New Delhi: The Kingdom of Bhutan has amassed a crypto fortune that is now valued at $1.1 billion, more than a third of the country’s total gross domestic product (GDP), up from just about $3,500 in March 2021.

This surge in the value of the Himalayan nation’s crypto holdings has been driven not only by the rally in the price of Bitcoin, but also by a concerted and targeted policy followed by the government’s investment arm to significantly grow the country’s crypto asset holdings.

Key to this endeavour has been the country’s efforts to increase its crypto mining capabilities and possibly using its abundant hydroelectric power to power these energy-intensive operations.

According to Arkham Intelligence, a data analytics firm, Bhutan’s crypto activities can be traced to a digital wallet held by Druk Holding & Investments (DHI), a wholly government-owned company established in 2007.

Arkham’s database, which has also traced the crypto transactions and holdings of DHI, shows that Bhutan’s cryptocurrency holdings are currently valued at $1.16 billion, with the overwhelming bulk being in Bitcoins ($1.14 billion). The rest is held in several other cryptocurrencies, but mainly Ethereum.

Also Read: Unemotional, faster & more secure — AI has many benefits for crypto, but don’t trust it blindly

A crypto revolution in phases

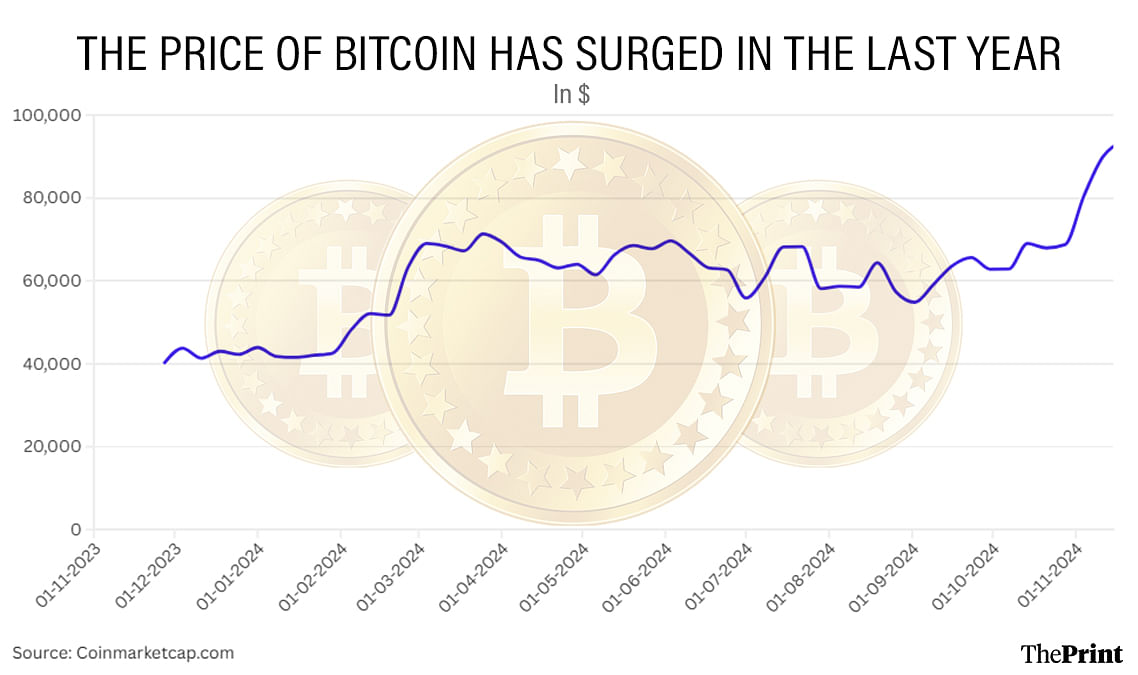

Bhutan has certainly benefited from the recent jump in the price of Bitcoin. The cryptocurrency has seen its price soar to more than $93,000 per Bitcoin, from about $37,000 a year ago—a near-tripling in one year.

