New Delhi: While all eyes are fixed on the macroeconomic data set to be released Wednesday in the form of the second quarter GDP data, an analysis of sector-wise performance shows that the economy is still far from the robust growth needed to boost employment and incomes.

The government releases a number of metrics periodically to provide a general picture of economic performance. These ‘high-frequency indicators’— used by researchers and the media — measure economic activities like cargo traffic, toll collections, electricity consumption, trade data, vehicle sales, freight traffics on a monthly basis.

However, there are some items such as lubricants for machines, grease, paints, construction material, etc that also provide a reasonably accurate picture of the underlying economic activity, and of areas which are booming and those lagging behind.

In other words, there are items that companies and households buy only when they plan to use them, and there are staples bought regularly. An analysis of the sales volumes in both these broad categories gives a good idea of the health of the Indian economy.

Further, looking at the number of units sold rather than the revenue earned from sales also eliminates the impact of the recent high inflation and allows for a more meaningful comparison.

The data shows that the consumption of industrial petroleum products, items of regular household consumption, and materials used in building construction and renovation seems to have recovered from the pandemic, but also appears to be on a weaker footing now than they need to be. This is corroborated by economists and the Reserve Bank of India, who predict that growth in the second half of this financial year will average less than 5 per cent.

Also Read: Data vs atta, petrol, LPG: How dirt-cheap mobile internet contrasts with surging food, fuel prices

