Counterintuitive as it seems, the Covid-19 pandemic was a boon for Indian tech start-ups. Specifically, there were 11 start-up initial public offerings just in the last year, compared to four between 2010 and 2020, according to a recent report by Orios Venture Partners. This is partly because low interest rates drove excess liquidity in the financial markets. This, in turn, lowered the cost of availing credit for tech start-ups to finance their growth. Such a favourable interest-rate paradigm is likely to shift with a rise in inflation. Consumer Price Index inflation is 6.18 per cent for 2020-21, as against 4.76 per cent in 2019-20.

Will there be a consequent market liquidity crunch and how soon? How will it change the tech start-up landscape? What are the other key concerns that worry tech-start-ups and how can policymakers address them, if at all? These are some important questions that have far-reaching consequences.

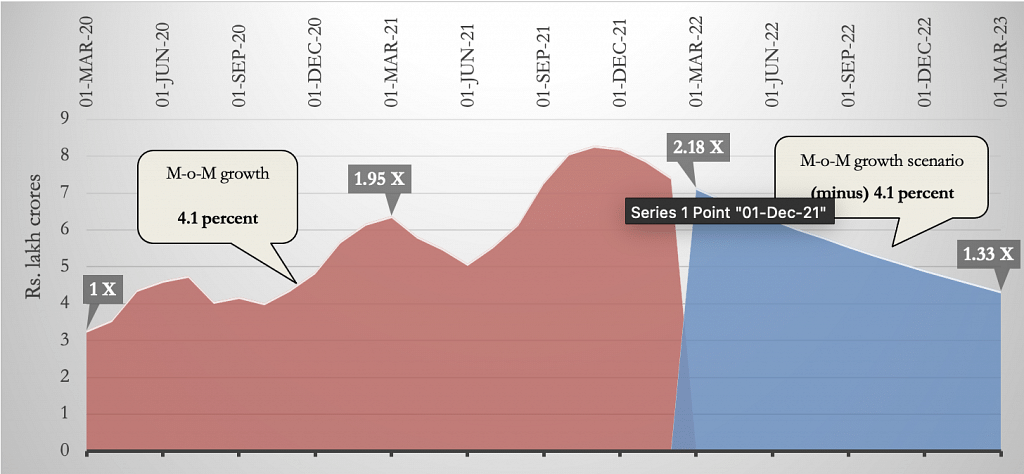

Since mid-2019, India has had surplus liquidity that only grew over the course of the pandemic due to the Reserve Bank of India’s (RBI) actions. Outstanding liquidity injection in the economy increased by nearly 4.1 per cent month-on-month over the last two years, which led to excess outstanding liquidity of Rs 7.44 lakh crore (on a three-month moving average basis). Such growth in liquidity is unprecedented. As a plausible future scenario, it may be worthwhile to consider if the RBI withdraws liquidity at the same rate. Over Rs 4.3 lakh crore excess liquidity will remain in the economy — nearly 33 per cent higher than that in March 2020.

Figure 1: Net Outstanding Liquidity Injection by the RBI

In any case, monetary tightening has a lag of several quarters before it shows on-ground impact. The RBI’s report on the Operating Procedure of Monetary Policy pegs this lag at three to four quarters. Therefore, a relaxed liquidity environment is expected till the end of the current fiscal.

Also Read: BCIC launches startup incubation centre in Bengaluru

Three key battles

Excess liquidity ensures that many projects will see the light of the day and several others will have a cushion to grow and prosper. Success stories are aplenty for tech start-ups in the past year. But, at a micro-level, excess liquidity is a double-edged sword. It will incentivise further expansion of the start-up ecosystem. As a consequence, competition for finances will intensify. We highlight three key challenges related to this.

First, an idea that can actually be executed is the foundation of any sustainable start-up. But this requires the market to be ready for it. For example, PepperTap, an online marketplace launched in 2014 to facilitate grocery orders from nearby stores. The start-up raised $51.2 million over four rounds, but had to pull its shutters down in 2016. While it was a lean zero-inventory operating model, it depended on ecosystem readiness. Unlike today, when hyperlocal start-ups are the norm, many grocery stores didn’t have digital inventories then. This indicates the value of product-market fit.

Second, start-ups have several distinct growth stages, and each requires different investment and business plans. Therefore, matching with the right investor at the right stage is critical. The widely covered story of Purple Squirrel is a prime example. Incubated at IIT-Bombay in 2013, its aim was to impart practical knowledge to students through curriculum-based industrial visits. It raised Rs 16 crore until 2016. Subsequently, it did not find the right investors and, therefore, had to shut down. There are hundreds of such examples that don’t get the same amount of press, and that are cautionary tales.

Finally, start-ups need a constant injection of investments to expand as they grow. Investors, on the other hand, look to diversify their positions to hedge against market risks. The mismatch between these two objectives implies that even those start-ups that were able to attract investors in their infancy may fail. The search for other investors is costly and difficult because new investors may not be sure of how their funds will be used to protect their interests vis-à-vis those of earlier or other investors.

Also Read: Paytm’s rising buy ratings signal return of confidence after IPO disaster

Policy levers

StartupIndia, as a Ministry of Commerce initiative, segregates almost 1,88,000 start-ups into different industries and stages of growth. Additionally, there are 788 incubators, 171 accelerators and 761 mentors connected to the initiative. A simple arithmetic suggests nearly 109 start-ups per incubator/accelerator/mentor.

Assuming the previous year’s record investments of $ 36 billion into this ecosystem remain intact for the current year, the average requisite investment injection per incubator/accelerator/mentor would be nearly $ 21 million. Conversely, an average start-up would bag nearly $ 0.19 million. Since the average deal size in the previous year was $32.9 million, this implies that only one out of 173 start-up will be able to tap this pool. This leaves too much to be desired to meet the financial needs of start-ups.

The Narendra Modi government, therefore, should explore a two-fold plan to support start-ups. It should facilitate an efficient pairing between start-ups and investors within the ambit of the Startup India initiative. An employment exchange-type template could be replicated. Additionally, it should examine the possibility of foreign listing by companies incorporated in India. This will require changes to the existing Securities and Exchange Board of India (SEBI), the RBI and tax regulations, as per the SEBI’s Expert Committee Report. Notably, the premium on foreign listings can be as high as 25 per cent of the entity value. It makes foreign listing an attractive proposition particularly for tech-oriented start-ups that may have a better product-market fit abroad. Should the government make necessary regulatory changes, it will structurally ease the financial requirements of start-ups and make them attractive propositions for foreign investors.

The author is lead economist at Koan Advisory Group, a technology policy consulting firm.

This article is part of ThePrint-Koan Advisory series that analyses emerging policies, laws and regulations in India’s technology sector. Read all the articles here.

(Edited by Pranay Roy)