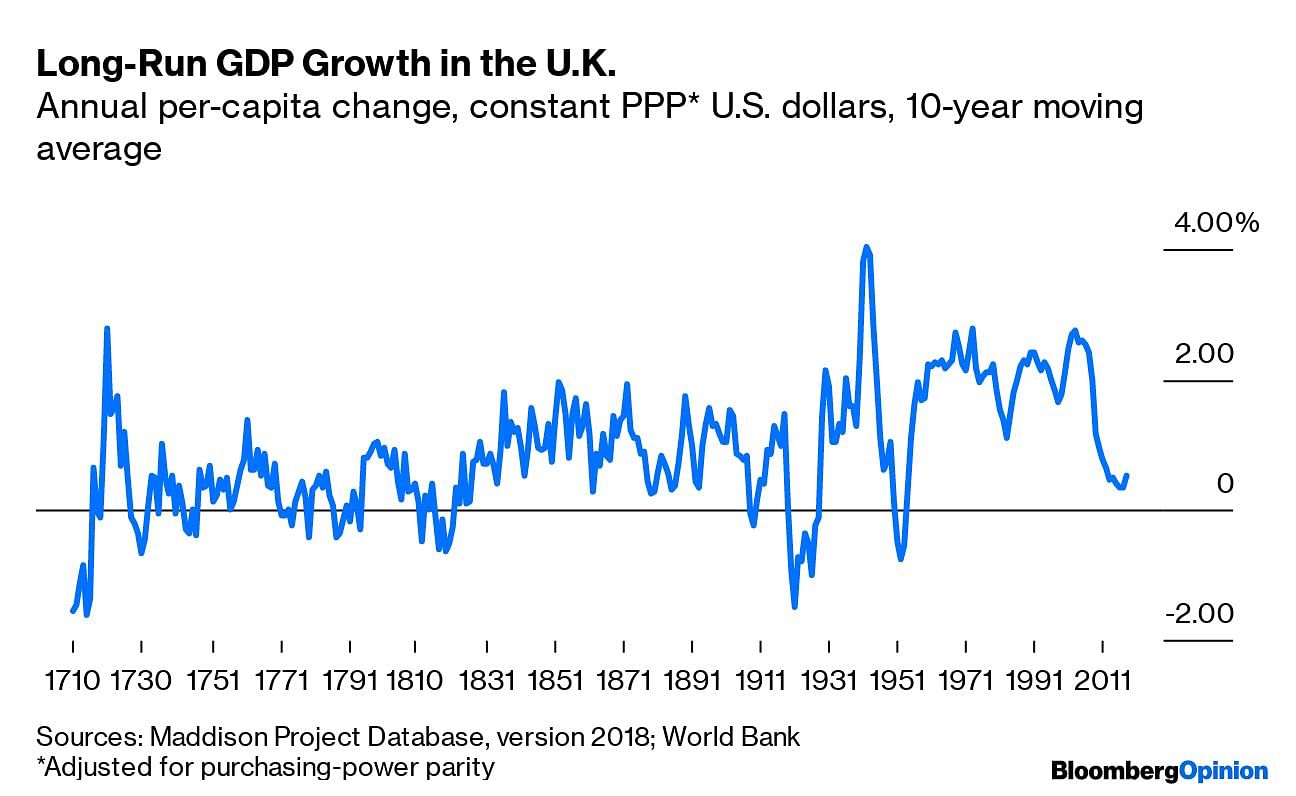

Growth is sputtering all over the world. Germany and the U.K. have both reported that their economies shrank in the second quarter, and signs of a slowdown are apparent in lots of other places. But as central bankers gather in Jackson Hole, Wyoming, and government leaders in Biarritz, France, to discuss what to do, it seems worth pointing out how slow growth already was in most rich countries even before the recent bad news. Historically slow, in the case of the U.K.:

These statistics (most of them, at least) are from the Maddison Project at the University of Groningen in the Netherlands, which maintains the database of long-run per-capita gross domestic product estimates originally compiled by the late economist Angus Maddison and updated in 2018 by Jutta Bolt, Robert Inklaar, Herman de Jong, and Jan Luiten van Zanden. I had been looking through it because I was curious when exactly economic growth had accelerated in Britain during the Industrial Revolution, and I calculated ten-year moving averages (using the compound-annual-growth-rate formula) to cut through the year-to-year noise.

