The government recently introduced changes to the Prevention of Money-Laundering Act.

The amendments bring practicing chartered accountants, company secretaries and cost and works accountants carrying out specified financial transactions on behalf of their clients under the ambit of the said legislation.

Who can argue against the need for every entity to follow the law, of all a law that guards against money laundering? It is believed that with these changes India will confirm to the recommendations of the international watchdog, the Financial Action Task Force (FATF). India’s assessment is to take place this year and the government’s move is expected to strengthen the country’s position. Once again, who can argue about the need for us to be part of the FATF? The devil, however, lies in the details. While the PMLA amendments may be justified by the government in view of FATF recommendations, we need to approach the anti-terror funding agency holistically, in true spirit and not merely in its letter.

Also read: Imran Khan’s fall due to blaming others, deflecting responsibility all the time: Ex-PTI worker

The FATF pressure

The FATF was set up to monitor cross-country financial flows to curb money laundering, terrorism finance and weapons proliferation.

The organisation requires member countries to comply with a list of recommendations. For example, each country has to set up a Financial Intelligence Unit (FIU), and entities such as banks and financial institutions are mandated to report suspicious transactions to the FIU. Member countries are also required to impose reporting requirements on another class of entities, the designated non-finance business professionals (DNFBP), which include casinos, real estate agents, gems and jewellery traders, chartered accountants, third-party service providers, crypto exchanges. While financial institutions in India had been notified, no entities other than casinos and the Inspector General of Registration in the class of the DNFBP were.

One of the FATF recommendations in the last evaluation was to extend the PMLA to the full range of DNFBPs

The recent notification seems to be driven by the desire to meet the FATF recommendations before India’s assessment begins.

Also read: Global policymakers don’t understand AI enough to regulate it. Tech companies must step up now

What India should have done

The exclusion of the DNFBPs was perhaps on account of the limited capacity at the FIU itself — when entities are required to report to the FIU, the FIU also needs to be equipped with staff and funding to be able to handle the reports, and further analyse them. While the government has notified the inclusion of CAs/CSs/CWAs, it is not clear what capacity changes have been brought about at the FIU to handle the reporting that may happen.

The amendment imposes additional reporting requirements on CAs/CS/CWAs for the following activities: buy or sell immovable property; manage client money, securities and other assets; manage client’s bank saving or securities account; organisation of contributions for the creation, operation or management of companies; and creation, operation or management of companies, limited liability partnerships or trusts, and buying and selling of business entities.

This may sound innocuous, but if a CA does not help create a company, then who will? A CA is not an auditor, and may not have a window into all the financial dealings of a firm. How is she to be held liable for something that is not her core function? This burden may result in many organisations exiting this aspect of their trade. As with financial institutions, we could expect professionals to also become extremely risk averse, hampering the ability of genuine entities to conduct business. The exact nature of the reporting requirements will make a material difference to the impact that this has on the cost of doing business.

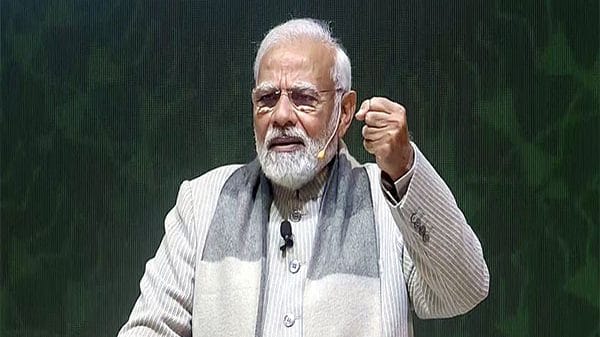

The FATF requires member countries to prepare a National Risk Assessment (NRA), which outlines what the threats and vulnerabilities in a specific country are. A risk-based reporting framework with adequate safeguards can then be designed on the basis of this document. India’s approach so far has been in an empirical vacuum. The Modi government seems to be in panic mode to meet the recommendations before the evaluation begins. It would have been more prudent to design our laws based on a risk assessment with adequate procedural safeguards embedded in the rule of law. This process should have begun years before the assessment was due.

Also read: Converting cantonments like Yol can reap benefits – only if govt is transparent in its dealings

The larger problem with the PMLA

The FATF assumed greater relevance after the 9/11 terror attacks. What it has done is given legitimacy to mass surveillance. There is little evidence across the world on the ability of a mass surveillance system to solve a problem, certainly relative to the costs of surveillance. In countries where the rule of law is weak, this has adverse consequences.

Take the example of India. There have been only 23 convictions out of the 5,422 cases under PMLA since the law was introduced 17 years ago. 96 per cent of the cases that get completed see a conviction, but most don’t reach conclusion. Reports suggest that the law is used to jail political opponents without a trial. The process is the punishment. The PMLA creates a presumption of guilt. In most other laws, the initial burden of proof is on the prosecution. This is not so under the PMLA.

Further, Enforcement Directorate (ED) officials are not considered police officers, and therefore do not follow regular police procedures. The ED is not required to provide a copy of the FIR to the accused. How does the accused mount a defence if she doesn’t know what are the charges against her? The ED is given the power to attach properties that are considered to be the “proceeds of crime”, whether or not the owner of the property was involved in any crime. The Supreme Court upheld the law last year reinforcing the State’s power, and eroding procedural safeguards. This could not have been the FATFs intent.

Renuka Sane is research director at TrustBridge, which works on improving the rule of law for better economic outcomes for India. Views are personal. She tweets @resanering

(Edited by Anurag Chaubey)