Thank you dear subscribers, we are overwhelmed with your response.

Your Turn is a unique section from ThePrint featuring points of view from its subscribers. If you are a subscriber, have a point of view, please send it to us. If not, do subscribe here: https://theprint.in/subscribe/

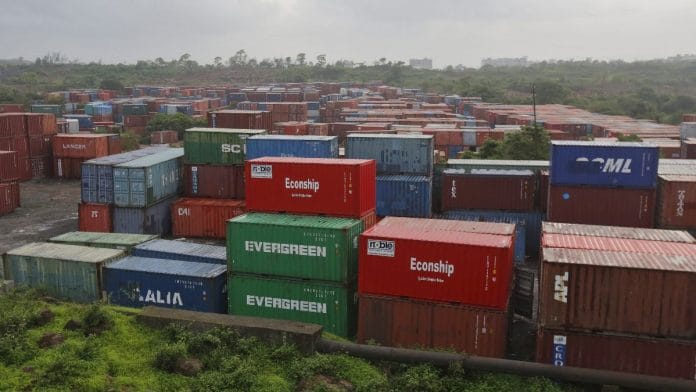

The Government of India, after a pandemic-related delay of almost 3 years, recently released the much-awaited (and needed) Foreign Trade Policy (FTP). The FTP aims to make India a more significant player in global supply chains by achieving an export value of $2 trillion through a variety of export-focused schemes and promotions. Moreover, its emphasis on this export growth being led by the so-called “mom-and-pop” sectors, or more formally the MSME sectors, has earned it the right of being called an “Inclusive India” policy by analysts.

This policy, which also echoes the current government’s “Atmanirbhar Bharat” ideology, boasts the leveraging of technology to facilitate and promote cross-border MSME trade on the back of increased mobile phone penetration, internet access and a digital payments system (UPI). However, it seems that the progressive nature of this policy is limited in scope, for despite all this talk about leveraging the digital, the policy has failed to mention how this emphasis on technology can address the financial shortcomings that plague the MSME sector.

The MSME Sector

The MSME sector is a major contributor to the socio-economic development of India. It accounts for over 45% of the country’s manufacturing output, 40% of its exports, as well as a significant share of its employment (especially in rural and semi-urban areas). Despite their economic importance, the sector has been facing challenges when it comes to access to financing.

MSMEs are typically cash-flow businesses. This means that their success depends on how well they manage their cash flow, and even minor disruptions can result in a complete collapse of the business. Hence, even though easy access to short-term financing or working capital to fund the day-to-day operations of these businesses is of existential importance, MSMEs often find it difficult to obtain loans from banks and other financial institutions due to a number of factors, including but not limited to a lack of collateral, lack of credit history, and high-interest rates.

These challenges, however, can easily be addressed by India’s burgeoning, but largely untapped, fintech sector.

Factoring is the name of the game

Factoring is a type of financing in which a business sells its invoices to a third party, called a factor, at a discount. The factor then collects the full amount of the invoices from the business’s customers. This allows the business to access cash immediately, rather than waiting for its customers to pay. In the past, factoring was a complex and time-consuming process, however, the emergence of fintech solutions have made it easier for businesses to factor their accounts receivable online, in a matter of minutes. The Indian Government too has played its part as a facilitator by creating a Bharat Bill Payment System (BBPS), a payment system that facilitates the electronic collection of payments for bills and invoices, making it easier for fintech factoring providers.

The Fintech factoring sector in India is currently in its nascent stages and was estimated to be worth $6 billion in 2022 (a mere ~1% of India’s export bill), leaving much of the market open for penetration.

Factoring offers quite a few advantages for companies engaged in export. It can help improve a business’s cash flow by reducing the amount of time it takes to collect payments from customers, freeing up cash that can be used to invest in the business or meet immediate obligations. This extra capital also prevents the exporter from taking on any short-term financing and thus reduces the risk of bad debt by transferring the risk of non-payment to the factoring provider. Factoring can thus help improve a business’s credit score by demonstrating that it is able to meet its financial obligations. This can make it easier for businesses to obtain loans or other forms of financing allowing for future business scalability.

It’s not a perfect solution though. Factoring can be expensive, as the factor will charge a fee for its services. The fee generally ranges from 1% to 5% of the invoice amount, though it can be higher for businesses with poor or no credit history, as in the case of MSMEs looking to get started in the export market. And this is exactly where the policy falls short. Without a provision for easier (and cheaper) access to factoring services, the efficacy of the new FTP will be mediocre, at best.

The FTP is a welcome step in the right direction, but it is far from complete. The policy needs to do more to help MSMEs have increased accessibility to the financing they need, thus allowing them to grow their exports, and succeed in the global marketplace. It must not only focus on the more obvious barriers to trade & export, but also on the financial ones, which tend to be far more insidious in nature.

These pieces are being published as they have been received – they have not been edited/fact-checked by ThePrint.