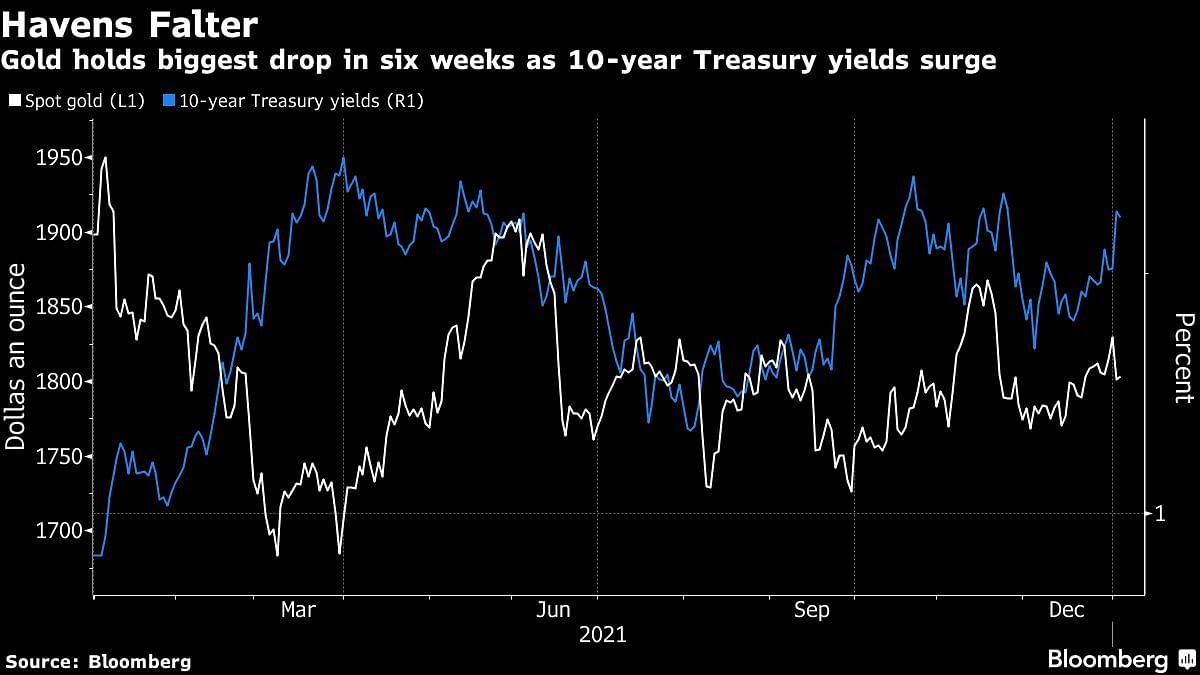

Gold was steady after posting its biggest drop in six weeks as bond yields surged, with investors bracing for monetary policy tightening in 2022.

Ten-year Treasuries had the worst start to a year in more than a decade, with yields rising 12 basis points on Monday, the largest first-day jump since 2009, according to Bloomberg data. Meanwhile, the S&P 500 Index closed at a record high on risk-on sentiment.

Bullion fell last year in its biggest annual decline since 2015 as central banks started to dial back pandemic-era stimulus to fight inflation. Traders are also monitoring the risks posed by the omicron virus variant and will focus this week on the releases of minutes from the Federal Reserve’s latest meeting and the U.S. nonfarm payrolls data.

Spot gold rose 0.1% to $1,803.81 an ounce at 7:54 a.m. in Singapore, after dropping 1.5% Monday, the most since Nov. 22. The Bloomberg Dollar Spot Index was flat after adding 0.5% in the previous session. Silver and platinum were steady, while palladium advanced. –Bloomberg

Also read: Gold steady as traders weigh record US stocks, Omicron risks