Last week, the UK Cabinet Office released its first ever Chronic Risks Analysis: a comprehensive risk forecast for UK businesses and policy leaders. The systemic risks it identified span security, technology and, notably, geopolitics. Within the report, for the first time, a major G7 economy has explicitly told its business and policy community that international instability and the fracturing of the “old international order” are risks that all – not just large – companies must now actively plan for.

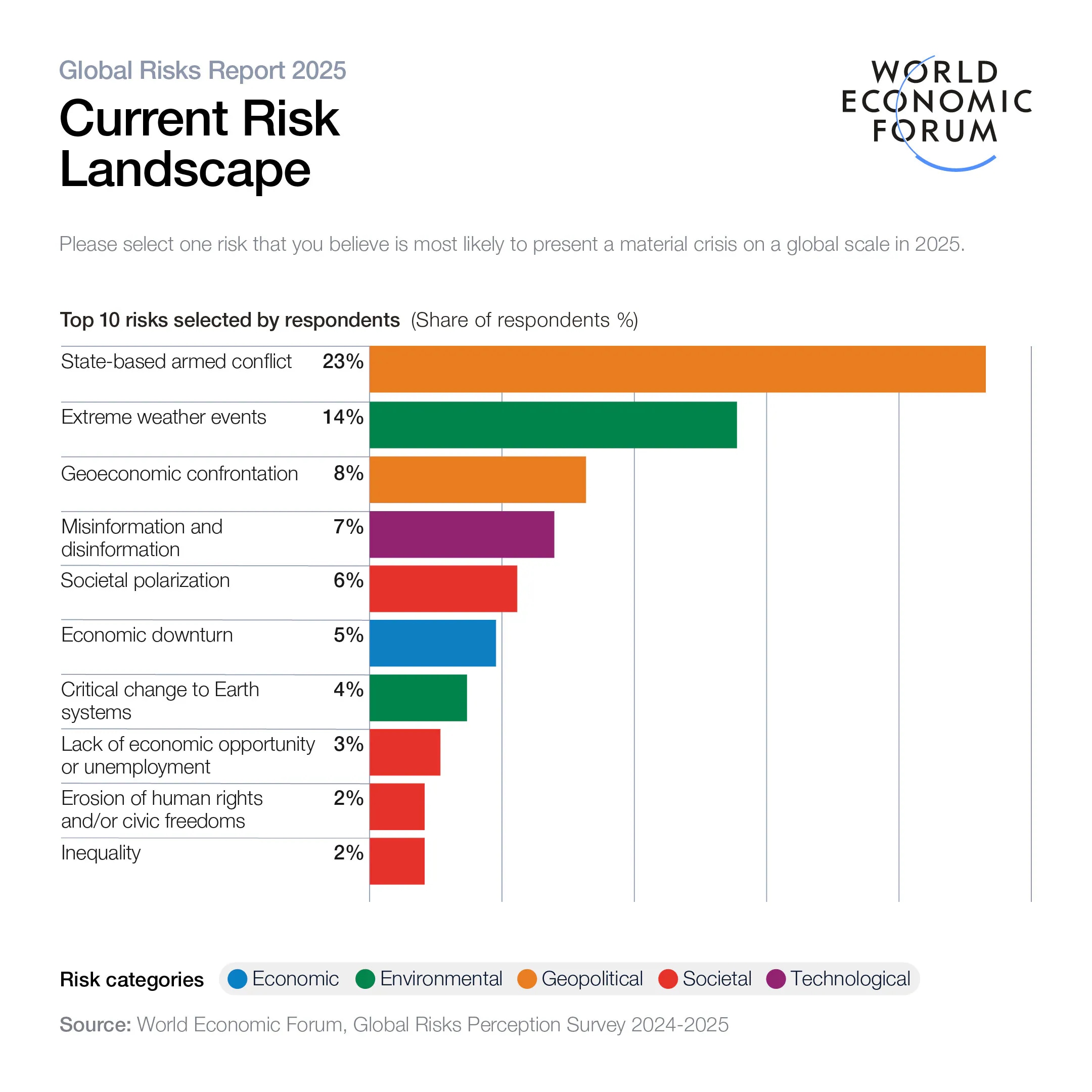

This unprecedented guidance aligns with the World Economic Forum’s own Global Risks Report. The 20th edition revealed a leadership community concerned by an increasingly fractured global landscape, where escalating geopolitical, environmental, societal and technological challenges threatened stability and progress. Its 2025 launch has proven prescient, with the year already seeing an escalation on a number of geopolitical fronts – trade wars, cyber conflict and even kinetic strikes.

When both governments and international institutions are explicitly warning businesses about geopolitical risks, traditional corporate approaches to navigating international relations are no longer sufficient. The solution isn’t merely better government relations or enhanced risk management; it’s the emergence of an entirely new C-suite role: the Chief Geopolitical Officer (CGO).

A shifting paradigm for a geopolitically charged era

The old paradigm of risk management operated on a foundational assumption: a stable, rules-based international system where business could operate within predictable and investible frameworks. However, both the Geopolitical Risk with Trade (GPRT) index has surged by approximately 30% from 2020 to 2024 compared to the previous two decades, and the Global Supply Chain Pressure Index (GSCPI) has nearly tripled during the same period.

