New Delhi: Is the Modi government prioritising political gain over much-needed economic prudence with an eye on crucial assembly elections coming up in Gujarat and Himachal Pradesh this year and more lined up the next?

The answer seems to be yes, going by several critical decisions announced over the last one week: the Reserve Bank of India’s announcement of a 50 basis points (bps) hike in the repo rate, the Union government’s extension of the Pradhan Mantri Garib Kalyan Anna Yojana (PM-GKAY) free food programme for another three months, and the Ministry of Finance’s decision to defer the imposition of a tax on unblended fuel.

All these decisions, economists say, have the potential to pay significant political dividends, but they could also have commensurate economic costs.

Also Read: RBI raises repo rate by 50 basis points to 5.90%, warns of broadening price pressures

Ineffective repo rate cuts

While the decision on the repo rate (the rate at which the central bank lends money to commercial banks) is taken by the Monetary Policy Committee (MPC) of the RBI, this is usually done after extensive consultations with the Ministry of Finance. Additionally, three members of the MPC are appointed by the government.

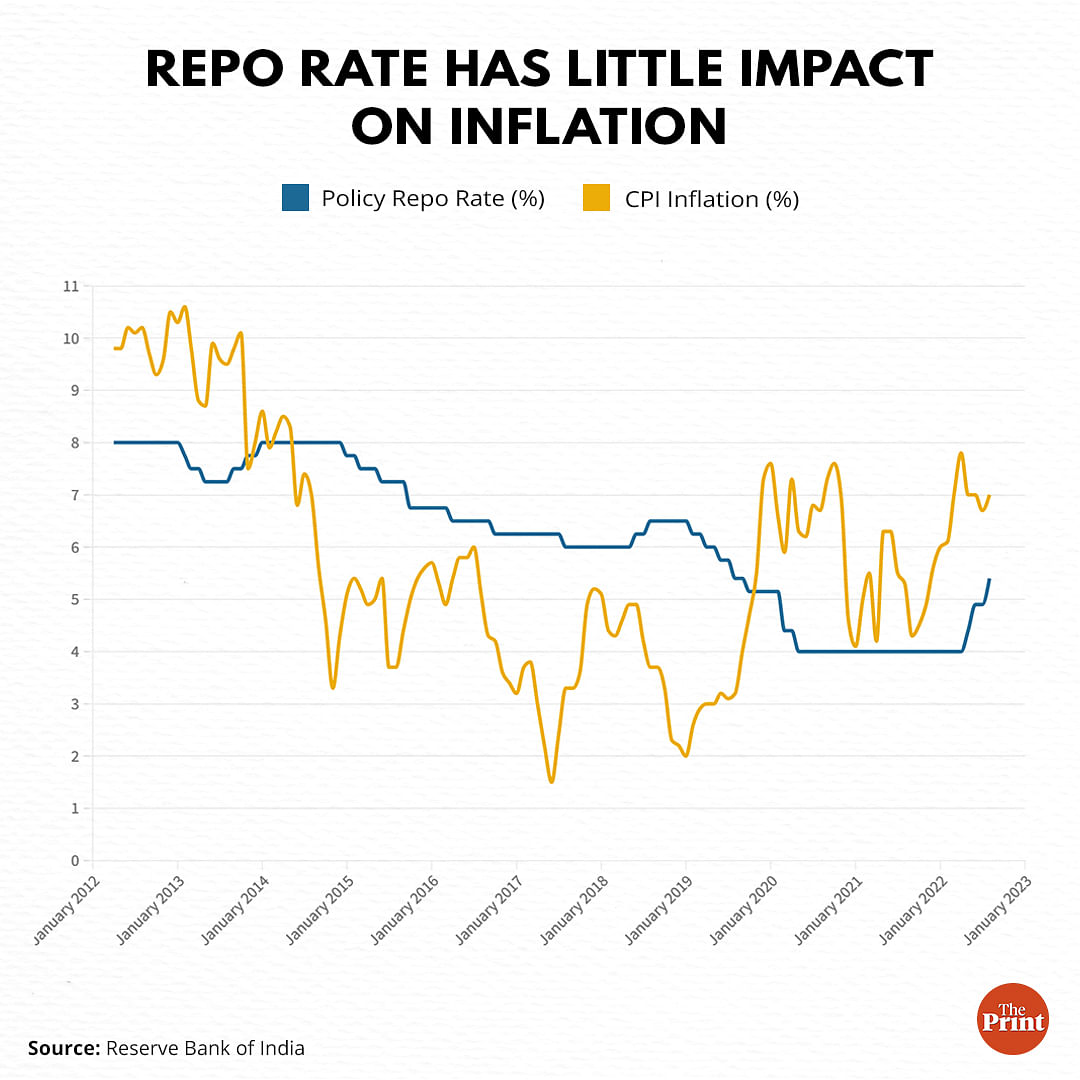

An analysis of the repo rate and retail inflation over the last decade has shown that there is barely any correlation between the two. That is, it doesn’t necessarily mean that an interest rate hike will be followed by a fall in inflation, or that an interest rate cut would spur higher inflation.

