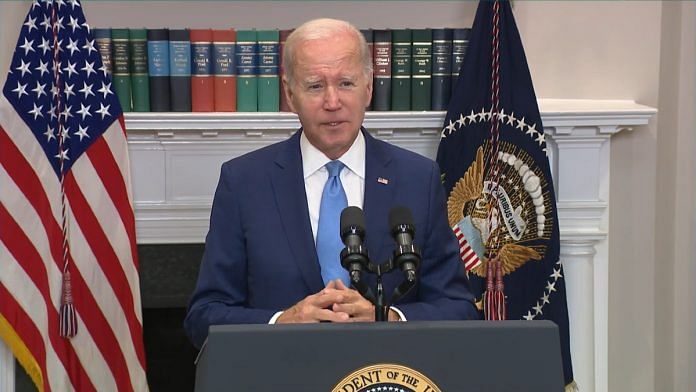

New Delhi: US President Joe Biden will be returning to Washington D.C. after the G7 Summit in Japan this weekend, for crunch talks on the US debt ceiling. He has ($)31.4 trillion reasons to, as his country heads towards a historic default of its debt obligations.

Biden also called off his trip to Australia, after which the Quad Summit scheduled for 24 May in Sydney, which Prime Minister Narendra Modi was to attend, was cancelled.

On 19 January this year, US Treasury Secretary Janet Yellen informed Speaker of the House of Representatives Kevin McCarthy that the treasury had begun using “extraordinary measures” as the US hit its statutory $31.4 trillion debt limit. Without Congress raising, or suspending the debt limit, the US would default on its debt obligations. A US default could potentially break the financial market and lead to another recession, comparable to the 2008 global financial crisis.

The debt ceiling crisis came to a head this week as Yellen highlighted that the treasury will “likely no longer be able to be able to satisfy all of the government’s obligations if Congress has not acted to raise or suspend the debt limit by early June, and potentially as early as June 1,” in a follow-up letter to Speaker McCarthy.

The White House has been clear in its stance that President Biden would only sign into law an “unconditional” rise to the debt limit. Senate Majority Leader and Democrat Chuck Schumer has echoed the thoughts of the President, calling for “Democrats and Republicans to come together….to pass a clean bill and ensure America continues to pay its bills on time”.

ThePrint explains the ongoing debt ceiling crisis in the US, and its economic ramifications.

Also Read: With First Republic Bank, US sees 2nd major banking collapse in 2 months. Fed rate hikes to blame

What is the debt ceiling?

The debt ceiling or debt limit is “the total amount of money that the United States government is authorised to borrow to meet its existing legal obligations, including social security and medicare benefits, military salaries, interest on the national debt, tax refunds and other payments”, according to the US treasury website.

The debt limit allows for the US government to fund existing legal commitments made by the Congress (House of Representatives and Senate) and past presidents. It does not permit new spending commitments. Currently, the debt limit is at $31.4 trillion. Failure to increase the debt limit or ‘ceiling’ would lead to the government defaulting on its legal obligations. Since 1960, Congress has voted 78 times to raise the debt ceiling.

To raise the debt limit, both the House of Representatives and the Senate must pass a majority vote. Currently, only the Republican-controlled House of Representatives has passed the Limit, Save, Grow Act of 2023, which has suspended the debt limit till 31 March 2024 or $1.5 trillion, whichever occurs first.

In essence, the House has raised the debt limit to $32.9 trillion. In exchange for raising the debt limit, the Limit, Save, Grow Act of 2023 would cut government spending by $1.47 trillion in the next fiscal year (2024) and thereafter institute a 1 per cent spending increase cap.

The White House made it clear in April that the bill passed by the House “has no chance of becoming law”.

Limit, Save, Grow Act

The Congressional Budget Office (CBO) estimates that the budgetary deficits as a result of the ‘Limit, Save, Grow Act of 2023’ would reduce by about $4.8 trillion in the next decade (2023-2033).

This House bill would curtail President Biden’s agenda, including prohibiting the cancellation of student loan debt, repealing changes to energy tax provisions, specifically the new tax preferences for clean energy, electric and alternative fuel vehicles, and decrease outlays for the Internal Revenue Service over the next decade.

The bill also introduces new work requirements for Medicaid beneficiaries and expands work requirements for beneficiaries of the key social security schemes such as the Supplemental Nutrition Assistance Program (SNAP) and Temporary Assistance for Needy Families (TANF), which, according to CBO estimates, would reduce federal social spending by $120 billion over the next decade.

Ramifications of a default

This is not the first time the US has been on the precipice of a default. In 2011, during the 112th Congress, the US was two days away from a default. According to US Government Accountability Office estimates, the immediate ramifications from the delay in raising the debt limits in 2011 led to an increase in treasury borrowing costs of about $1.3 billion for the 2011 fiscal year alone.

An analysis by credit analysis and financial risk management firm Moody’s Analytics shows how even a short breach of the debt limit could lead to the US’s unemployment rate hitting a peak of 5 per cent from the existing 3.4%. A longer breach could potentially lead to the loss of 7.8 million jobs, pushing the US unemployment rate to 8 per cent, leading to a deep recession of the US economy. Earlier this month, nearly 150 US business leaders had in an open letter to Biden warned of the potential devastation to the economy if the debt limit is not raised.

The open letter had also highlighted how the delay to raise the debt limit in 2011 resulted in “1.2 million fewer jobs, 0.7 per cent higher unemployment rate and a $180 billion smaller economy than it otherwise would have”.

Closer to home, any default by the US might have an impact on currency exchange rates, explained Biswajit Nag, a professor at the Indian Institute of Foreign Trade.

“The US defaulting might have an impact on the exchange rate, that may have an impact on imports for India. In the short run, it may affect import of fuel that leads to rise in prices and in the medium run exports to the US. If the rupee slides against the dollar, our comparative advantage for exports should go up. However, if the recession in the US deepens, their demand will shrink and in turn India’s exports will get hurt,” he added.

(Edited by Gitanjali Das)

Also Read: ‘Let’s finish the job’ — Joe Biden, 80, announces official bid for second term as US President