New Delhi: Indians are once again flocking to gold — both physical and digital — in a bid to hedge against economic uncertainty, high inflation and a weak rupee. But what’s adding to the influx of gold into the country is a particular provision in the free trade agreement India signed with the United Arab Emirates (UAE) in 2022.

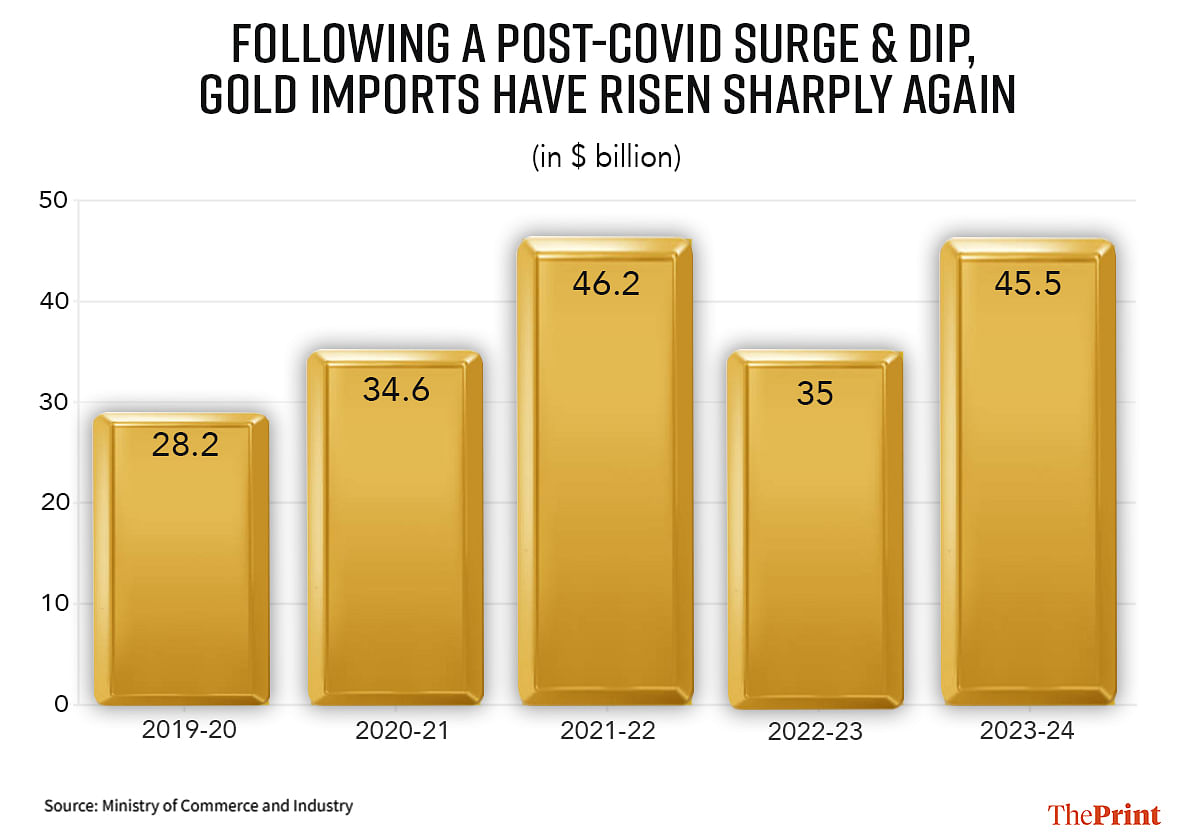

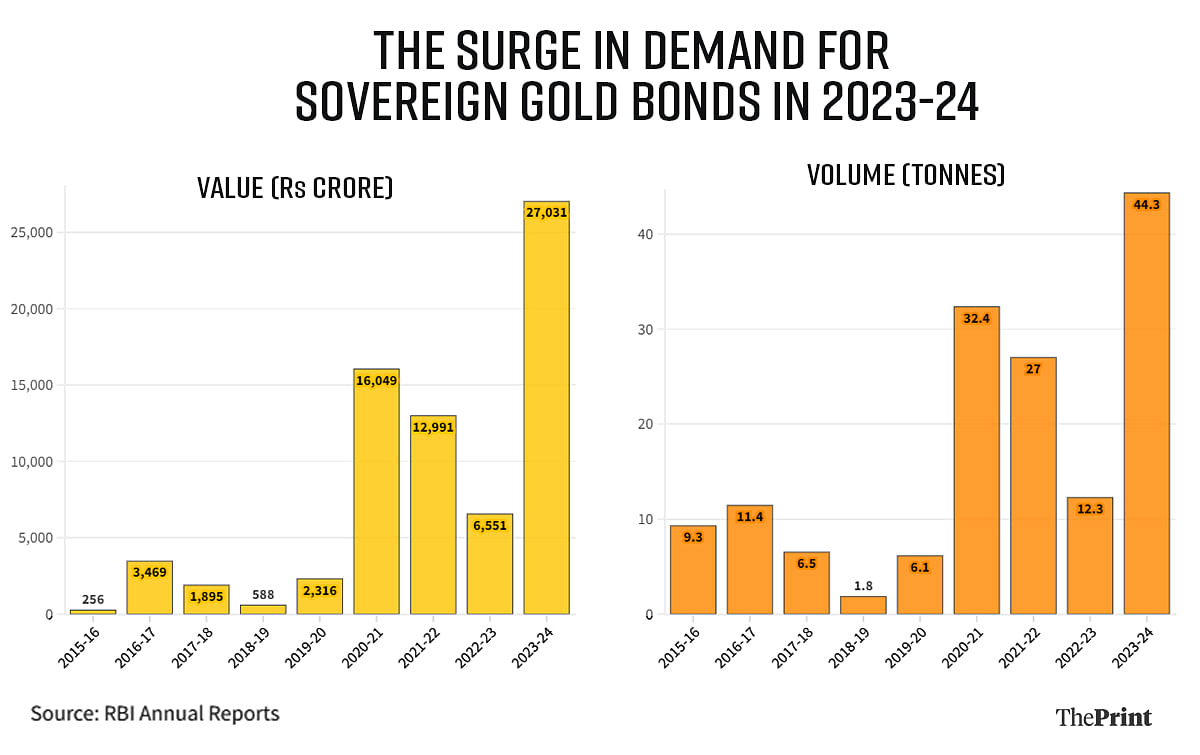

An analysis of the government’s trade data shows that gold imports rose 30 percent in 2023-24 to $45.5 billion or 795.25 tonnes. At the same time, the demand for sovereign gold bonds (SGBs) jumped 312 percent in 2023-24. That is, the value of SGBs bought that year was more than in the two previous years combined.

“While cultural affinity for gold remains a significant driver of demand, especially in countries like India and China, the recent surge in gold imports can be attributed to a combination of economic, geopolitical and market factors,” Prithviraj Kothari, managing director of RiddiSiddhi Bullions, told ThePrint.

According to Kothari, rising inflation, economic uncertainty, geopolitical tensions, currency weakness, low real interest rates, increased investment demand and technological uses all play a role in the growing appetite for gold.

“These factors together create a compelling case for the heightened demand and subsequent rise in gold imports,” he explained.

Also Read: India’s trade deficit hits record high in October, largest share of imports from China

Govt policy leads to demand dip

The onset of the COVID-19 pandemic in 2020 triggered a substantial fall in demand for gold due to lower discretionary spending, according to Motilal Oswal Financial Services.

“The closure of stores for a significant period and intermittent lockdowns in select states during that time further exacerbated the decline,” it said in a report.

However, demand bounced back soon after due to the lifting of lockdowns, increased wedding-related purchases, and an improvement in overall consumer sentiment.

“In FY22, there was a notable improvement in volume for gold to reach 767 tonnes from 510 tonnes in FY21,” Motilal Oswal said in its report. “This surge was propelled by heightened discretionary spending and the gradual easing of the pandemic’s impact.”