The reason for this is largely structural, according to experts.

“There is going to be a disconnect between the repo rate and the Consumer Price Index (CPI),” Madan Sabnavis, chief economist at Bank of Baroda, told ThePrint.

“This is because of various factors. One is that for the repo rate to be effective, it needs to be transmitted properly. That is, the banks must alter their lending rates by the same amount and quickly,” he explained.

The other factor Sabnavis pointed towards is that most consumption in India, and most of the items measured in the CPI, are consumed without any borrowing.

“People don’t borrow to buy food, consumer electronics, pay for healthcare, or their rent. So, lending rates have little impact on the purchase of these things and their prices,” he added.

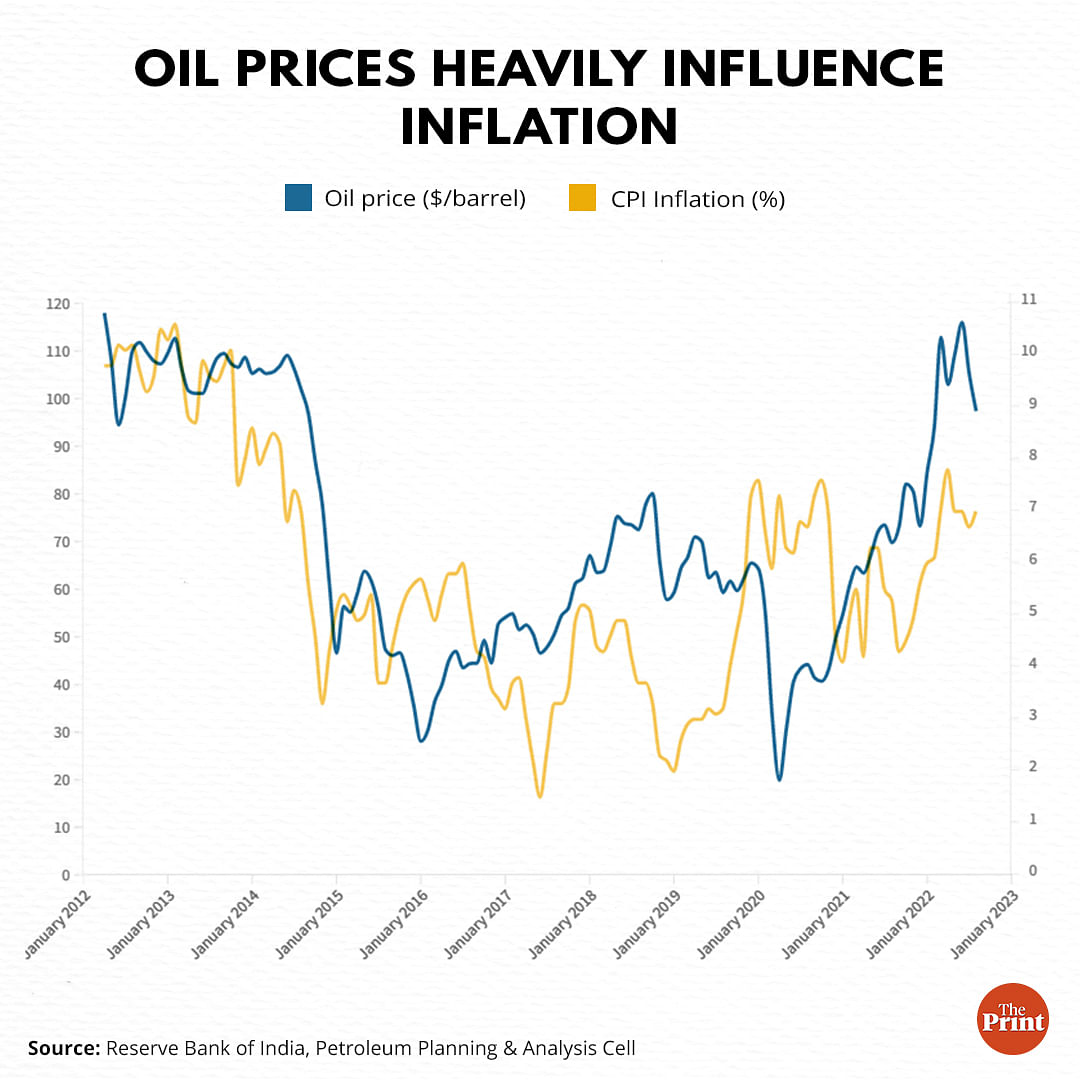

An important factor to be considered is that India’s high inflation is largely imported, as has been stated by Finance Minister Nirmala Sitharaman and other senior officials.

