The Reserve Bank of India’s thrust on economic growth and beefing up cash in the banking system is signaling to some investors that the nation’s bonds are set to turn a corner.

Demand for rupee sovereign notes is seen picking up as bets emerge that the central bank will cut benchmark rates again next month while continuing to inject funds through its open-market debt purchases. One-year interest rate swaps have slipped nine basis points so far this month, signaling traders are pricing in odds of an easing.

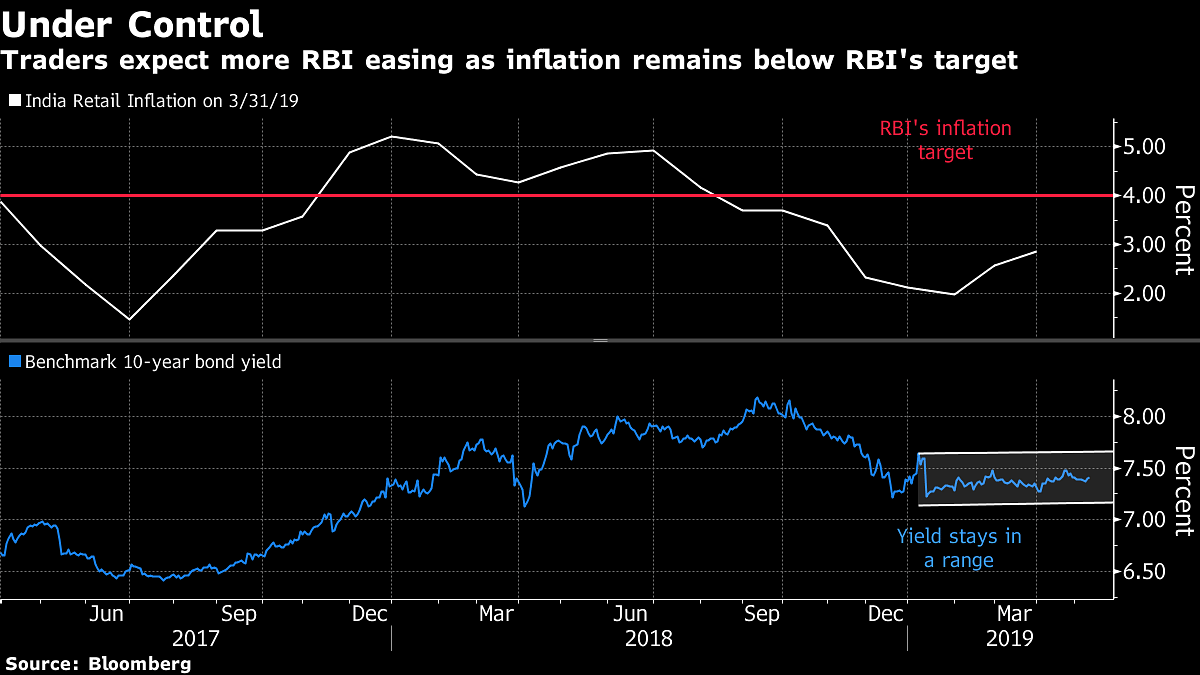

With data on Monday set to show consumer-price gains stayed below the RBI’s 4% target for a ninth straight month in April, those expectations look set to solidify.

Benign inflation conditions will “pave the way for a 25-basis points repurchase rate cut in the June meeting,” said Nagaraj Kulkarni, senior Asia rates strategist at Standard Chartered Plc in Singapore. “As the RBI continues to focus on monetary policy transmission, we expect government bonds to remain supported.”

The yield on India’s benchmark 10-year bonds will drop to 7.30% by end-June, according to the median estimate in a Bloomberg survey, from 7.41% mid-day in Mumbai on Friday. Consumer prices probably rose 2.98% year-on-year in April, compared with 2.86% in March, a separate survey shows.

Governor Shaktikanta Das has cut borrowing costs and eased lending norms to boost credit flow since taking charge at the central bank in December. India’s growth needs to pick up to about 8%, he said last month.

Yet, bond returns from one of emerging Asia’s highest-yielding debt markets have dwindled, marred by concerns about a record 7.1-trillion rupee ($102 billion) government borrowing plan and uncertainty over the result of national elections. The benchmark yield rose six basis points in April, even as the RBI cut rates for a second straight meeting.

Madhavi Arora, an economist at Edelweiss Securities Pvt. in Mumbai, says supply concerns will likely fade in June-July amid heavy bond redemptions, offering a near-term positive for the market. That, along with a forecast for near-normal monsoon rains, is adding to optimism that the worst may be over for bonds.

“Indian bonds right now pricing in all the risks possible, whether it’s a supply-demand mismatch or a hung parliament,” said Rohit Garg, Singapore-based emerging-markets strategist at Bank of America Merrill Lynch. “In terms of risk-reward, Indian bonds are one of those favorite trades out there.”

Also read: Shaktikanta Das will remain RBI governor, no matter who wins Lok Sabha elections