New Delhi: The government is working on a mechanism where the tax deducted at source (TDS) for salaried employees will automatically reduce if they have to pay tax collected at source (TCS) on foreign transactions, according to Chief Economic Advisor (CEA) V. Anantha Nageswaran.

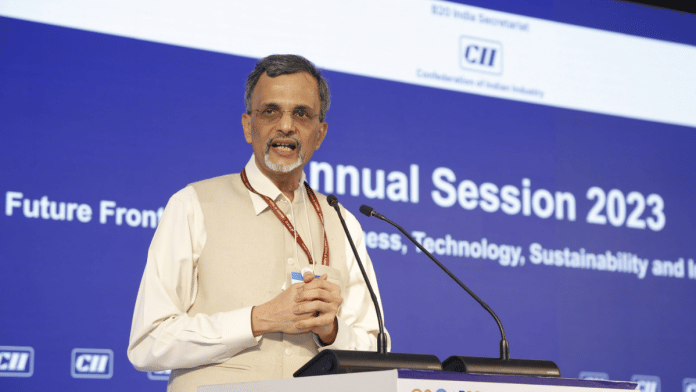

At an annual event hosted by the Confederation of Indian Industry (CII) Thursday, the CEA also explained the government’s rationale for raising the rate of TCS that would be levied on international transactions.

Finance Minister Nirmala Sitharaman had, in her Budget speech, said that the rate of TCS applicable on most foreign transactions would be increased to 20 per cent from the previous 5 per cent, from 1 July onwards.

On 16 May, the Ministry of Finance announced that international credit card transactions would also be included under these rules.

While TCS is adjusted against the final tax payable at the end of the year, and so isn’t strictly a tax, TDS is deducted from an employee’s monthly salary before it is deposited in his/her account.

The decision to include credit cards sparked outrage from businessmen, economists, and politicians, who said that this would impose a disproportionate compliance burden on honest taxpayers.

Soon after, the government relented and clarified that only international transactions above Rs 7 lakh in a financial year would attract the TCS.

Now, according to Nageswaran, there are attempts to ease another major concern — that the high rate of TCS would entail a cash-flow issue since that amount would be locked away with the government until the end of the financial year.

“First of all, they (the government) have exempted transactions of up to Rs 7 lakh from this TCS, so the bulk of the transactions made by most of us will not be covered under this levy,” the Chief Economic Advisor said.

“There are also attempts to link the TCS with your tax deduction at source, such that if there are TCS payments being made by you, then it has to reflect in a lower tax deduction at source,” he added. “It is simply a matter of making sure you aren’t affected from a cash-flow perspective.”

Nageswaran added that this would provide relief for people who are concerned about this “annoyance or irritation” of seeing a TCS being levied apart from the TDS. This is an issue that had been raised by some critics of the TCS hike, who complained that this would entail a tax levied on income that was already taxed.

A major issue flagged by the bankers was if the point of the TCS was to track transactions, as is its conventional purpose, then even a 1 per cent TCS would have done the job. There was no need for a 20 per cent TCS, they argued.

The CEA, however, reasoned that a low rate of TCS was not serving as a big enough deterrent to tax avoiders.

“One point of view that is being made is that all that you (the government) needed to do was make the TCS 1 per cent or 5 per cent so that you can track it,” he said. “But there are people who are happy to stay out of the tax net if it is 1 per cent or 5 per cent.”

“That is still a price worth paying for them,” Nageswaran explained. “So there has to be a deterrent effect as well, while at the same time, without inconveniencing those who are going about paying their taxes.”

He added that, contrary to the view that there were only a few people who were abusing the rules relating to foreign transactions, the government’s data showed that the volumes involved in such tax are “fairly substantial”.

(Edited by Tony Rai)

Also Read: Fuel rates unchanged for 365 days & counting. Why it may be time to return to dynamic pricing