Thank you dear subscribers, we are overwhelmed with your response.

Your Turn is a unique section from ThePrint featuring points of view from its subscribers. If you are a subscriber, have a point of view, please send it to us. If not, do subscribe here: https://theprint.in/

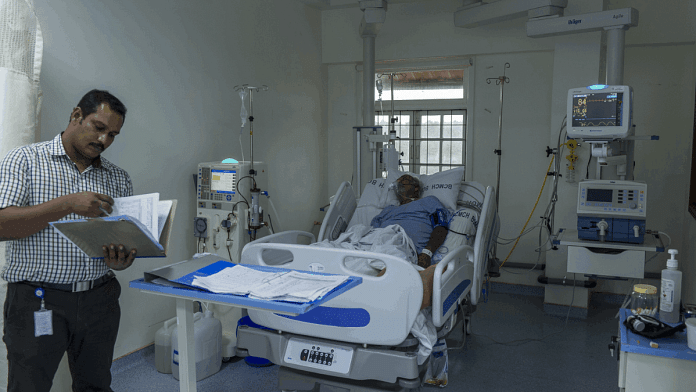

The COVID-19 pandemic exposed significant shortcomings in the Indian healthcare system such as hospital beds, oxygen availability, lifesaving medicines as well as the number of caregivers such as doctors and nurses. According to WHO, India has 0.5 beds/1000 people compared to 4.5 beds/1000 for China and 2.9 beds/1000 for The United States, indicating the stress on the overall healthcare system.

The Indian government since the end of COVID restrictions has not invested any significant money to bridge this gap or to build an additional infrastructure. The market has now risen to the opportunity with over $4 billion investment in the healthcare sector with Singapore-based Temasek and US-based Blackstone being the major players.

The common and more enthusiastic explanation about this type of investment in the healthcare sector is that the private investment brings a welcome change such as capacity addition, modernization of the healthcare system, and a much-needed capital injection to ensure the quality and speed of healthcare services to the general population in India. By investing added capital, the healthcare system is readily accessible to a larger population. The growing healthcare industry also fuels innovation thereby facilitating the development of innovative drugs in India, reducing its dependence on the rest of the world.

The other side of private equity investment however needs to be closely scrutinized. The goal of any private equity in the healthcare sector is to improve the balance sheet (P&L), reduce costs, and more importantly Increase sales to maximize returns.

A low-hanging target of cost reduction is to usually reduce the number of people providing care by bringing more automation. While automation brings speed and efficiency, it also negatively affects the job prospects of hundreds and thousands of young women and men looking to enter the healthcare industry. This will most likely have a huge negative impact on the already high youth unemployment numbers in the country.

The second aspect is the increased cost of services. According to Statista.com, ‘In fiscal year 2023, Apollo hospitals generated approximately fifty-one thousand rupees per day from each occupied bed in their various hospitals. In comparison, the revenue in the fiscal year 2014 from each occupied day was about twenty-four thousand rupees per day.

Investment by private equity in the hospital system will further drive up not only the service costs but also the health insurance costs. The average income of an Indian family of four in 2023 stands around twenty-five thousand rupees a day. Moreover, approximately 6% of the Indian workforce is employed in an organized sector and therefore has the benefit of health insurance /healthcare. As for the rest of the workforce, affordable healthcare will likely be a distant dream. This in turn will give rise to a back door health care system which will be exploited by fraudsters and scammers alike.

One of the imminent dangers of the private equity investment in the healthcare industry is going to be the upselling by the healthcare industry ( a common trend in The United States) which will include coercing people to get additional tests, prescribing unwanted surgeries, bringing more people under the “radar” by facilitating the change in the threshold values of the common health guidelines ( such as blood pressure, cholesterol etc.) by “collaborating “ with the medical associations, as well as by prescribing “routine” medication to a larger population.

The increase in the cost of healthcare per person (the current average healthcare cost in India is less than $80 per person per year) may not necessarily lead to an increased lifespan or improved quality of life for the individuals. For example, the OECD report states that, for the year 2023, The United States spent $12555 per capita on health, more than the OECD average of $4986 (USD Per Person Per year). This is equal to 16.6% of GDP, compared to 9.2% on average in the OECD The Life expectancy in the United States however was 76.4 years which is 3.9 years below the OECD average. Preventable mortality was 238 per 100,000 (higher than the OECD average of 158); with treatable mortality at 98 per 100,000 (higher than the OECD average of 79)

The Indian government therefore will need to play a critical role in preventing runaway costs of treatment, formulating enforceable laws to ensure pharmaceutical costs are kept in check, drafting legislation to protect the rights of the patients, incentivizing and subsidizing preventative health care, and general making sure that the getting a good healthcare is not the right of a wealthy few.

Private healthcare investment is a double-edged sword, and an enforceable, well-drafted regulatory framework is needed as a scabbard to ensure that it does not cause acute injury to the unsuspecting society.

These pieces are being published as they have been received – they have not been edited/fact-checked by ThePrint.