Some industrial petroleum products see higher demand

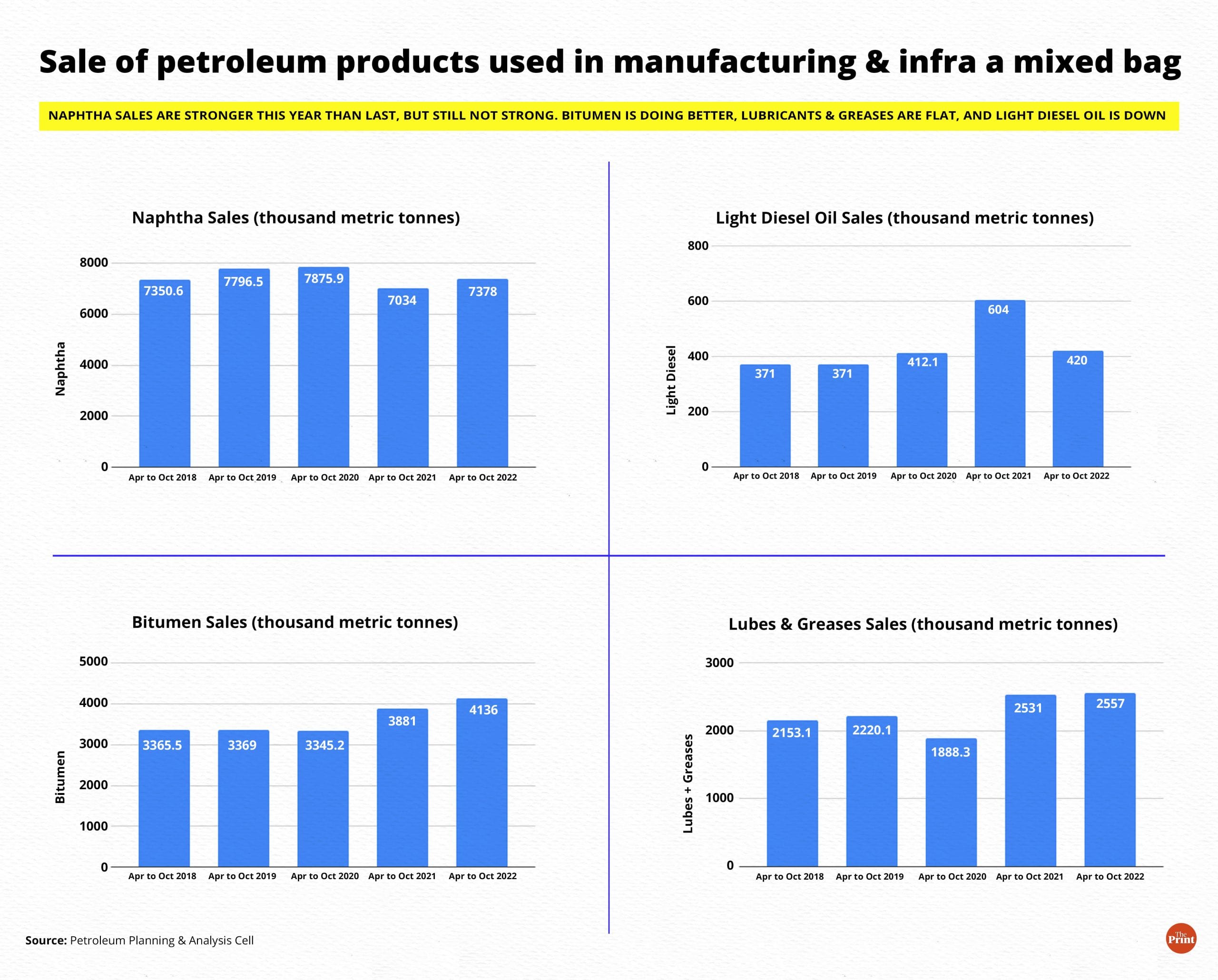

Some petroleum products such as naphtha, bitumen, lubricants and grease, and light diesel oil (LDO), serve as lead indicators of economic activity. That is, they are bought in anticipation of economic growth. If growth in the near future is predicted to be poor, then the sale of these products falls.

Data from the Petroleum Planning and Analysis Cell (PPAC) shows that the sale of these products has been a mixed bag, which lends some insight into how particular sectors are doing. For example, bitumen is largely used in road construction. Its consumption stood at 4,136 TMT (thousand metric tonnes) in the April-October 2022 period. This is a 6.6 per cent increase over last year, and is higher than the trend since 2018, but is still not as high as it can be.

Confirming this is the fact that highway construction has been very slow this year, which is poor news since the road construction sector is a major employer.

“During H1 FY23 (April to September 2022), NHAI awarded only 35 projects with length 1,024 km of Rs 191 billion (includes 386 km of maintenance contracts),” Centrum Broking Limited said in a report on the infrastructure sector. “This is mere 17 per cent of NHAI’s FY23 awarding target of 6,000 km.”

Lubricants and greases are used by companies to run machines and engines. Their sales increase if companies use their machines and engines more extensively, or if they predict that they will in the near future.

The volume of lubricants and grease consumed in April to October 2022 stood at 2,557 TMT, a mere 1 per cent increase over the same period of last year.

Another lead indicator of economic activity is the sale of naphtha, which is used widely in all manner of industrial solvents. The sale of naphtha, at 7,378 TMT, was just 4.9 per cent higher than last year, but far lower than the average of 7,600 TMT over the three previous years (2018, 2019, and 2020).

The sale of light diesel oil (LDO) — used in furnaces and boilers — touched just 420 TMT in the April-October 2022 period, down by 30.5 per cent over the same period of the previous year when it was 604 TMT. However, this year’s sales are higher than the average seen in the three years of 2018-20, which shows that its usage is rising in general.

