New Delhi: The Pakistani rupee (PKR) depreciated dramatically in the interim government’s first three weeks in power amid efforts by caretaker prime minister Anwaar-ul-Haq Kakar to bring economic stability to the country by, among other measures, cracking down on cross-border dollar smuggling.

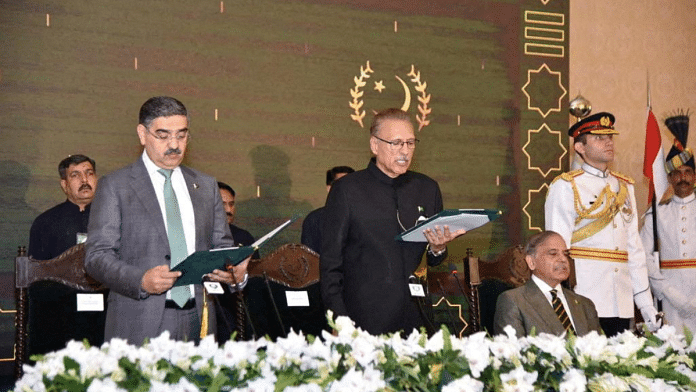

Kakar was sworn in as the interim prime minister of Pakistan on 14 August, following the dissolution of Pakistan’s National Assembly on 9 August.

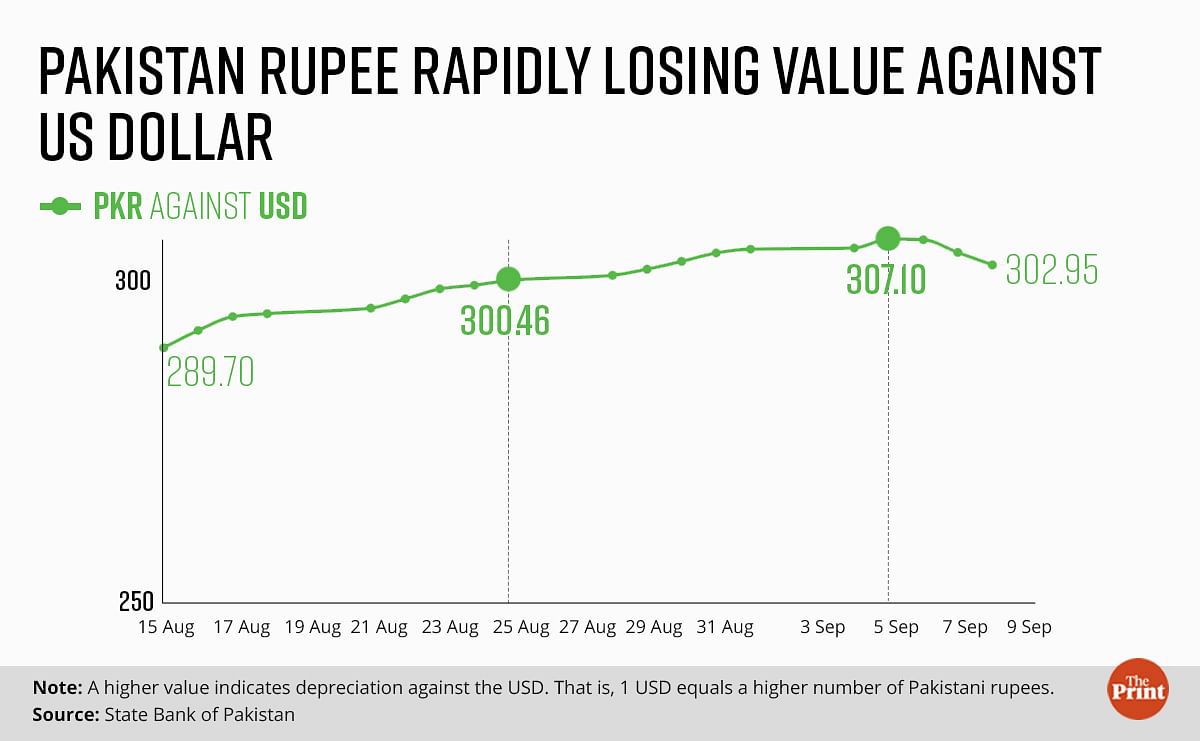

According to data released by the State Bank of Pakistan (SBP), the value of the Pakistani rupee fell to 307.10 to a US dollar from 289.70 to a US dollar between 15 August — the interim government’s first day in office — and 5 September.

This is a record low for the Pakistani rupee, which has lost about 6 percent of its value against the US dollar over the past month, making it the worst-performing Asian currency this quarter, according to a report by Bloomberg.

Economist Uzair Younus, Director of the Pakistan Initiative at the Atlantic Council, explained to ThePrint that a change in government is one of the key factors that led to this steep depreciation of the Pakistani rupee, along with high inflation. “The previous government had intervened in the market to control the exchange rate, but now that has been removed and people were expecting this impact,” he said.

