New Delhi: After a brief surge in 2022-23, private sector investment and hiring activity have once again turned cautious as companies look to use their excess cash to reduce their debt burdens rather than devote it towards fresh investments.

What this has meant is that—after rising sharply in 2022-23—new project announcements fell in 2023-24, as did employment growth in India Inc. Adding to this slowdown in corporate activity was the general election in the first quarter of 2024-25.

The slowdown in economic activity during the election period saw lower revenues for corporate India and subdued demand for key inputs like cement as construction activity was largely paused during this period.

That said, analysts both within the government and outside are optimistic of an acceleration in private investment over the next five years, driven in large part by the real estate and power generation sectors.

Also Read: Working-age Indian population rising; expected at around 64% in next census: SBI Research

2022-23—the year the private sector pushed ahead

The financial year 2022-23 saw both government and private data reflecting a substantial pickup in corporate investment activity.

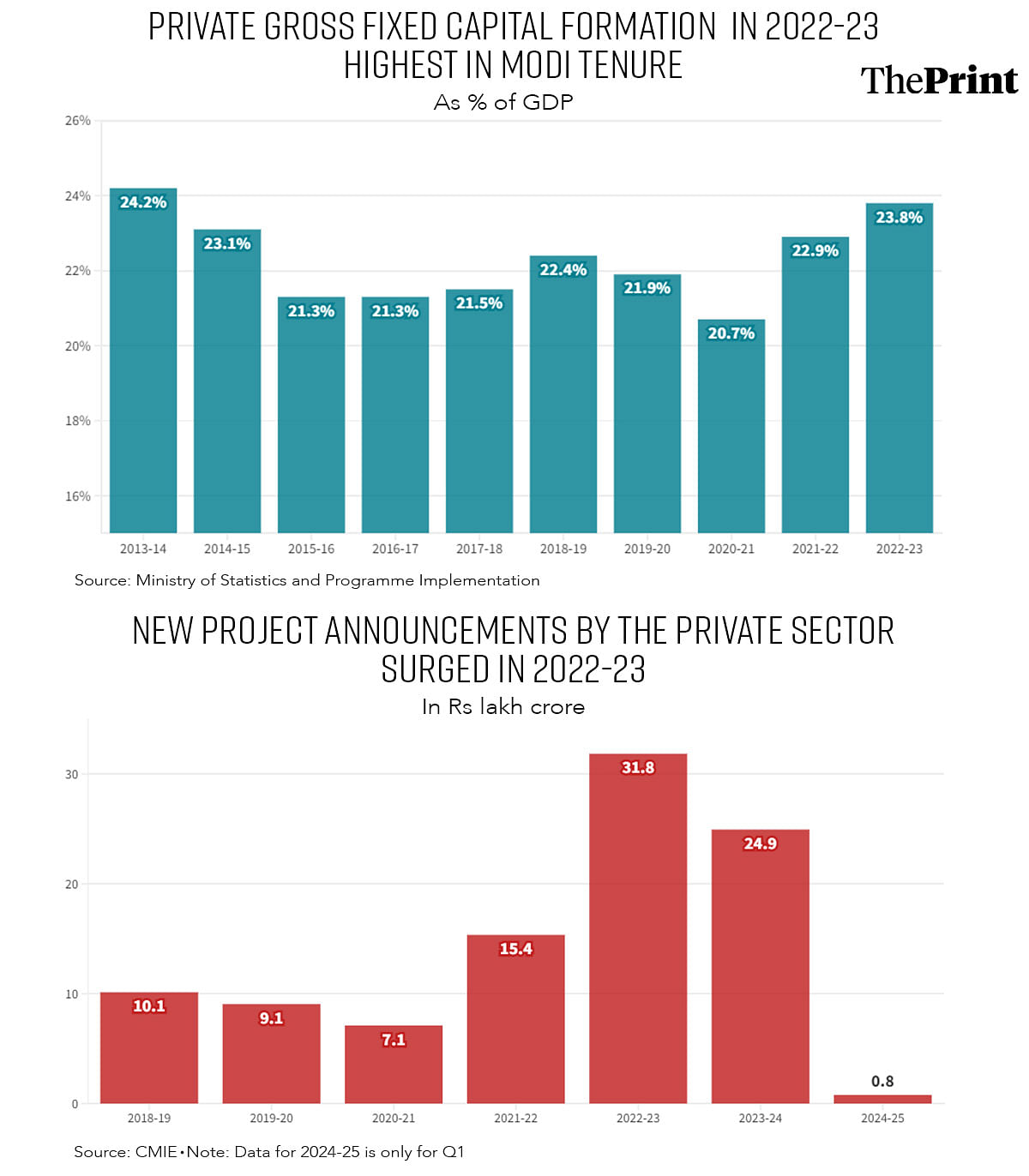

The private sector’s gross fixed capital formation—a measure of investments in real assets—rose to 23.8 percent of gross domestic product (GDP) in 2022-23, the highest it has been during the entire term of the Narendra Modi-led government, according to data with the Ministry of Statistics and Programme Implementation.

This heightened activity is reflected in data with the Centre for Monitoring Indian Economy (CMIE) as well. The CMIE data shared with ThePrint shows that the value of new project announcements surged to Rs 31.8 lakh crore in 2022-23, a little more than double what it was in the previous year.

However, the data shows investment announcements were not particularly broad-based, concentrated in sectors typically associated with construction, real estate, and power generation. So, while 46 percent of the value of new project announcements in 2022-23 were in the manufacturing sector, the chemicals & chemical products (24 percent), machinery (10 percent), and metals & metal products (5 percent) sectors accounted for the bulk of them.

The electricity sector accounted for 23 percent of the new project announcements by value, while the transport services sector comprised a 24 percent share.

Taken together, the five sectors—chemicals and chemical products, machinery, metals and metal products, electricity sector, and transport services—accounted for 86 percent of all investment announcements made in 2022-23.