As soon as I’d made the chart, the deceleration since about 2006 caught my eye. The Maddison Project numbers end in 2016, so I added in World Bank data for 2017 and 2018. Those improved the picture a teeny bit, but still show the U.K. going through the worst slowdown since the demobilization after World War II. That slowdown was followed by a rapid return to high growth rates. The 1920s depression in the U.K. was much worse, and lasted for a while. But again it was eventually followed by per-capita real growth of more than 2% a year, which sure doesn’t seem to be in the cards for the near future.

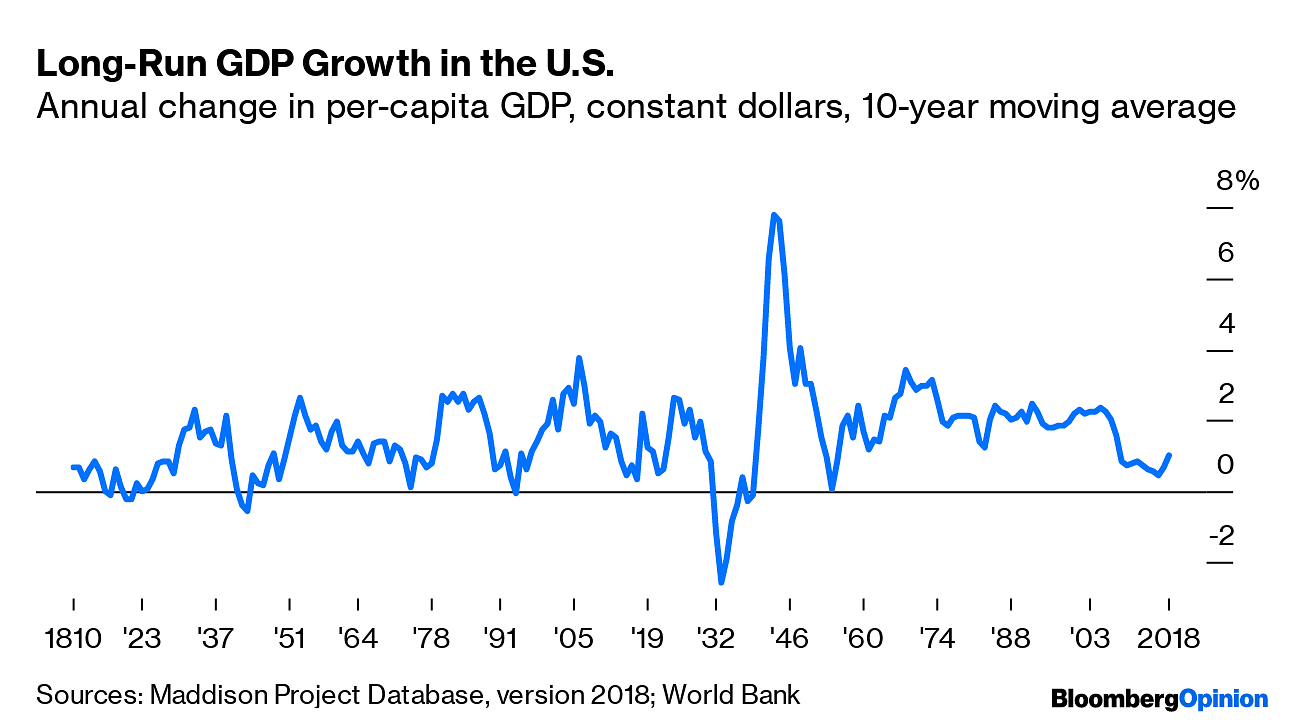

How about in the U.S.?

The spectacular GDP increases of the World War II years give the chart a different scale, and the recent numbers are a little more encouraging, but the same basic story repeats. After decades of strong growth in real per-capita GDP, the post-global-financial-crisis period has been anomalously bad.