Pakistan’s currency also witnessed a brief appreciation in July this year and was valued at 275.10 against the US dollar on 4 July, following the International Monetary Fund’s (IMF) approval for a $3 billion bailout package for the country. However, subsequent depreciation led to the PKR/USD rates surpassing the 300-mark by 25 August.

While overall inflation in the country declined slightly to 27.4 percent in August from July’s 28.3 percent, food inflation remained high at 38.5 percent, Reuters reported.

Furthermore, as part of the IMF conditions, the government increased fuel prices twice last month, by up to PKR 20 per litre the second time, while electricity prices saw a hike of PKR 2.07 per unit.

To bring matters under control, the SBP is looking at numerous measures to combat structural challenges within the economy. These include reforming the exchange rate, expanding the role of banks as direct players, capitalisation and overall modernisation, said Younus.

Also Read: Pakistan is banking on $3bn IMF loan, but it might just buy time, not solve debt crisis

Drivers for depreciation

According to Younus, one of the reasons that led to the depreciation of Pakistan’s currency was the government’s intervention in the market to control the exchange rate.

Former finance minister Ishaq Dar introduced exchange controls in June last year to protect the country’s declining forex reserves. This ‘managing’ of the exchange rate artificially further fuelled economic instability in Pakistan over the past year, as the market caps created ‘distortions’ within the economy, said a Reuters report.

However, under the IMF’s $3 billion Stand-By Arrangement (SBA), Pakistan had to commit to a market-determined exchange rate to absorb external pressures, remove exchange controls and eliminate multiple exchange rate practices in different markets.

The IMF also forced the government to remove import restrictions that were placed last year, to restrict outflows from its shrinking foreign reserves.

“The IMF obligations, such as relaxed curbs on imports and lack of exchange rate control as well as pent-up demand for dollars that Pakistan’s foreign exchange reserves cannot meet, have led to the depreciation of the rupee,” Younus noted.

While these are some of the short-term factors affecting Pakistan’s economy, Younus also highlighted some long-term drivers, such as the government’s high fiscal deficits — the difference between the government’s total revenue and expenditure — over the years.

Pakistan’s PKR 14.46 trillion budget for the financial year 2023-24 revealed that the government’s overall fiscal deficit, according to reports, stands at its highest ever, at PKR 6.95 trillion — roughly 6.53 percent of the GDP. Approximately half of this expenditure has been allocated for interest payments, amounting to PKR 7.3 trillion (roughly $25 billion).

While such high fiscal deficits have further affected Pakistan’s economy, Younus said another long-term factor is the mismatch between domestic money supply and dollar inflow. “Due to higher fiscal deficits, domestic currency circulation within the economy has gone up, while foreign reserves have continued to decline, which has impacted the depreciation of the rupee,” he explained.

Last week, the Monetary Policy Committee of the State Bank of Pakistan (SBP) auctioned Treasury Bills (T-Bills), which helped the government raise PKR 1.3 trillion in domestic debt. Post this auction, the central bank is expected to increase the policy rate by at least 200 basis points to 24 percent.

Pakistan’s foreign reserves dropped to $8.1 billion in January 2023 from $16.4 billion in April last year. Post the IMF agreement, the total liquid foreign exchange reserves stood at $13.1 billion in the week ending 1 September.

Apart from the $1.1 billion from the IMF, Pakistan reportedly also received $2 billion from Saudi Arabia and $1 billion from the UAE in foreign exchange reserves over the past few months.

Another reform mandated by the IMF was the “timely” establishment of a new base level for power sector tariffs — hiking electricity prices for consumers. This has also had an inflationary impact on the Pakistani economy.

Also Read: All about Pakistan’s $3bn standby agreement with IMF & what it means for cash-strapped country

Way forward, reform

The SBP is looking at numerous measures to combat these structural challenges within the economy.

Last week, the central bank announced structural reforms, such as creating a transition process for exchange companies (ECs), their franchises, and category B exchange companies (ECs-B) to become mainstream ECs.

According to reports, these reforms were introduced to provide “better services to the general public and bring transparency and competitiveness” in the sector.

The SBP also announced that “various types of existing exchange companies and their franchisees would have to be consolidated and transformed into a single category of exchange companies with a well-defined mandate”.

Furthermore, it also increased the minimum capital requirement for exchange companies to PKR 500 million from the earlier PKR 200 million.

The interim government has also launched a crackdown against illegal currency dealers, hoarders and smugglers. This led to a slight appreciation of the PKR to 302.95 on 8 September, after having touched a record-low at 307.10 on 5 September.

(Edited by Richa Mishra)

Also Read: Pakistan’s constitution always accommodated the guilty. Now 20 million kids are out of school