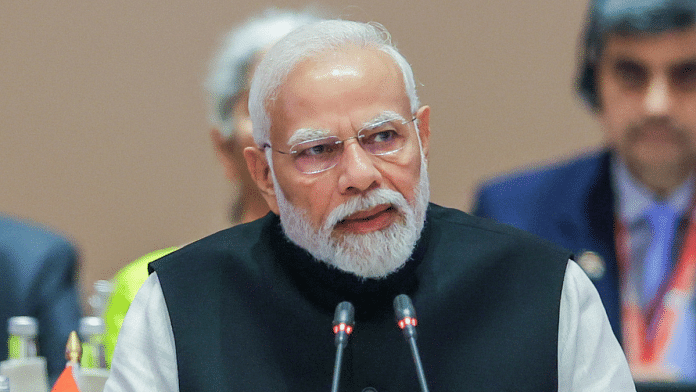

New Delhi: As part of the Global Biofuel Alliance announced during the G20 Summit Saturday, Prime Minister Narendra Modi called for countries to work together in the field of fuel blending and proposed a global initiative to take ethanol blending in petrol up to 20 percent.

This has put the spotlight on India’s own push for ethanol as an alternative to fossil fuel to power automobiles. But it also shines light on a significant challenge to these efforts — the predicted disparity between the demand and supply of domestically-produced ethanol.

The country currently uses E10 automobile fuel — consisting of 10 percent ethanol and 90 percent petrol — to power vehicles. In an attempt to bring down carbon emissions, the central government has advanced the target of achieving 20 percent ethanol blending in petrol by 5 years from 2030 to 2025.

But India’s low ethanol production and competing claims over it from other industries could pose a significant challenge to achieving this target. Currently, the country’s ethanol production is estimated to stand at 5.42 billion litres annually for about 12 percent blending. However, to achieve its 20 percent blending target, India is estimated to require about 10.16 billion litres annually — nearly twice the current production — by 2025-26.

According to experts, India will need to ramp up its production significantly to meet its petrol blending target — Ashim Sharma, a senior partner and group head of business performance improvement at research firm NRI (Nomura Research Institute) Consulting & Solutions, told ThePrint that India’s ethanol production capacity would have to grow to 15 billion litres to achieve the target by November 2026.

This is particularly significant given India’s rising demand for petrol — NITI Aayog, the government’s apex advisory body on public policy, projects the country’s petrol demand to be 50.8 billion litres by 2025-26.

Here’s a look at India’s current ethanol production levels and what needs to be done to increase it to meet targets.

Also Read: Ethanol blending for cars is ignoring food security in India. Go for green hydrogen instead

Competing claims from other industries

The majority of ethanol production in India comes from sugarcane or is molasses-based, while the remainider is grain-based. According to government data, during 2013-14, 38 crore litres (or about 0.38 billion litres) of ethanol was produced, which increased more than 10 times to 408 crore litres (4.08 billion litres) in Ethanol Supply Year (ESY) 21-22.

Of the 4.08 billion litres of ethanol supplied for fuel blending in 2021-22, about 84 percent was produced from sugarcane juice and molasses, about 11 percent using surplus rice from the Food Corporation of India, and the remaining 5 percent from damaged grains — including rice from the open market, as well as maize.

In its 2023 report, Delhi-based agriculture think-tank Arcus Policy Research said in order to produce the required 10.16 billion litres of blending ethanol from three crops — sugarcane, maize, and rice — India would need about 275 million metric tonnes (MMTs) of sugarcane, 6.1 MMTs of maize, and about 5.5 MMTs of rice.

But the auto industry isn’t the only one that requires ethanol. According to the report, titled Ethanol Blending of Petrol in India: An assessment of raw material availability, looking at additional demand from other industries such as cosmetics, alcohol, and pharmaceuticals, the country will require a total of 13.5 billion litres of ethanol annually by 2025-26. And this could be a challenge.

“There is no doubt that the country may struggle to meet its ethanol demand of 13.5 billion litres by 2025-26,” the report said, adding that from the viewpoint of efficiency and sustainability, India would do well to research alternative feedstocks for increasing production.

“Besides, considering the competition for ethanol among OMCs (Oil Marketing Companies), beverage manufacturers and other industries, there is a need to consider the viability of imported ethanol, at least for purposes other than fuel-blending,” the report said.

According to the report, there are two major challenges to meeting the E20 target in the next two years: the competing claims from other ethanol consuming sectors like potable alcohol “which has been growing at a double-digit rate”, and competition for grains like maize from the feed industry.

According to the report, the country’s poultry industry, which has competing claims over grains like maize, “has shown impressive growth” and will steadily need more and more maize as feed.

“Farm yields of crops including paddy, maize, cotton, and chilli have also been impacted by weather and climate changes. Therefore, the big question is: Does India have the ability to supply an adequate quantity of ethanol to its Oil Marketing Companies (OMCs) to meet the targeted mandate of E20 by 2025-26,” the report asked.

