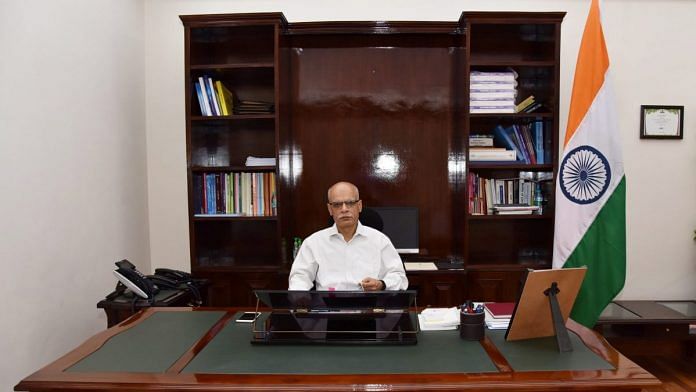

New Delhi: It is not illegal to trade in crypto assets as India has not stopped crypto exchanges from functioning, revenue secretary Tarun Bajaj said.

“I would stick my neck out and say it is not illegal as so many exchanges are running before our eyes. Otherwise, our agencies would have reached their premises by now,” he told ThePrint in an interview.

He further said that while the new tax regime with regards to virtual digital assets will be implemented from 1 April 2022, the government can tax these assets even today.

“The regime is applicable from 1 April but that does not mean that there are no taxes on these assets. It’s taxable even today. It is not that it is a tax-free item. But then you will come to me with your return, and I am the assessing officer. We will decide whether you have done it right or not,” Bajaj said.

In her Union Budget 2022 speech, Finance Minister Nirmala Sitharaman proposed to levy a 30 per cent capital gains tax on income from transfer of virtual digital assets, along with a surcharge. She also announced a tax deductible at source (TDS) of 1 per cent on the value of these transactions.

Even though the threshold over which TDS will be applicable wasn’t specified, the finance minister clarified that even a gift of virtual digital assets will be taxed at the recipient’s end.

Sitharaman’s announcement came a day after Principal Economic Adviser Sanjeev Sanyal said that the government would take a balanced view on digital currencies.

Also read: How Modi govt has given legal sanction to cryptocurrencies in India, through the backdoor

Retrospective tax matter to be closed within a month

Bajaj said the government will be able to pay a refund on taxes collected from Cairn Plc on account of retrospective taxation in a matter of days. Along with this, all other cases under such tax applicability will be closed within a month, he said.

“All other formalities are complete. What is left is the refund to Cairn which will happen in days. There are many others that have been closed but since the money did not have to go in, they didn’t create any noise… We should close this matter within the next 15-30 days.”

Last year, Parliament passed a bill to withdraw the retrospective nature of the indirect transfer of assets in the Income Tax Act. This retrospective amendment was introduced after the Supreme Court’s verdict in the case of Vodafone in 2011.

Because of this, all the companies that had made gains from indirect transfer of assets before 28 May 2012, came into the tax net.

Bajaj said the government, going forward, will start getting more revenue from direct taxes, that include income and corporate tax, from the current financial year than indirect taxes. He was replying to a question on the inequality the system creates when indirect taxes are more than direct taxes as the former are regressive in nature and affect the poor.

In 2021-22, the government has pegged the gross revenues from indirect tax — Goods and Services Tax, Excise and Customs duty — at Rs 12.58 lakh crore, marginally higher than direct taxes at Rs 12.5 lakh crore.

Discussion on GST slab rationalisation in March

Setting the stage for an overhaul of the multiple tax rates under the GST regime, the GST Council may consider slab rationalisation with the indirect tax regime in March.

Speaking in this, Bajaj said: “Whether these slabs should be two slabs or three slabs, whether the commodity should be 5, 12 or 18, is something that the Bommai committee is looking into. We will await their recommendations and after that the GST Council will take it up. So we will discuss it in the month of March.”

The government in September had tasked a group of ministers led by Karnataka Chief Minister Basavaraj S. Bommai with proposing a rationalisation of tax rates and considering the merger of different tax slabs within two months.

Currently, the GST regime has five broad tax rate slabs of zero, 5 per cent, 12 per cent, 18 per cent and 28 per cent, with a cess levied over and above 28 per cent on some goods, and special rates for items like precious stones and diamonds.

Also read: FM Sitharaman has made a prudent choice in pushing capex instead of demand stimulus