New Delhi: The Tea Board of India has passed an order to put a stop to coveted local varieties such as Darjeeling, Kangra and Nilgiri being blended with imported brews of inferior quality.

The order is expected to boost the export of Indian tea — one of the most decorated and internationally renowned commodities of the country — which is currently plagued by rising import of cheap variants for blending, as well as low local production.

Indian varieties have a massive domestic as well as international market, with many of them, such as Darjeeling and Kangra, even having Geographical Indication (GI) tag recognition.

In the order released this month, the statutory body, which operates under the commerce ministry, instructed all tea importers to ensure that the tea’s origin is mentioned on all their sale invoices. The importers were also barred from passing off imported tea as that of Indian origin, by blending the two, for domestic consumption.

“No registered buyers of tea shall blend any imported teas with teas of Darjeeling, Kangra, Assam (Orthodox) and Nilgiri (Orthodox)… failure to comply with this direction shall invite action as deemed fit,” it added.

The order instructed the manufacturers of Darjeeling tea to not purchase green leaf from outside the GI area.

Also Read: It’s premium Darjeeling Tea, but from Nepal: How ‘fake’ tea is threatening the pride of India

Underlying stress in tea sector

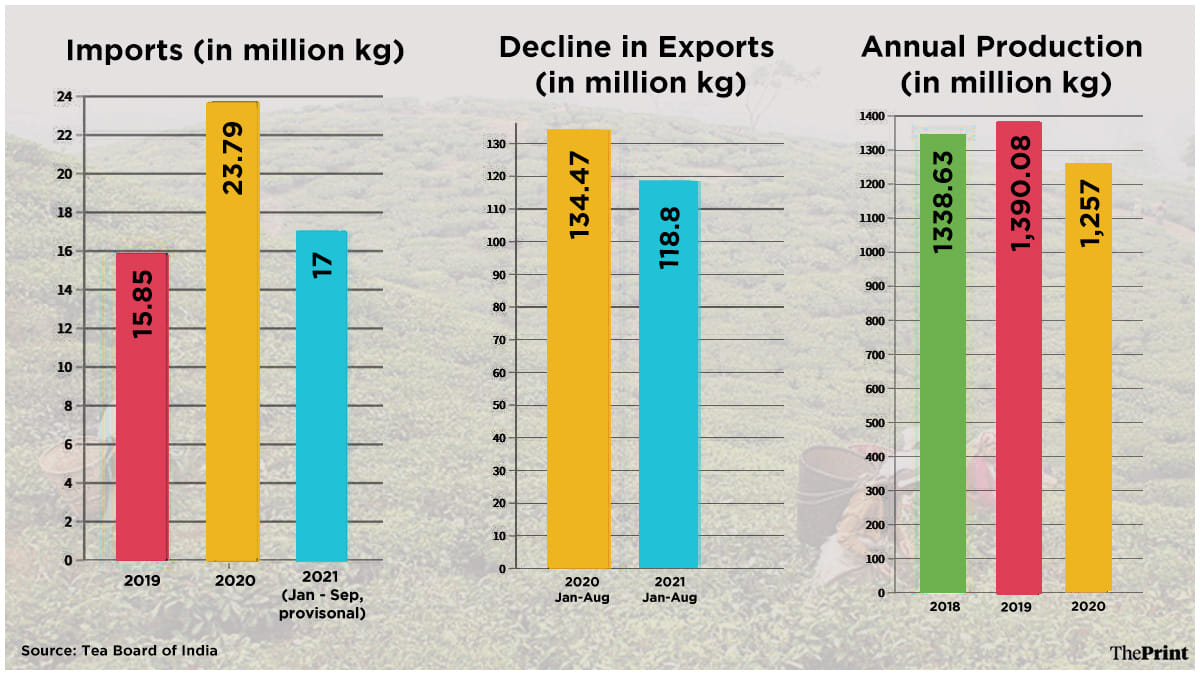

According to Tea Board data, despite a global recovery between January and August this year, tea exports from India dropped by over 11 per cent. This followed a 20 per cent drop in exports to markets such as Russia, the UK, and Egypt in 2020.

Moreover, imports have increased by almost 34 per cent in the same period, while in 2020, imports surged by more than 50 per cent. The country’s overall tea production in 2020 was down by almost 10 per cent to 1,257 million kg, compared to 2019.

The overall production in 2019 was 1,390.08 million kg, and 1,338.63 million kg in 2018.

This problem of rising imports and falling exports has been caused by multiple factors such as a dip in production, leading to a surge in prices, making the commodity internationally uncompetitive, global export constraints, and the blending problem.

Huge crop loss during lockdown

Sujit Patra, secretary, Indian Tea Association, told ThePrint that “at least two months of operations were disrupted during the Covid-19 lockdown, leading to huge crop loss, around a 40 per cent decline in quality tea crops such as Darjeeling tea”.

“This led to an increase in prices, which reached a record high last year. Due to this, our other competitors such as Kenya and Sri Lanka, which don’t have a substantial domestic market and hence have low-priced tea produce, invaded our export markets such as Egypt, Russia, the UK and other countries,” he added.

“This year too, due to weather-related vagaries, there was a setback in crop produce, leading to lower production than 2019. This October, we produced 55 million kg less against what was produced in 2019,” he said. “This year, we expect a 60-65 million kg export dip from 2019. Since last year, there has been an uncertainty of availability of containers in the market for export as freight charges have increased by 500-600 per cent, which is further hurting exports,” Patra added.

The auction prices of the Indian ‘crush, tear, curl’ variety, popularly known as CTC, shot up to as high as over Rs 300/kg in 2020 from Rs 150-180/kg before the pandemic. This price is still hovering at over Rs 200/kg this year

P. K. Bezbaruah, chairman, Tea Board of India, said: “Last year, we lost more than 10-15 per cent of output, which pushed prices by 30 per cent. Exports dropped by 15 per cent and this year it’s even worse.”

The blending menace

Experts blame blending of tea for further pushing imports and leading to fall in exports.

Bezbaruah said some “tea exporters buy tea from elsewhere and mix it with Indian tea and export that blend as Indian tea, which we are trying to clamp down on to ensure that tea exported from India in its name meets the minimum standards”.

“The import is further rising as Indian tea is outpriced due to a dip in demand. This has also damaged the export market because if you blend the product with cheap tea and send it to customers, it will definitely turn them off.”

Koneenika Bhattacharjee, a Siliguri-based exporter of Darjeeling tea, told ThePrint: “The import of cheap tea from destinations such as Nepal, Vietnam and Argentina, which cost even less than Rs 100/kg, has exponentially increased since last year as domestic prices shot up.

“The blending of this tea makes it practically impossible to offer even a decent or standard tea at these price points. This is denting India’s tea stature in global markets as consumers abroad are very conscious about their quality.”

Sujit Patra added: “If domestic tea is subjected to norms set by the Food Safety and Standards Authority of India (FSSAI), the imported ones too should be brought under it. Records of imported tea should be maintained and that too at a minimum import price. If that is being blended and re-exported, then it should be labelled as the multi-origin, and not Indian tea.”

(Edited by Gitanjali Das)

Also Read: Indian tea is world famous, but our exports are still behind Kenya, China and Sri Lanka