Construction materials in the green

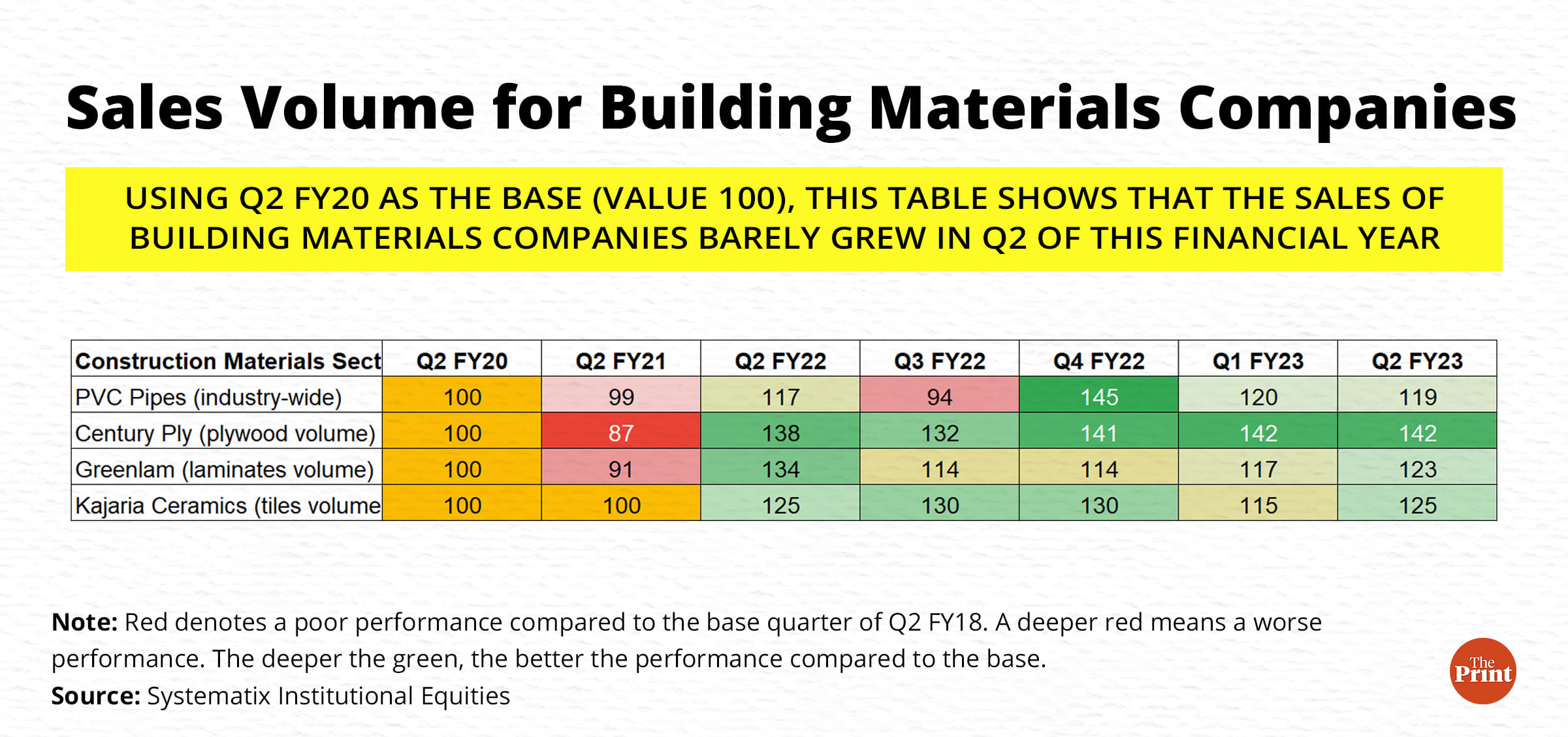

A useful gauge of the state of the economy is to look at the sale of items that involve discretionary spending by households and companies, such as building materials. Households and companies usually go in for renovations or new constructions when they have the funds to support it, or when they have a need for it (for example, expansion of a company).

An analysis of data compiled by Systematix Institutional Equities on the building materials sector shows that the sale of PVC pipes, ceramic tiles, plywood, and laminates have grown strongly in the second quarter of this financial year, as compared to the pre-pandemic period.

It, however, also does show that the sales volumes remained largely flat as compared to the same quarter of last year, indicating that the sector hasn’t really grown in the last year.

“Of all the segments within building materials, wood panel reported an overall healthy Q2 FY23, driven by healthy volumes and margins in key categories,” Systematix Institutional Equities said in a report which ThePrint has accessed. Regarding the ceramic tile companies, it said that while sale volumes and revenues were up about 10 per cent over the first quarter of this year, higher gas prices and inadequate price hikes by the ceramic companies hurt their margins.

Although Nuvama Research, which conducts sector-wise analysis of companies’ performance, categorises Asian Paints as being in the ‘household staples’ category, the sales of paints are strongly correlated to construction and renovation activity.

Nuvama’s data shows that Asian Paints saw more than a doubling in the volumes it sold in the second quarter of this financial year compared with Q2 FY18, and a 9.9 per cent growth over the second quarter of last year.

