Data on India’s wholesale price index (WPI) and retail or consumer price index (CPI) were released recently for the month of June 2022. Compared to May 2022, there is slight reduction in both wholesale and retail inflation rates at the overall level. For food items, while the retail inflation rate moderated marginally, wholesale inflation levels soared, reaching new peaks in June 2022. We interpret and analyse these numbers.

Overall inflation print

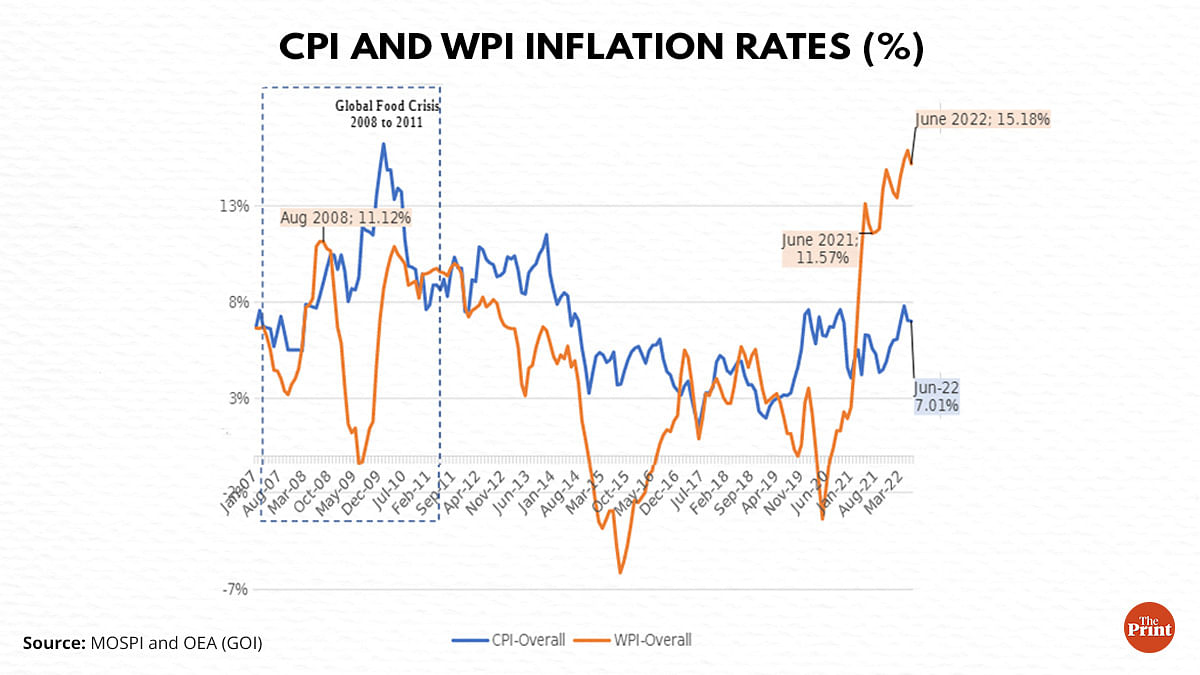

Yearly inflation rates in June 2022 were about 7.01 per cent at the retail level (7.04 per cent in May 2022) and about 15.2 per cent at the wholesale level (was 15.9 per cent in May 2022) (Figure 1).

Three interesting trends, inter alia, emerge from the figure above:

- At wholesale, inflation rates have breached the 2008 global food crisis levels (dotted box in Figure 1). Since April 2022, the country has witnessed the highest levels of wholesale inflation rates since January 2007.

- Wholesale inflation is cumulating: Unlike any time in recent history, India is facing double-digit inflation rates at wholesale level for two consecutive years (since April 2021). In June 2021, wholesale inflation rate was already 12.1 per cent. Inflation rate of 15.2 per cent in June 2022 builds on this higher base.