Last year, India imported about 86 per cent of its crude oil requirement, meaning it is hostage to global oil prices, which have shot up ever since the war in Ukraine began.

Data from the RBI and the Petroleum Planning and Analysis Cell (PPAC) of the Ministry of Petroleum and Natural Gas shows that there has been a strong correlation over the last decade between crude oil prices and retail inflation in India.

However, there is always a danger that higher interest rates will slow India’s economic recovery, which needs all the support it can get given the global headwinds due to the war in Ukraine and faltering global growth.

“As far as growth is concerned, investment demand is part of the aggregate demand story,” Pronab Sen, former principal economic advisor to the Planning Commission and former chief statistician of India told ThePrint.

“So, if some part of investment demand is squeezed out (due to higher rates), then demand will go down, which means there will be a downward pressure on growth. But that is what you need to bring inflation down,” he explained.

But there are political advantages to being seen doing something about an issue like inflation. This is all the more important right before a critical election — such as the one coming up in Gujarat.

Also Read: Why volatile food prices will keep the heat on India’s consumer inflation level this year

Disincentivising work?

The other decision that shows the government might be thinking more about electoral gain than about its finances is the extension of the PM-GKAY free food programme for another three months.

The scheme, introduced in March 2020, was supposed to run for the period between April and June 2020. Extended several times since then, the scheme provides 5 kg of foodgrains per person per month free of cost for all the beneficiaries covered under the National Food Security Act (NFSA).

This works out to about 80 crore people receiving 5 kg of foodgrains every month since April 2020.

The scheme, which was expected to have an expenditure of Rs 3.45 lakh crore — already a significant sum — before the extension announced this month, now has a revised expenditure expectation of Rs 3.91 lakh crore.

While this free food, provided over and above the NFSA entitlement, was of utmost importance in the first year and a half of the pandemic, the extensions do not reconcile with the government’s claims of a robust economic recovery, an increase in employment, and increased economic activity in rural India.

There is anecdotal evidence from Europe and the US that significant welfare schemes were allowing people to stay out of the workforce for longer than normally possible. What is worrying is that some of this anecdotal evidence has started coming from rural India as well.

“There is always a moral dilemma when it comes to giving subsidies or items for free,” Sabnavis said.

“The danger always is that it could disincentivise the behaviour that is preferable. For example, loan waivers could disincentivise good borrower behaviour in terms of paying back on time. The free food could similarly be disincentivising low wage workers from doing menial work,” he explained.

Sabnavis, however, is of the opinion that if the government can provide incentives to industry through production-linked incentive schemes, then it can also provide subsidies to the people who need them.

Optics over economics?

The Ministry of Finance on 30 September announced that it would be deferring the implementation of a tax on unblended fuel (which is not mixed with ethanol and is considered ‘dirtier’) — a levy that had been announced in the Union Budget 2022-23 presented on 1 February 2022.

“Blending of fuel is a priority of this government,” Finance Minister Nirmala Sitharaman had said during her Budget speech. “To encourage the efforts for blending of fuel, unblended fuel shall attract an additional differential excise duty of Rs 2/litre from the first day of October 2022.”

However, the 30 September notification says that the deadline for the tax has been extended to 1 November 2022 for unblended petrol and to 1 April 2023 for unblended diesel.

“Our desire is not to collect this tax, because the tax will be very minimal, but the desire is that the blending happens… to that extent it benefits the country,” Revenue Secretary Tarun Bajaj had said during the press conference following the Budget announcement.

If revenues will be low, it stands to reason that the impact on the public will also be low. However, the optics of deferring a tax hike is significant.

If India wants to reduce its dependence on oil imports, blending of fuel with ethanol is a must. A tax on unblended fuel is an effective way to incentivise this blending. Deferring the tax, largely for optics, will only delay the achievement of India’s economic imperatives.

(Edited by Theres Sudeep)

Also Read: Gujarat garba season meets elections. BJP, AAP release political songs