Also Read: Indian banks are heading into a trap. High inflation and interest rates are a deadly mix

Household staples same level as last year

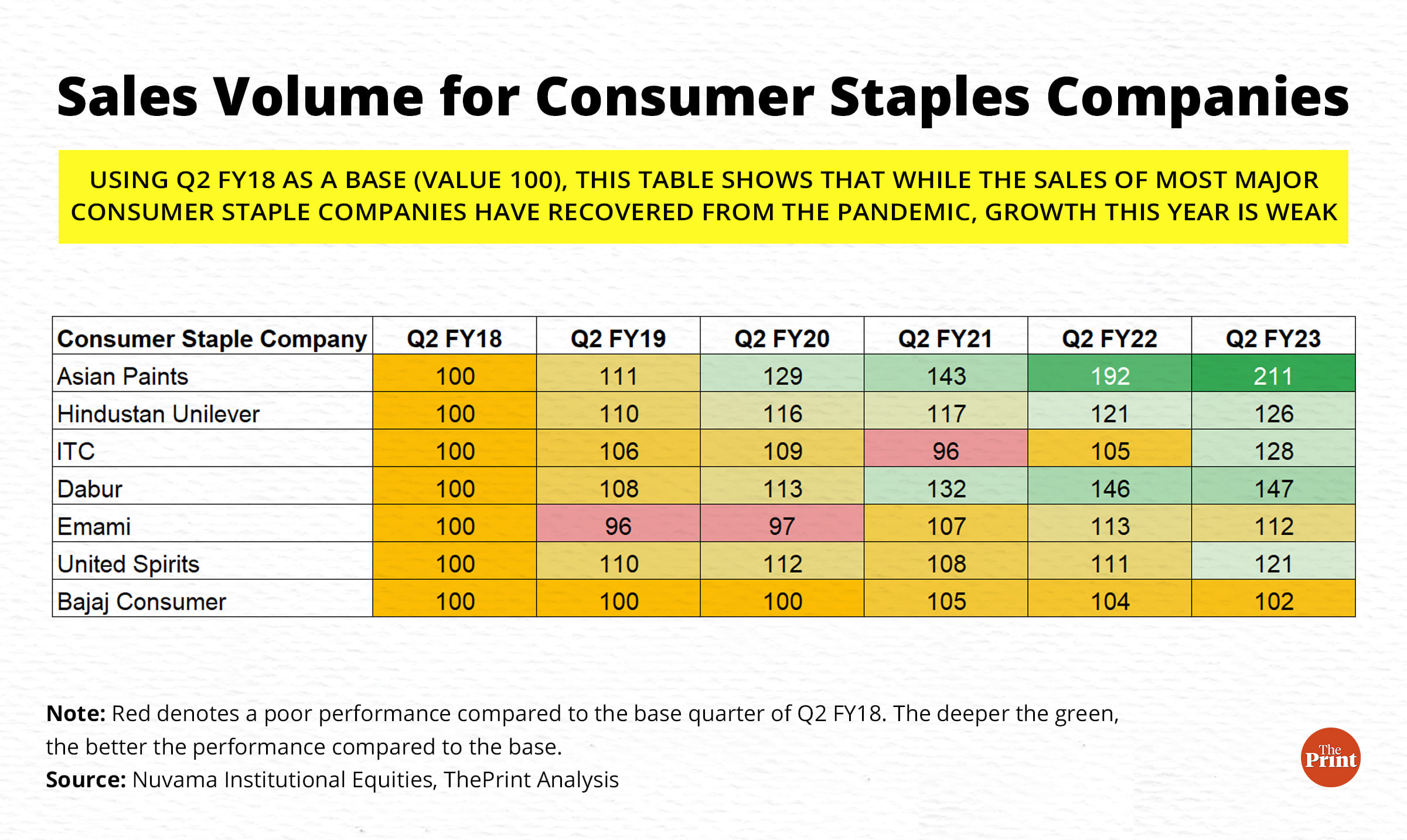

Another measure of the health of the economy is to look at the sales of fast-moving consumer goods (FMCG) and items that are bought on a regular basis, such as tea, coffee, deodorants, soap, cleaning products, biscuits, ready-to-eat food items, etc.

An analysis of the sales numbers of companies dominant in these sectors such as Hindustan Unilever, Dabur, ITC, Emami, Bajaj Consumer shows that while the volume of sales has recovered from the pandemic, the growth has been anaemic.

