2023 has been a year of the haves and the have-nots. There has been a mix of assets that have exhibited strong performance while others have been stuck or moving lower. Central banks, including the Federal Reserve, the Bank of England, and the European Central Bank, have continued to embark on a tightening campaign to reduce inflation. The moves by the Federal Reserve have buoyed the dollar (see chart), put downward pressure on some commodities, and generated some headwinds for equity prices. Safe-haven assets such as gold and Bitcoin outperformed during 2023 (see chart). As we move toward Q4, higher rates for longer could impact the value of assets moving forward.

Several factors will likely drive asset prices during Q4. Interest rates, economic growth, and seasonal factors. Market sentiment will impact investors as they determine if the coast is clear and its time to dip their toes in the water.

Central Banks

It appears that many of the major central banks worldwide are getting close to the end of their tightening campaigns. While it is unclear if the Fed, ECB or BoE will end their tightening cycle, announce a neutral stance, or hold off on additional tightening, there is still fear that these banks will move another quarter point. The CME Fed Watch tool shows that the market believes the Fed will keep rates unchanged until July 2024, when the first hint of a rate cut is noticed.

The rise in rates in the United States and around the globe has buoyed treasury yields (see chart). The 10-year U.S. Government yield is close to its highest levels in decades. Higher yields can generate headwinds for both commodities and stock prices.

How do Higher Rates Impact Equity Prices

Higher interest rates can have several effects on equity prices. For example, equities are often valued using the DCF model, which considers the present value of future cash flows. When interest rates rise, the discount rate used in the DCF model increases. This issue means that future cash flows are discounted at a higher rate, resulting in a lower present value for those cash flows. As a result, the intrinsic value of equities may decrease, leading to a potential price decline.

Higher interest rates can increase the cost of borrowing for companies. When companies must finance their operations or invest in growth, higher borrowing costs can reduce profits and earnings potential. This scenario can lead to lower valuations and, consequently, equity prices.

Higher interest rates can also affect investor sentiment. When interest rates rise, fixed-income investments become more attractive than equities since they offer higher returns with less risk. As a result, some investors may shift their allocations from equities to bonds, leading to decreased demand for stocks and potentially lower prices.

How Do Higher Interest Rates Impact the Dollar

Higher interest rates can have both positive and negative impacts on the dollar. On one hand, when a country raises interest rates, it often attracts foreign investors seeking higher investment returns. This increased demand for the country’s currency can strengthen the dollar’s value.

On the other hand, higher interest rates can also have adverse effects on the dollar. When a country raises interest rates, it becomes more expensive for businesses and individuals to borrow money. This situation can slow economic growth and reduce consumer spending, weakening the currency’s value.

Additionally, high interest rates can create a favorable environment for foreign investors to invest in other countries with higher returns, which may divert capital away from the country with the higher interest rates. This scenario can decrease demand for the country’s currency and negatively impact its value.

Oil is Beating to Its Own Drum

The rising dollar has negatively impacted oil prices, but its supply and demand have been the real price drivers. Saudi Arabia has announced that it will likely roll over its output cuts in October, reducing the daily volumes by one million barrels. The move by Saudi Arabia followed an output cut in September to help buoy oil prices that can be traded on a Forex app. Just as Saudia Arabia has been reducing output, China has been importing record volumes, putting upward pressure on prices. According to the U.S. Department of Energy, global oil production will likely be down 200,000 barrels daily in Q4 2023. While the decline in output is likely to buoy prices as consumption continues to remain robust, the EIA believes prices will begin to ease in 2024. The Energy Information sees that liquid fuel consumption in the United States will rise. In its latest Weekly Petroleum Status report, the EIA reports that consumption is up by 6.6%, with most of the gains in gasoline.

Do Higher Gasoline Prices Act as a Tax?

While higher gasoline prices can sometimes have a similar effect as a tax, they are not precisely the same. Governments impose taxes to raise revenue, while gasoline prices are determined by market forces such as supply and demand. However, when gasoline prices rise, consumers pay more at the pump, which can feel like an additional cost similar to a tax. In some cases, governments may also impose other taxes on gasoline, which further contributes to the price increase. So, while it’s not a direct tax, higher gasoline prices can impact consumers’ wallets.