- Inflation-in-the-pipeline: Usually, rates of inflation at retail levels are higher than at wholesale level. Since March last year, this trend has reversed. The WPI in the economy is rising much faster than the CPI. It appears that the wholesalers are absorbing the price shocks and not passing it down fully. But will they continue to do that or will the burden be passed on to the consumers in near future? This is what we call inflation-in-the-pipeline, which is clearly building-up.

Even the gap between wholesale and retail inflation rates is unprecedented. Between January 2007 and December 2020, wholesale inflation rates trailed the retail rates by a margin of about three per cent on average. However, since March 2021, retail inflation rates trail behind the wholesale inflation rates by about 7.3 per cent on average.

Also read: Agnipath only latest example — why govt is no longer keen on recruiting people permanently

Food inflation: the weak link

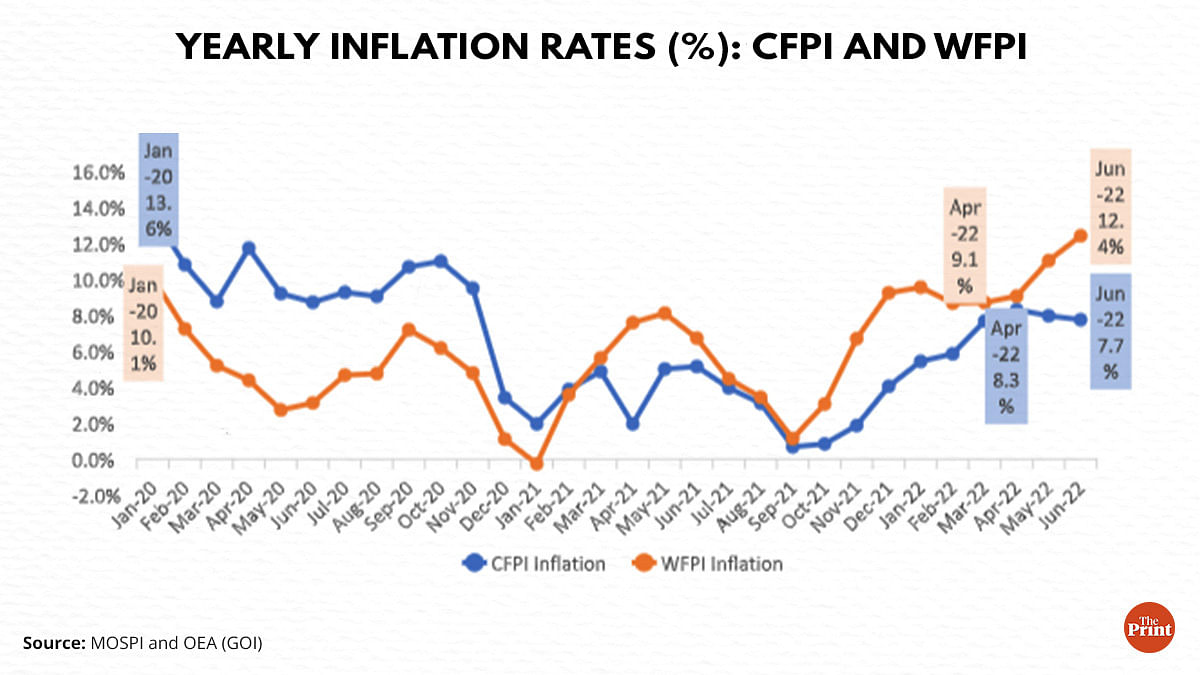

Indian food inflation rates can be read from trends of CPI’s Consumer Food Price Index (CFPI) and WPI’s Wholesale Food Price Index (WFPI). The CFPI averaged 173.8 in June 2022, up about 1 per cent from May, and 7.7 per cent above its level a year earlier. The WFPI averaged 178.4, which was about 1.3 per cent above May 2022 and about 12.4 per cent above June 2021 level. Both the food indices are picking up monthly momentum, with again, wholesale level inflation rates rising much faster than at retail.

Disaggregating the CFPI components, we find that more than half of the inflation in CFPI is due to high inflation in vegetables (30 per cent) (led by tomato and potato), cereals (16 per cent) (mainly wheat), milk products (12 per cent) and oils & fats (10 per cent). There is deflation in eggs and pulses, which has somewhat moderated the increase in CFPI.