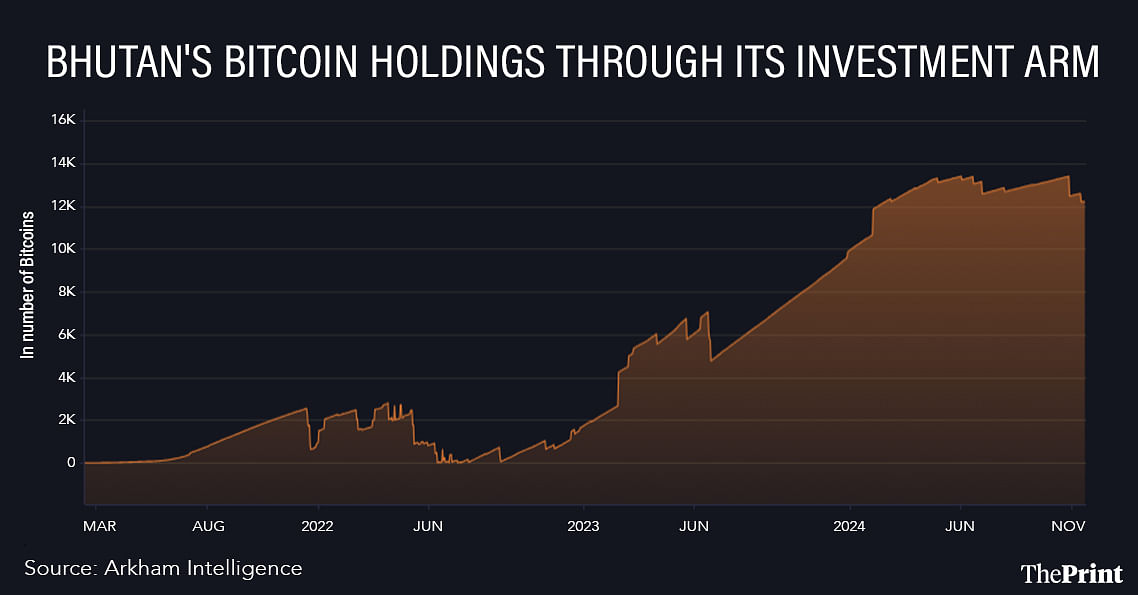

However, Bhutan’s crypto gain has not been a passive activity, either. The country has, in a targeted manner, gone about increasing its Bitcoin holdings. As of 29 October, DHI held 13,000 Bitcoins, up from just 0.074 Bitcoins in March 2021.

One of the rationales for the creation of DHI was to “make strategic investments as the government on its own can’t make these investments outside Bhutan”, according to DHI’s annual report. As the investment arm of the government, DHI has a diversified portfolio—digital assets being a part of that.

The country’s foray into crypto can be divided into two phases.

In phase 1 (2019-2023), when the country’s mining operations were in the nascent stages, Bhutan was buying crypto directly from lenders as shown from the fact that, in 2022, when crypto lenders BlockFi and Celsius went bankrupt, DHI was listed as a customer in court documents.

Mining cryptocurrency is an energy-intensive process. Specialised high-end computers and servers are used to validate transactions on a public ledger called the blockchain. A reward for adding a new “block” onto the blockchain is in the form of a newly-minted crypto token. This way, mining both secures the blockchain network and brings new tokens into circulation.

Mining operations begin in earnest

While Bhutan spent this phase buying cryptocurrencies, it also began investing in its own crypto mining capabilities. Forbes reported that in 2021, Bhutan imported $51 million worth of computer chips, “a significant increase” from $1.1 million in 2020.

“Bhutan’s aspirations with crypto mining became apparent when the Royal Monetary Authority (RMA) of Bhutan introduced the Regulatory Sandbox Framework for Mining Cryptocurrency in January 2019,” Aditya Gowdara Shivamurthy, associate fellow at Observer Research Foundation (ORF) wrote in a May 2024 note along with ORF associate fellow Basu Chandola.