Higher gasoline prices can impact discretionary spending, but the extent of the impact can vary depending on several factors. Generally, when gasoline prices rise, individuals may need to allocate more of their budget toward fuel expenses, reducing the available funds for discretionary spending. This scenario could affect spending on non-essential items such as dining out, entertainment, or luxury purchases. However, the effect may differ among individuals based on their income levels, commuting needs, and priorities. Some individuals may reduce their discretionary spending to compensate for increased fuel costs. In contrast, others may look for alternative transportation options or adjust their overall budget to accommodate the higher expenses.

What Does Seasonality Say About the Balance of 2023

Seasonality might impact the balance of 2023 and the direction of major asset classes. Price seasonality refers to the regular and predictable prices of goods or services throughout the year. Certain products or industries often experience price fluctuations based on different factors such as supply and demand dynamics, weather conditions, cultural events, or holidays. For example, fireworks prices tend to increase around the Fourth of July in the United States, and winter clothing prices usually go up as the colder months approach. Understanding price seasonality can help investors plan their investment strategies and anticipate changes in consumer behavior.

Traders often analyze historical data to identify seasonal patterns in specific markets or individual securities. For example, the retail industry may experience increased sales during the holiday season, which can impact the stock prices of retail companies. Likewise, energy prices may be influenced by seasonal demand for heating or cooling.

Considering seasonality, traders can identify opportunities to enter or exit positions based on anticipated price movements. Some traders may use seasonal strategies involving buying and selling securities during specific periods when historical data suggests a higher probability of positive returns.

However, it’s worth noting that while seasonality can be a helpful factor in developing trading strategies, it is just one of many factors to consider. Traders typically combine seasonality with other technical and fundamental analysis techniques to make more informed trading decisions. Market conditions can change, and historical patterns may not always repeat, so it’s essential to use seasonality as part of a broader approach to trading.

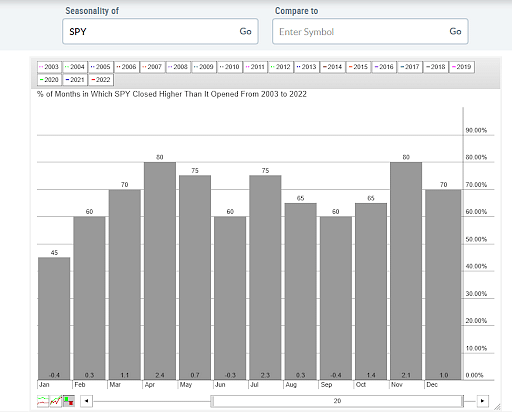

Stocks generally rise in Q4 (see chart). During the past 20 years, the Benchmark S&P 500 index has increased by an average of 1.5% during the last three months, with an average of 75%. While the past is not always reflected in the future, the seasonal tendency of stock prices shows that some forces usually drive stock prices higher. Commodities like oil are generally flat in q4 (see chart), and the dollar is also mixed (see chart).

What is Market Sentiment?

Market sentiment refers to the overall attitude or feeling of market participants towards a particular financial market or asset. It reflects the collective emotions and opinions of investors, traders, and market analysts. Various factors, including economic indicators, geopolitical events, news releases, and investor behavior, can influence market sentiment.

Market sentiment is often categorized as bullish, bearish, or neutral. A bullish sentiment indicates optimism and positive expectations for rising prices in the market. Conversely, a bearish sentiment reflects pessimism and expectations of falling prices. A neutral view suggests a lack of firm conviction in either direction.

Traders and investors pay attention to market sentiment as it can help gauge market expectations and potentially identify market turning points. It is typically analyzed through various methods, including sentiment surveys, news sentiment analysis, social media sentiment analysis, and volume analysis.

The Bottom Line

The upshot is that much bad news has been incorporated into asset prices. Higher rates have not only reduced inflation but also generated headwinds for growth. In the United States, the outlook is for the Fed to remain on hold but not create an accommodative stance in q4. This scenario should keep the dollar buoyed and could generate headwinds for riskier assets. Oil prices are also rising, creating an involuntary tax and potentially reducing discretionary spending. The seasonal factors show that stock prices will likely increase while the dollar and commodities will likely remain unchanged.