The year 2022-23 was a relatively good one in terms of employment in the corporate sector as well, with a study by the Bank of Baroda’s economic research team showing that employment grew by 5.7 percent that year.

“FY23 was the first year post-pandemic when there was a certain degree of voluntary and involuntary displacement of staff,” the study noted. “Therefore there was a tendency for growth in employment to be higher in FY23 as activity was ramped up.”

Caution rears its head again

Following a relatively ebullient 2022-23, the private sector witnessed a more subdued 2023-24, choosing to spend their cash on things like debt reduction rather than in new projects.

The government doesn’t yet have data for private sector gross capital formation in 2023-24, but the CMIE data on new project announcements shows a slowdown. The value of new project announcements fell to Rs 24.9 lakh crore in 2023-24 which, though relatively high, is about 21 percent lower than the previous year.

On the employment front as well, caution seems to have taken over, with employment growth slowing to just 1.5 percent in 2023-24.

“It can be said that the employment growth scene in India Inc. was quite lacklustre when looked at the aggregate level,” the Bank of Baroda study said.

“Higher growth in FY23, the base effect, can only partly explain low growth of 1.5%,” it added.

“As this sample (on which the study was based) includes only large and medium size companies, it can be said that India Inc. contribution to employment growth has been cautious in FY24,” the study added.

The general elections in the first quarter of FY25 didn’t help matters either. The slowdown in government expenditure in accordance with the model code of conduct and the resultant slowdown in government projects had a knock-on effect on corporate profits as well.

Analyses by various brokerages and banks found that corporate India’s profits shrank by 3.1 percent in the first quarter of the current financial year, the worst performance since the Covid-19 pandemic.

This slowdown in construction also impacted other related sectors, most notably cement.

“The listed cement universe, which generally accounts for 87-88 percent of the total industry volumes, reported modest volume growth of around 3 percent year-on-year in Q1 of FY25 as construction activity was affected by the general election during the period, in addition to the heat waves,” India Ratings and Research said in a note.

What’s corporate India doing with its money?