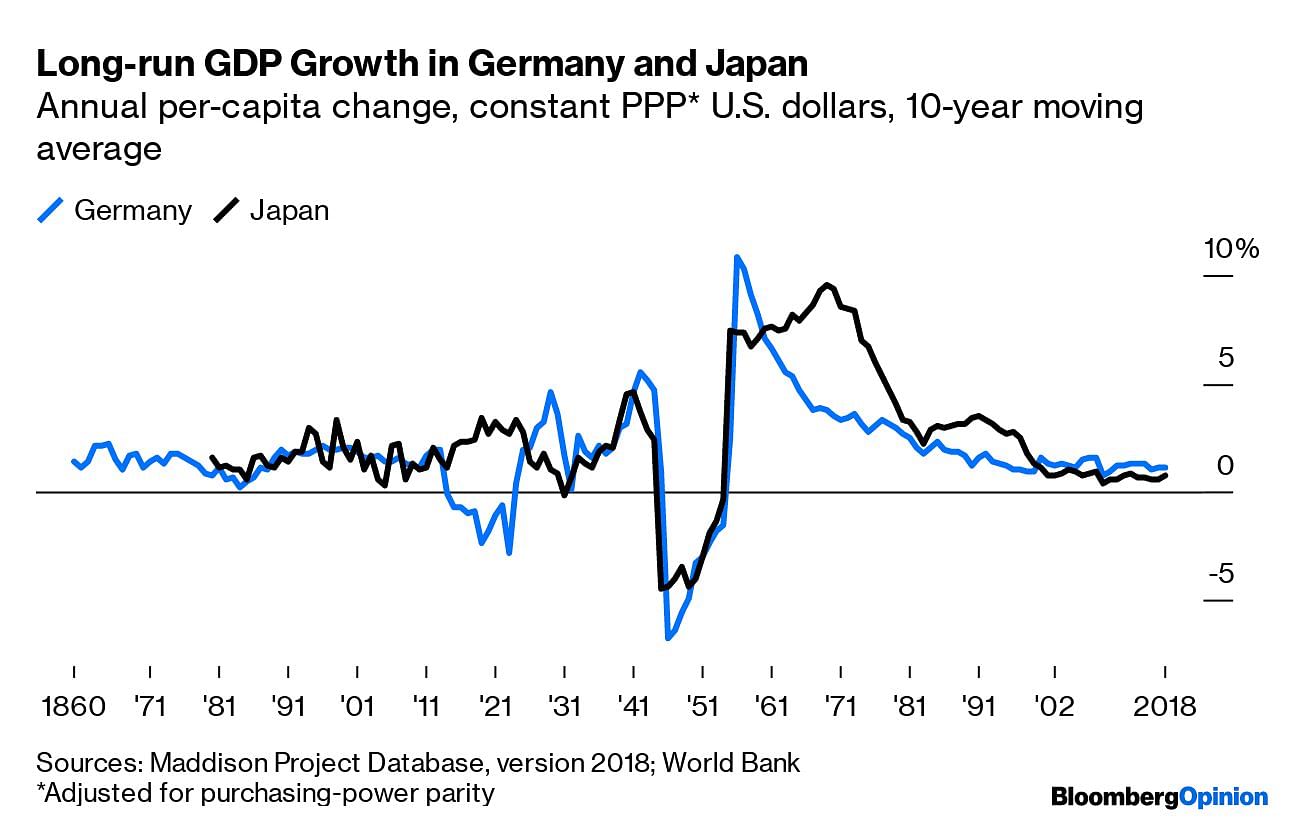

With Germany and Japan, which I put together because I figured they might display some similar patterns (they did not disappoint), the picture is more of a long deceleration after the spectacular growth of the postwar decades, although Germany did bounce back in the 2000s from a post-reunification growth slump.

