Washington: President Joe Biden said the U.S. will ban imports of Russian fossil fuels including oil, a major escalation of Western efforts to hobble Russia’s economy that will further strain global crude markets.

“We’re banning all imports of Russian oil and gas and energy,” Biden said Tuesday at the White House. “We will not be part of subsidizing Putin’s war.”

The U.S. move will be matched in part by the U.K., which will announce a ban on Russian oil imports on Tuesday, though it will continue to allow natural gas and coal from the country. Other European nations that rely more heavily on Russian fuels will not participate. The scope of Biden’s action was not immediately clear, including exceptions and the impact on shipments already in transit.

Biden’s move is a significant step in his sanctions campaign against Russia after its invasion of Ukraine. While so-called self-sanctioning by the oil industry has limited some purchases of Russian barrels, an outright U.S. ban would further weigh on the market and increase volatility.

Biden was already grappling with political fallout from surging gasoline prices even before the invasion. At an average of $4.173 per gallon, the auto club AAA says that pump prices have never been higher according to its records, without adjusting for inflation.

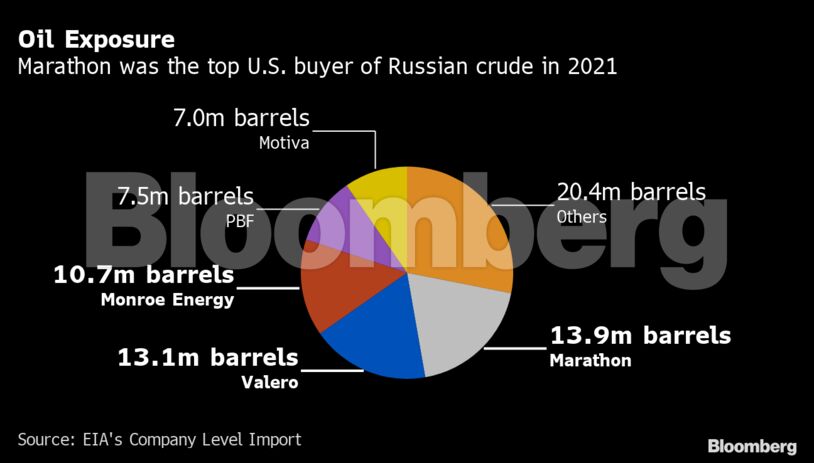

Russian oil made up about 3% of all the crude shipments that arrived in the U.S. last year, amounting to over 600,000 barrels a day, U.S. Energy Information Administration data show.

When other petroleum products are included, such as unfinished fuel oil that can be used to produce gasoline and diesel, Russia accounted for about 8% of 2021 oil imports, though those shipments have also trended lower in recent months. U.S. imports of Russian crude in 2022 have dropped to the slowest annual pace since 2017, according to the intelligence firm Kpler.

Biden acted as Congress was about to move on its own. Legislation to ban Russian crude imports gained traction rapidly among both Republicans and Democrats on Capitol Hill, with congressional staff honing text over the weekend and preparing for a House floor vote as soon as Wednesday.

In moving first on Tuesday, Biden can claim symbolic credit for the measure. But he also could end up shouldering blame for soaring fuel prices that will likely follow.

After Bloomberg News reported Tuesday that the move was imminent, the U.S. oil benchmark extended gains, rising 7.5% to $128.38 at 10:45 a.m. in New York. The prospect of an oil import ban is helping drive crude to its highest levels since 2008.

Europe, by comparison, imports about 4 million barrels per day of Russian crude and refined products, according to Eurostat data. Russia was the source of 27% of Europe’s crude oil imports in 2019, according to the European Commission.

Canada’s government announced last month that it intended to ban all crude oil imports from Russia, but the move was largely symbolic. The country hasn’t imported any since 2019.

House Speaker Nancy Pelosi told lawmakers Tuesday that House Democrats still plan to move ahead with legislation. She previously said they were “exploring strong legislation” that would ban the import of Russian oil and energy products among other steps to isolate Russia from the global economy.

Pressure to act increased increased after President Volodymyr Zelenskiy asked lawmakers to ban the import of Russian oil during a call on Saturday.

Biden administration officials on Monday asked Pelosi to hold off amid concern that it was important politically for the White House to move first. The administrative approach also gives Biden more flexibility to adjust import controls later if tensions ease or prices rise precipitously.

In a sign that the U.S. is trying to round up other sources of energy, two senior U.S. officials met over the weekend with members of Venezuelan President Nicolas Maduro’s government in Caracas to discuss global oil supplies and the country’s ties to Russia, according to people familiar with the matter. The Biden administration is weighing a temporary waiver of sanctions against the country’s oil industry to allow it to increase production and sell more to on the international market, two of the people said. –Bloomberg