Mumbai: It had been seven months since the Covid outbreak in the country in 2020, when Scam 1992, an OTT series based on the life of stock trader Harshad Mehta, was released. Mehta, popularly known as the ‘Big Bull’, made millions off the stock market by leveraging loopholes in the system and conniving with some banks to get fake bank receipts.

Although he unceremoniously fell from grace on being arrested for manipulating the securities market, which the series showed in detail, for a number of youngsters, who were facing the threat of losing their jobs and pay cuts due to the pandemic-induced lockdown, Scam 1992 had only one takeaway — ‘Risk hai toh ishq hai’ (greater risk brings greater returns), a catchphrase from the show.

Among them was Ritesh Shinde from Maharashtra’s Sangli district. Shinde had entered the world of derivatives trading in 2017, when he was pursuing an MBA from a Kolhapur college.

Shinde recalled how several of his friends “got addicted” to trading futures and options during the pandemic, and while he consciously extricated himself out of the vicious circle of “betting, winning, betting, losing, betting again hoping to recover loss, and losing again”, most others are still on the hamster wheel.

There’s been a surge in the number of Indians trading in futures and options (F&O) since 2019, with students and unemployed as well as salaried people turning to the derivatives market with the hope of making a quick fortune.

According to the Futures Industry Association, 16.97 billion F&O contracts were traded worldwide in June. Of these, 10.34 billion — about 61 percent — were traded on India’s National Stock Exchange (NSE).

Till June this year, 98.06 billion F&O contracts had been traded worldwide. Of these, India accounted for 75.7 percent, that is, 74.2 billion.

India’s markets regulator, the Securities and Exchange Board of India (SEBI), has repeatedly said in its reports that nine out of 10 individual traders lose money in the derivatives market.

Shinde said most traders he knows are aware of this grim statistic, but they all pin their hopes on turning out to be that tenth person who walks away with the pot. But, more often than not, that tenth person is a proprietary trader or foreign hedge fund that has perfected its strategy.

While these individual traders are bleeding money, a legal battle between two United States-based money management companies, Jane Street and Millennium Management, threw some light on the beneficiaries of the market — hedge funds with sophisticated algorithms.

Jane Street sued Millennium Management and two of its former employees for allegedly stealing a trade strategy related to the Indian derivatives market. According to a Bloomberg report, Andrew Levander, a lawyer representing Millennium, had said that the Indian government has promoted opportunities for traders in the US.

“The individual traders are simply cannon fodder for the large non-individual players that are high-frequency algorithm-based proprietary traders and foreign hedge funds, who make almost all the profits,” Ajay Bodke, an independent analyst tracking economic and financial policy, and markets, told ThePrint. “The government also earns money through the Securities Transaction Tax. So, there appears to be no real will to take any stringent measures to address this issue.”

