Thank you dear subscribers, we are overwhelmed with your response.

Your Turn is a unique section from ThePrint featuring points of view from its subscribers. If you are a subscriber, have a point of view, please send it to us. If not, do subscribe here: https://theprint.in/subscribe/

The major reasons cited by the Government of India for merger of 8 public sector banks w.e.f. 01.04.2020 are to arrest the mounting bad loans, create globally stronger banks and to increase the operational efficiency and profitability with a widened branch network.

Let us examine through this article whether the mergers justified their action.

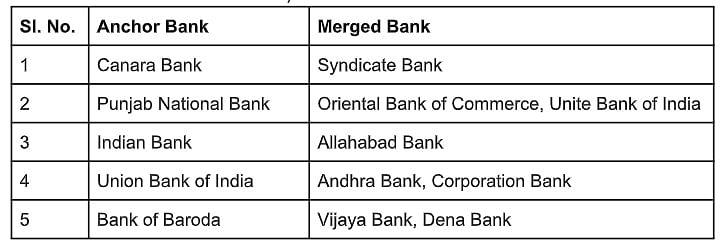

The following banks were merged with respective anchor banks w.e.f. 01.04.2020 ( Merger with Bank of Baroda w.e.f. 01.04.2019).

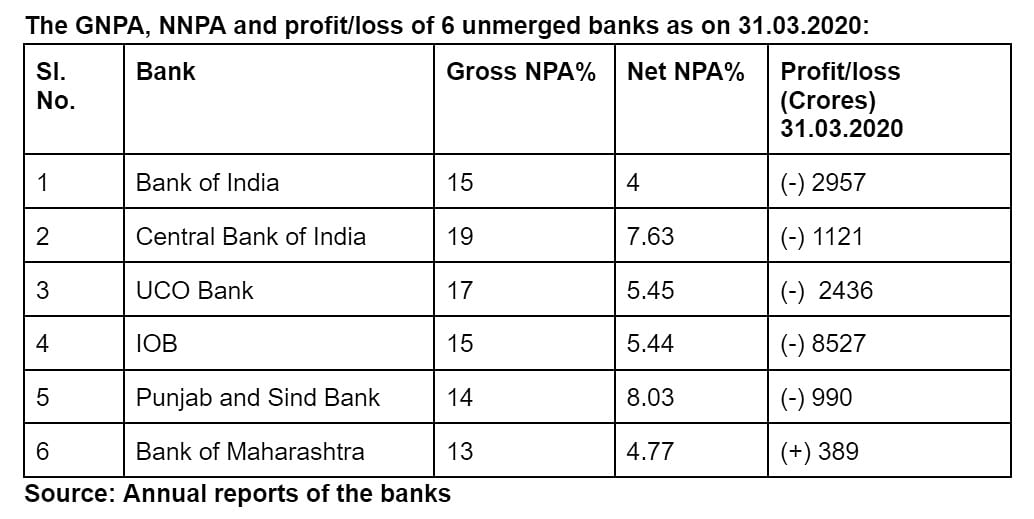

The following 6 PSBs were not merged and remained independent. Unofficial reports suggest that it was because of the unwillingness of the anchor banks to take them over considering mounting NPAs, huge losses, weak balance sheets and their inclusion in the PCA (Preventive Corrective Action) framework of the RBI. It was also feared that these banks would lose business due to fierce competition from the Big 5 and eventually either close down or would be put up for privatization at a later date.

Operational efficiency of 5 big banks created post merger vis-a-vis unmerged banks:

