Electoral bonds is the name of the game for political parties that seek the pecuniary route to political power. Introduced in 2018, the electoral bond is a unique funding scheme for political parties registered under Section 29A of the Representation of the People Act and which have secured at least one per cent of the votes polled in a recent election. Such parties were allotted a verified KYC-compliant account by the State Bank of India. With EBs valued at Rs 1,000 to Rs one crore, there was no upper limit to the EB that a person or a company could purchase to fund a political party.

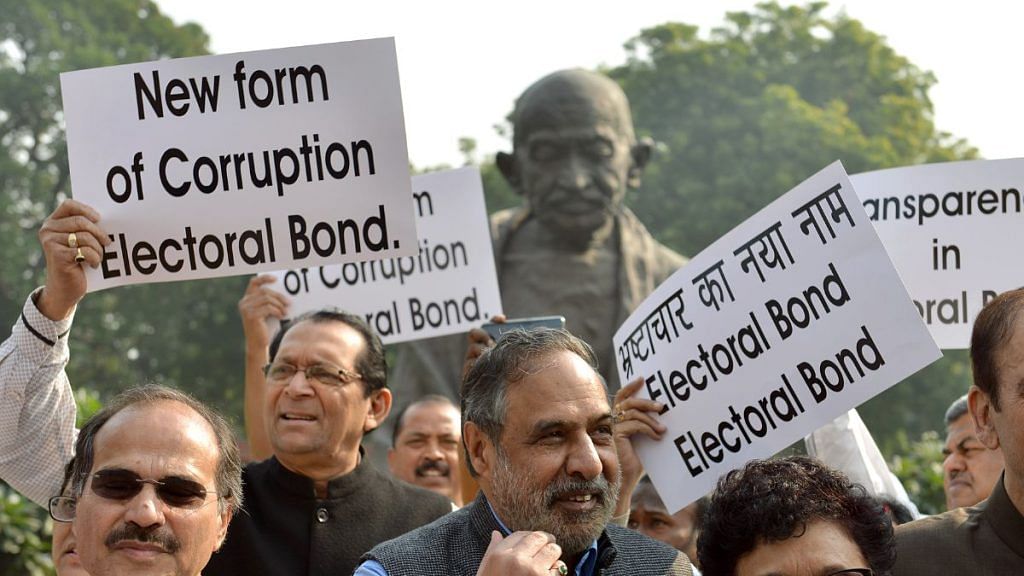

The Supreme Court has not only found the entire process of collecting funds through electoral bonds full of flaws but even suggested that the process suffers from serious deficiencies. The apex court is not wrong in its observations, several citizens and civil society organisations may have felt the same way but were probably unable to find the right platform to air their apprehensions. But the government’s intention of getting rid of dirty money in politics should also be appreciated as a laudable move.

The government suggested two important corrections to the process such as the substitution of the State Bank of India (SBI) with the Reserve Bank of India (RBI) as the issuing authority for the bonds and ensuring donor confidentiality by treating breach of confidentiality as a criminal offence. This would have mandated a change in the nature of RBI’s work as political parties are required to open an account with SBI to encash the bonds which is not possible with the RBI.

Not convinced by the arguments of the government, the Supreme Court had asked the SBI to share the list of donors with the Election Commission of India (ECI). On 12 March, in compliance with the Supreme Court’s order, the SBI furnished details of bonds purchased and redeemed between 12th April 2019 to 15th February 2024 to the ECI. The commission made the data public on 14 March, unceremoniously junking the ‘opacity’ argument of the government, thus bringing it and the judiciary on a collision course.

Also read: Electoral bonds ruling cuts down corporate clout in politics. But it’s more complicated than that

Drawbacks to SC decision

The unfortunate part of the judiciary-legislature conflict is that neither of the entities appears to have gone into the necessity of such a scheme or consulted all the stakeholders. The government intended to eliminate the flow of black money (unaccounted money) into the electoral process and facilitate transparency in donations to political parties. The EB route allows corporations and individuals to donate money to any political party through official means without their political affiliation being disclosed. This is all the more important because while taxation policies are decided by the Union government, the corporations are subject to state laws as far as trading and manufacturing are concerned. Disclosure of their political affiliation may lead to victimisation by the state government.

The Supreme Court’s decision may also create a huge taxation and tax assessment issue for corporations and high-net-worth individuals whose accounts may have to be reopened. Under sections 80GGB and 80GGC of the Income Tax Act, all contributions, including through EBs (excluding cash donations) to political parties by corporations and individuals are eligible for deduction of equivalent amounts from taxable income. The EB scheme provides strict rules for purchase, validity, expiry date, encashment, and claim for deduction against taxable income.

The cancellation of the electoral bonds scheme by the apex court poses a serious question of income tax authorities disallowing the rebate and adding donations as taxable income for corporations and individuals. The Central Board of Direct Taxes (CBDT) should come out with a clarification on this account.

The new Parliament may have to amend the relevant laws to grant immunity to all the donors irrespective of the party to which the amount was given. Meanwhile, the tax authorities should also investigate the extent of the use of ‘shell companies’ by corporations and political parties to indulge in corrupt practices.

With the list of donors out in the open, parties and corporations will scramble for cover while they face accusations and counter-accusations. It is unlikely that the BJP alone will face the brickbats, as the Congress, TMC and other regional parties have benefited from the scheme.

Elections and political power have become far beyond the reach of those with meagre means, both in terms of money and muscle power. No ordinary citizen can participate in the electoral process unless he has the backing of a political party flush with funds or the support of a rich corporation. Needless to say, this will highly compromise the independence of such a person in political and policy matters. Hopefully, the next Parliament will rise above narrow political considerations and find a way to clean the murky Augean stable of political funding.

Seshadri Chari is the former editor of ‘Organiser’. He tweets @seshadrichari. Views are personal.

(Edited by Theres Sudeep)