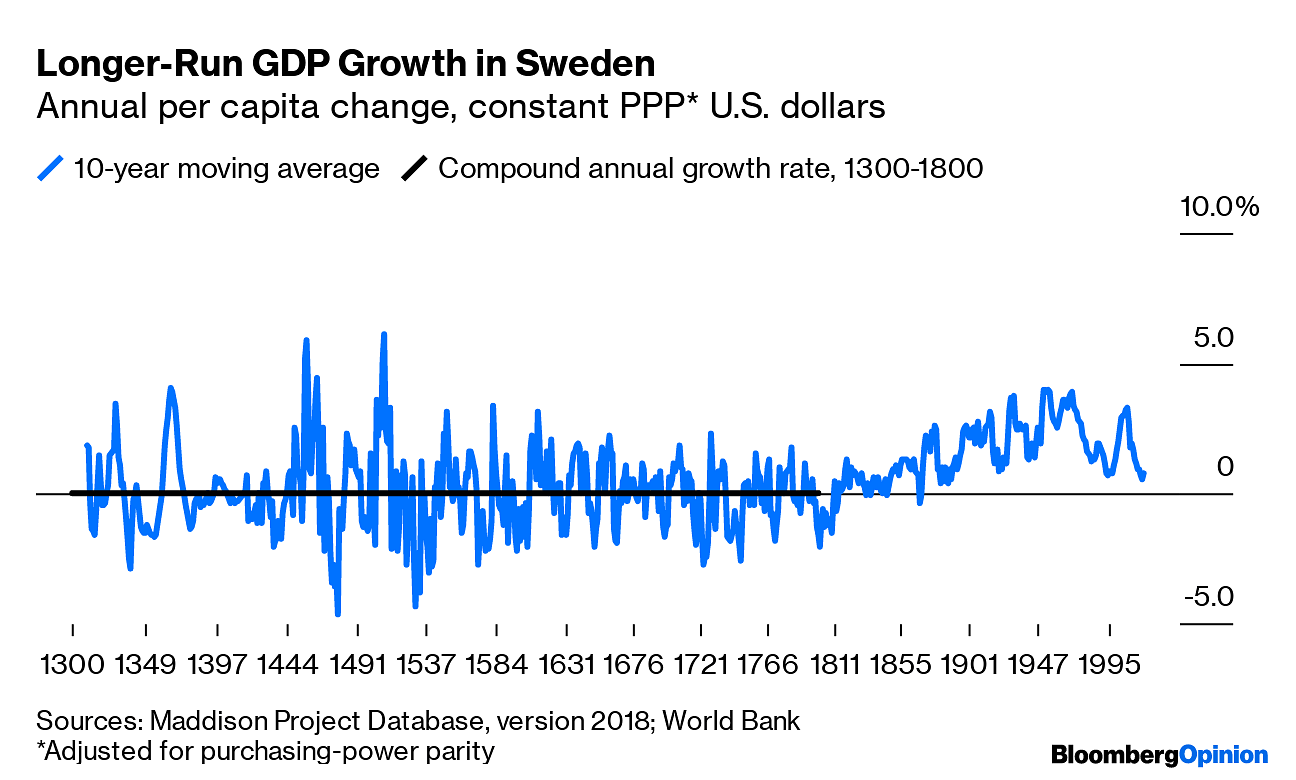

The Maddison Project has per-capita GDP estimates for 14 countries for the year 1 A.D. (Italy was the richest, followed by Greece and Egypt), a smattering of other estimates over the next 13 centuries and lot of really old numbers for the England and Holland, which are now both part of larger nations (the U.K. and the Netherlands). But the only entire countries for which there are annual estimates going back to the Middle Ages are France and Sweden. Here’s Sweden:

