IL&FS Employees’ Welfare Trust enriched senior management but the rank and file mostly got hopes.

It was buried in plain sight, in footnote No. 8 on page 28 of an IPO prospectus.

But nobody in September 2009 was paying attention to that particular disclosure.

And certainly not with any misgivings: Six months later, IL&FS Transportation Networks Ltd., which housed the road assets of a pioneering Indian infrastructure finance, construction and management group, would see demand for 33 times the shares on offer.

Fast forward a decade, and the IL&FS Group is insolvent with $12.5 billion in unpaid debt. Credit analysts are doing a postmortem now, and finding clues that investors missed. The biggest of all was an employee welfare trust, whose name kept cropping up in filings.

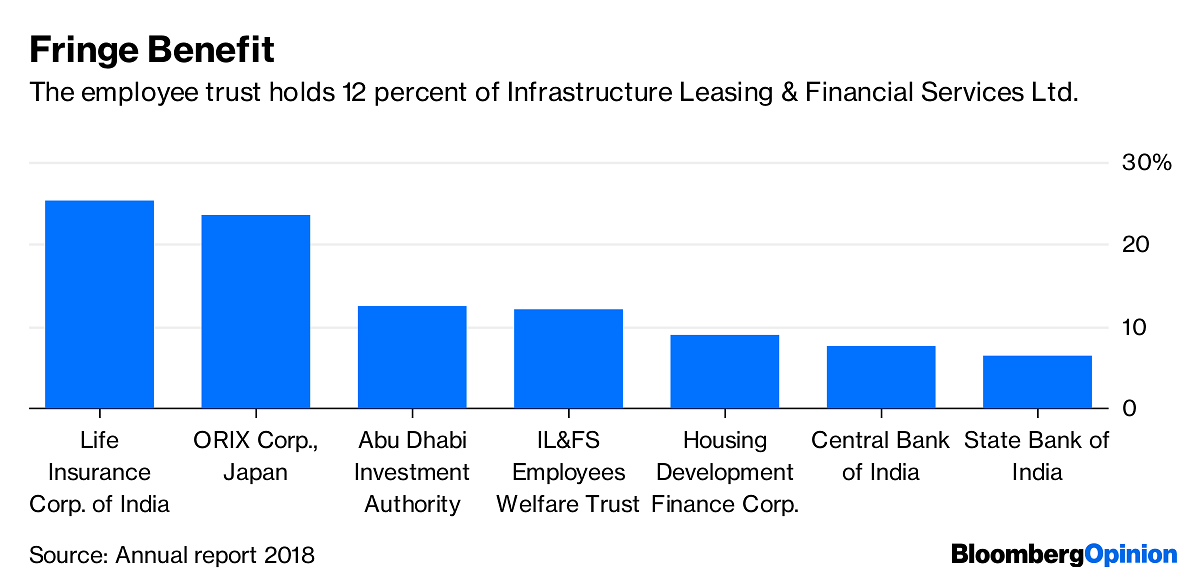

The IL&FS Employees’ Welfare Trust, which owns 12 per cent of unlisted parent Infrastructure Leasing & Financial Services Ltd., benefited a small group of senior staff. IL&FS previously disclosed that the trust had 10 “specified beneficiaries” entitled to receive the greatest amount of stock from a 2006 allocation of 5.3 million shares. Beyond that, nothing much is known about its inner workings.

The trust’s dealings were ignored by everyone, perhaps in the hope that the institutions that owned IL&FS — including India’s Life Insurance Corp., Japan’s Orix Corp. and the Abu Dhabi Investment Authority — had adequate board oversight of founder Ravi Parthasarathy and his people.