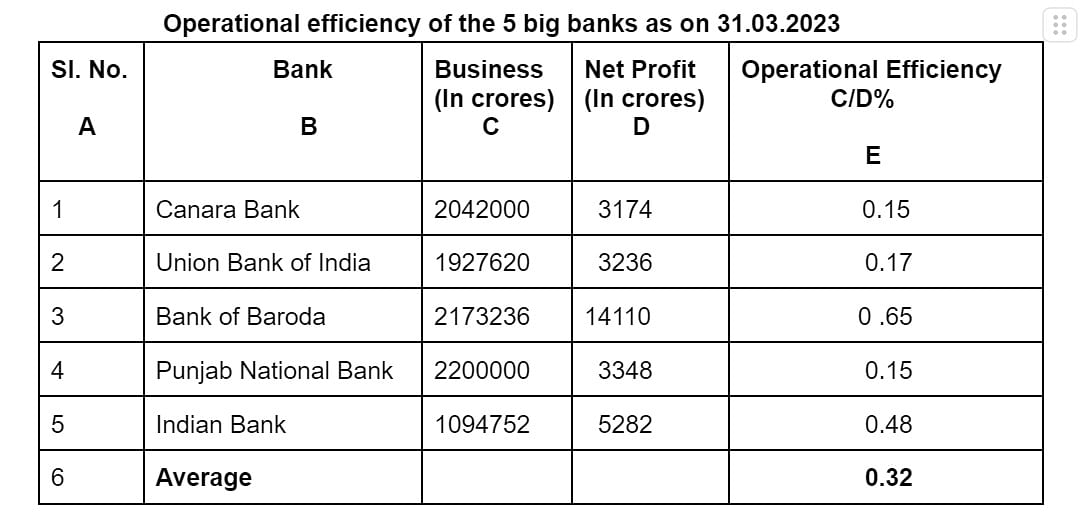

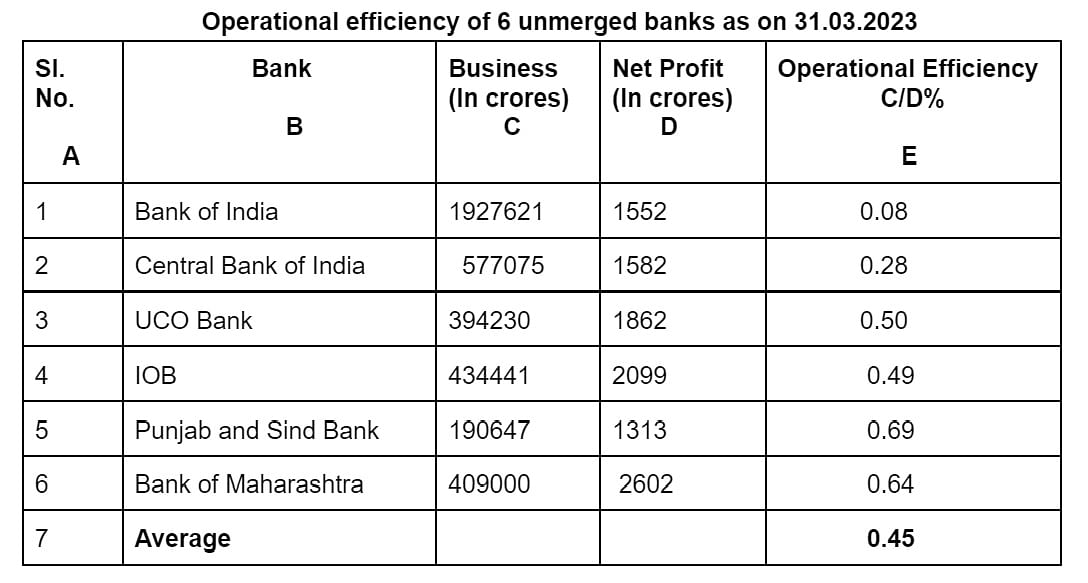

An analysis of the operational efficiency of the 5 big banks ( PNB, BOB, UBI, IB and Canara) vis-a-vis the 6 unmerged banks show a different picture indicating poor operational efficiency among the former and better efficiency among the latter after the completion of 3 financial years of merger as on 31.03.2023 as per the table shown below (Source: Annual reports of banks):

It clearly emerged that banks, when left alone with their independent identity have made an impressive turn around and shown better operational efficiency compared to the 5 big banks that fell way behind.

Branch Network:

In response to an RTI query, RBI has informed that as many as 4837 bank branches of Public Sector Bank branches were either closed or merged in the financial years 2020-21 and 2021-22 post merger.

Assuming that each branch had an average customer base of 5000, the total number of

population deprived of physical banking facilities is a staggering 2.42 crore. So, the objective of a widened branch network due to mergers has been defeated due to closure of branches.

Business Growth:

While the 5 big banks bloated their balance sheets, registering an alarming growth rate of over 105% from 2020 to 2023, the unmerged banks grew at a healthy rate of 39% during this period. It is also observed that these 5 big banks focussed more on Corporate Advances to boost their top line instead of having a well-diversified portfolio to mitigate the risk. One of the reasons why Indian banks survived the 2008 meltdown was because of the diversified portfolio and risk spread.

Conclusion:

Mergers are not the panacea to the ills of the banking industry. When banks grow too big, they also tend to be complacent and reckless in lending, leading to failures as witnessed by us historically and in recent times too.

Government must ensure that robust governance and risk management practices are put in place to ensure that a few global sized strong banks are created.

These pieces are being published as they have been received – they have not been edited/fact-checked by ThePrint.