Mumbai: Bajaj Finance Ltd. has been one of the top stock performers in India this year, defying drops in peers amid a crisis of bad loans and defaults that has hobbled India’s nonbank financial companies.

The shadow bank’s shares have surged 25% while some rivals have plunged as much as 89% since August 2018. That was the month IL&FS Financial Services missed a payment on short-term borrowings, triggering a cash crunch and a crisis of confidence in its fellow lenders.

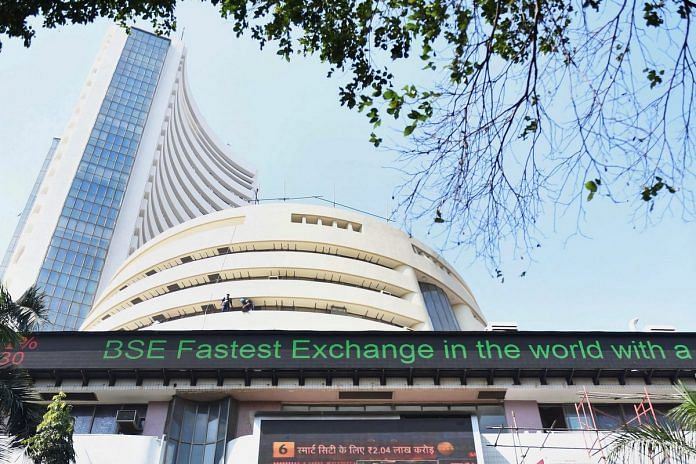

Bajaj Finance’s stock gains have accelerated more recently, with its 36% advance so far this year topping the benchmark Sensex index. The company has been helped by its strategy of diversifying into lending to the consumer durables sector as well as rural and medium-sized businesses. This has limited the company’s exposure to housing finance loans, and kept its bad loan ratio at 1.5% versus 8.8% at Shriram Transport Finance Co. and 9.7% at Mahindra Rural Housing Finance Ltd.

“They have done a good job of diversifying their business beyond housing finance, unlike other NBFCs,” said Deepak Kumar, an analyst at Narnolia Securities Ltd. “Also, their asset-light operating model by working with dealers has helped the company bring down its operating expenses.”

The shadow banking crisis began due to an asset-liability mismatch, which transformed into a problem of mistrust after IL&FS was downgraded from its former triple A rating. Bond buyers shunned non-banking lenders with large exposure to housing finance loans leading to a credit crunch.

“Well-run NBFCs with parentage and vintage never saw a funding crunch,” Subramanian Iyer, an analyst at Morgan Stanley, said in a video address. “They grew their borrowing, at a higher cost though. The funding market has been clearly demarcating them from the rest.”- Bloomberg

Also read: NBFCs have a new crisis coming with huge wall of maturing debt