In their article in ThePrint last month, Agricultural Economist and Arcus CEO Shweta Saini and former Union agriculture secretary Siraj Hussain — who were both part of the team that wrote the Arcus report — write that, against the requirement of 10.16 billion litres, India will be able to supply an estimated 7.5 to 9.6 billion litres of ethanol in 2025-26.

“The ability to supply the additional ethanol requirement of 3.35 billion litres remains another puzzle. However, unlike ethanol-for-fuel, ethanol for other needs is open to be supported via imports,” they wrote.

According to the Indian Sugar Mills Association (ISMA), of the total ethanol requirement of about 10 billion litres to achieve 20 percent ethanol-blend by 2025-26, 55 percent or about 5.5 billion litres is expected to come from sugar, and the remaining 45 percent or 4.5 billion litres from grain/maize.

In a letter to the Union Department of Food and Public Distribution in July this year, ISMA sought an increase in the ethanol price (made from cane juice/syrup) to Rs 69.85 per litre from the current Rs 65.61/litre, while arguing that in order to achieve higher production, new capacities will be required in the sugar sector. The letter added that the industry will need to invest Rs 17,500 crore to create additional capacity for 8 billion litres and more with “reasonable return on investment”.

The Arcus paper also suggests upping ethanol production from both sugar and grain. “To meet the total ethanol demand by 2025-26, both the sugar and grain sectors would need to supply close to 7 billion litres of ethanol each,” the report says.

Despite this, however, it adds a word of caution, highlighting the challenges that ethanol production could face in the future due to fluctuating crop yield.

“The buoyancy around the likely impact of ethanol-blended fuel on crude import bills, emissions, and mounting sugar surpluses is not unfounded,” it says. “However, assuming that enough crop surpluses will continue in the future may be rather bullish…”

Also Read: India’s green hydrogen dream: Businesses are raring to go clean, but cost, safety are concerns

Cleaner fuel with low emissions

According to a government press release from June 2022, the central government’s Ethanol Blended Petrol Programme has not only helped augment India’s energy security “but also translated into a forex impact of over Rs 41,500 crores, reduced GHG emissions of 27 lakh MT and also led to the expeditious payment of over Rs 40,600 crores to farmers”.

The programme, launched in 2003, has helped public sector OMCs save 433.6 crore litres of petrol in ESY 2021-22, resulting in approximate savings of more than Rs. 20,000 crore of foreign exchange, according to another release from this July.

Ethanol-blended petrol is expected to burn cleaner, resulting in lower emissions. According to the data shared by Minister of State for Petroleum and Natural Gas Rameswar Teli in a written reply to the Lok Sabha in July 2023, E10 two-wheelers as well as four-wheelers emit 20 percent lower carbon monoxide and hydrocarbons, while E20 emits 50 percent lower carbon monoxide, and 20 percent lower hydrocarbons.

In comparison, E20 four-wheelers emit 30 percent lower carbon monoxide and 20 percent lower hydrocarbons compared to neat petrol vehicles.

A January 2023 note by research agency ICRA also noted that ethanol blending will help not only to reduce vehicular emissions but also strengthen energy security, reduce oil imports and conserve forex reserves.

According to NITI Aayog’s ethanol roadmap released in 2021, the country can annually save about $4 billion in foreign exchange by blending petrol with ethanol. Other benefits include controlling excess sugar supply in the country as 65 percent of the total ethanol production comes from molasses-based distilleries, the government think tank said.

However, ICRA went on to add that loss of fuel efficiency is expected as vehicles transition from the E10 to E20 compliant design, thus increasing the total cost of ownership (TCO) — that is, the cost to buy something plus the cost to operate it .

According to the research agency, Original Equipment Manufacturers (OEMs) are looking at technological improvements like light-weighting to offset the impact. In the auto industry, light-weighting is the concept of building cars and trucks that are less heavy in order to achieve better fuel efficiency and handling.

“ICRA believes that the readiness of the auto industry and the OEMs to meet E20 blending norms is unlikely to be a major challenge. No major design changes are required from a vehicle standpoint, except material recalibration,” the agency said in its 2023 note.

According to Ashim Sharma from NRI, quoted earlier, governments globally are focussing on alternatives to fossil fuels, driven by climate change considerations and energy security concerns. CO2 emissions have been rising steadily over the years and vehicular emissions, which contribute about 17 percent of the total global emissions, are becoming a focus area, he said.

“Global CO2 emissions stood at 37 gigatons in 2022, of which 22 percent comes from transportation. Of this 22 percent, vehicular transportation accounts for 74 percent of the emissions,” he told ThePrint.

Currently the US and Brazil have the largest ethanol production capacity, contributing 54 percent and 31 percent of global ethanol production, he said. India contributes to 2 percent of global ethanol production. “Globally, three major factors drive ethanol production and usage in transportation – government mandates for ethanol blending, support for utilisation of different feedstock and consumer incentives to buy E20 and E85 vehicles,” he said.

(Edited by Uttara Ramaswamy)

Also Read: Green hydrogen in SIGHT, India has taken a leap. Now ensure it doesn’t end up being hot air