Rising oil prices and fears of greater fiscal spending before next year’s election are making local investors wary.

While foreigners are returning to India’s bond market amid optimism it may have turned a corner, local investors still see yields rising.

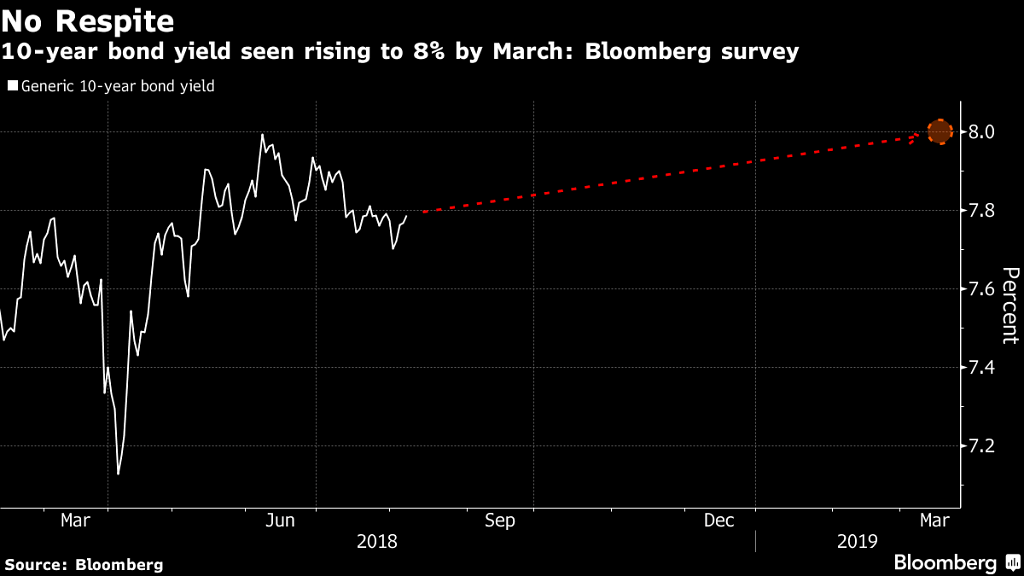

The 10-year sovereign yield, currently at 7.76 per cent, will climb to 7.90 per cent by year-end, according to the median estimate of 15 local traders and strategists surveyed by Bloomberg. It will rise to 8 per cent by end-March, which would match the three-year high reached in June, they forecast.

Rising oil prices, fears of fiscal slippage before next year’s election and higher U.S. interest rates have driven a yearlong sell-off in Indian bonds. A seven-basis point decline in the 10 year yield on Aug. 1 when the central bank kept its neutral stance has proved transitory, with the drop since being erased.

“The outlook on bonds still remains cautious, otherwise we wouldn’t have seen bonds giving away recent gains,” said Vijay Sharma, the New-Delhi based executive vice president for fixed-income at PNB Gilts Ltd., one of the primary dealers that deals with the Reserve Bank of India. “As of now, I don’t see any chance of a big rally.”

The negativity comes after foreign lenders including Standard Chartered Plc and Nomura Holdings Inc. said they were adding to holdings of Indian debt on optimism the worst of the sell-off was over. Overseas investors have bought a net $496 million of rupee debt this month through Aug. 7 after inflows of $105 million in July. Year-to-date outflows are still $5.5 billion.

The locals polled in the survey said headwinds remain, most notably from the price of oil — the nation’s top import — and its impact on public finances. ING Bank NV was the most bearish, predicting the yield will climb as high as 8.30 per cent by year-end.

“Any bad news emanating on the fiscal side will definitely will keep people on their toes, and even though crude prices have come down from the highs, directionally it’s difficult to take a call,” PNB Gilt’s Sharma said.

Sovereign bonds advanced at open on Thursday, with benchmark yields dropping three basis points, after the central bank said late yesterday that it would transfer 500 billion rupees surplus to the government.

Here’s what else traders and strategists had to say:

Harish Agarwal, fixed-income trader, FirstRand Bank Ltd

There’s going to be another rate hike in the coming months, and after that, one can’t say it’s going to be the end of the rate-hike cycle. You also have a huge supply of bonds coming from the central and state governments and that’s going to damp sentiment in the second half.

R. Sivakumar, head of fixed income, Axis Asset Management

The RBI could hike rates further in light of the current fiscal position and concerns over inflation. RBI’s stance is clearly in favor of staggered hikes based on incoming inflation and economic data. Long-duration bonds may face headwinds stemming from the increasing rate scenario.

Arvind Chari, head of fixed income and alternatives, Quantum Asset Management

In an election year, the government will seek to compensate farmers fully, which will lead to an increase in food prices and CPI inflation moving well above the 5% mark. This will drive the repricing of inflation risks and we will see markedly higher yields. –Bloomberg