“One of the main objectives for introducing this policy was to assess the viability of crypto mining as an investment in light of the country’s low-cost electricity and climate.”

In another report, Forbes found that Bhutan’s fourth and largest crypto mine at the time was built on a failed government project called “Education City”, a $1 billion effort to create a world class hub for its citizens. The project had the infrastructure in place for a mine—roads, water supply and power lines—which were repurposed for the crypto mine.

“Bhutan was importing mining equipment from other countries,” Shivamurthy told ThePrint. “From 2020-2022, their trade with China increased but in 2024 this has fallen. In phase 2, the government is investing less, but is using its geography and ecosystem to attract investments and generate profits.”

In early 2023, the Bhutan government started partnering with mining companies and entering profit-sharing arrangements.

In May 2023, DHI partnered with Singapore-based Bitdeer Technologies Group to develop green digital asset mining operations in Bhutan. The proposed plan involved raising a fund of up to $500 million for launching a “carbon-free digital asset mining data centre”, among other digital and green energy initiatives.

By July 2023, Bitdeer had completed the construction of a 100 MW data mining centre in the southern town of Gedu.

In September 2023, Bitdeer announced it had mined 217 Bitcoins at the Gedu centre, which contributed to 45 percent of the total Bitcoins mined across all its operations for the month. The company is aiming for a 600 MW capacity in Bhutan by 2025.

The construction of Bhutan’s sixth mining facility, called the Jigmeling data centre, reportedly began during the first quarter of 2024.

Possibly leveraging hydroelectric surpluses

Bhutan is a power surplus nation, largely due to its ample hydroelectric resources. A study conducted by the Department of Energy in Bhutan described hydropower as “the backbone of the Bhutanese economy” and estimated the country’s hydropower potential at 30,000 MW, only 1.6 percent of which has been harnessed so far.

The country’s topography plays a significant part in its status as a hydroelectric powerhouse. According to a World Bank report published in 2021, “steep mountains and abundance of water resources make the projected average cost of hydropower projects lower than for other countries in the region”.

Hydropower contributes close to 30 percent of Bhutan’s GDP, which also includes 70 percent of the country’s hydropower exported to India.

Bhutan’s Ministry of Finance reported that the country exported over 27,000 million units of hydro power to India in 2020. This figure fell to around 16,000 million units in 2023, a 41 percent decline.

An increase in domestic consumption—especially for crypto mining operations—could have played a part in this fall in power exports.

According to the ORF analysts, several of the crypto mining operations in Bhutan are near the country’s hydroelectric projects and “are likely consuming energy from them”.

ThePrint has reached out to both DHI and Bhutan’s Ministry of Finance for comment. This report will be updated when a response is received.

Real wealth at an opportune time

Bhutan isn’t just holding onto the bitcoins they have mined. Taking advantage of the recent spike in Bitcoin prices, the government sold $33.5 million worth of Bitcoins this month through Binance, a popular cryptocurrency exchange.

“The profits they have received from selling off cryptocurrency is being used to cover salary hikes,” Shivamurthy said. “This is being done to mitigate the problem of migration, especially to Australia.”

The Bhutanese reported that a 50 percent hike for public servants was effective from 1 July, 2023.

“It’s the least they could do to stop people from leaving,” Shivamurthy added. “They wanted to offer some kind of incentive and offered hikes for civil services and teachers.”

According to the Asian Development Bank, Bhutan’s fiscal deficit widened from 1.8 percent of GDP in 2020 to 6.7 percent in 2023 and the country’s current account deficit worsened from 13 percent of GDP in 2020 to around 25.2 percent in 2023.

Udit Hinduja is an intern with ThePrint.

(Edited by Nida Fatima Siddiqui)

Also Read: Indians have two attitudes towards cryptocurrency – deep suspicion or blind hero-worship