In value terms, gold imports touched $46.2 billion in 2021-22, up 33.5 percent over the previous year.

However, in the next fiscal, the Indian government hiked import duty on gold to 12.5 percent from 7.5 percent, effective from 30 June. This was a significant blow to the market. Gold imports fell nearly 25 percent in 2022-23, which Motilal Oswal attributes almost entirely to the duty hike.

“The higher import duty prompted retailers to transfer the additional costs to customers, adversely impacting discretionary purchases,” it said.

UAE trade deal offers respite

Despite this higher import duty, the financial year 2023-24 saw a reversal in this fall in imports, with gold imports again rising 30 percent to $45.5 billion.

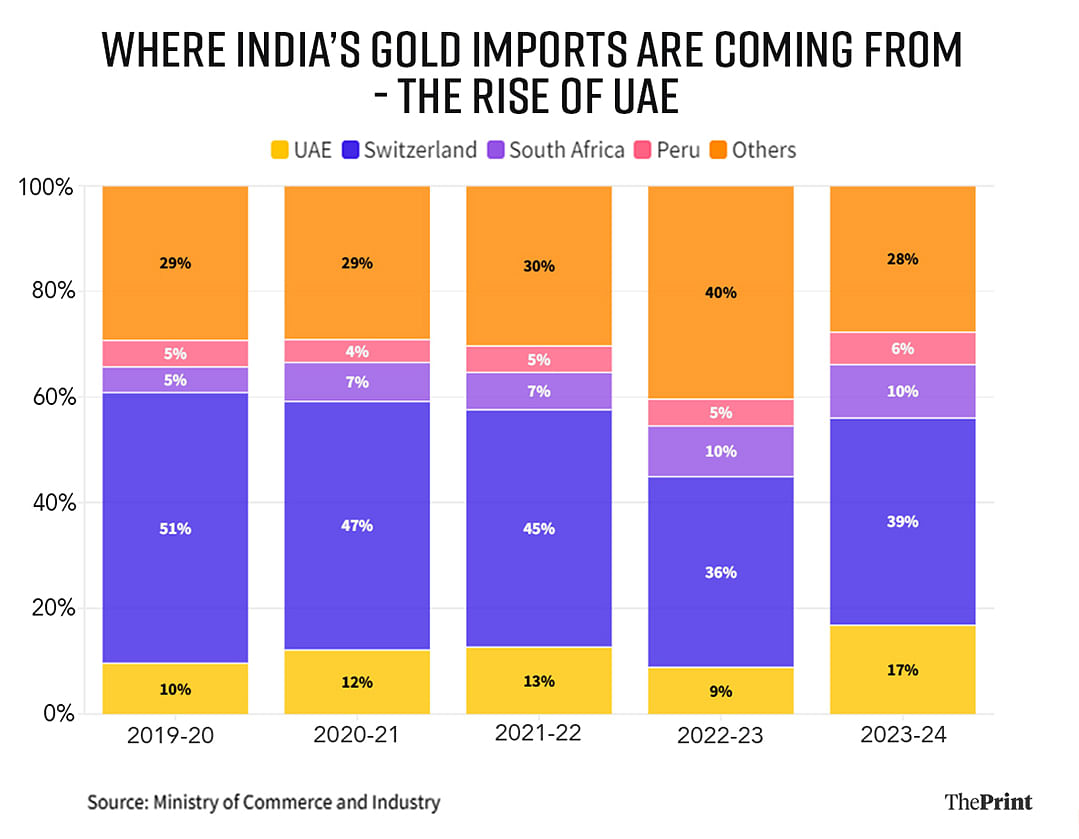

A major factor driving the surge in imports is the location they are increasingly coming from — the UAE — and the favourable tax treatment that imports from that country have been receiving from India over the last couple of years.

India and the UAE signed the Comprehensive Economic Partnership Agreement (CEPA) in February 2022 and it was implemented in May that year. Under the agreement, the UAE was granted a 1 percent tariff concession on gold imports into India.

