New Delhi: One of the reasons demonetisation was implemented was to convert India’s economy into a “less cash” one, according to Prime Minister Narendra Modi. However, what the note ban could not do in this regard, is instead being achieved by the COVID-19 pandemic.

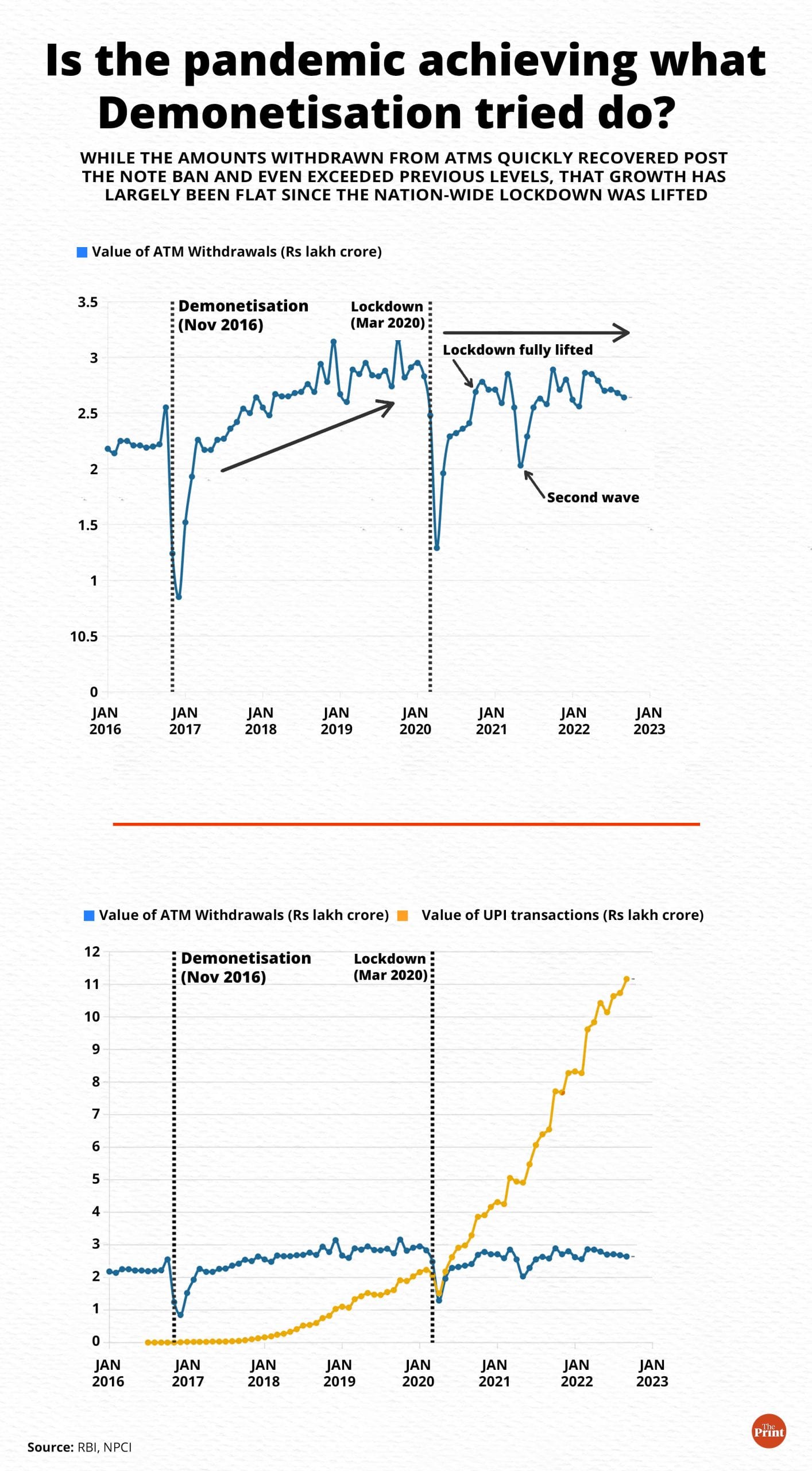

The fear of the virus and the resultant behavioural changes have meant that the amount of money being withdrawn from ATMs has remained largely the same, about Rs 2.6 lakh crore, for about two years since the nation-wide lockdown was comprehensively lifted in October 2020.

