Several headlines after the IMF’s annual report on India have been screaming about the national accounts securing a C-grade. However, the IMF’s own assessment of India’s economy is that it “continues to perform well”. “Despite external headwinds, growth is expected to remain robust, supported by favorable domestic conditions,” the Staff Report reads.

The report further records an expansion of GDP to 7.8 per cent, a decline in inflation, controlled food prices, a resilient corporate sector and rising capital buffer. No surprises that the report is indicative of fiscal consolidation.

Cherry-picking certain sweet points and spinning them into a narrative is a special talent of the Opposition alliance, which is being created to destabilise a rising Bharat. It could also be done to denigrate the relations between the IMF and the Indian government, and create a conflict and definitely to create a negative image of Bharat. This opportunity appears to have been exploited because of the tabulation methodology which has been inserted in the report and is inconsistent with the conclusions made in the study.

The IMF has been depicted as a global school headmaster who admonishes and rewards students with a grade. The self-appointed global auditor of fiscal virtue has awarded ‘C’ to India, a country that is growing exponentially as the world’s fastest-growing economy, and seemingly suggested that it undergo remedial tuition.

Why IMF numbers matter

A ‘C’ grade on a report card is enough to shake any parent, and the same applies in the world of fiscal policy and monetary growth. Can the IMF be regarded as a trusted organisation with enough credibility to damage India’s growth chart for the next ten years? Will an unfavourable rating through a report which on the surface looks like a shoddy accounts reconciliation, affect how investors, policymakers, and economists view India’s GDP and inflation rates, and make decisions regarding investments and business decisions.

The not so hidden purpose of these ratings is to cast doubt on India’s favourable GDP numbers, which is expected to grow at the rate of above 8 per cent in the recent quarter, raise concerns about ‘inflated’ numbers and bring down the credibility of government data. Critics of the government are always in any case insisting that data is flawed, and the insertion of the table in otherwise a favourable report is to give credence to their allegations.

Concerns about methodology seem superficial as decisions on taxation, subsidies, social welfare and investment incentives seem to be working out well in terms of reaching out to the unreached, GDP, controlled inflation etc.

Most importantly, as Prime Minister Narendra Modi is pushing his ‘Make in India’ initiative for a competitive, global manufacturing hub. It is perceived that the IMF’s report will be read by the global investors, organisations and investment rating agencies to push foreign investment and not just the inserted table will be seen . A ‘C’ is a bad grade for an ‘ease of investment’ report.

The ‘C’ has been blown out of proportion

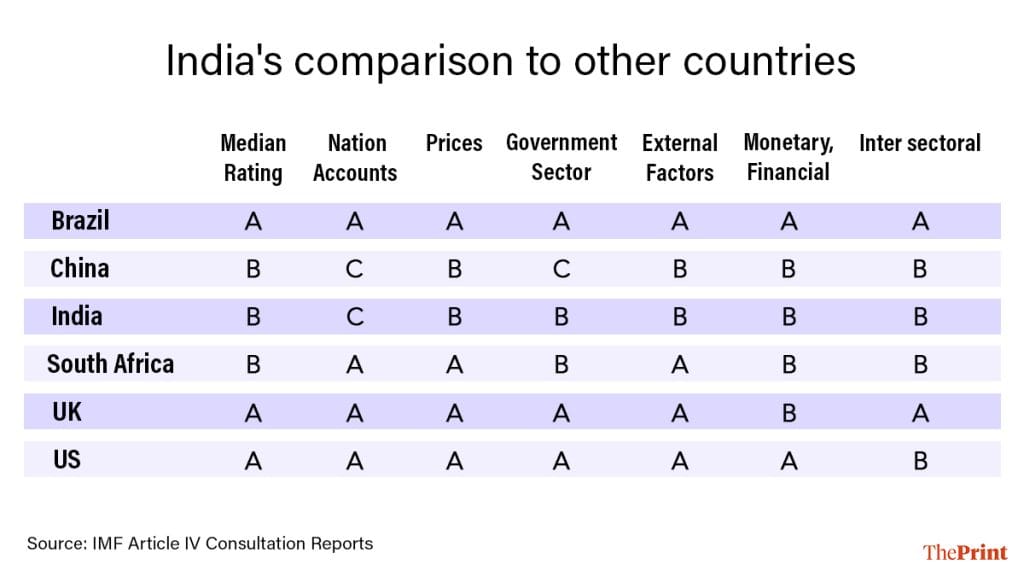

The appended table below shows how India compares with other countries in the IMF Rating.

India has been awarded an overall ‘B’ and has received a ‘C’ for only national accounts. In fact, it has performed better than China. This means that the judgement is not on economic performance, but on data and methodology.

The IMF is criticising the method, not the core, and concerns lie in the statistical technique, not ethical conduct. Some concerns raised were regarding the base year, 2011-12, which is said to be outdated and may no longer reflect structural changes such as service sector growth, increased digitalisation, dynamics in the informal sector and a shift in consumption patterns. Deflators (the mechanism to convert nominal GDP into real GDP) often rely on old indices like the Wholesale Price Index instead of the Producer Price Index.