At a time when import tariffs were hiked for the rest of the world, this 1 percent benefit for the UAE was game-changing. According to industry estimates, this 1 percent difference amounted to Rs 71,000 per kilogramme of gold, a substantial saving for those routing their gold through the UAE.

Gold imports from the UAE surged nearly 150 percent in 2023-24 to $7.65 billion. The country’s share in India’s total gold imports jumped from 9 percent in 2022-23 to 17 percent in 2023-24, a near-doubling, and an indication that more gold was being sourced through the UAE to India.

Even silver benefited from the India-UAE CEPA, since silver imports from the UAE attracted 7 percent duty concession under the agreement.

“While India’s total imports from the UAE fell by 9.8 percent, from $53.2 billion in FY23 to $48 billion in FY24, imports of gold and silver skyrocketed by 210 percent, from $3.5 billion to $10.7 billion,” Global Trade Research Initiative (GTRI), a trade policy think-tank, said in a report.

“This sharp rise in gold and silver imports is primarily driven by import duty concessions granted by India to the UAE under the India-UAE Comprehensive Economic Partnership Agreement,” GTRI noted.

Notably, the UAE has significantly increased its share in India’s gold imports while other countries have seen their shares remain largely stable. This suggests that the UAE, more than any other country, accounts for the overall increase in India’s gold imports.

This isn’t great news for India. According to GTRI, the Indian government has foregone import tax revenue of Rs 635 crore in FY24 by granting lower tariffs for gold and silver imported from the UAE.

Favourable treatment to UAE doesn’t end there

The benefits from the India-UAE CEPA extend further than lower import tariffs and seem to include exemptions from import restrictions.

India’s Directorate General of Foreign Trade (DGFT) on 12 June restricted the import of certain kinds of studded gold jewellery and its parts.

However, imports of these items under the India-UAE CEPA were exempted.

“Additionally, India facilitates gold and silver imports by allowing private firms to import from the UAE through the India International Bullion Exchange (IIBX) in Gift City,” GTRI noted.

This is an advantage other countries don’t yet enjoy, and is yet another outcome of the CEPA.

The rise of non-physical gold

While the India-UAE CEPA route has led to a surge in the import of physical gold, India is also seeing demand for non-physical gold — SGBs and digital gold — rising sharply.

SGBs are government securities that are denominated in grammes of gold. They act as substitutes for holding physical gold. The SGB scheme was introduced in 2015. Since then, after an initially tepid response from the public, demand for SGBs has grown over the years.

However, 2023-24 marked a particular milestone in this growth, with the purchase of SGBs crossing Rs 27,000 crore (or 44.3 tonnes), more than four times the amount bought in the previous year.

“SGBs eliminate the need for secure storage and insurance costs associated with physical gold, making them a more convenient investment option,” Kothari explained. “Unlike physical gold, SGBs offer an annual interest payment (typically around 2.5 percent per annum). This feature makes them more appealing to investors seeking both capital appreciation and regular income.”

SGBs that are held till maturity are even exempt from capital gains tax.

According to Kothari, several of the economic uncertainties — such as concerns about the stability of the financial system, potential recessions, and the long-term impact of the COVID-19 pandemic — that have driven people to buy physical gold have also led them to increasingly adopt digital forms like SGBs.

This has also led to the increasing acceptance of digital gold products, where investors can invest in gold without actually buying the physical metal. Several startups and fintech companies offer services where their customers can buy gold, which is stored at a facility created by the company.

Similarly, they can sell this gold without ever having touched it.

“In light of these dynamics, digital gold has emerged as a practical choice for investors seeking to hedge against economic volatility and inflation,” said Rohit Garg, co-founder and CEO of Olyv, formerly called SmartCoin, a company that allows customers to buy and sell digital gold.

“Its ease of purchase, secure storage options, and the ability to trade or sell gold electronically without the hassle of physical handling make it attractive to both newcomers and experienced investors,” he added.

(Edited by Nida Fatima Siddiqui)

Also Read: Who’s snatching your gold, mangalsutras? RBI data says it’s Modi