Contrast this with what happened after demonetisation, where ATM withdrawals recovered quickly and reached pre-note ban levels within a year, and then exceeded them over the subsequent 2.5 years until the lockdown.

Simultaneously, transactions on the Unified Payments Interface (UPI) also grew strongly between demonetisation and the lockdown, but it was only during the COVID-19 period that UPI payments really took off, dwarfing the growth of the past.

In other words, while demonetisation and subsequent policy decisions attempted to reduce cash usage and increase the adoption of digital transactions, the real shift only took place once the pandemic hit.

“Both these trends have indeed been happening, where ATM withdrawals have been coming down and UPI payments have been growing strongly,” Madan Sabnavis, Chief Economist of Bank of Baroda told ThePrint. “It can be said that the pandemic has given a strong push to what the government was trying with demonetisation and beyond.”

“The last few years have seen a marked change in behaviour as people have become increasingly comfortable with using digital means of making payments,” economist Rishi Shah said. “The success of the overall initiative can be seen as multiple payment apps have cropped up and there is widespread acceptability across vendors irrespective of their size.”

The impact of the pandemic in providing a fillip to digital transactions has been highlighted by the State Bank of India as well, with the bank’s research team releasing a report Thursday on the changing dynamics of cash in circulation and of digital banking.

“The innovations in technology have changed the Indian payment system,” the report said.

It noted that over the years, the Indian cash-led economy has changed to a smartphone-led payment economy.

“The COVID-19 pandemic has caused disruption to embrace contactless digital transactions, especially for day-to-day transactions, as people tried to protect themselves from the virus. With the increased acceptance of digital payments in the country, the over reliance on cash is slowly fading away,” it said.

Also Read: After World Bank, UNDP says 41.5 cr Indians were lifted from poverty. But it was all before Covid

What is currency in circulation?

There is, however, a difference between the amounts being withdrawn from ATMs and the currency in circulation. Currency in circulation refers to all the cash that has been printed by the RBI minus what it has revoked, so this also includes the cash in banks.

