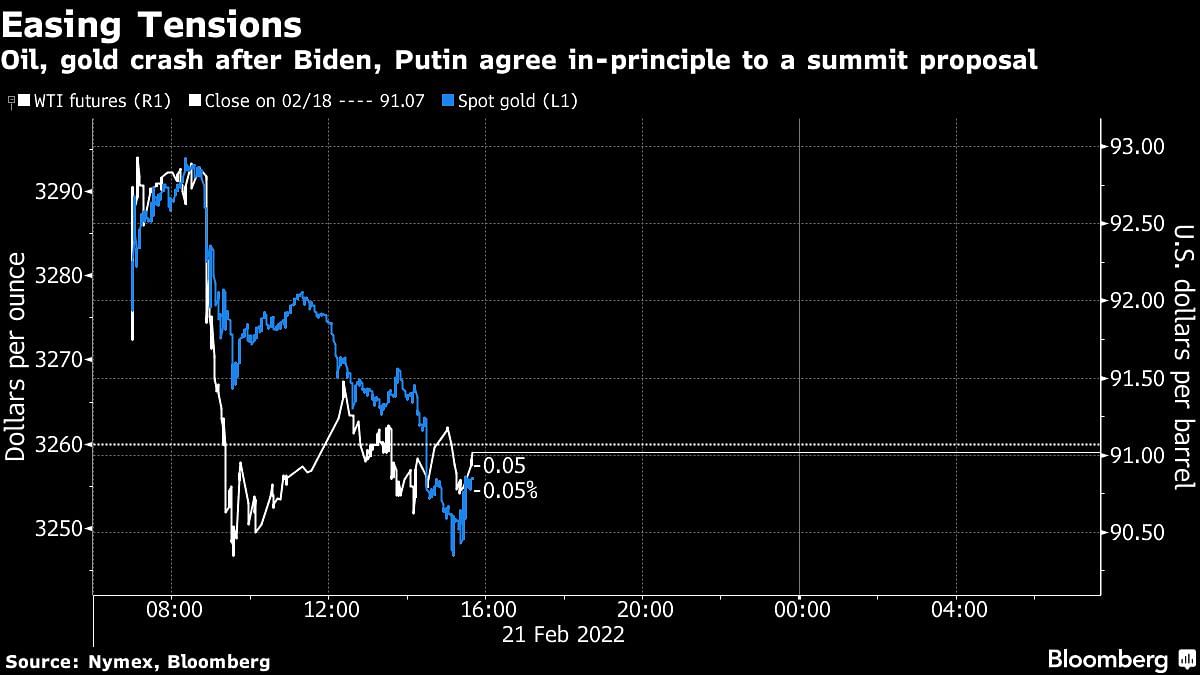

Oil was whipsawed along with gold after France said that the U.S. and Russian presidents agreed to a summit meeting over Ukraine.

West Texas Intermediate sank as much as 0.8%, reversing an early gain, after Joe Biden and Vladimir Putin agreed to the “principle” of a summit proposed by French President Emmanuel Macron, according to statements from the White House and the Elysee. There was no immediate confirmation from the Kremlin.

Earlier, crude traded higher as the week’s trading began after the U.S. told allies any Russian invasion would potentially see it target cities beyond the capital, Kyiv. Moscow, which has repeatedly denied it plans an invasion, said over the weekend that its forces would remain in Belarus indefinitely.

Global commodity markets have been in thrall to the prolonged standoff over Ukraine, which comes at a time of already robust demand, surging prices and concern over fast-depleting inventories. Raw materials are trading close to a record, boosting inflation and complicating the task for central banks as they seek to tame the pace of price gains without derailing the recovery.

“The oil market continues to be whipsawed by Russia-Ukraine developments,” said Warren Patterson, head of commodities strategy at ING Groep NV. “A proposed summit does offer some relief to the market, as it suggests that both sides are still possibly open to dialog.”

Macron will prepare talks between Biden and Putin on “security and strategic stability in Europe,” the French government said, with the timing and format to be determined. Biden accepted the meeting on the condition an “invasion hasn’t happened,” White House Press Secretary Jen Psaki said in a statement.

Any attack on Ukraine from multiple locations could essentially fence the country in, potentially upending commodity markets as regional flows are disrupted and possibly targeted by Western sanctions. Traders are also tracking wheat, which both Ukraine and Russia export, as well as aluminum and nickel.

Oil investors, meanwhile, were also following negotiations to rekindle Iran’s 2015 nuclear agreement, which remain bogged down. Germany’s chancellor warned that it’s now or never to save the accord, which could usher in a return to the world market of official oil supplies from the Persian Gulf nation.

“Geopolitics continues to hog the limelight and will likely influence the direction of commodity markets,” said Howie Lee, an economist at Oversea-Chinese Banking Corp. “Volatility is here to stay for a while.”

Still, underlying bullishness about crude remains. Oil could be set for a “prolonged period” above $100 a barrel this year given world demand is poised to expand to a record, according to Vitol Group Chief Executive Officer Russell Hardy. The head of the world’s largest independent oil trader told Bloomberg Television that the market will get tighter.

In a signal of the crude market’s bullishness, nearby contracts for WTI and Brent are commanding significant premiums over those further out, indicating that traders are clamoring for barrels right now. In Asia, refiners are seeking to ramp up their run rates to benefit from healthy margins. –Bloomberg

Also read: Hinduja Global Solutions wins ‘biggest ever’ public sector contract for health services in UK