Kotak Mahindra AMC and Mirae AMC are among investors seeking refuge in debt maturing in less than 5 years.

Mumbai: Asset managers in India are buying shorter-maturity debt and triple-A rated corporate paper, as uncertainty about the pace of rate hikes by the central bank and a global trade war add to fear of an impending cash crunch.

Kotak Mahindra Asset Management Co. and Mirae Asset Management Co. are among investors interviewed by Bloomberg that say they’re seeking refuge in debt maturing in less than five years. A liquidity crunch is looming, which would hurt companies seeking to refinance, according to IDFC Asset Management Ltd.

Hurt by a bond rout that’s lasted almost a year in India, investors are seeking to get the next big call right as trade jitters and an unexpected rate hike by the central bank threaten to extend the slump. The bout of caution could pressure Prime Minister Narendra Modi’s funding plans, and even raises the specter of the benchmark yield approaching levels last seen during the 2013 taper tantrum.

“In this market, the last thing you want is to act adventurous,” said Lakshmi Iyer, chief investment officer for debt at Mumbai-based Kotak Mahindra Asset. “This is not the time for bungee jumping. This is the time to go to a four-feet pool and walk, not swim.”

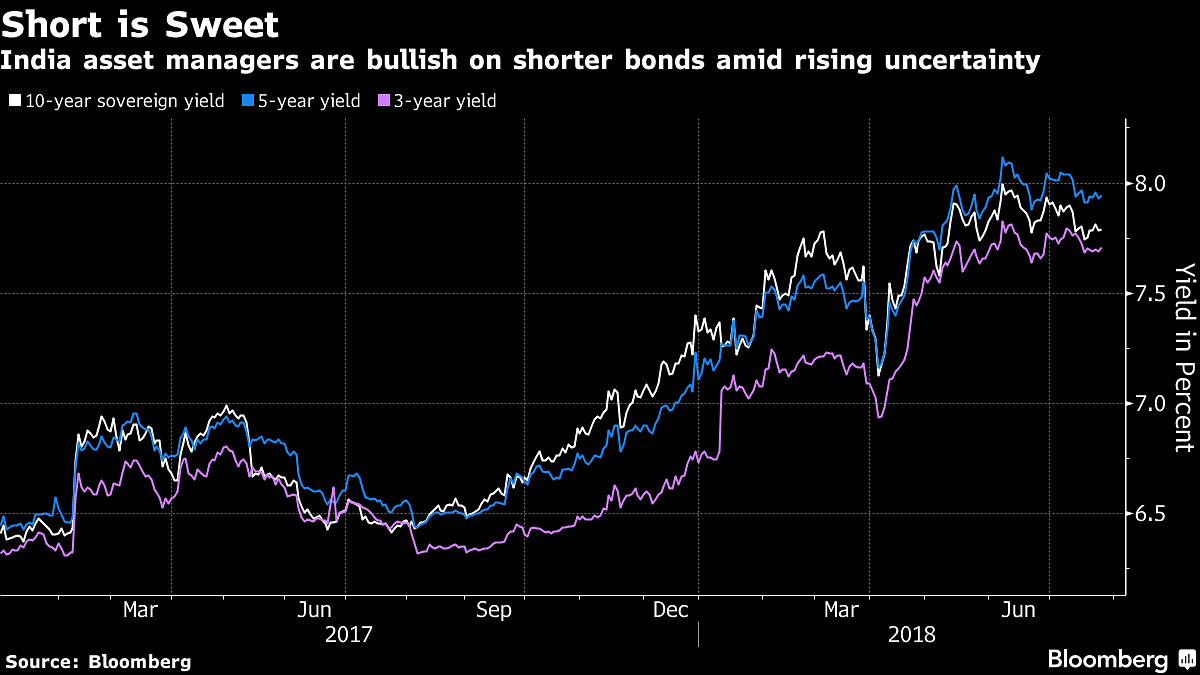

Bond prices have declined in 10 of the past 11 months. The benchmark yield is up 43 basis points in 2018 on fears of fiscal slippage ahead of next year’s general elections, surging crude prices, and rising interest rates.

The 10-year yield, which reached a high of 9.47 per cent in 2013, declined three basis points to 7.76 per cent Thursday. Sovereign bonds in the three-to-five year maturity bucket have posted better returns in the past month than those due in 10 years and beyond, according to calculations by Bloomberg.

Policy Action

All six money managers Bloomberg spoke to expressed concerns over the potential for more rate hikes by the Reserve Bank of India(RBI), and most indicated that they are shunning lower-rated paper. Funding costs are set to rise for all but the strongest Indian firms, IDFC Asset said.

“With rates only expected to go up in the next seven to eight months, I would be fairly conservative in positioning across duration and liquidity,” said Rajeev Radhakrishnan, head of fixed income at SBI Funds Management Pvt. “Additional policy action is clearly on the cards.” The fund’s portfolio is skewed toward shorter-maturity AAA and AA notes, he said.

The RBI, which raised rates in June for the first time since 2014, is set to review policy on Aug. 1. Eighteen out of 24 economists expect it to hike rates while the rest expect a hold, according to a Bloomberg survey of economists.

Cash Crunch

Any rate increase would add to the start of a cash crunch already hinted at in the economy. Banking system liquidity is expected to turn to a deficit of about 240 billion rupees by end-August, with the gap widening to 640 billion rupees by September, according to Bloomberg Economics’ liquidity forecasting model.

“The focus on sovereign and AAA-rated paper is razor sharp this year as one doesn’t want illiquidity risk,” said Suyash Choudhary, head of fixed income at IDFC Asset.

Back in 2013, rate increases by the RBI to lure inflows drove the spread between corporate and government debt to a 2009 high. Then, the extra yield on three-year company bonds over government notes more than doubled from the start of the year to an August peak of 237 basis points.

To add to the market’s concerns this year, foreigners have pulled $6.1 billion from local debt, the most among Asian markets tracked by Bloomberg.

“The three-year segment is the most attractive for the simple reason that beyond that there are lot of challenges and uncertainties,” said Mahendra Jajoo, head of fixed income at Mirae Asset in Mumbai. “If things get worse from here, then you’re not panicking because you’ll get back your capital at the end of three years.” – Bloomberg