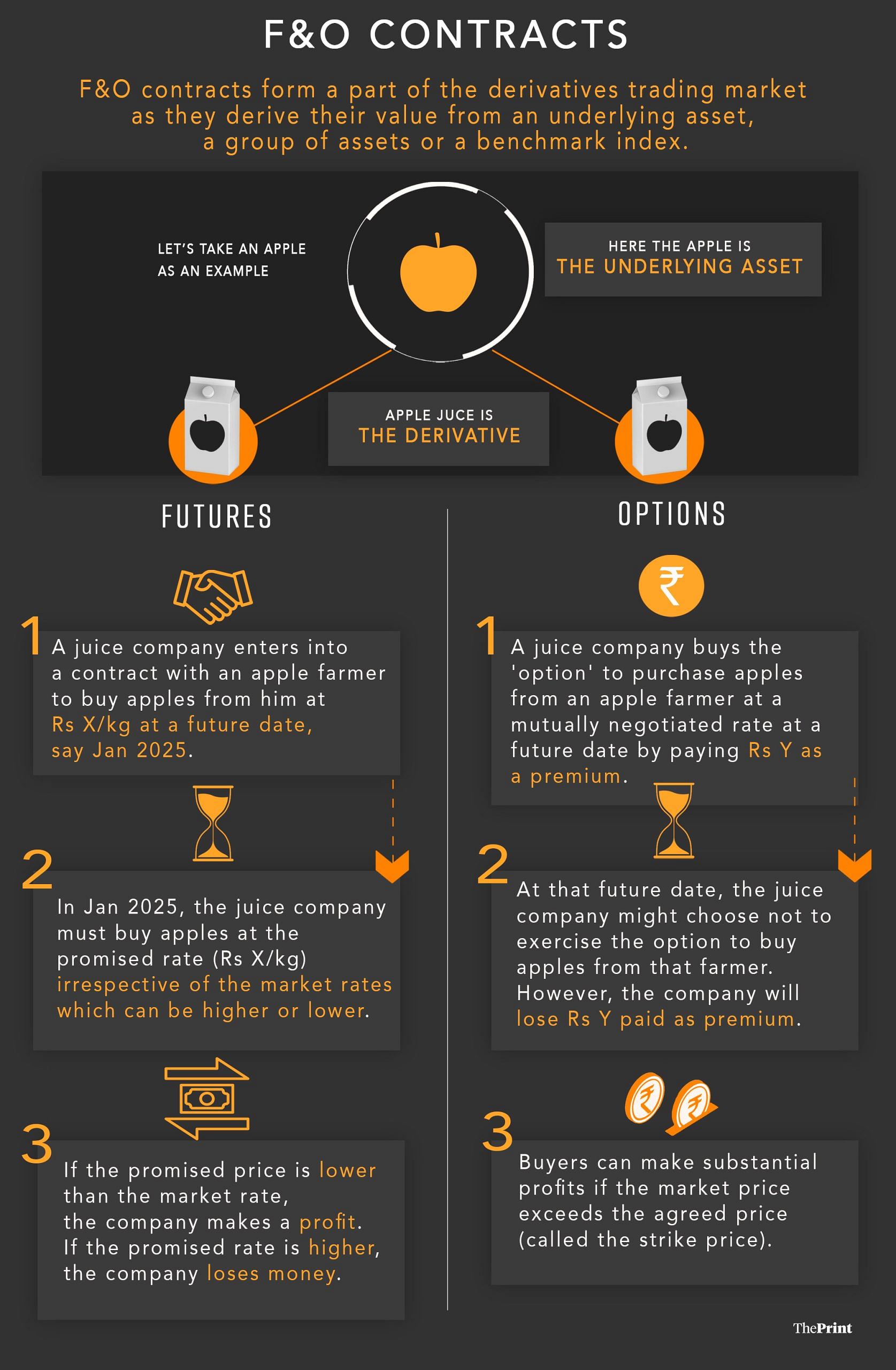

F&O contracts form a part of the derivatives trading market as they derive their value from an underlying asset, a group of assets or a benchmark.

Futures trading involves entering a contract to buy or sell a particular underlying financial instrument at a pre-determined price on a set future date. In an options contract, traders can purchase the option to buy a financial instrument at a pre-determined price on a future date, without creating an obligation to actually go through with the purchase. If the trader decides not to make the transaction, he or she only loses the premium paid to the seller for the option.

