New Delhi: Chew on this, the entire electric vehicle (EV) industry in India sold 58,000 passenger vehicles in the first nine months of 2023, while in China, a single Chinese EV maker sold more than five times that number in one-third of the time.

China has at least 100 companies exclusively making and selling EVs, while India, which is in a nascent stage, has about a dozen big brands making electric passenger vehicles right now.

With demand within China stagnating, carmakers are increasingly looking to export.

However, with big export destinations, like Europe, now looking to clamp down on cheap Chinese vehicle imports, and India’s own EV market in a nascent stage, Chinese EV makers might start eyeing India as an attractive investment destination.

Currently, Russia, Mexico and Belgium are top destinations for Chinese car exports.

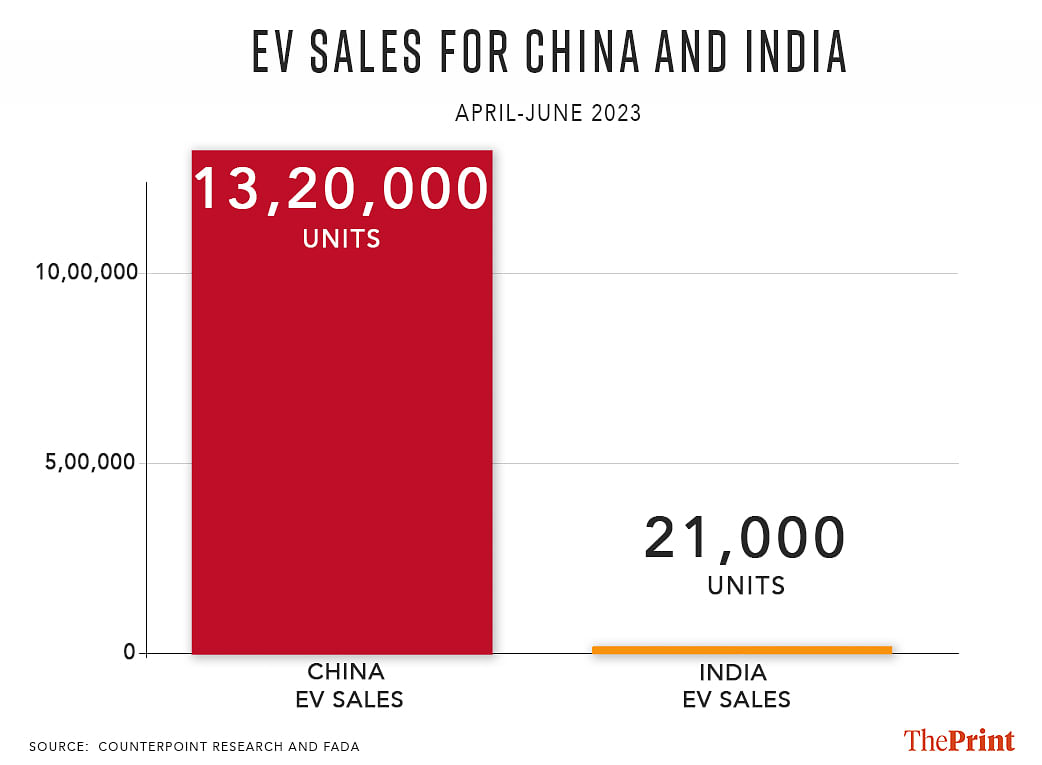

According to data from the Federation Of Automobile Dealers Associations (FADA) and Counterpoint Research (a research firm) that was analysed by ThePrint, India sold 58,000 electric passenger vehicles domestically from January to September.

In contrast, BYD — the biggest electric vehicle manufacturer in China with a 24 percent market share — alone sold over 3,00,000 passenger vehicles in China’s domestic market in just three months i.e. from April to June this year.

According to data from Counterpoint Research, China has dominated the global electric vehicle market — accounting for 56 percent of global unit sales — driven by a significant government push, including subsidies.

However, its market is now seeing slower growth, expanding 37 percent in Q2 2023, lower than the global average of 50 percent. This is “highlighting a slowdown in domestic growth as the frail Chinese economy impacted demand in the world’s biggest EV market”, the report added.

Given the slower pace of growth in the domestic market, many Chinese Original Equipment Manufacturers (OEMs) are looking to grow outside of China, and gain a foothold in markets like Europe and Asia, the research firm said.