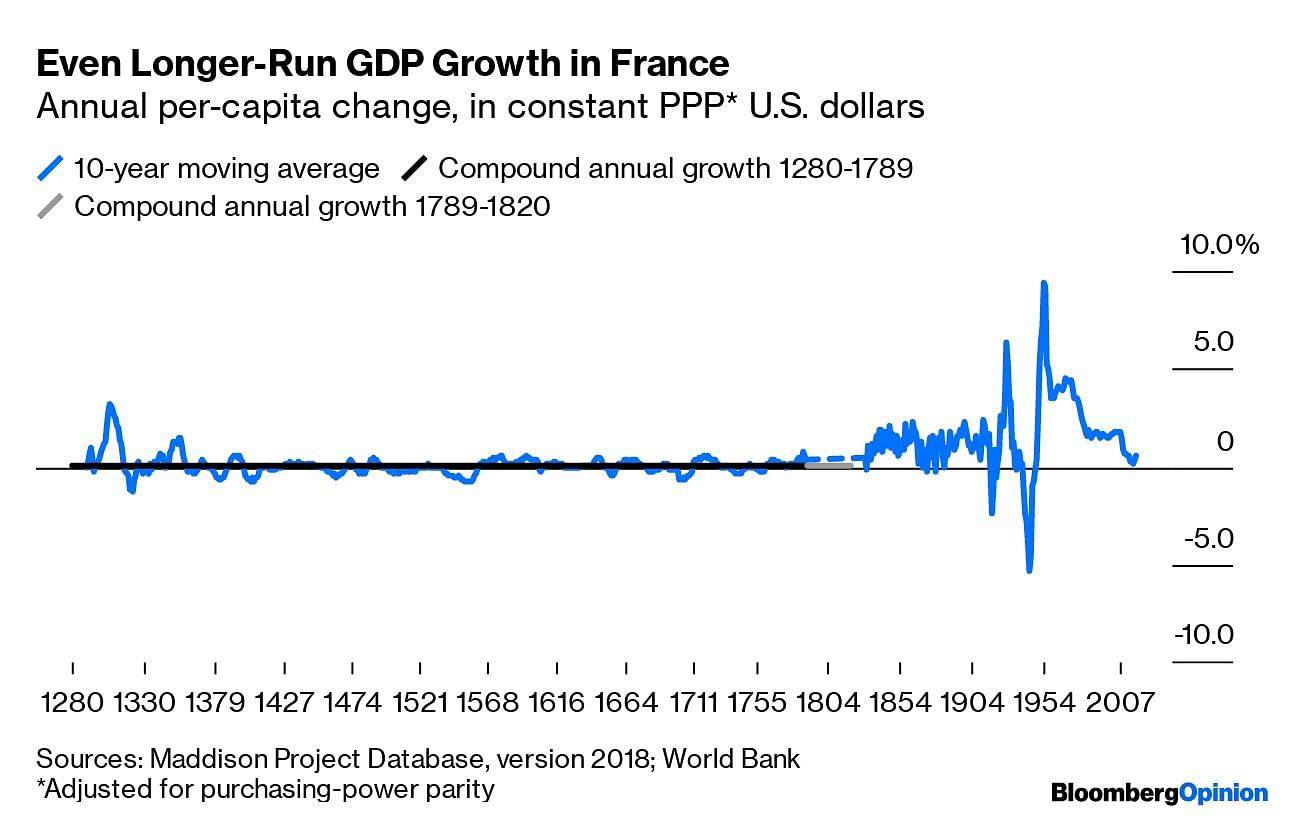

The pre-1800 numbers are pretty noisy, which is why I decided to calculate the annual growth rate from 1300 to 1800; at 0.04% a year, it really wasn’t much. I did something similar for France, where there are no estimates for the three decades following the Revolution of 1789 but there are numbers going back all the way to 1280.

What’s most striking here is how close Sweden’s and especially France’s current per-capita growth numbers now are to those that prevailed before 1800. This is partly just because the 2008 global financial crisis and the recession that followed were especially awful and the 10-year rolling window I’ve chosen for my charts is going to keep reflecting that awfulness for a couple more years, and partly because the percentages involved are so tiny that they look more similar than they really are — France’s dismal 2006-2016 average annual growth rate of 0.2% was still more than three times higher than the annual rate from 1280 to 1789. We aren’t really back in the Middle Ages. But per-capita GDP growth in wealthy countries does seem to have slowed to a much slower pace than in the 20th century, and possibly at any time since the dawn of the Industrial Revolution. Add to this the fact that population isn’t growing much in these countries, and in some cases is actually shrinking, and you have at least part of the explanation for why interest rates are so low and politics so weird these days. The growth that we’ve gotten used to over the past two centuries or so just hasn’t been there lately.

Now it’s worth pointing out that some economists worried in the 1930s and again after World War II that the age of rapid growth might be coming to an end. “We are passing, so to speak, over a divide which separates the great era of growth and expansion of the nineteenth century from an era which no man, unwilling to embark on pure conjecture, can as yet characterize with clarity or precision,” Harvard’s Alvin H. Hansen said in his presidential address to the American Economic Association in 1938. It might turn out to be an era, he went on, of “secular stagnation — sick recoveries which die in their infancy and depressions which feed on themselves.”

Turns out it was instead an era of even-more-rapid growth and expansion. But maybe that was just a lucky break (or inadvertently smart fiscal policy). Harvard economist and former Treasury Secretary Lawrence Summers — this era’s leading worrier about secular stagnation — tweeted as part of a long thread this morning about slowing growth and what central banks and governments can do about it:

Many believe that events proved Alvin Hansen wrong about secular stagnation. On the contrary, the fact that it took WW2 to lift the world out of depression proves his point. Absent the military buildup, a liquidity trap deflation scenario would likely have persisted. 9/

— Lawrence H. Summers (@LHSummers) August 22, 2019

There are other ways of looking at the growth slowdown: University of Houston economist Dietrich Vollrath has a book coming out in January called “Fully Grown: Why a Stagnant Economy Is a Sign of Success,” in which he argues that with their material needs more than satisfied, many people in rich countries are simply shifting their focus to activities that don’t generate as much growth in productivity or GDP. Could be! But it would still mean that we have entered a new era that none of us are really prepared to navigate. – Bloomberg

Also read: Sluggish animal spirits of economy reflect how badly India is struggling with slowdown