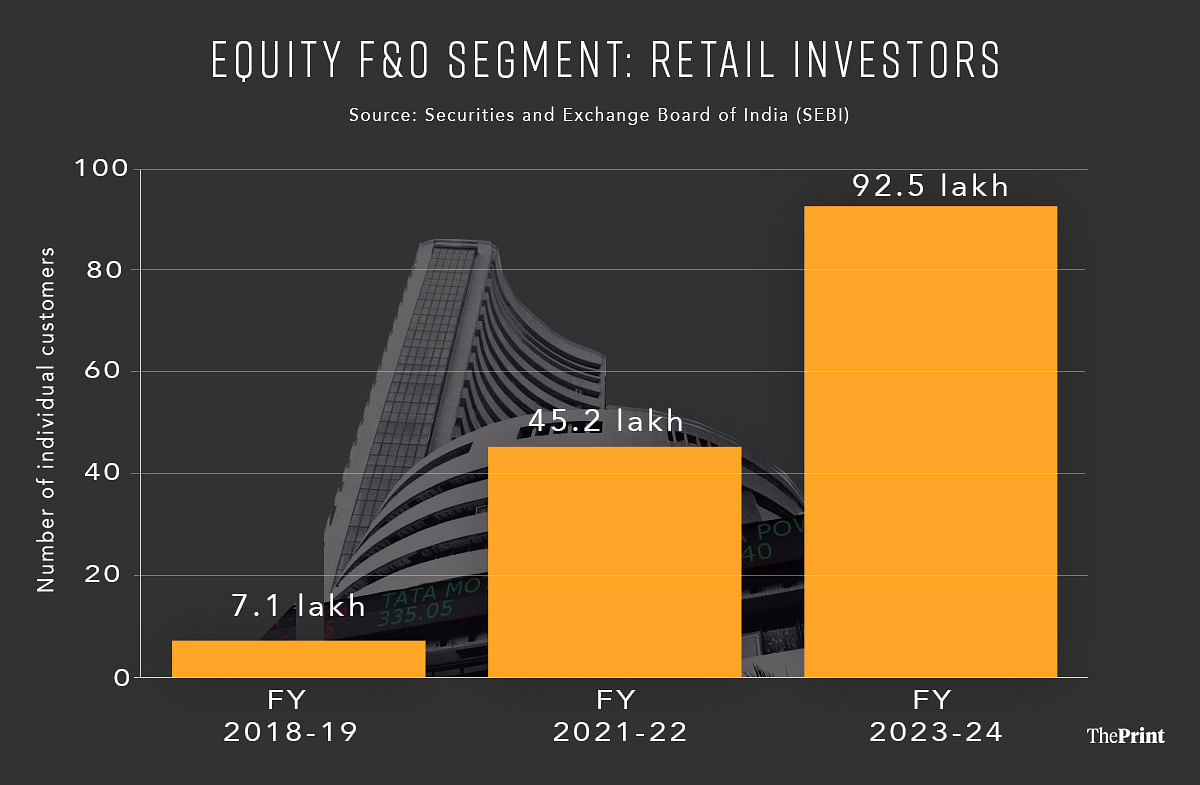

A consultation report released by SEBI on 30 July said that in FY 2023-24, 92.5 lakh individuals and proprietor firms traded in the index derivatives segment of the NSE, and cumulatively lost Rs 51,689 crore.

A 2023 SEBI report, which studied a sample size of traders taken from the top ten brokers in the equity F&O segment, noted that the total number of individual traders had jumped to 45.2 lakh in FY 2021-22, more than six times the number in FY 2018-19, 7.1 lakh .

This growth is, however, concerning, according to analysts and policy makers from SEBI and the Reserve Bank of India (RBI). Deposit growth is lagging far behind credit growth. Household money, which should have gone into productive economic activities, is being diverted to the F&O market, and in the words of SEBI chief Madhabi Puri Buch, has “macroeconomic implications”.

SEBI’s consultation paper said that the absolute value of the net loss that individuals have suffered in index derivatives “is over 32 percent of the net inflows into the growth and equity schemes of all mutual funds during fiscal 2024”. It is also more than 25 percent of the average annual inflows into all mutual funds across all schemes over the past five years.

The concerns have prompted SEBI to suggest seven steps to strengthen the derivatives framework, such as increasing the minimum contract size, rationalising of weekly options and upfront collection of options premium.

Bodke said: “SEBI seems to have finally woken up from its slumber. After prolonged dawdling, it has released a consultation paper to regain a semblance of control over this out-of-control gargantuan beast of speculative binge.”

SEBI has invited suggestions and objections on its recommendations from all stakeholders by 20 August.

Former SEBI chairman Ajay Tyagi said that the market regulator’s measures are “in the right direction”, considering that the F&O market has ballooned, compared to the equity cash market since 2020. “However, the measures to restrict speculative activity should not lead to traders shifting from futures to options and a spurt in the options market, because that would be counterproductive,” he said.

Meanwhile, for the players, the F&O market, originally meant as an instrument to hedge risks, is turning into a gamified addiction. These individual traders borrow money from family and friends or take personal loans. They also turn to ‘finfluencers’ to learn options trading strategies.

Also Read: Brokerages & hedge funds make a killing as India’s inexperienced youth flocks to the equity market

‘Personal loans fuelling addiction’

In 2017, Shinde joined classes offered by Bharti Share Market — which calls itself a stock market training institute — founded by Ravindra Bharti, a trader himself, in 2008.

“At the time, I thought this was my side hustle. I approached it very seriously. I was aware of the risks, but I thought I could do it. I was young, independent and had no family responsibilities. I thought this was the time to take risks. In the first two years, I made money, but then had a string of losses,” Shinde said.

“It turns into an addiction. You put in Rs 100 and watch that become Rs 200. Then you want to put in a hundred more. Ultimately, when I married and had a family of my own, I thought hard about it. The losses were eating into my capital. And I realised, if nine out of 10 people make losses, I don’t have it in me to be that 10th profitable trader,” Shinde said.

Shinde’s mentor, Bharti Share Market, eventually got into trouble with SEBI, which barred its founders from accessing the securities market. The regulator alleged that the company had circumvented all the regulatory requirements pertaining to an investment adviser by acting as an unregistered investment adviser, collecting large amounts in fees from investors. SEBI directed that the Rs 12 crore the company had made from its investment advisory business be impounded.

SEBI’s April 2024 order said Bharti Share Market “compromised investors’ confidence” and “abused systems for personal gains and attainments”. “Guaranteed returns up to 1000 percent is a clear case of abuse of investors’ confidence in the securities market,” it added.