These could result in a distortion of the real growth estimates. There is also a reservation regarding the coverage of the informal/organised sector, as it has expanded with leaps and bounds in the last few years. Experts suggest relying on alternate indicators such as consumption, employment, production indices and sector-level data rather than solely on GDP.

Apparently, there is someone with a vested interest, trying to create a conflict and spin the story of economic underperformance under the Modi Government. India’s economy has grown significantly since 2011-12, reaching approximately $4.19 trillion. This represents a growth of roughly $2.5 trillion or more in the last decade or so. For a country with a population of 1.3 billion, our granaries are full as there has been a sixfold increase in food production since independence, with a whopping 500 per cent rise. India’s granaries are now full, and India is exporting food to other countries.

Also read: Labour Codes to QCO—Modi’s third term looks more open to economic reforms

Secure institutionalised mechanism framework

India’s fiscal architecture is built on solid foundations, with robust checks and balances in place. The Comptroller and Auditor General is the cornerstone — an independent authority that is constitutionally empowered to audit every single naya paisa received and spent by the Union Government and the States. Its findings are tabled in front of the Parliament and scrutinised minutely by multi-party committees, making it virtually impossible to ‘fudge’ the accounts.

The Reserve Bank of India directly supervises all borrowings of the government; rules are formal, and all disclosures are transparent. RBI data and audit reports are cross-referenced, and tax collections are also audited and balanced through digital administrative systems that undergo regular reconciliations. Corporate records are also thoroughly scrutinised, and 95 per cent of all payments in the BFSI sector have been digitised.

Such an ecosystem leaves very little scope for creative manipulations, and the capacity to doctor fiscal numbers is greatly constrained. There may be some limitations in the national accounting system, but it cannot be stated that India’s data is covered under an ominous haze of institutional darkness.

Growth of India’s informal sector

Informal economy refers to all those economic activities by workers and economic units that are not covered, or are inadequately covered, by the formal arrangements. These do not include illicit or illegal activities. Informal businesses include shop workers, street vendors, small cart sellers, domestic workers, home businesses, embroiderers, tailors, artisans and such. It is believed that the informal sector contributes almost 50 per cent to India’s GDP.

There is a narrative that the informal sector is an economic void, lying at the periphery of the economy like a dark cloud. But that isn’t the case at all. Today, thanks to the digitalisation of payments through UPI-based apps, even transactions of as low as Rs 10 are being made through smartphones. Gen Z, especially, is no longer in the habit of carrying cash around. Research data shows strong digital adoption among Kirana stores (82 per cent) and among street vendors (68 per cent), and among gig workers (74 per cent). I have been told that even beggars at religious places share QR codes to receive digital alms. How then can we say that the informal sector has been left out of the growth story of India?

Whilst a pavement hawker may not have a GST registration, and he may not file returns, yet the goods sold by him have already passed through the registered manufacturers, the chain of distribution and wholesalers who report their transactions. To link to UPI payments, he has had to come under the ambit of the banking system, and any micro loans he has taken have brought him within the formal economy. The same goes for the domestic worker who takes her payments through digital means. The number of bank accounts opened in India doubled between 2011 to 2021, according to the World Bank’s Global Findex report, rising from 35 per cent of adults to 78 per cent.

Also read: New labour codes make India’s workforce competitive with global market & build Viksit Bharat

Revolution wrought by smartphones

In India, smartphones have penetrated even rural areas, and thus smartphone usage is a strong indicator of economic growth. It has served as a catalyst for economic expansion by improving access to digital payments, access to information and services, empowering small businesses and enabling business models in rural areas. The small quiltmaker in Rajasthan can now go global with her smartphone, as can the woollen hat knitter in Uttarakhand. The Comprehensive Modular Survey:

Telecom from January-March 2025 shows that 96.8 per cent of rural residents in the age group of 15-29 used smartphones compared with 97.6 per cent in urban areas. The smartphone has become the bank, classroom and television for the people in India, and rural penetration is complete. Even farmers are increasingly using digital tools like the Digital Crop Survey, mKisan Portal and the National Pest Surveillance System app. These help them with market prices, weather alerts and pest situations. And even to sell their produce in distant locations. The Mobile revolution has replaced the Green Revolution in Rural India.

India’s economy is unique and caters to the needs of its thriving 1.3 billion people. The IMF, while being a respected agency, must maintain a systematic reconciliation and not allow partisan politics to hijack its stand when reporting on economic growth and development. There is no need to act as a proxy for those with vested interests to destabilise India or the ‘tukde-tukde’ gang, as they’re popularly known here.

Despite the implementation of Trump’s tariffs and a rekindling of China-US relations, India’s economy has rallied under domestic consumption and digitalisation. We will rewrite our own growth story under the able leadership of PM Modi.

Meenakashi Lekhi is a BJP leader, lawyer and social activist. Her X handle is @M_Lekhi. Views are personal.

(Edited by Saptak Datta)