Consequently, Chief Risk Officers focused on financial and operational issues, and government affairs departments handling compliance and lobbying, are being outpaced by today’s geopolitically charged environment. These risks span the spectrum, from policy fragmentation and digital threats to financial warfare. Issues once peripheral to business strategy now pose major financial, competitive and existential risks including:

- Regulatory divergence. Conflicting national policies create impossible compliance matrices: TikTok faces forced divestiture in the US while operating freely in Europe, forcing ByteDance to fragment its global operations.

- Military action. Foreign companies lost over $170 billion exiting Russia, including one of the biggest single write-offs in corporate history when British Petroleum (BP) wrote-off $25.5 billion, following the invasion of Ukraine in February 2022.

- Cybersecurity. Digital safe havens are a symptom of staling international cooperation; enabling online gangs to target and extort businesses, causing severe financial distress and, in some cases, insolvency, and even have forced governments like Costa Rica to declare National Emergencies.

- Economic conflict. Sanctions, tariffs and export controls have become routine tools and can be extremely costly to individual companies. US sanctions are estimated to have cost Huawei $30 billion annually in smartphone losses alone.

CGOs must consider an escalating range of global risks.Image: World Economic Forum

Geopolitical early adopters

Restructuring in the light of geopolitical upheaval is a corporate trend gathering pace. McKinsey, Russell Reynolds and others report that leading companies are appointing senior government affairs roles, setting up geopolitical intelligence units and, in a post-Trump election bump among Fortune 500 companies, hiring executives directly for their diplomatic and geopolitical expertise.

While the CGO title is new and rare, the function isn’t. Meta’s Vice President of Global Affairs – held until recently by former British Deputy Prime Minister Nick Clegg – is a role that has existed for over 10 years in the company. His experience was sought as the tech giant needed to navigate the intricate web of EU privacy regulations, US content moderation demands, and other challenges of entering complex markets.

This is a pattern seen with other specialized executive roles: the Chief Sustainability Officer (CSO) emerged as environmental concerns became material business risks, while the Chief Information Security Officer (CISO) evolved from IT departments as cyberthreats reached boardroom priority. Like these predecessors, the CGO represents the elevation of what was once a peripheral concern to an existential business imperative requiring dedicated C-suite leadership.

The CGO is not an elevated government affairs director; it is a strategic position integrating sophisticated geopolitical intelligence directly into core business decision-making. This role transcends traditional lobbying, focusing instead on proactive navigation of the global political landscape, including:

- Intelligence and anticipation. Monitoring global political developments and developing scenario-planning to anticipate impacts on operations, supply chains, market access and strategic partnerships – from economic disputes to regional conflicts.

- Stakeholder navigation. Managing complex relationships with diverse governments, regulatory bodies and international organizations with conflicting agendas, while integrating geopolitical risk assessment into market planning and trade policy decisions.

- Crisis response. Providing rapid, informed responses to unforeseen geopolitical events affecting operations, supply chains or reputation, ensuring organizational agility in a volatile environment.

Implementing the CGO role

It is not simply about navigating risk, but also maximizing opportunity – the upside can be very real. Positioning for geopolitical change can capture shifting trade corridors, new areas of organic growth, or opportunities to realign global operations to improve cost or capital efficiency.

For example, while other Western car manufacturers found themselves shut out of China, Tesla’s Gigafactory Shanghai became their highest-capacity vehicle production facility worldwide, accounting for over 40% of their global deliveries. Similarly, Apple’s diversification of its supply chain to India enabled a 50% year-over-year increase in iPhone production and billions in new revenue.

For companies ready to proactively address geopolitical risk, a structured framework is essential:

- 1. Audit current geopolitical exposure. Begin by conducting a comprehensive internal audit. This involves meticulously mapping all operations, supply chains and revenue streams across identified geopolitical risk zones. Simultaneously, identify all regulatory dependencies and compliance requirements across various jurisdictions. Finally, assess current stakeholder relationships, identify potential conflicts of interest, and pinpoint areas of vulnerability.

- 2. Build geopolitical intelligence capabilities. Establishing robust intelligence capabilities is crucial. Form cross-functional teams that can effectively link geopolitical analysis to specific business functions, from R&D to sales. Develop sophisticated scenario-planning frameworks and stress-testing protocols to prepare for various geopolitical futures. Crucially, integrate geopolitical risk assessment into existing business continuity-planning.

- 3. Elevate geopolitical risk to strategic level. The final step is to embed geopolitical risk at the highest levels of the organization. This may involve expanding existing government affairs roles or, more effectively, creating a dedicated senior position. Crucially, the CGO must operate as a central node, fostering seamless collaboration with other C-suite members, ensuring a holistic approach to risk management and business planning.

As the world becomes increasingly multipolar and fragmented, this role will transition from a novel concept to an essential component of the C-suite. Companies that proactively integrate sophisticated geopolitical intelligence into their strategic DNA can not only survive but thrive. In an era where a single calculation can impact decades of value creation or lead to decades of growth, the Chief Geopolitical Officer will not be a luxury – but a necessity.

This article is republished from The World Economic Forum under a Creative Commons license. Read the original article.