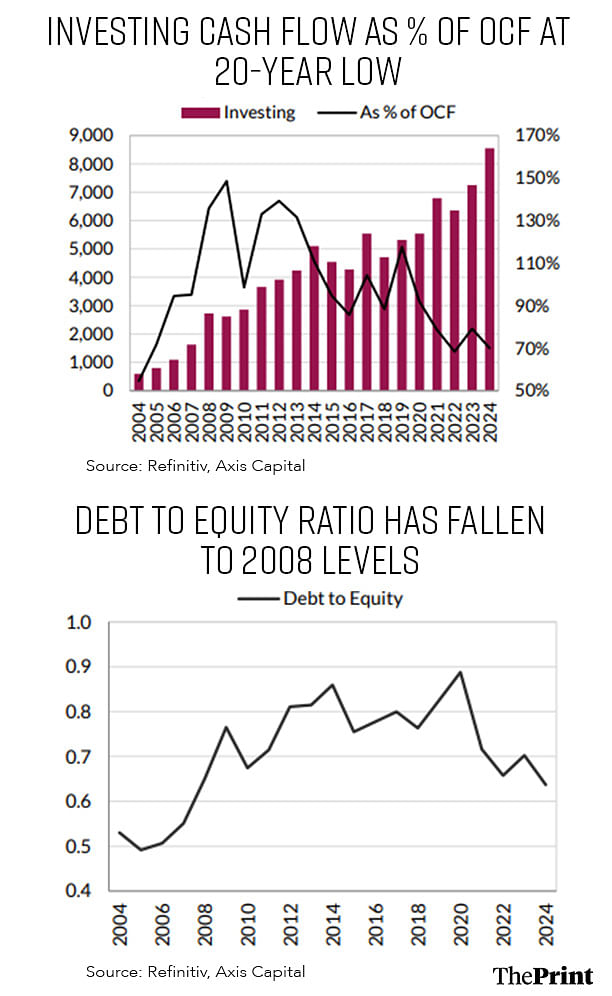

A study by Axis Bank found that the operating cash flow (OCF) of the top 200 non-financial companies in the Bombay Stock Exchange stood at nearly Rs 12 lakh crore by the end of 2023-24, about 2.6 times what it was in 2018-19.

OCF is nothing more than the cash generated by a company from its core business activities.

These large corporates have been able to generate strong cash flows by benefiting from a number of factors, the study said, such as faster sales growth,

higher profit margins, and lower tax rates following the 2019 cut in corporate tax rates.

Yet, these companies are not using this cash to invest in assets.

“As OCF grew faster, investing in FY24 was only 70 percent of OCF, the lowest since 2004 and half of the 140 percent seen in FY12,” the report added. “The excess cash was used to repay debt, bringing debt-equity down to 0.6 for the set, the lowest since 2008. Leverage is now below 2019 levels for all the sectors excluding telecom.”

In other words, the cash was being used for debt repayment.

Real estate and power to drive future capex growth

Looking ahead, two sectors in particular—real estate and power generation—are expected to drive private investment back up again, according to Neelkanth Mishra, chief economist at Axis Bank and part-time member of the Economic Advisory Council to the Prime Minister (EAC-PM).

In fact, Mishra explained to ThePrint that these two sectors are key to the economy—responsible for the slowdown the economy witnessed in the 2012-13 to 2020-21 period, and the source of growth in the years ahead.

“The slowdown that happened from 2012-21 was primarily driven by two factors,” Mishra said. “The first was the downturn in the real estate market in urban areas. The second was the downturn in power generation because we had built excessive capacity till 2016-17.”

As a result of this excess power generation capacity, India barely added any additional capacity in the 2017-24 period, he added.

“On both fronts, there is reason to be optimistic,” Mishra said. “The real estate launches are going up, inventories are low, and construction needs to start picking up to meet demand.”

He predicted that in the power generation sector, since utilities are going to soon hit their maximum capacities at peak power demand, India will see these companies starting to expand their capacities over the next five to seven years.

“With real estate going up, we are starting to see cement companies become more aggressive on expansion,” Mishra added. “Some of it is competitive, but some of it is a response to the expectation that there would be more construction of houses. Steel companies, most of the major ones, are talking of doubling their capacity by 2030 or 2032.”

Krishan Arora, a partner at New Delhi-based professional services firm Grant Thornton Bharat, said that other sectors, too, would add to this growth in investment.

“While traditional capex-linked sectors like infrastructure, manufacturing, and energy continue to attract significant investment, there is also a notable surge in other areas,” Arora said. “The technology and digital services sectors are seeing strong investment momentum, driven by the increasing demand for digital transformation and innovation.”

He added: “Sectors like healthcare, pharmaceuticals, and consumer goods are also ramping up investments, fueled by rising domestic demand and favourable government policies.

“The green energy sector is another key area seeing increased investment, as India pushes towards its renewable energy targets.”

Overall, he said, while capex-linked sectors remain pivotal, a broader investment trend is emerging, signalling a more diversified and resilient economic landscape.

(Edited by Radifah Kabir)

Also Read: India mustn’t skip the manufacturing train. Services alone won’t tap into demographic dividend