Since last month, inflation in edible oils has fallen due to (i) moderation in their global prices (as per World Bank data, between May and June 2022, prices of palm oil fell by 13 per cent, soybean oil by 11 per cent, rapeseed oil by 9.8 per cent and sunflower oil by 9.4 per cent) and (ii) the impact of the government’s aggressive policies of reducing import duties. More recently, the government has even pushed edible oil processors to reduce retail prices of edible oils by up to Rs 10 per kg.

The global impact

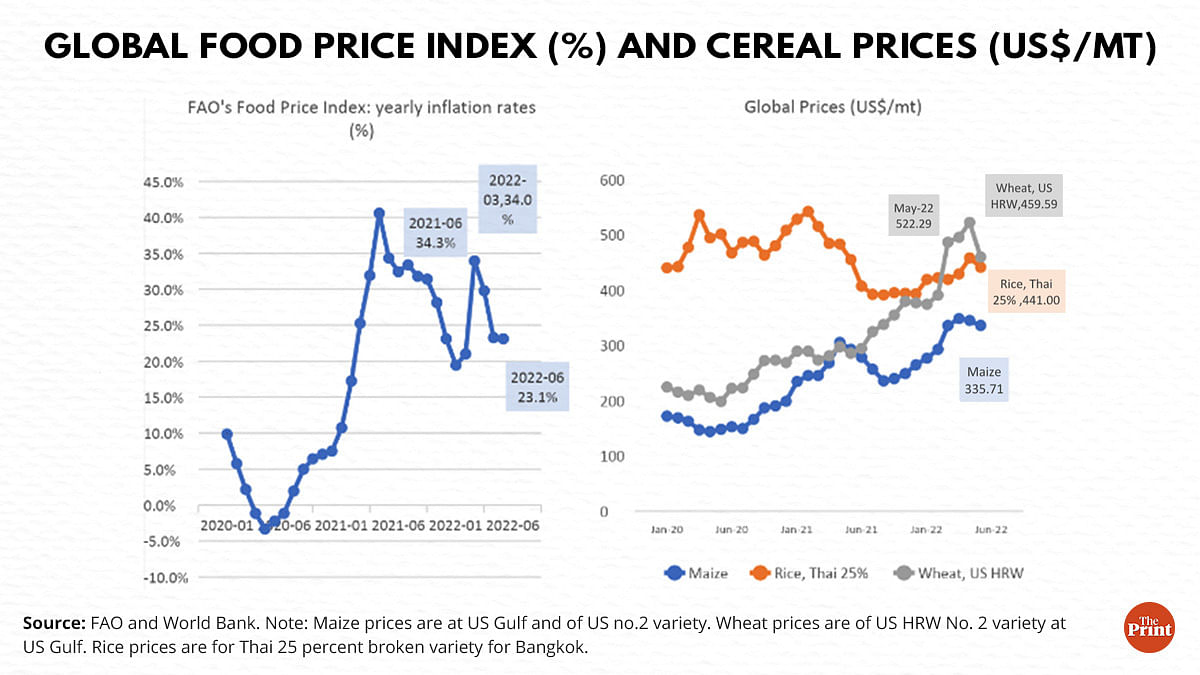

Food and Agriculture Organization’s (FAO) global food price index grew at 23.1 per cent in June 2022 compared to its value last year (see Figure 3). Even though the yearly inflation rates continue to be high and in double-digits, the monthly momentum in the index losing steam for the past three months seems to offer relief. Since April 2022, the index has been falling.

The monthly decline in FAO food index is mainly attributed to a decline in sub-indices of vegetable oils, cereals, and sugar, though indices of meat and dairy have gone up.

Within cereals, as per price data from World Bank (Figure 3), wheat prices, which reached about $522/mt in May 2022, decelerated to about $ 460/mt in June 2022. The prices fell due to seasonal increase in global wheat supplies. Nonetheless, prices stayed higher than last year and wheat showed a yearly inflation of about 61 per cent in June 2022.