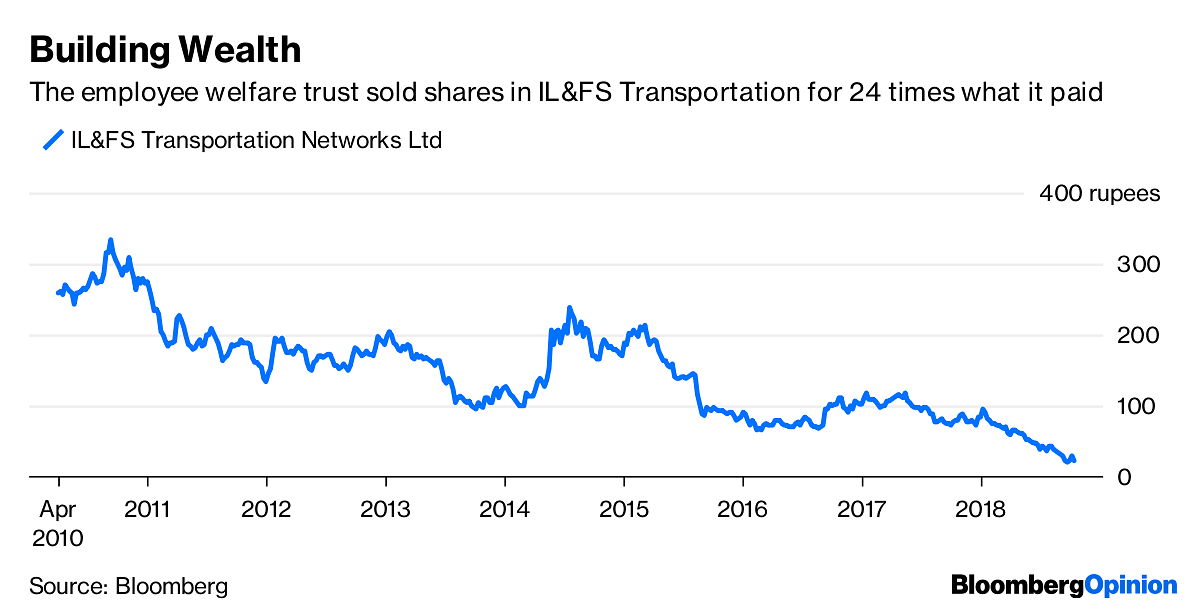

Under the cover of the trust, Chairman Parthasarathy’s team rode roughshod over other stakeholders. In 2006, the trust had picked up 15 million shares in the transportation firm at a 78 per cent discount to what parent IL&FS paid at the time. That should have raised the first red flag, says Ghanshyam Agarwal, an analyst at REDD Intelligence.

A more stark second warning was in the footnote, says the distressed-debt specialist: The employee trust was selling 4 million of its 15 million shares to a fund at 24 times the price it paid three years earlier. While the shares rose initially after their 2010 debut, nobody who tried to offload IL&FS Transportation in public markets has received even half of that price in the past three years. Now that the company can’t pay creditors, the stock is all but worthless.

Everything about IL&FS is shrouded in opaqueness, as the new board, appointed by the Indian government to fix the mess, is quickly discovering. The rescue group led by banker Uday Kotak went in earlier this month, hoping to find 169 subsidiaries, associates and joint ventures, only to discover that there are twice as many.

The welfare trust is also a black box. It enriched senior management, but for the rank and file what flowed — apart from an occasional double bonus — was mostly hopes. In November 2014, for instance, the trustees offered shares in the parent at 265 rupees to employees, who paid 2 rupees upfront to lock in their quota amid rumors that Indian businessmen Ajay Piramal wanted to buy IL&FS. A year later, however, Piramal’s 750-rupees-a-share offer was rejected by shareholder Life Insurance Corp., and with that the dreams of junior employees came crashing. However, top management kept stuffing the trust’s vaults all the way to bankruptcy.

Analysts kept missing the signs. On July 27, three days after Parthasarathy unexpectedly quit the group he had steered for three decades, A2Z Infra Engineering Ltd. informed the National Stock Exchange about a one-time debt settlement in its waste-management subsidiary. Foreign banks including Standard Chartered Plc, as well as Indian lenders, such as Yes Bank Ltd. and Axis Bank Ltd., took 66 per cent haircuts. But IL&FS’s financial services subsidiary got less than $1,500 — yes, you read that right — against its $25 million exposure to the group.

That isn’t all. The IL&FS employees’ trust, along with two partners, got a waste management facility and a 15-megawatt power plant as part of the same settlement by paying $7,000. (Yes, you read that number right too.)

What a neat model of sweat equity. A lender sweats losses, and its employees — who happen to be the lender’s part owners — get equity in a waste-to-energy power plant in one of India’s dirtiest cities on the side. And then there were the dividends, which went to the welfare trust as they would to any other shareholder.

As Mumbai-based investigative journalist Sucheta Dalal notes on website Moneylife India, “It is no wonder that IL&FS kept paying dividends even when the ship was tilting.” Now that the vessel is sinking, and may require an infusion of state funds to stay afloat, Kotak, the new board chairman, must throw the trust overboard.-Bloomberg

Every time, ALL, means ALL will only wake up after the disaster.

Why then auditors ? what are they doing ? why for all these years they keep on giving clean reports ?

What then Anylist are doing?

For the companies like ILFS, whose all information is supposed to be available in public domain , and it is. Then, where is the problem ?

In last 3 years , ILFS and its subsidiaries would have taken debt / finance from bank / private or any other sources for few projects, then the rating agencies who gave the rating – what were they doing ?

If above all interested parties say – they can not do anything, then – for what all this fuss is about ?

Ravi Parthasarathy joins several other well heeled Indians in leafy London. As Amitabh Bachchan says in Shehshah, Ret hamari sehat ki liye achhi nahin hai.