New Delhi: The Narendra Modi-led government appears to be facing a problem of plenty when it comes to the Goods and Services Tax (GST). GST collections have been so robust over the past year or so that it has prompted the Ministry of Finance to discontinue issuing monthly press releases of the data.

The reason? The high collections were breeding resentment among the public, who felt the government was collecting too much tax.

Therefore, the Ministry of Finance decided to do away with the official press release — which also contains the state-wise breakup of GST collections — and instead only disclose the gross figures, two senior officials in the ministry told ThePrint.

This July, for the first time since the rollout of GST in July 2017 — excluding the first few lockdown-affected months in 2020 — the Ministry of Finance did not issue an official press release regarding the collections and breakup of revenue under GST.

The releases are usually issued on the first day of each month, and the latest one — reporting collections during the month of June 2024 — should have been issued Monday.

ThePrint has reached the Ministry of Finance for comment over email. This report will be updated if and when a response is received.

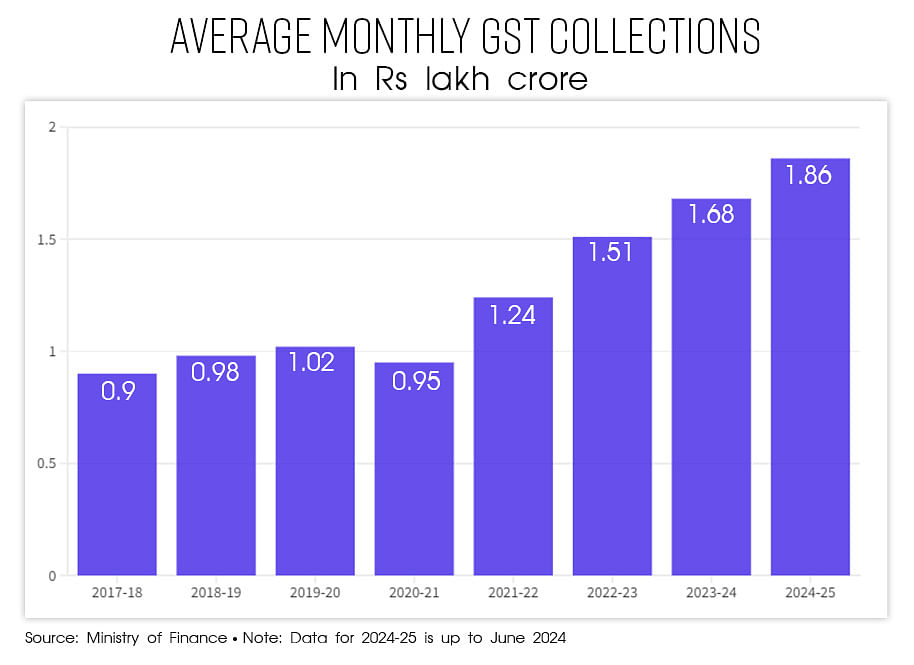

One of the officials said the collections for June 2024 stood at Rs 1.74 lakh crore, which is 7.7 percent higher than was collected in June last year. Average collections so far (April-June 2024) in this financial year stood at Rs 1.86 lakh crore, which is the highest so far since GST was introduced.

Neither official from the ministry wished to be named as they are not allowed to officially speak to the media in the pre-budget period.

Also read: Not enough time left, same fiscal constraints — why July budget maths will be similar to February’s

Embarrassment of riches

One of the officials said that the robust GST collections were creating a perception problem for the government in the minds of the public.

“GST collections have been very buoyant, and people are seeing the high absolute figures. This is creating resentment that the government is ‘sucking the people dry’ or that it is collecting too much tax,” he explained.

“They don’t see the realities of the situation about expenditure by the Centre or that the GST collections have to be shared with the state governments,” he added. “Not just the state GST, which is anyway theirs, but also a significant portion of the central GST, which has to be shared under the Finance Commission rules.”

The difference between GST and income tax, he explained, is that not everybody pays income tax, while nearly everyone pays GST, since it is a consumption-based tax. The monthly income tax collection releases are set to continue.

The other official said that the government would still disclose the gross GST collection figure every month, but it would no longer be in the form of a press release since releases “get taken up and receive wider publicity”.

“The point is not that we are hiding the data,” he said. “It is that we are not going to be drum-beating about it.”

Finance Minister Nirmala Sitharaman has been at the receiving end of a lot of social media criticism — from supporters and critics alike — over the perceived high rates of GST.

Also read: Why Nirmala Sitharaman 2.0 is good for finance ministry, govt & even the economy

Missing the point

Economists and indirect tax experts, however, note that this episode has revealed that everybody involved — the public as well as the government — has either missed the point behind GST collections rising or has miscalculated the impact of the move to discontinue the monthly releases.

“The growth in the gross GST collections can be attributed to the widening of the tax base and the increased compliance,” Pratik Jain, partner, PwC India told ThePrint. “The effective tax rate under GST has in fact reduced from what we had earlier, the effective rate being lower than the revenue-neutral rate we were aspiring for.”

“So, the increase in collections is not because the tax incidence has increased,” he added.

However, while the public is missing the point by mistakenly attributing the growth in GST collections to an increased tax burden, the government might have miscalculated the impact of discontinuing the monthly press releases, according to other economists.

“If they are still going to be releasing the gross figure, then that will still be reported, and will affect the people as the government fears,” a noted economist said, declining to be named as she did not want to comment on an unofficial government policy.

“But, on the other hand, GST data and its breakup is an important indicator of consumption patterns and so, doing away with the breakup is a blow to the analysis of the economy on a rolling basis,” she added. “It also reinforces the perception that this government does not like to share data.”

(Edited by Radifah Kabir)

Also read: PM’s economic advisor asks if India needs a new poverty line, says multidimensional index not enough

If GST collections rise. Then cut petrol taxes. That’s only reasonable.