Shinde, whose father is a government employee and mother a homemaker, had also taken a personal loan to expand his capital for options trading. He ended up losing Rs 4 lakh over five years.

Last year, as Roshan Agarwal, a chartered accountant based in Assam, was going through the monetary statements of one of his clients ahead of the deadline to file income tax returns, he was surprised to see a glaring Rs 20 lakh loss. The element of surprise was not just because of the amount, but also because his client was a second-year BTech student.

“He is from a Tier 2 city and had approached me asking for my services as a CA on social media. He told me he had borrowed some money, taken personal loans from banks to trade. He had got hooked on F&O trading because of one of his friends. I advised him that he should avoid trying to make quick money and leave F&O trading,” Agarwal told ThePrint, after he shared the observation on social media platform ‘X’.

Agarwal said that the student had agreed to leave derivatives trading behind. But, this year, when Agarwal was going through his documents to file his income tax returns, he was surprised to see an even bigger loss of Rs 26 lakh with zero income.

“He said he is addicted to trading and unable to quit. His parents were completely unaware,” he said.

In October last year, RBI Governor Shaktikanta Das had raised concerns about the rise in unsecured loans, particularly personal loans. He had advised banks and non-banking financial companies (NBFCs) to put safeguards in place to address the issue. Later, in November, the RBI tightened the norms for the disbursement of such loans, instructing the country’s banks to set aside more capital to back consumer loans, thereby making it costlier to lend and borrow unsecured loans.

“The galloping rise in personal loans is concerning as lenders and RBI don’t know the end use of these loans. It is certain that a part of this concerning rise in risky loans may be making its way into F&O trading,” Bodke said.

According to RBI data, in May 2024, the growth rate of personal loans moderated just a bit to 17.8 percent, compared to 19.1 percent a year ago.

Sometime in 2021, the Service for Healthy Use of Technology (SHUT) clinic at Bengaluru’s National Institute of Mental Health and Neurosciences got an unusual case.

The clinic is known to handle patients seeking remedies for technology-related addictions, such as pornography consumption, OTT viewing, online gaming, and so on. But this case was slightly different. The patient had lost lakhs of rupees in F&O trading.

“Since then, we have been seeing about one or two such cases every month. From what we have seen, it is a compulsive habit, like any other addiction. People see their money double, and then they want to put in more. They keep going back to the trading app, thinking they absolutely must make a trade,” Dr Manoj Kumar Sharma, professor of clinical psychology and SHUT clinic’s coordinator, told ThePrint.

Sharma said that according to the clinic’s observations across cases, most patients are in the 30-40 age bracket and trade with their savings and personal loans. Often, it is only when losses magnify that the family finds out about the habit, and that’s when the individuals come forward to seek professional help.

He added: “In cases where the family is involved and supportive, patients follow up on their treatment and come back for sessions. But many of them simply take one or two sessions and leave it at that. Many of them find it difficult to rehabilitate themselves in the structure of a salaried job, where there is limited potential to scale up.”

The ‘gamified’ F&O market

The Covid pandemic, and the associated financial impact on households and wallets, did drive many individuals to the F&O market. At the same time, however, the platform also underwent churning to make the system more accessible for individual investors.

For instance, before discount broking apps such as Zerodha, Groww and Angel One became popular, making a trade was a slightly more tedious process. Incidentally, the discussion forums of these discount broking apps are rife with sagas of people making devastating losses and seeking advice on the best strategies to recover their money.

The exchanges, making tall profits from derivatives trading, have been introducing ways of boosting the numbers. One such catalyst was the introduction of weekly options, and then the zero day to expiration contracts. Earlier, there were just monthly contracts. The daily options expire on the same day as they are traded, and have especially soared in popularity.

Former SEBI chief Tyagi said, “Weekly settlements in the derivatives market shouldn’t have been introduced. It used to be monthly earlier, and changed in 2019 or so. Ideally, it should be monthly.”

According to an Axis Mutual Fund report, authored by its chief investment officer, Ashish Gupta, a push for short durations has made the options market more about speculation than hedging, and the zero day to expiry options are already at 50 percent of the volumes.

“The introduction of shorter durations in options has effectively sachetised trading, reducing the capital needed to take on similar risks… Most of the options volumes are speculative and this can be gauged from the fact that open interest at the end of the day is only 1 percent of the daily traded volumes, that is, only one out of a hundred contracts are carried forward the next day,” the report noted, adding that fantasy sports offers better odds than options trading.

