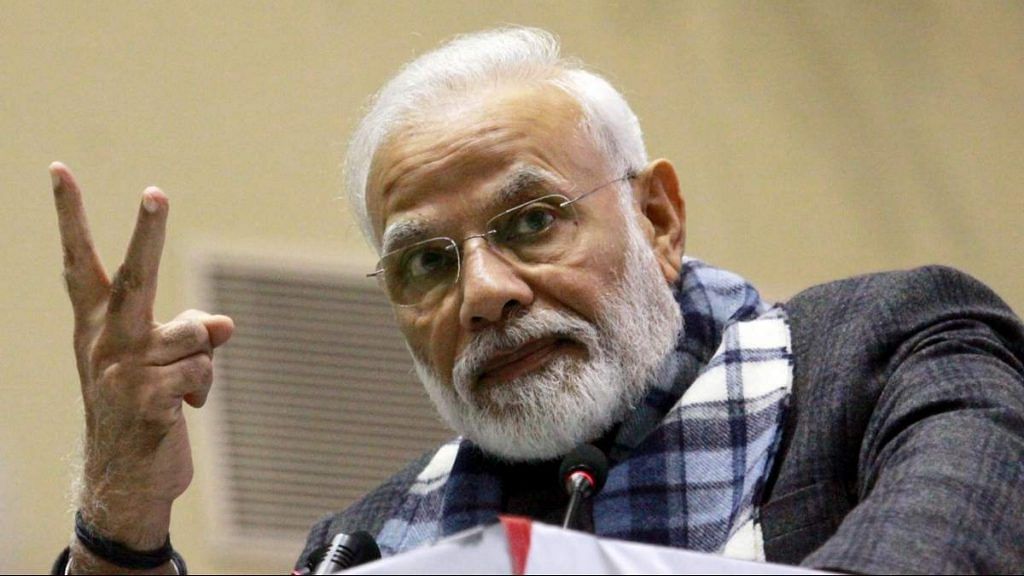

The Indian economy is amidst a slowdown. Both private and government investment is down, and the Narendra Modi government seems likely to miss its fiscal deficit targets. Credit growth is decelerating, credit to industries is shrinking, revenue collections have faltered to hit the lowest level in a decade, and desperation is running high.

On 1 February, the Modi government has its best chance to re-invigorate the Indian economy. While the Budget speech is a less potent tool for policymaking today than it was 20 years ago, it is still the single most significant economic policy statement that the government provides each year. But for good ideas in the Budget to resonate with investors, the “execution-focused” Modi government must show a good track record in enacting previously-announced reforms. Unfortunately, that has not always been the case. There are several implementable reforms that the Modi government has announced in recent years that continue to languish. Given the state of the economy today, it is time the Modi government looks back to itself for inspiration while demonstrating it can get things done.

It must heeds its own advice to attract foreign capital into distressed assets, create fresh credit, meet fiscal deficit targets, and provide a stimulus to India’s economy. These are quick-impact reforms that are already on the government’s agenda and shouldn’t harm austerity efforts.

Also read: 5.5% inflation is transitory, it shouldn’t prevent a fiscal boost in Budget 2020

Attracting foreign capital into distressed assets

As banks prepare for fresh non-performing assets (NPAs) to emerge from loan books this year and investment rates decline, there is an urgent need to attract foreign investment into distressed asset sales. Prime Minister Modi has been India’s most aggressive champion of foreign investment and needs to burnish his credentials.

Already, foreign investors are more enthused than the economy would seem to warrant, with investments in India’s distressed assets. Out of the total merger and acquisition (M&A) deals in India between 2015-19, distressed assets accounted for 70 per cent of the growth in deal value.

The Modi government has increasingly liberalised foreign investment into asset restructuring companies, following which the number of these companies in India rose to 28. Institutional investors, most of which are foreign funds, also increased their security receipts from one per cent to 60 per cent after the government allowed 100 per cent foreign portfolio investment in security receipts.

Some of the challenges that asset restructuring companies encounter are small asset holdings in comparison to NPAs, lack of a developed debt market, and lack of a robust secondary market for security receipts. Access to foreign investors who have experience and expertise in turning around distressed assets can play a major role in battling these challenges.

The Modi government can ensure asset restructuring companies have access by making operational the already incorporated Sashakt India Asset Management Company, which will raise money from foreign investors through an alternate investment fund. The government can also let distressed asset players avail a tax relief if the firm agrees to put some part of its tax proceeds in a long-term infrastructure bond. The debt raised through these bonds can be ploughed back into the government’s infrastructure projects.

Also read: There’s hope for Indian economy if it becomes No. 1 priority of Modi govt instead of CAA

Create fresh credit

The Modi government has carved a niche for itself in the creative use of special purpose vehicles (SPVs). With the credit crunch in the economy, decelerated credit growth, and existing credit gaps in India’s lending system, the government should provide funds to medium-scale enterprises directly through an SPV set up for disbursing loans to the medium sector based on collateralising account receivables, or collateral-free competitive funding.

The government can further develop and expand the algorithmic online sanction system used for ‘PSB Loans In 59 Minutes’ for digital sanctions to borrowers. With public sector bank (PSB) lending declining, this could be an innovative way of directly injecting fresh, healthy credit to growing sectors as India emerges out of the four-balance sheet problem. The Modi government can be even more innovative and catalogue its unused land and securitise it to raise debt, and/or provide guarantees so that PSBs cooperate. Given the flexibility SPVs enjoy, the SPV can also function as a non-banking financial company (NBFC). Such an idea was explored by the Bharatiya Janata Party (BJP) government in Maharashtra.

Meet fiscal deficit targets

Due to the Modi government’s declining revenues and difficulties in meeting fiscal deficit targets, the Centre should stay the course on its strategic asset sales. The focus should be on carrying out clean sales, which involve government divestment, rather than public sector unit (PSU) mergers or PSU buybacks.

The government should quickly complete the announced divestment and privatisation plans, while adding new PSUs to the queue. This will not only supplement the fiscal targets but also ensure that the government is not pouring money into failing and underperforming PSUs, while turning the PSUs into more market competitive and profitable entities.

Also read: PM Modi should make me finance minister, he doesn’t understand economics: Subramanian Swamy

Stimulus to Indian economy

Debt is often known to provide stimulus to a recessing economy. The issuance of government bonds in foreign denominated currency was announced by Finance Minister Nirmala Sitharaman in the 2019-20 Budget speech. However, even with the minister affirming her resolve on sovereign bonds in the wake of criticism, the Modi government never followed through. Foreign denominated debt will provide stimulus, and help attract foreign inflows when domestic demand is low. The foreign currency exchange risk is no longer a glooming threat given India’s low sovereign debt, and the recent surge in India’s foreign exchange reserves.

As the Modi government takes a cue from the US Federal Reserve (Fed) in carrying out “operation twist” for the first time, it should also consider more aggressive Fed-style quantitative easing by purchasing non-government bonds and securities. These credit easing measures can have a positive impact and provide stimulus to a credit-starved and slowing economy.

As the economic slowdown intensifies, and the Modi government is pressed for measures, remembering its own advice and plans can provide quick fixes to the impending troubles as we head into a new year, and decade.

The author is a research associate for the Wadhwani Chair in US-India Policy Studies at the Center for Strategic and International Studies (CSIS), where she specialises in US-India economic ties and Indian federal economic reforms. Views are personal.