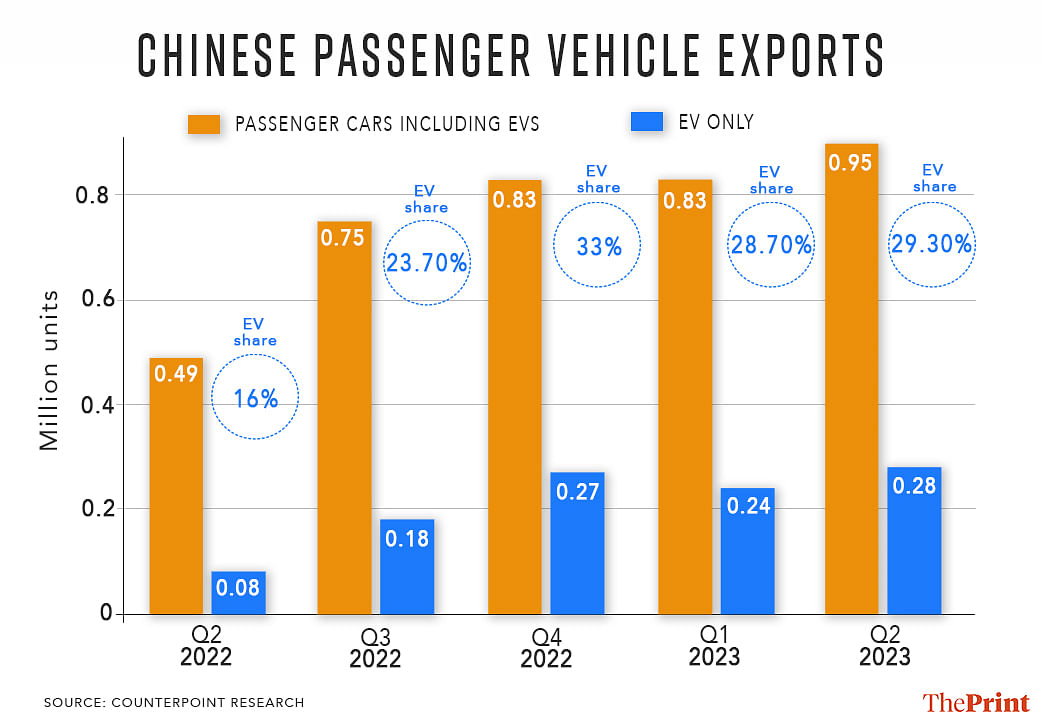

The country’s electric passenger vehicle (PV) exports soared by 250 percent in one year, reaching 2.8 lakh units in the second quarter (Q2) of 2023 from 0.8 lakh units in the same quarter of 2022, it added.

Also Read: Happenstance or manufacturing prowess? How China reached pole position in key businesses of future

China’s export potential

China’s increasing export dependence on the EV market can be seen by the fact that, in Q2 2023, the share of EVs in total PV exports rose to 29.3 percent from 16 percent in Q2 2022.

“The domestic PV market in China is rebounding following the Covid-19 outbreak,” Soumen Mandal, senior research analyst (IoT, Automotive & Devices Ecosystem) at Counterpoint Research told ThePrint.

“However, the landscape is growing competitive due to the emergence of next-generation Battery Electric Vehicles (BEV) entrants like NIO, Xpeng, and Li Auto,” he added.

According to him, in Q2 2023, the passenger vehicle market in China was 60 lakh units, of which 22 percent (13.20 lakh units) were electric passenger vehicles.

Mandal added that, though government initiatives and subsidies have been pivotal in bolstering EV adoption in China, many Chinese EV firms grapple with profitability issues.

“The prospect of the Chinese government rolling back subsidies for the sector is prompting these companies to expand internationally to leverage economies of scale,” he said. “Consequently, these conditions are driving Chinese automakers to boost their exports.”

India in China’s sights

According to FADA data, Tata Motors dominates the electric car market in India, with a whopping 70 percent share of the retail sales of 4,217 electric cars in September.

The next biggest player is MG Motor India, which sold 855 electric cars — a nearly 200 percent (288 units) growth in September compared to the same month last year — and captured about 14 percent of India’s EV retail sales market, the data further showed.

The Chinese company BYD — a relatively new entrant in the Indian EV market — sold 139 electric vehicles in India in the same month, making it one of the top five sellers in the country in September, which also included Mahindra and Mahindra and Hyundai.

From January to September, BYD sold 1,325 electric cars in India, while MG Motor sold 6,344 units, according to the data.

However, most of these electric cars are not imported from China but assembled in India.

According to reports, BYD, which makes everything from semiconductors and batteries to powertrains and motors in-house, currently imports semi-knocked-down kits, or partially stripped-down vehicles, and assembles them in its factory in Chennai.

