New Delhi: Three cancer drugs and critical minerals have been exempted from customs duties, gold, silver and platinum will get cheaper, as will mobile phones and chargers. Meanwhile, fertilisers and environmentally hazardous PVC flex banners are set to get costlier.

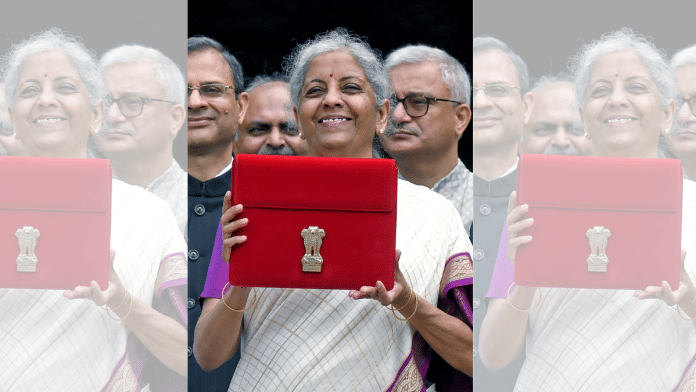

Finance Minister Nirmala Sitharaman presented the Union Budget for 2024-25 Tuesday, highlighting the Modi 3.0 government’s nine key priorities. These are — boosting productivity and resilience in agriculture, enhancing employment and skills, promoting inclusive human resource development and social justice, supporting manufacturing and services, advancing urban development, ensuring energy security, improving infrastructure, fostering innovation, and initiating next-generation reforms.

What will become cheaper?

In her budget, Sitharaman announced significant price reductions in various sectors. Medicines and medical equipment will see price cuts. To support cancer treatment in India, three cancer medicines will be exempt from customs duties.

Precious metals such as gold, silver, and platinum will also become cheaper. Customs duty on gold and silver will be reduced to 6 percent, while platinum will see a reduction to 6.4 percent.

Additionally, 25 critical minerals, including lithium, copper, cobalt, and rare earth elements, essential for sectors like nuclear energy, renewable energy, space, defence, telecommunications, and high-tech electronics, will be exempt from customs duties, with a reduction in basic customs duty (BCD) on two of them.

Electronic items, such as mobile phones and chargers, will become more affordable due to a reduction in BCD to 15 percent. BCD on marine feed and shrimp has also been reduced to 5 percent.

Leather and footwear are likely to become cheaper as the government proposes to cut customs duties on these items as well.

What will become costlier?

The government is set to increase import duty on printed circuit boards (PCBs) for telecom gear by 5 percent to encourage domestic manufacturing. This comes alongside exemptions for critical minerals used in communication equipment manufacturing.

The customs duty on ammonium nitrate and non-biodegradable plastics will rise to 10 percent. Ammonium nitrate is commonly used in fertilisers, pyrotechnics, herbicides, insecticides, and the production of nitrous oxide.

“PVC flex banners are non-biodegradable and hazardous for environment and health. To curb their imports, I propose to raise the BCD on them from 10 to 25 percent,” Sitharaman said.

Furthermore, the finance minister announced the abolition of the angel tax for all classes of investors in startups. “To bolster the Indian startup ecosystem, boost entrepreneurial spirit, and support innovation, I propose to abolish the so-called angel tax for all classes of investors,” she stated.

This removal is expected to significantly benefit startups by creating a more supportive environment for innovation and growth.

(Edited by Gitanjali Das)

Also read: Not enough time left, same fiscal constraints — why July budget maths will be similar to February’s