Global rice prices continue to be low compared to last year, with an annual inflation of about (-) 3.1 per cent. However, growing global demand for rice, mainly indica and basmati varieties is likely to pull up prices in coming months. FAO’s all-rice price index grew in June 2022 by 1.5 per cent compared to May 2022 and 2.3 per cent compared to June 2021.

Maize prices, on the other hand, have been growing at double-digit rates since October 2020 when its price was about US$ 187/mt. In June 2022, maize traded at about $ 336/mt. It is moderating from its peak of $348/mt in April 2022. Seasonal supplies and prospects of good upcoming crops are pulling down maize prices globally.

What it all means

The slight moderation observed in India’s retail inflation rates is certainly good news. However, the current rates are still very high. Worse, they are high on a higher base from last year. High inflation-in-the-pipeline adds to the worries.

Three key events, inter alia, will determine food inflation in the coming months.

Performance of monsoon

Despite all the progress made over years, about 48 per cent of India’s gross cropped area (GCA) still depends on rains for meeting its irrigation needs (DES data for 2018-19). Kharif is still the main cropping season of the country as only about 42 per cent of the country’s gross cropped area (GCA) takes more than one crop a year. India’s growth of agricultural GDP, its food security and rural incomes still depend, to a great extent, on good monsoon rains.

We are currently near the middle of the four monsoon months of June to September. Till now, we observe that after a patchy start, monsoon rains have recovered. As on 17 July 2022, overall rains are about 13 per cent above average. But, six states, including UP, Bihar, and Jharkhand have deficit rains even now and eleven states, including Gujarat, Telangana and parts of north-central Maharashtra are suffering due to excess rains. There are reports about paddy crops drying up in UP and vegetable and cotton crops damaging due to flooding in Maharashtra and Gujarat. Going forward, therefore, not just monthly averages, but also spatial and geographic spread of these rains have to be closely monitored.

Global inflation, particularly of US

Last week, inflation data for the US was also released. In June 2022, its retail inflation rate averaged about 9.1 per cent. This is the highest inflation rate US has seen in the last 41 years. The EU also revised its 2022 inflation forecast upwards to 6.8 per cent against the target of two per cent. These high rates of inflation affect the Indian economy in several ways. For example, high US inflation rates increase chances of a rate increase by the US Fed. If interest rates do increase in the US, chances of further depreciation of Indian currency become palpable. This depreciation is likely to increase the landed cost of imported commodities like the edible oils and pulses, which are critical to the Indian consumer. Also, a depreciated rupee will make our exports competitive, pushing up opportunities for Indian exporters.

Also read: India is splurging big time on airlines, roads & railways. Let’s just hope it all pays off

Global demand and supply situation

As per FAO, 46 countries, including 33 in Africa, 10 in Asia (including Sri Lanka, Pakistan and Bangladesh), two in Latin America and one in Europe (Ukraine) are already in need or will be needing external food assistance in the coming months. Extreme weather events, civil insecurity, high food prices, and economic downturn are some of the reasons cited by FAO for having pushed these countries to the current verge of food insecurity and crisis. As per IFPRI’s food restriction tracker, 21 countries including India (who banned wheat exports and capped sugar exports) have put bans on food exports.

This combination of (i) rising global prices, (ii) deepening global food crisis, (iii) growing number of countries banning food exports; and (iv) extreme weather behavior, contribute to increasing uncertainty about predicting food inflation in India. As India enters the festival season in the coming months, during which the demand is higher, usually prices tend to face upward pressures. Softening of global prices of edible oils, maize, crude, is good news for the government but uncertainty about Russia’s war on Ukraine, a weakening rupee and changed climate patterns pose stiff challenges to the policy makers.

If Indra dev continues to be kind, food inflation pressures would surely moderate.

Saini is an Agriculture Economist and Director, Khatri is Consultant and Hussain is former Agriculture Secretary, GOI and Director, Arcus Policy Research. Views are personal.

(Edited by Anurag Chaubey)