One of SEBI’s recommendations in its 30 July consultation paper seeks to remedy this. As of now, there are index-based contracts that expire on all five trading days of the week. SEBI has proposed that weekly options contracts be provided on a single benchmark index of an exchange, which will essentially mean that there will be two expiries a week.

“Expiry day trading is almost entirely speculative. Given there is an expiry of weekly contracts on all five trading days of the week, combined with previous findings on increased volatility on expiry day and within that increased volatility during closing time, speculative activity created near contract expiry and poor profitability outcome for individual investors in F&O segment, rationalisation is warranted in the product offering,” the paper read.

SEBI has also suggested increasing the contract size to Rs 15-20 lakh in the first phase and Rs 20-30 lakh in the second phase to make it harder for retail investors to participate. Currently, the minimum size required for a contract is Rs 5-10 lakh.

“Given the inherently higher risk in derivatives and the large amount of implicit leverage, increase in minimum contract size would result in reverse sachetisation of such risk bearing products,” SEBI said in its paper.

There is, however, a fear that retail traders addicted to the game will eventually find ways of working their way around these fresh barriers.

Sushil Choksey, managing director of Indus Equity Advisors, said, “How do you control a person who is earning Rs 20,000 a month and betting Rs 2 lakh? Barriers are broken by somebody or other. Unless you ask people to produce a net worth certificate, people will pool in and play. Someone might say they will do a pair trade with three other people.”

NSE MD and CEO Ashishkumar Chauhan has often cautioned investors against high-risk derivatives trading, saying that F&O markets should be left to informed investors who can manage risks. However, he is also bullish on the rise of the derivatives market, which is delivering enormous profits for the NSE.

The NSE has a 96 percent market share in equity derivatives and 86 percent in the currency derivatives segment. In the quarter ending March 2024, NSE’s revenue from transaction charges surged 23 percent year-on-year to Rs 3,719 crore. Of this, 88 percent came from equity derivatives.

During its earnings call to discuss the FY 2023-24 fourth-quarter results, Chauhan expressed optimism while responding to a question on the possible loss of market share in derivatives to the Bombay Stock Exchange.

“Overall, the market has increased. You might have seen the volumes. Overall market pie increased because of the competition. And that is what we believe will happen in the future also,” Chauhan said.

Ashok Devanampriya, founder of Cautilya Capital, a financial education firm, rejected labels such as “gamification” and “addiction” for any aspect of the stock market.

“Trading is not easy. It is among the toughest professions in the world. However, it has its own benefits. For example, if you start a restaurant, you have no idea what the extent of your maximum loss will be, but in stock markets you will always be aware of the maximum potential loss,” Devanampriya said. “The second thing is scalability. Every buyer will find a seller. Third, it is democratic. There is no threat of competition, new entrants or bureaucratic hurdles, unlike other professions.”

He added, “But at the end of the day, our motive will always be to tell the world not to come into the stock market to make easy money. Share market is a combination of mathematics, science and psychology.”

According to Devanampriya, there needs to be better education about the F&O market for investors to make strategic, informed trades while being fully cognisant of their risks. With this in mind, he started organising training conferences — the Bharat Option Traders Summit (BOTS) — from June this year under the banner of ‘Traders Gurukul’.

The aim of BOTS, he said, is to highlight all the statistics that SEBI has shared about retail traders making losses, and teach them how to hedge well, instead of trying to make money. With hedging, traders are bound to make money anyway, he said.

“It is like cricket. I will not teach you to hit fours and sixes, but I will teach you how to bat well, play a bouncer or a googly,” said Devanampriya, who claims that he has never made big losses in the stock market due to his hedging strategy.

He has organised three BOTS events so far at Hyderabad, Bengaluru and Chennai, each of them attracting about 1,000 to 1,500 participants from the metro cities and nearby smaller towns. Traders Gurukul is now gearing up for the fourth one in Kochi on 1 September, where “how to hedge” will be the top focus.

Devanampriya often employs witticisms to explain the risk-versus-reward calculation in trading. This is what he said at one of his seminars:

“There is a group of 100 terrorists, and a bomb is dropped to kill them. Dropping a single bomb costs $1 million. One of the 100 walks away on a smoke break minutes before the bomb is dropped, and instead of a hundred, only 99 are killed. Now, to kill the 100th terrorist, another bomb needs to be dropped, which will cost an additional $1 million. Is it going to be worth it? That’s what one has to decide. If not, walk away like the 100th terrorist, instead of getting killed.”

(Edited by Mannat Chugh)

Also Read: How do you spot a fake ‘finfluencer’? Red flags include penny stocks, get-rich-quick schemes