Nuvama Research, which compiled the sales numbers of these companies, said that inflation played a part in suppressing demand, although some companies managed to increase market shares despite hiking prices, while others benefited from the fact that consumers were switching from expensive alternatives to cheaper ones.

“Consumer companies braved inflationary headwinds in raw materials across multiple commodities in Q2 FY23,” Nuvama Research said in a report. “In fact, inflation dealt a double whammy—it eroded margins across companies and suppressed rural demand.”

“Even so, category leaders continued to hike prices (largely cost pass-through) and yet gained market shares,” it added. “Demand appetite in categories such as biscuits, noodles and atta bounced back driven by down-trading (switching from more expensive to cheaper alternatives) from street food and launches.”

Nuvama Research found that urban pockets continued to outgrow rural ones, particularly in the luxury, premium and quick commerce segments. “In all, we believe the worst is over for FMCG with a gradual recovery underway,” it said.

What lies ahead

The broad consensus among industry and economists seems to be that growth for the full financial year 2022-23 will be in the range of 6.5-7 per cent, Chief Economic Advisor (CEA) V. Anantha Nageswaran said Thursday. However, he added that greater clarity would come from the second quarter GDP data that will be released on November 30.

“Projections of the private sector, the Reserve Bank of India and international participants for FY23 (growth) are roughly in the ballpark of 6.5-7 per cent,” the CEA said at State Bank of India’s Banking and Economic Conclave. “This appears to be reasonable at this point in time although we will get data on the fiscal second quarter in a few days, which will give clarity on these numbers, whether they need to be revised.”

He added that the projections by international agencies for FY24 are largely converging at the 6-6.2 per cent range.

In the immediate future, Nuvama Research says it is “seeing early signs of a good winter this year”, with consumer demand starting to pick up in skin cream, chyawanprash, honey and Honitus.

“This can also potentially somewhat benefit hot beverages such as tea and coffee,” it said. “These are initial days for winter, so we continue to track, but data is encouraging.”

However, the research firm added that there does not seem to be any structural recovery in rural demand for FMCG products, so while there might be a growth in the second half of this year as compared to the first due to the base effect, this will largely be optics rather than real growth.

In the medium term, Bank of Baroda Capital Markets (BOBCAP), a wholly-owned subsidiary of Bank of Baroda, believes that an upcoming “supercycle” in the infrastructure sector will buoy the economy.

“We believe India is on the cusp of a new capex upcycle, close to two decades after the country’s last infrastructure supercycle of 2003-08,” BOBCAP said in a report. “The previous cycle ground to a halt amid the 2008 Global Financial Crisis, after which the government became the torchbearer of capex, keeping infrastructure at the fore and culminating in the ongoing Rs 111 trillion National Infrastructure Pipeline (FY19-FY25).”

“The government’s trifecta of asset creation (NIP), asset recycling (National Monetisation Pipeline) and integrated planning (Gati Shakti) should reboot India’s infrastructure cycle,” it added. “Notably, even if only 50 per cent of the NIP fructifies, it would still imply a massive annual capex injection of Rs 11 trillion over five years.”

Overall, however, growth in the second half of this year will likely be at 4.6 per cent, the RBI Governor had said while announcing the Monetary Policy Committee’s decision on 30 September.

EY India chief policy advisor D.K. Srivastava agrees with this assessment, adding that industrial activity looks like it will not be growing fast enough.

“Normal growth in Q3 and Q4 is expected to be just 4-5 per cent, which is what RBI had also said,” Srivastava told ThePrint. “After the base effects are taken out, it is expected that the Q3 and Q4 growth rates will be less than 5 per cent. That would mean that industrial activity is showing growth of only 5 per cent, which is not enough.”

Srivastava added that the services sector — which has not been measured in this analysis — has segments that still have not fully recovered from the pandemic, which has implications for their employment potential.

“The one sector that had not fully recovered by the first quarter of this year was transport, storage, communications, etc,” he explained. “That sector had not recovered to pre-COVID levels, and that is a sector where a lot of informal employment takes place.”

(Edited by Tony Rai)

Also Read: Govt not in business: Modi govt accounts for 72% of all disinvestment since 1991, data shows