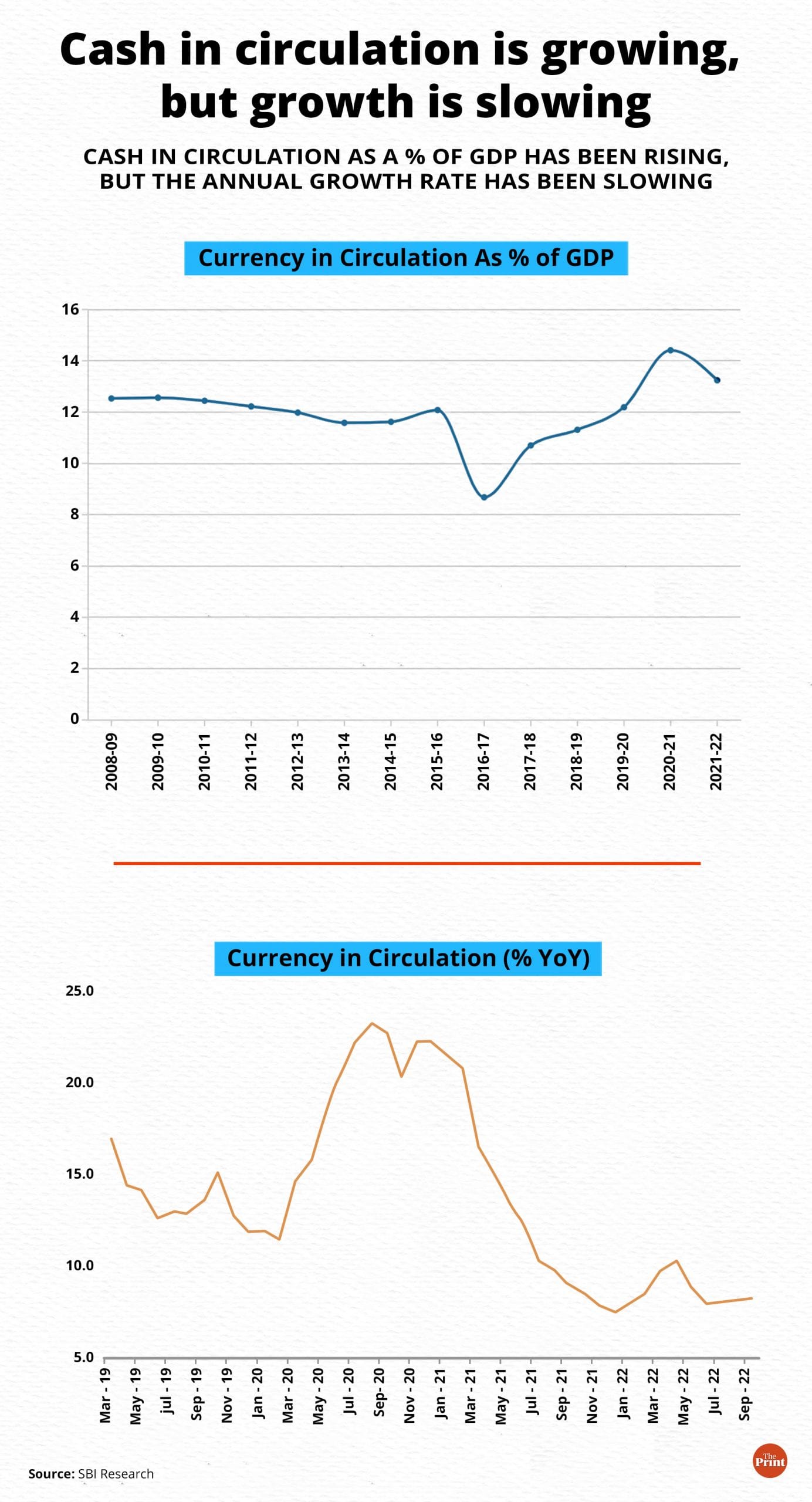

Currency in circulation, as a percentage of GDP, has been increasing over the past five years. Although the latest data, for 2021-22, shows a dip, the levels that year are still the second-highest in 14 years.

The currency in circulation aspect is something the SBI researchers also looked at in their report. However, they note that though currency in circulation as a percentage of GDP has been increasing, the growth rate on an annual basis is much slower now than before.

“As digital transactions through UPI and e-wallet have been increasing, the demand for cash is declining,” the report noted. “If we look at the data on CIC [currency in circulation], though it is increasing with the rise in the economy, the trend is declining… In particular, there has been a substitution from currency and much of it has gravitated towards digital mode of payments.”

There is, however, a chance that the plateauing of ATM cash withdrawals and the simultaneous rise of UPI payments could point towards a slightly different behavioural shift, Sabnavis pointed out.

It could be that people are taking out large amounts of cash as a precautionary measure in light of the pandemic, but are conducting smaller transactions on UPI.

“It is important to note that cash in circulation has been increasing while the amount withdrawn from ATMS has not seen a significant change,” he said. “It could be that people are withdrawing cash straight from the banks since they are taking out larger amounts than what ATMs will allow. It is a more accurate statement to say that the pandemic has very strongly encouraged a behavioural change — especially among the younger population — away from ATMs and towards UPI.”

Also Read: UPI powers India’s digital transactions. RBI’s eRupee is compelling but must argue retail use

Government push for UPI

That said, it is also important to acknowledge that steps by the government to enable digital transactions and create platforms such as UPI provided the foundation for the behavioural shift towards digital payments that the pandemic encouraged. The SBI report also makes note of this.

“The success of the digital journey is primarily due to the relentless push by the Government to formalise and digitalise the economy,” the report said. “Further, interoperable payments systems like UPI, wallets & PPIs have made simple and cheap ways to transfer money digitally, even for those who don’t have bank accounts. Over the years, the system has expanded rapidly with new innovations like QR code, NFC, etc, and has also seen the swift entry of big tech firms in this industry.”

“The pandemic, in fact, helped catalyse the change in behaviour, which was in no small way supported by the safe and secure payments infrastructure built by the government,” Shah added.

(Edited by Theres Sudeep)