In fact, BYD is reportedly also facing an investigation over allegations that it paid too little tax on imported parts for cars it assembles and sells in the country.

MG Motors, too, manufactures most of these cars in India at its plant in Gujarat’s Halol. From January to September, MG Motors retail sales of electric vehicles stood at 6,344 units.

Also Read: Mercedes-Benz EQE 500 proves the luxury-EV combo is only getting stronger

What India aims to do

The Indian government has set a goal of increasing the EVs’ share in the country’s vehicles to 30 percent by 2030. To achieve this, it has launched various schemes to encourage the adoption and production of electric vehicles and their components.

One of these schemes is FAME, which stands for Faster Adoption and Manufacturing of Electric Vehicles. FAME offers incentives to consumers who buy electric vehicles, to stimulate the demand. FAME has two phases: FAME I and FAME II.

Another scheme is the Production Linked Incentive (PLI) for the automotive sector, which aims to provide financial incentives to the industry to boost the domestic manufacturing of advanced automotive technology products, including electric vehicles and their components.

A third scheme is PLI for the National Programme on Advanced Chemistry Cell (ACC), which aims to provide incentives for the establishment of giga-scale ACC manufacturing facilities in the country. These ACCs will be used in batteries, and are aimed to promote the widespread adoption of EVs.

Apart from these, BYD’s plan to invest a billion dollars in India to build electric cars is reportedly uncertain due to security concerns. MG Motor, on the other hand, has a fully operational plant in Halol, Gujarat, with a capacity of about 1,20,000 units.

Catching up with market leaders

The increase in electric vehicle exports has also helped China close the gap with the biggest passenger vehicle export market — Japan.

While in Q2 2022, China’s PV exports stood at 4.9 lakh units (of which 0.8 lakh units were EVs), for Japan, the PV exports stood at 7.1 lakh units during this period, Mandal said.

However, in Q2 2023, China’s PV exports touched 9.5 lakh units (of which 2.8 lakh units were EVs) — just a shade behind Japan’s exports of 9.6 lakh units in the quarter, he added.

“Other major automobile manufacturing markets, including Europe, Japan and South Korea are losing to China in the global market because of a lack of EV portfolio,” Mandal told ThePrint.

“These countries are lagging significantly in the EV game compared to China,” Mandal said, adding that China has around 100 vehicle makers manufacturing and selling only EVs.

For two-wheelers this number is even bigger, Mandal noted. “The sales of electric two-wheelers in the domestic market in China last year were about 50 million units,” he said.

Currently, Tesla is the global leader in the EV market, with a 16 percent share, but China’s BYD is close behind with a 12 percent share. However, in the Chinese market, Tesla has a smaller share of 12 percent, stated both Mandal and the Counterpoint Research report.

“You can think of Tesla as Apple, which has limited premium smartphones on offer, while BYD is like Samsung which has multiple products across all price ranges, which is helping sales,” Mandal explained.

Also Read: Uttar Pradesh announces subsidy for skill development in manufacturing electric vehicles

Europe fights back

Europe is facing a challenge from China in the electric car market, as cheaper Chinese models are flooding the EU market. The European Commission even launched a probe in September to see if it needs to impose tariffs to defend its car makers from the Chinese competition.

China has increased its share of the European electric car market to 8 percent and is expected to reach 15 percent by 2025, according to a Reuters report.

According to the European Commission, Chinese vehicles are estimated to be priced about 20 percent below EU-made models. Meanwhile, of the 8,50,000 electric passenger cars imported by Europe in 2022, more than half reportedly came from China.

“If you exclude China, by far, the biggest market for EVs globally is Western Europe,” Ethan Qi, associate director at Counterpoint Research, said in a September 2023 report.

He added, that currently, MG, a British marquee brand now owned by Chinese auto major SAIC, is spearheading Chinese growth in the region with its compact cars and SUVs.

“It’s filling a vacuum in the affordable segment, where traditional names are struggling to supply consumers with EVs in that $20,000-40,000 sweet spot. This is where Chinese brands have a lot of depth,” Qi said.

According to Qi, BYD Auto is enjoying success across a diverse group of markets mainly in Asia, and it is gearing up for Europe growth with new models to be shipped into the region.

Interestingly, the Chinese electric vehicle giant plans to build its first European car factory in Hungary, Reuters reported last week quoting a German newspaper.

(Edited by Richa Mishra)

Also Read: Delhi govt’s newest push toward EVs burdens intermediaries & gig workers. Learn from China